Telecom DCF Valuation Model (3 Years Actual and 5 Years forecast)

Detailed Financial model for DCF valuation on Telecom Company

This is a very detailed and user-friendly valuation model with the three financial statements i.e. Income Statement, Balance Sheet, and Cash Flow Statement, and detailed calculations around DCF-based valuation and financial analysis.

The model captures 3 years of Historical + 5 Years of the forecast period. Valuation is based on the 5-year forecast using the Discounted Cash Flow methodology.

The assumptions tab allows for the input of a large amount of financial data for your business.

These inputs cover a wide range of financial data:

1. Revenue Assumption (ARPU, No. of Users, Market Share)

2. Costs Assumptions (Access charges, License Fees, Network Operations costs & more)

3. Income tax

4. Working Capital Assumptions (Receivables, Payable, Inventory)

5. Capital Expenditure and Depreciation/Amortization (Tangible and In Tangible Assets)

6. Long Term and Short Term Debt

7. Share Capital (Issue of New shares, Retained Earnings, Reserve Accounts)

8. Dividend Calculation (Interim and Final Dividend along with Tax impact)

9. Interest Income and Expense calculations

The model runs comprehensive calculations based on the inputs provided by the user and generates very accurate outputs which include:

1. Income Statement: Includes Historical and forecast Profit and Loss statement

2. Balance Sheet: Includes Historical and forecast Balance sheet

3. Cash Flow Statement: Includes Historical and forecast cash flows

4. Valuation: DCF based valuation is based on the forecast cash flows and discount rate assumptions

5. Valuation Ratio: A very detailed financial analysis covering:

– Price and EV based valuation ratios

– Per Share Data like EPS, DPS, FCFF per share & more

– Margin ratios

– Return ratios

– Dupont Analysis

– Gearing Ratios

– Liquidity ratios

– Coverage Ratios

– Activity Ratios

– Investment rations

– Enterprise value

Functional areas where this model can be used:

1. Investment Banking (Buy-Side and Sell-Side)

2. Equity Research Firms

3. Financial Analysis and Valuations

4. Financial Modeling with Best Practices

5. Business Planning for Telecom Companies

Similar Products

Other customers were also interested in...

Telecom Company Financial Model – Dynamic 10...

Financial Model presenting a business scenario of a Telecom Company providing Broadband, Landline, M... Read more

Telecoms Financial Model

Telecom Financial Model presents the case of an already operating business in the telecom sector (mo... Read more

Complete buy-side Telecom Tower Portfolio LBO

Complete Buy-Side Telecom Tower Portfolio LBO Model. This model allows investors to make a full towe... Read more

Biomass to Hydrogen Gas PPP Project Model Template

Biomass to Hydrogen Gas PPP Project Model with 3 Statements, Cash Waterfall & NPV – IRR Analys... Read more

Waste Treatment Template Bundle

Take this opportunity and get a discount by getting the Waste Treatment Plant and Waste Water Treatm... Read more

Hydrogen Gas Sales & Tolling Business Plan an...

Hydrogen Gas Sales & Tolling Fee business plan and valuation model is an excellent tool to asses... Read more

Waste Water Treatment Plant Financial Model Templa...

Waste Water Concession Model is a Project Finance Model for construction and operations of a waste w... Read more

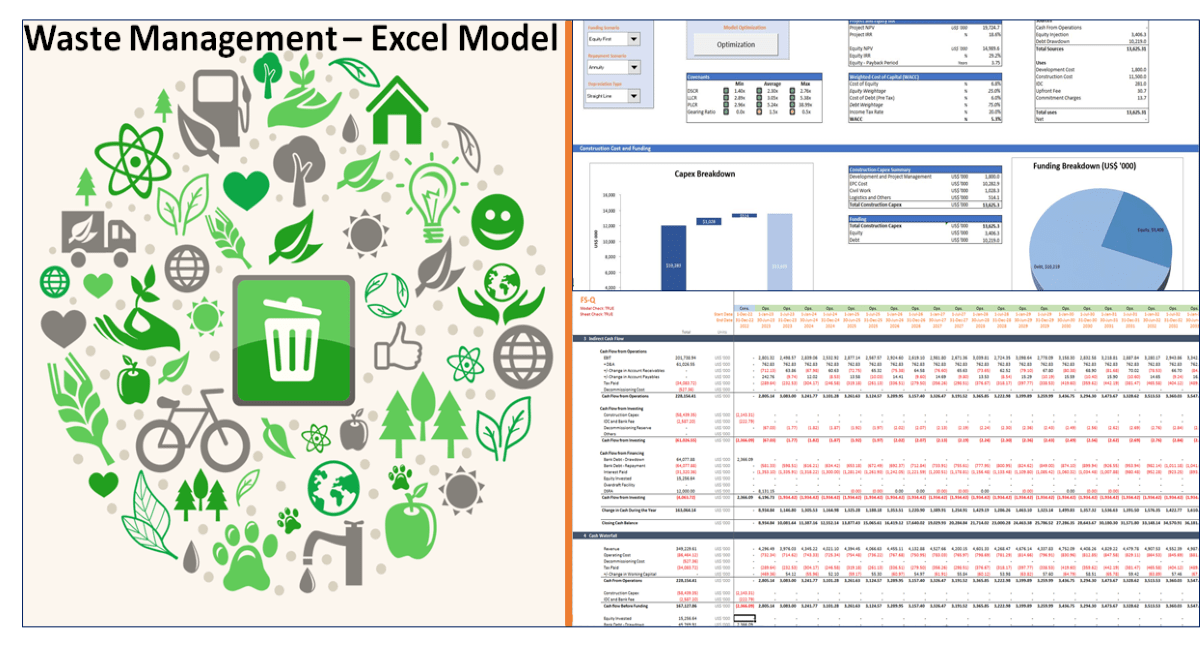

Solid Waste Treatment Plant Financial Model with V...

Solid Waste Treatment Plant Model is a project finance model for the construction and operations of ... Read more

Discounted Cash Flow (DCF) Valuation Excel Model (...

This is a very detailed and user-friend financial model with the three financial statements i.e. Inc... Read more

Project Finance – Toll Road – Build an...

Toll Road Build and Operate financial model is a project finance model for construction and operatio... Read more

You must log in to submit a review.