Project Finance

Renewable Energy Financial Model

Comprehensive financial model designed for analyzing renewable energy projects, such…

Carbon Capture and Sequestration Project Analysis

The Carbon Capture and Sequestration (CCS) Project Analysis Template is…

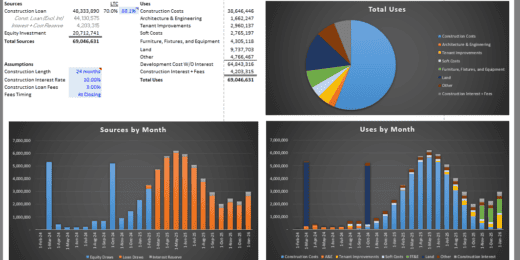

Construction Draw Schedule & Gantt (New Development Cost/Sources & Uses Model)

Elevate your construction project planning with our Construction Draw Schedule…

Renovation Project Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking renovation project…

Online Travel Agency Financial Feasibility Model

Create up to 72 months of financial projections based on…

Blue Ammonia using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Ammonia Production Plant Model that…

Blue Hydrogen using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Hydrogen Production Plant Model which…

Financial Model for a Smart City Project

This is a financial model to identify various components of…

Consortium Agreement for Professional Services Template

A Financial and Professional Services Consortium Agreement - Actual Example…

Solar Farm (PV) Tax Equity – Fixed Partnership US

PV farm Tax Equity partnership in the US is designed…

Green Ammonia from Renewable Energy Financial Model

This comprehensive 40-year tool aid investors in evaluating potential risks…

Yacht Marina Acquisition Financial Model

Financial model presenting an acquisition scenario of a Yacht Marina.

Expert Sensitivity Analysis for Upstream Petroleum Models

The main purpose of the model is to enable users…

Public-Private Partnership (PPP) Financial Model

Financial Model presenting development and operating scenarios of various projects…

Upstream Oil Financial Derivative Hedging Model

This model calculates financial oil derivative positions for Put Options,…

Public Private Partnership (P3) Financial Model for Value-for-Money (VfM) Analysis

This financial model calculates the risk adjusted life cycle cost…

Oil & Gas Marketing and Distribution DCF Valuation Model with 5 Yrs Actual,1 Yr Budget & 5 Years Forecast

A detailed and user friend financial model that captures 5…

Sunflower Farm & Oil Processing Plant Financial Model

Financial model presenting a Sunflower Farm and & Oil Processing…

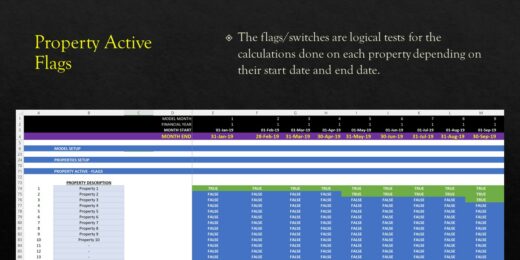

Property Manager Plan with Return Calculations & M&A Model

Pro Forma Models created this model to analyze the financial return…

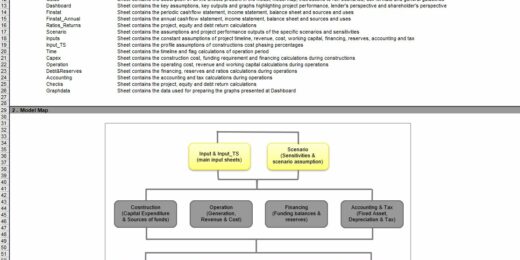

Energy Project Finance (Infrastructure Model)

This is a special project vehicle (SPV) for an Energy…

Project Finance Model for a Highway SPV Project

This Project Finance Model for a Highway SPV Project is…

Wind/Solar Power Generation (Renewable Energy) Financial Model

Financial Model to calculate Profit/Loss, accurately forecast financial statements and…

Port Terminal Operator – Project Finance Model

Financial Model presenting a business scenario of a Port Operator…

Airport Financial Model (Development, Operation & Valuation)

Financial Model presenting a development and operating scenario of an…

Energy Recovery Facility (ERF) – Dynamic 10 Year Financial Model

Financial model presenting a business scenario of a company owning…

Telecom Company Financial Model – Dynamic 10 Year Forecast

Financial Model presenting a business scenario of a Telecom Company…

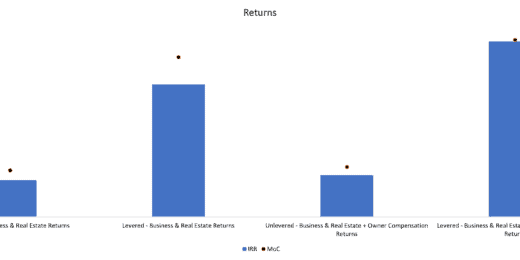

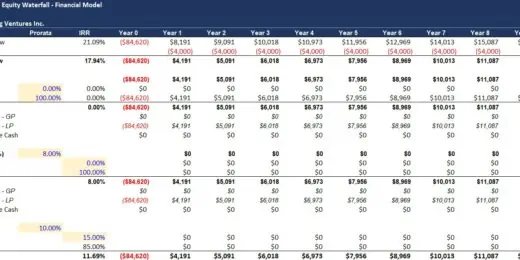

Dynamic Annual Private Equity Waterfall Cash Flow Distribution Financial Model

Pro Forma Models created this model for private equity professionals…

Apartment Block Acquisition & Valuation Model 20 years Three Statement Analysis

This Apartment Block Acquisition Model produces 20 years of Three…

Quantity Surveyor / Architect – Project Financial Feasibility Model

This Project Feasibility Model is purpose-built to assist Quantity Surveyors,…

Ethanol and Sugar Production Plant Financial Model

Fin-wiser’s Ethanol and Sugar Plant PPP project model helps users…

Toll Road Financial Model (Development, Operation & Valuation)

Financial Model providing forecast and profitability analysis for a development…

Gold Mining Investment Project – 10 year Financial Forecast

Financial Model providing forecast and valuation analysis of a Gold…

Green Hydrogen Project Financial Model (Electrolysis & Onsite Solar Plant)

A Project-Level Financial Model to assess the financial feasibility of…

Hydrogen Gas- Tariff Calculator with Integrated Financial Statement and Cash Waterfall

The Perfect tool to assess the financial feasibility, proposal to…

Geothermal Energy – Project Finance Model

Project Finance Model providing forecast and profitability analysis of a…

Professional Services Project Proposal on Three Pages: Actual Example and Template

An actual example and template of a successful Professional Services…

Pricing Framework for Consulting and Wider Professional Services

Pricing Framework for Consulting, Financial Services and Wider Professional Services:…

Biomass to Hydrogen Gas PPP Project Model Template

Biomass to Hydrogen Gas PPP Project Model with 3 Statements,…

Apartments Development Model – 20 year three statement analysis (Hold and Lease) or QS type for Sale Model

This Apartment Development Model will produce 20 years of three-statement…

Prefabricated Buildings Manufacturer – Dynamic 10 Year Financial Model

Financial model presenting a development scenario for a Prefabricated Buildings…

Cotton Farm Financial Model – Dynamic 10 Year Forecast

Financial model presenting a Cotton Farm business scenario.

Project Management Financial Evaluation Model

Project Management - Financial Viability, Comparisons, and Evaluation using XNPV,…

Oil & Gas Financial Model – Dynamic 10 Year Forecast

Financial Model providing forecast and valuation analysis of an upstream…

Renewable Energy Financial Models Bundle

A collection of user-friendly Project Finance Models in the Renewable…

Biogas (Waste to Energy) – Project Finance Model

Project Finance Model providing forecast and profitability analysis of a…

Wind Farm – Project Finance Model

Project Finance Model providing forecast and profitability analysis of a…

Solar (PV) Power Plant – Project Finance Model

Project Finance Model providing forecast and profitability analysis for a…

Renewable Energy Project Finance Model Template

The Renewable Energy Project Finance model is used to provide…

Project Finance Excel Models for Large Commercial, Industrial, and Infrastructure Projects

What is Project Finance?

Project Finance permits shareholders to raise capital for long-term public infrastructure or industrial projects through a specific financial scheme. In general, project finance is only applicable to investments that are likely to generate their own cash flows.

Project finance Excel models help analyze the financial projection of the complete life-cycle of a certain project. Ideally, the economic benefits derived from the project should exceed the economic costs.

Understanding Project Finance Models

Let's dive deeper to understand this concept better.

Long-Term Financing

Project finance is commonly used in long-term infrastructure projects such as power production, toll road, oil extraction, etc. These sectors often granted structured financing due to the lower technological risk and predictable market associated with these industries.

Non-recourse financial structure

Project financing is a non-recourse or limited recourse as to shareholders or project sponsors. In non-recourse financing, the borrowers have no personal obligation in case of monetary default. Project financing model relies on projected cash flows for repayment of the indebtedness. The Special Purpose Vehicle (SPV) assets or rights serve as collateral for the project finance, allowing the lender to seize the property upon default. However, the lender cannot claim the shareholder's assets further if the SPV's asset is insufficient to satisfy any deficiencies.

Cash Flow of the SPV

The cash flows the SPV generated must adequately cover operating costs and repayment of loans and interest. Any residual after the latter can be used to pay a dividend to the project sponsors. The project finance modelling in Excel will demonstrate the allocation of these generated cash flows.

Off-Balance Sheet

The balance sheet of the SPV is not consolidated to the balance sheet of the project sponsors. This project finance models feature makes it more attractive to project sponsors since the project loan does not impact the sponsor's balance sheet or available financing capacity.

Project Finance Modelling

Most often, project finance models are typically premised with assumptions of the costs of constructing the project and the debt and equity mix ratio. These project finance modelling in Excel allows you to change key assumptions easily and analyze financial projection better. Normally, the assumption lies between financing and operational assumptions. You can download various ready-to-use project financing model templates such as Solar Farm Project Finance, Toll Road BOT, Wind Power Generation Plant, and so on. If you do not find what you are looking for, feel free to drop us a message.

Conclusion: Project Finance Excel Models requires financial expertise

The key concepts of project finance are important to understand thoroughly as there is no standard definition of project finance. Project finance provides long-term, non-recourse loans used to finance large commercial, industrial or infrastructure projects. Repayment of loan must be generated by the SPV backed by its own seizable in case of default. Thus, project financing requires financial expertise and relevant technical knowledge.