Bookkeeping

CEO Dashboard KPI Excel Template

Our CEO Dashboard Excel Template provides a comprehensive overview of…

Bookkeeping Agency Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Bookkeeping services…

Logistics Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking logistic company…

Brewery Financial Model and Budget Control

This Excel model is an advanced, user-friendly financial planning tool…

Gym Financial Model and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Construction Tender and Proposal Example and Model Answer

A successful, high-quality and detailed tender and proposal document that…

Coffee Shop Financial Plan and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Pro Financial Forecast – Dynamic and Advanced Financial Projections

Unleash the power of precise, customizable forecasting with Pro Financial…

Real Estate Proforma – Value-Add Apartment Acquisition Model

This multifamily apartment value-added real estate model is a sophisticated…

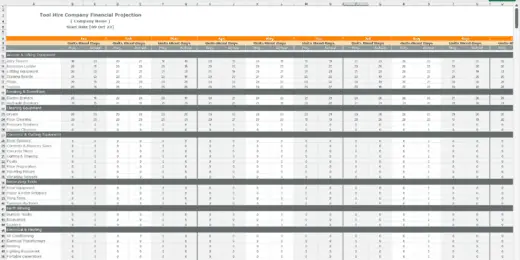

Tool Hire Company Finance Model

A very comprehensive editable Excel spreadsheet for tracking your tool…

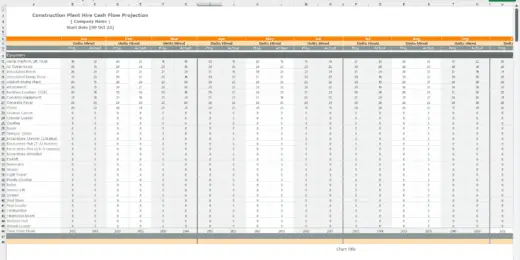

Plant Hire Business Financial Model

A comprehensive editable MS Excel spreadsheet for tracking your plant…

Dental Clinic Financial Model and Budget Control Template

This financial model serves as a tool for owners and…

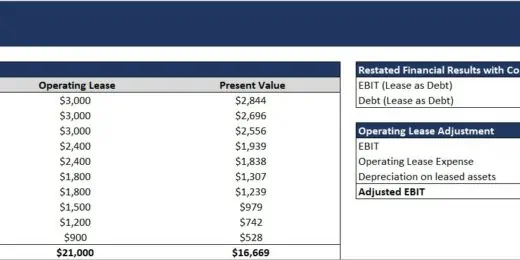

Amortization Schedules Template (Loans, Mortgages, LC, Bonds, Leases)

User friendly template including Amortization Schedules for Loans, Mortgages, Operating…

Balance Sheet, Sales Forecast, Profit & Loss Forecast, Cashflow Statement and Dashboard

All You Need to Run or Advise a Business: Five…

Consortium Agreement for Professional Services Template

A Financial and Professional Services Consortium Agreement - Actual Example…

Depreciation Recapture – Accounting Calculator

A simple calculator that displays the resulting tax basis for…

Car Wash Financial Model and Budget Control Template (Excel and Google Sheets Options)

The financial model for a car wash business is a…

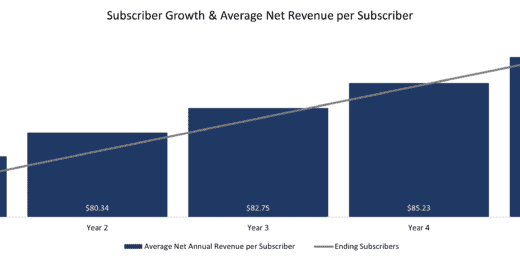

Mobile Applications (App) Monthly 3-Statement Business Plan with Return Calculation

Pro Forma Models created this model to prepare and analyze…

Personal Finance Budget and Tracking with Net Worth Forecast

Pro Forma Models created this model to prepare an annual…

Principal Residence Real Estate Investment Model

This Pro Forma Model is designed to analyze Principal Residence…

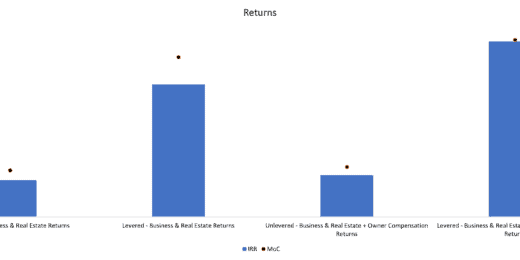

Property Manager Plan with Return Calculations & M&A Model

Pro Forma Models created this model to analyze the financial return…

Capital Budgeting Model with NPV, IRR, & RoC Calculation

This model was developed to complete capital budgeting and analysis…

Dynamic Franchise Business Plan – 3 Statement Model with DCF & Returns

Pro Forma Models created this model to analyze the financial…

3-in-1 Templates: Accounting System in Excel

This is an easy financial statement creator based on various…

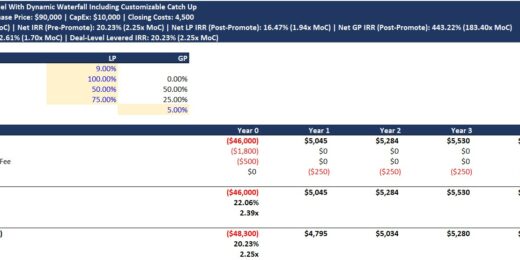

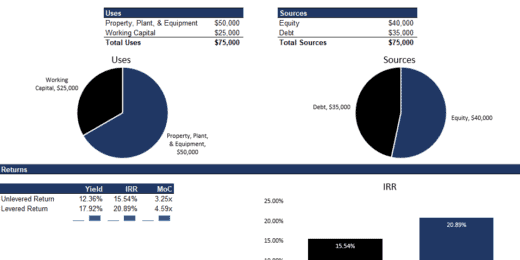

Real Estate Investment Model Template with Waterfall & Catch Up

The waterfall model includes a dynamic catch up. This model…

Wholesale Business 3 Statement Model with Returns Calculation

This model can be used to analyze the financial return…

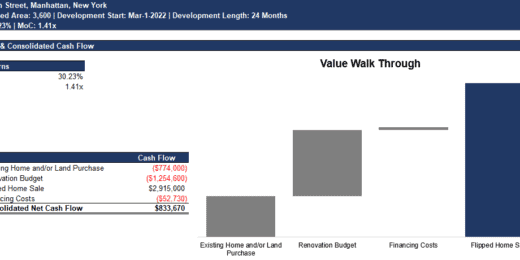

End User Real Estate Development Model – Development Feasibility & Budgeting Model

This model can be used to budget and analyze the…

Start-Up Business 3 Statement Model with Returns Calculation

This model can be used to analyze the financial return…

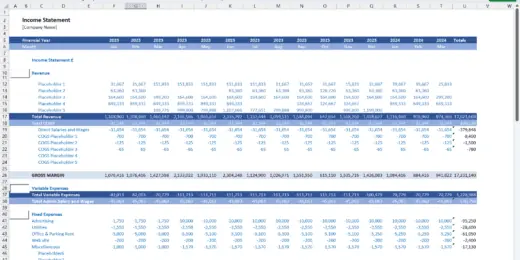

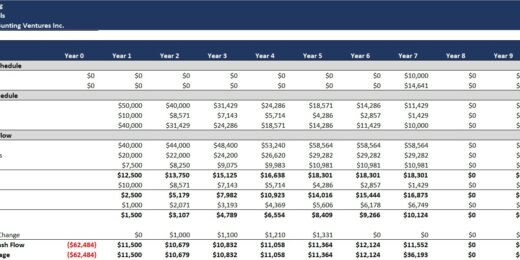

Accounting Firm Financial Model – Dynamic 10 Year Forecast

Financial Model providing a dynamic up to 10-year financial forecast…

Accounting Help: Inventory Logic within 3-Statement Financial Model

A simple tool that helps anyone doing three statement modeling…

Accounts Receivable and Accounts Payable / Invoice Tracking – Aging Report Template

User friendly template to monitor Accounts Receivable & Accounts Payable…

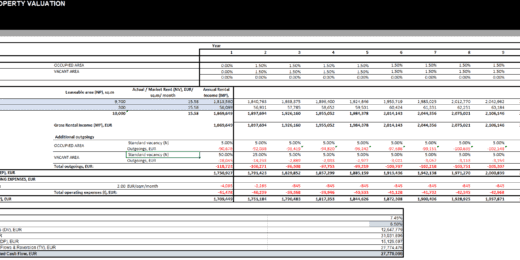

Office Property Valuation Template (DCF Valuation)

OFFICE PROPERTY VALUATION model allows you to determine the value…

Prepaid Expense and Unearned Income Calculator

Prepaid Expense and Unearned Income amortization calculator with accounting entries

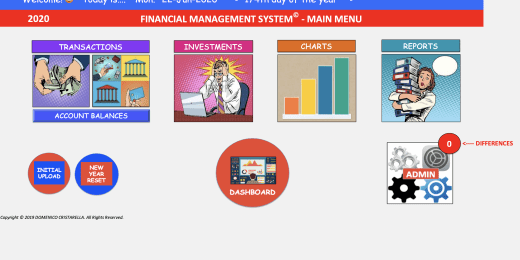

FINANCIAL MANAGEMENT PACKAGE (2023 RELEASE)

FULLY FLEDGED FINANCIAL MANAGEMENT AND ACCOUNTING SYSTEM, DEVELOPED ENTIRELY IN…

Inventory Valuation Using FIFO – Automatically Calculate COGS Accordingly

Any accountant that needs to comply with IFRS will have…

General Use 3 Statement Financial Model – With Exit Assumptions

Monthly and annual summaries of the income statement, balance sheet,…

Payable and Receivable Tracking (Google Sheets)

This is a Google Sheets version of the financial model…

1 year Budget vs. Actual (Google Sheets)

Enter your expected annual budget by month and compare that…

Goodwill Valuation and Impairment Test Model Template

Goodwill impairment is a charge that companies record when goodwill's…

Tips for Growing Your Bookkeeping Business

"Never take your eyes off the cash flow because it's the lifeblood of business," said Richard Branson, founder of Virgin Group. This quote succinctly captures the essence of a bookkeeping business and its critical role in business management. By emphasizing the importance of cash flow monitoring, a bookkeeping business is essential to understanding and managing the money that flows in and out of a company.

Growing a bookkeeping business in today's competitive marketplace requires strategic planning, technological savvy, and an unwavering commitment to client service. This journey, while challenging, offers numerous opportunities for growth and success. These tips will guide you in creating a robust, dynamic bookkeeping business that meets and exceeds your client's evolving needs. Let's dive into the key strategies that can propel your bookkeeping business to new heights of success and sustainability.

What are Bookkeeping Services?

Bookkeeping is recording and organizing all financial transactions of a business or individual. It includes tracking changes in income, expenses, and business assets and liabilities. It ensures all transactions are documented accurately and systematically. Bookkeepers maintain a comprehensive record of cash flows, sales, purchases, and other financial activities, typically using journals, ledgers, and trial balances.

Effective bookkeeping services is essential for informed decision-making, financial management, and maintaining the financial integrity of a business or individual's financial affairs. It forms the foundation of the accounting process, providing a detailed, chronological record of all financial operations, such as sales, purchases, receipts, and payments. This practice ensures accurate tracking of income and expenses, facilitating effective financial management and smart decision-making.

What are the Two Types of Bookkeeping?

In accounting and finance, bookkeeping is a fundamental activity for maintaining accurate financial records. Two primary types of bookkeeping systems exist: Single-Entry Bookkeeping and Double-Entry Bookkeeping. Each system has its unique characteristics and is suitable for different types of businesses and financial recording needs.

Single-Entry Bookkeeping

Single-entry bookkeeping is a straightforward and simplistic approach. It is akin to maintaining a checkbook register, where transactions are recorded as single entries in a ledger. This method is most effective for small or uncomplicated businesses with minimal financial transactions. It involves recording primarily cash sales and business expenses; entries are usually logged in a cash book.

Key Characteristics of Single-Entry Bookkeeping

- Efficiency: Ideal for businesses with straightforward financial transactions.

- Limited Scope: Primarily focuses on recording cash inflows and outflows, less effective for complex financial scenarios.

- Simplicity: Easier to maintain, suitable for entrepreneurs or small business owners without extensive accounting knowledge.

However, single-entry bookkeeping needs to track assets and liabilities or provide a complete picture of the financial health of a business. It could be more robust in terms of error detection and financial analysis.

Double-Entry Bookkeeping

Double-entry bookkeeping is a more comprehensive and systematic approach. It is based on the accounting equation that states that assets = liabilities + equity. In this system, every financial transaction affects at least two ledger accounts and involves two entries: a debit in one account and an equivalent credit in another.

Key Characteristics of Double-Entry Bookkeeping

- Accuracy: Provides a more accurate financial picture of the business.

- Complexity: Requires more knowledge of accounting principles.

- Comprehensive: Tracks assets, liabilities, equity, expenses, and revenue, offering a complete view of the business's financial health. This system is essential for medium to large businesses and companies producing detailed financial statements for external users like investors, banks, and regulatory agencies.

- Error Detection: It is easier to detect errors as the sum of debits should equal the sum of credits.

In the modern business environment, even small businesses are gradually adopting double-entry bookkeeping systems. It is because such a bookkeeping method has become the objective standard of how accounting is done today. It aligns with balancing the chart of accounts, using the equation: assets = equity + liability. Besides, double-entry bookkeeping is the basis for preparing financial statements (Income Statement, Balance Sheet, and Cash Flow Statement).

What Does a Bookkeeping Business Do?

A bookkeeping business plays a crucial role in the financial management of its clients, providing a range of services that ensure accurate record-keeping, compliance with financial regulations, and valuable insights for decision-making. The list of services offered by a bookkeeping business typically includes:

Recording Transactions

Bookkeeping starts with meticulously recording all financial transactions, including sales, purchases, receipts, and payments. It is usually done chronologically and can be managed in physical ledgers, financial models, or digital accounting software. Transaction recording also encompasses the following bookkeeping services:

- Accounts Payable Management: Managing and tracking what the business owes to suppliers or creditors, ensuring timely payments and avoiding late fees.

- Accounts Receivable Management: Handling incoming payments, tracking outstanding invoices, and managing collections for sales made on credit.

- Cash Flow Management: Monitoring and managing the cash flow to ensure the business has enough cash to meet its obligations.

- Inventory Management: Tracking inventory levels, orders, sales, and deliveries, which is especially important for product-based businesses.

- Financial Analysis and Consultation: Offering insights and advice based on financial data to help with business decision-making.

Transaction Classification

Each transaction is categorized into relevant accounts. For instance, a sale is recorded in the sales ledger, while an expense is noted in the expense ledger. Proper classification aids in a clear understanding of financial activities. The bookkeeper also must adhere to relevant financial regulations and standards.

Maintaining Ledgers

Ledgers are essential components of bookkeeping where all the categorized transactions are recorded. These include, but are not limited to, the general ledger (summarizing all transactions), accounts receivable ledger (tracking money owed to the business), and accounts payable ledger (tracking money the business owes).

Integration with Other Business Systems

Integrating bookkeeping systems with other business software for streamlined operations. These services are essential for businesses to maintain accurate financial records, comply with legal requirements, and make informed business decisions.

Custom Financial Reporting

Creating specialized reports tailored to the business's specific needs, such as departmental performance analysis or project-specific reports.

Bank Reconciliation

Regularly comparing the internal records with bank statements or other external sources ensures accuracy and consistency in financial reporting. Bookkeepers compare the business's documents with bank statements to ensure financial record accuracy and identify discrepancies.

A bookkeeping business can serve various clients, from small companies and startups to large corporations, each requiring different expertise and service customization. The ability of a bookkeeping business to provide reliable, timely, and comprehensive services directly impacts its clients' financial health and success.

What is the Difference Between Bookkeeping and Accounting?

If you are in a bookkeeping business, clients' most common question is: what is the difference between bookkeeping and accounting? Understanding the distinction between bookkeeping and accounting is crucial for professionals in the financial sector, including those engaged in financial modeling, analysis, and planning. Both play a vital role in the financial management of businesses, but they serve different purposes and require distinct skill sets. Here are some general answers on what is the difference between bookkeeping and accounting?

Focus

Bookkeeping is primarily the process of recording financial transactions and maintaining financial records. It involves systematically documenting a business's day-to-day financial transactions. The focus is on accurately and promptly recording all financial transactions, including sales, purchases, payments, and receipts. Accounting is a more comprehensive discipline of interpreting, classifying, analyzing, reporting, and summarizing financial data. Accounting goes beyond the mere recording of transactions. It involves interpreting the data recorded by bookkeepers to provide insights into the business's financial health.

Objective

The primary objective of bookkeeping is to ensure that all financial data is accurately recorded and organized to support the accounting process. Accounting aims to provide financial insights based on bookkeeping records, which help stakeholders make informed business decisions. Accounting plays a more direct role in aiding business decisions and financial planning, whereas bookkeeping is more about maintaining a clear and accurate record of financial transactions.

Scope

Bookkeeping is a subset of accounting, focusing on the recording phase, while accounting encompasses the entire process of managing a company's finances. Generally, accounting is considered a more advanced discipline requiring a higher level of expertise than bookkeeping. Bookkeepers generally need to be detail-oriented and good with numbers. They require less advanced knowledge of financial principles compared to accountants. Accountants need better understand financial concepts, business strategies, and tax laws. They often hold higher educational qualifications and certifications, such as a CPA (Certified Public Accountant).

Tasks Involved

A bookkeeping business typically includes maintaining ledgers, balancing books, and preparing invoices. It's more about keeping track of what's happening financially in the company daily. An accounting firm includes adjusting entries, analyzing operations costs, preparing company financial statements, and completing income tax returns. Accountants prepare financial statements and reports that aid financial planning, whereas bookkeepers focus on recording transactions that form the base for those reports.

For businesses and finance professionals, both bookkeeping and accounting are indispensable. Bookkeeping ensures accurate data entry, essential for reliable financial modeling and analysis. Conversely, accounting provides the analytical framework for interpreting required financial data for strategic decision-making, forecasting, and financial planning.

Why is Bookkeeping Important?

Bookkeeping plays a crucial role in the success of any business. Understanding its importance is vital to making better financial decisions and maintaining the robust financial health of a business. Here's a list of why is bookkeeping important:

- Accuracy of Financial Records: Bookkeeping involves the systematic recording of financial transactions. It ensures that financial records are accurate and up-to-date, which is essential for understanding the financial position of a business at any given time.

- Cash Flow Management: Effective bookkeeping helps manage cash flow by tracking incoming and outgoing funds. Maintaining the liquidity necessary to meet day-to-day expenses and avoid cash crunches is crucial.

- Compliance and Legal Requirements: Proper bookkeeping helps comply with tax laws and regulations. Accurate financial records are necessary for tax filings and can be invaluable in the case of a tax audit. Non-compliance can lead to significant fines and legal issues.

- Effective Budgeting and Planning: With precise bookkeeping, businesses can better plan and budget for future expenses and investments. It provides a clear picture of where money is being spent and how much revenue is generated, which is crucial for effective financial planning and decision-making.

- Performance Analysis: Bookkeeping allows businesses to analyze their financial performance over time. Companies can identify trends, measure growth, and make informed strategic decisions by regularly reviewing financial statements, such as the balance sheet, income statement, and cash flow statement.

In conclusion, why is bookkeeping important? It includes more than just a compliance exercise. Instead, it is vital for financial management, strategic planning, and informed decision-making. For businesses and professionals in the financial sector, it lays the groundwork for sustainability, growth, and success.

How to Grow Your Bookkeeping Company

Growing your bookkeeping company requires a strategic approach combining solid business planning and innovative practices. Here's a detailed guide on how to expand your business effectively:

Build a Clear Business Plan

Crafting a winning business plan is crucial for making informed business decisions and securing funding if needed. First, you need to understand your target market's needs. It involves researching the types of businesses you want to attract and understanding their unique challenges and needs in bookkeeping. Identify your competitors and analyze their strengths and weaknesses. This knowledge can help you define specific, measurable, achievable, relevant, and time-bound (SMART) goals. From here, you can develop a financial plan that includes budgeting, forecasting, and managing cash flow.

Continuous Training

The financial world is constantly evolving. Keeping abreast of the latest accounting software, tax laws, and financial regulations is essential. Invest in training for yourself and your staff. It can include workshops, webinars, or certifications in areas like cloud accounting, advanced bookkeeping techniques, or specialized software.

Create an Efficient Work System

An efficient work system in bookkeeping is crucial for accurate and timely financial recording. Implement a system for regular checks and balances to maintain high-quality work. Streamline your processes for efficiency. It might involve automating routine tasks, implementing cloud-based bookkeeping solutions, or developing standard operating procedures. Utilize advanced bookkeeping and accounting tools that integrate with other business tools for seamless data flow and accuracy.

Price Strategically

Consider value-based pricing, where the price is set based on the perceived value to the client rather than just the hours worked. Offer different service levels or packages to cater to diverse client needs and budgets. It can range from basic bookkeeping to full-fledged financial analysis and advisory services. Maintain transparency in pricing to build trust with clients. Strategically pricing your bookkeeping business using financial model templates can significantly enhance your pricing structure's effectiveness and competitiveness. They can help you analyze different pricing scenarios and their impact on your bottom line.

Reinvent Work with Financial Model Templates

Financial model templates represent a significant advancement in bookkeeping and financial management. They streamline and enhance traditional bookkeeping practices and empower businesses with deeper insights and strategic capabilities. Develop or use sophisticated financial model templates tailored to different industries. It can improve efficiency and provide deeper insights for clients. Utilize templates for recording transactions and helping clients with budgeting, forecasting, scenario analysis, and decision-making.

Wrap Up

Remember, the key to growing your bookkeeping business lies in staying adaptable, leveraging technology, and continuously adding value to your clients' businesses. By following these steps, you can position your company for sustainable growth and success in the dynamic world of finance and bookkeeping.

The financial model templates offered by eFinancialModels.com can significantly contribute to the growth of a bookkeeping business by enhancing analytical capabilities, increasing efficiency, and improving decision-making processes. These templates, crafted with sophistication and industry-specific insights, provide a robust framework for detailed financial analysis, enabling bookkeepers to accurately forecast revenues, manage cash flows, and analyze various financial scenarios. It empowers bookkeeping businesses to make informed, strategic decisions, such as identifying profitable ventures, optimizing resource allocation, and planning for sustainable growth.

By leveraging these comprehensive tools, a bookkeeping business can streamline its internal financial processes and offer enhanced services to clients, ultimately driving growth and establishing a competitive edge in the market.