The Benefits of Managing Days Inventory Outstanding Efficiently

Table of Content

- What is Inventory?

- Days Inventory Outstanding Tells You If Your Inventory is Managed Efficiently

- The Formula for Days Inventory Calculation

- How to Use Days Inventory

- How Do You Analyze Days in Inventory?

- What is a Good Days Inventory Outstanding Value?

- Why Adopt an Efficient Days Inventory Management?

- Understanding Days Inventory is Key to Manage Your Business Effectively

In the complex supply chain management and financial analysis world, one crucial metric stands out: days in inventory. This financial ratio can transform how businesses handle inventory, impacting everything from cash flow to operational efficiency. This article will explore the concept of days in inventory, its significance, and the benefits of effective days inventory management.

What is Inventory?

Inventory is a crucial component of many businesses, especially those in the manufacturing and retail sectors. It represents the tangible items a company holds with the intent of selling, using in production, or consuming in its operations.

Here’s a breakdown of the typical items found in inventory:

- Raw Materials are the basic, unprocessed materials used to produce finished goods. For instance, a furniture manufacturer might have raw materials like wood, nails, and fabric. These materials have not been used in any production process but are essential for creating the final product.

- Semi-Finished Goods are also known as work-in-progress. These items have undergone some production processes but still need to be completed. They are in between the stages of raw material and finished goods. For example, the body without the paint or interior might be considered a semi-finished good in producing a car. It has been processed to some extent, but a few more steps are required before it can be sold as a finished product.

- Finished Goods are products that have completed the entire production process and are ready to be sold to customers. Using the car example, a fully assembled and painted car with all its features and functionalities ready would be considered a finished good.

- Supplies are not items sold or used to produce goods for sale. Instead, they support the operations of the business. This category includes items like cleaning supplies, office supplies, and other materials necessary for the day-to-day functioning of a company. For instance, a restaurant might have cleaning agents, napkins, and office stationery as part of its supplies inventory.

What ties all these inventory items together is their financial aspect. Each of these items represents a cost to the company. They were purchased from suppliers, and the company invested money in them with the expectation of generating revenue, either by selling them directly (as in the case of finished goods) or by using them in the production process to create sellable items.

Holding inventory also represents an investment, as the company has invested capital in these items rather than using it elsewhere. Hence, effective inventory management ensures this investment yields positive returns and supports the company’s financial health.

Days Inventory Outstanding Tells You If Your Inventory is Managed Efficiently

Days Inventory is a fundamental financial ratio used in business that can quickly tell how efficiently a company manages its inventory. Days inventory outstanding is calculated by dividing the inventory balance at a specific point in time over the annual Cost of Goods Sold and multiplying by 365 days.

The Days Inventory ratio represents the average number of days a business has stock in inventory at a given time. Therefore, the Days Inventory financial ratio can quickly tell how long a business has goods or supplies in inventory. Other terms for Days Inventory are Days Inventory Outstanding (DIO) and Days in Inventory.

There are some key implications with this ratio:

- Inventory consumes capital. The more inventory a company requires, the more funding is needed. Therefore, companies should have an inherent interest in keeping inventory levels low.

- Days in Inventory is a financial ratio you can easily compare across companies. E.g., the annual reports of publicly quoted companies offer a great data source to obtain benchmarks of how efficiently other companies manage their inventories.

- Inventory levels can vary greatly during a financial year. If a company, e.g., orders all its raw materials in January, then inventory levels are higher in the first months of the year compared to the last months of the year. Even if we calculate days inventory based on year ends financials, we still need to be cautious and understand if inventory days might be significantly different during certain times of the year. It is important when forecasting companies’ funding requirements.

Overall, day inventory tells you how long it takes to sell and replace inventory. This metric is crucial because it directly affects cash flow, working capital, and overall business operations. While days inventory is a widely used term, you might also encounter similar phrases such as days inventory outstanding, inventory days turnover, or inventory turnover period. All these terms refer to the same essential concept: the number of days it takes for a company to cycle through its inventory.

Understanding days inventory outstanding is essential for any business looking to maximize efficiency and streamline its inventory processes. Assessing the days inventory outstanding helps businesses identify potential areas for improvement. When a company has high days inventory turnover, it suggests that the products or goods stay on the shelves for an extended period before being sold. It can lead to challenges, including tying up valuable capital in unsold inventory, increased carrying costs, and potentially outdated products. High inventory days turnover can also reflect sluggish sales, inadequate demand forecasting, or production imbalances.

The Formula for Days Inventory Calculation

The days inventory outstanding ratio is relatively straightforward. Days inventory calculation considers the average inventory level on the balance sheet in relation to the cost of goods sold from the Income Statement over a specific period. By multiplying the ratio by 365, you get the average number of days to turn over the inventory.

Mathematically, days inventory calculation uses the formula:

Days Inventory = Inventory/Cost of Goods Sold × 365 Days

Where:

- Inventory refers to the total value of a company’s goods or products at a certain time. Typically, we only prepare the balance sheet once per year, which is at the end of its fiscal year or accounting period, also known as Ending Inventory or Closing Inventory. Please note this also means that during the year, the inventory levels can be very different than at the year’s end, meaning the real days inventory can also deviate significantly if you are only looking at the year’s end figure.

- The Cost of Goods Sold (COGS) represents the direct costs of producing or purchasing a company’s goods during a specific period. It includes expenses such as materials, labor, and manufacturing overhead. COGS do not include indirect costs like sales and marketing or administrative costs. You can find the cost of goods sold on the Income Statement. The cost of goods sold is an essential data point used in various financial analyses, including inventory management and efficiency assessments.

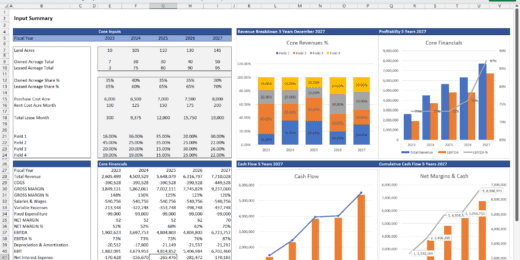

Sample Calculation

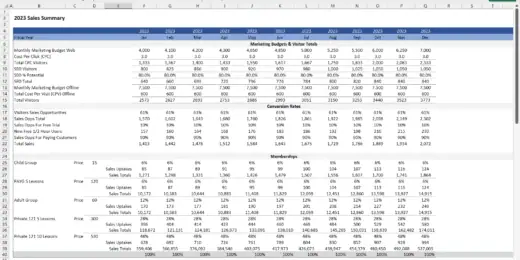

Let us assume that Company ABC has a year-end inventory value of $300,000 for 2022. That year, the $ Cost of Goods Sold was $1,000,000. We can then calculate the days inventory outstanding value.

The table above shows that Company ABC’s days inventory outstanding value is 109.50. It means that, on average, it takes approximately 110 days for the company’s inventory to be sold.

How to Use Days Inventory

Days Inventory provides insights into the efficiency of inventory management and can have significant implications for cash flow and profitability.

Here’s how to use the Days Inventory:

- Managing Inventory Levels: Regularly calculate and monitor your Days in Inventory to ensure you only hold stock for a short time. A higher Days in Inventory might indicate overstocking, which ties up cash and increases holding costs. Consider reducing order quantities or increasing sales efforts if it is consistently high. Conversely, very low Days in Inventory might indicate stockouts and lost sales opportunities.

- Forecasting & Estimating Required Funding: Knowing how long inventory sits before being sold can help forecast when cash will come in from sales. Plan to increase inventory levels for a sales push or a seasonal period. The Days in Inventory can help estimate how much additional funding might be needed and for how long.

- Benchmarking Efficiency: Compare your Days in Inventory with competitors in your industry. If theirs is significantly lower, they might manage their inventory more efficiently, and it’s worth studying their practices. Look at industry averages. Being far from the average might indicate inefficiencies or the need for a different business model.

- Efficient Company Management: If you’re holding inventory for too long, it might be worth renegotiating terms with suppliers, such as extended payment terms or smaller, more frequent deliveries. Use Days in Inventory insights to drive sales strategies. For instance, if certain items have a high inventory level, consider sales promotions or discounts to move them faster. Products that consistently have a high inventory level could be candidates for discontinuation.

- Risk Management: A sudden increase in Days Inventory Outstanding might indicate problems like declining sales or issues with a particular product line. If external factors (e.g., economic downturns, global crises) are expected to increase them, have contingency plans, such as securing additional financing or finding alternative sales channels.

How Do You Analyze Days in Inventory?

Analyzing days in inventory levels is crucial for businesses to ensure they have the right stock to meet customer demand while minimizing costs. Aging analysis for inventory is a technique used to evaluate the age of inventory items. It categorizes inventory based on the time the items have been held. This analysis helps businesses identify slow-moving items, potential obsolescence, and areas with excess stock.

The aging analysis typically breaks down inventory into time buckets, such as:

- 0-15 days

- 16-30 days

- 31-45 days

- 46-60 days

- 60+ days

You would look at the respective buckets in the aging analysis report to determine how much and which parts of your inventory value are older than specific days (e.g., 15, 30, 45, 60).

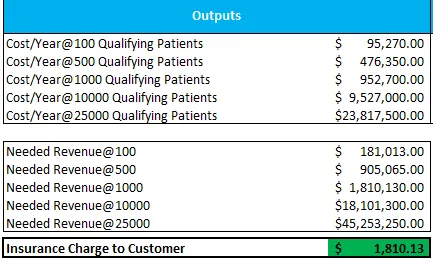

Here’s a sample chart:

The chart shows that over 50% of the inventory is aging beyond 30 days. They remain unsold for a prolonged period. These can be due to several reasons, including:

- Economic Downturn

- High Price Point

- Inaccurate Demand Forecasting

- Inadequate Marketing and Promotion

- Overordering

- Overproduction

- Poor Inventory Management

- Product Obsolescence

- Quality Issues

- Seasonal Demand Fluctuations

- Stidd Market Competition

Avoiding long inventory times is crucial for businesses to maintain efficient operations, reduce costs, and ensure timely delivery of products to customers.

Here are some strategies to avoid long inventory times:

- ABC Analysis: Categorize inventory items into A, B, and C categories based on their value and turnover rate. Focus more on ‘A’ items as they are the most valuable.

- Forecasting Tools: Utilize forecasting financial models to predict demand. It helps maintain optimal inventory levels, reducing the time spent on excess stock management.

- Inventory Management System: Use software solutions to track real-time inventory, predict demand, and automate reordering processes. Barcode scanning and RFID (Radio Frequency Identification) can speed up the inventory process.

- Just-in-Time (JIT) Inventory: The Japanese automotive industry, particularly companies like Toyota, revolutionized inventory management by introducing the Just-In-Time (JIT) system. JIT is a management philosophy that directly aligns raw material orders from suppliers with production schedules. It aims to reduce inventory levels by receiving goods only when needed in production, thereby reducing inventory costs.

- Optimize the Warehouse Layout: Design the warehouse layout for efficient movement of goods. Place high-turnover items near the front or in easily accessible locations. Use vertical space efficiently with appropriate shelving and racking systems.

- Regular Cycle Counts: Instead of doing a full inventory count once a year, consider doing cycle counts, where you count a portion of your inventory regularly. It reduces the disruption and time spent on a full inventory count.

By implementing these strategies, businesses can significantly reduce inventory times, leading to more efficient operations and cost savings.

What is a Good Days Inventory Outstanding Value?

Days Inventory Outstanding (DIO) provides insights into how efficiently a company manages its inventory. A lower DIO indicates that a company can quickly convert its inventory into sales, while a higher DIO might suggest inefficiencies or overstocking. But the ideal range for days in inventory can vary significantly depending on the industry, the nature of the products, and other factors. Benchmarking against industry peers can provide valuable context for evaluating your company’s performance.

Service-based businesses, such as consulting firms, software companies, or financial services, typically don’t have physical inventory. Their primary assets are human resources, knowledge, and expertise. Therefore, they have a Days Inventory Outstanding of zero since they don’t have goods to sell. It is ideal from an inventory management perspective because there’s no tied-up capital in unsold goods, no storage costs, and no inventory risk of becoming obsolete.

For manufacturing businesses, inventory is often a significant part of their operations. The ideal Days Inventory Outstanding can vary based on the industry, supply chain complexities, and business model. However, many manufacturing businesses show Days Inventory Outstanding between 30 and 60 days. It means that, on average, it takes them one to two months to sell their inventory.

Nevertheless, this might be needed; it always poses a challenge if that cannot be reduced further. Reducing DIO can free up cash, reduce storage costs, and decrease the risks associated with holding inventory, such as obsolescence or damage.

Why Adopt an Efficient Days Inventory Management?

Adopting efficient days inventory management offers businesses several benefits, regardless of size or industry. Managing inventory effectively is crucial for optimizing operations, reducing costs, and improving overall business performance.

Here are some reasons why adopting efficient days inventory management is important:

- Cost Savings: Maintaining excess inventory ties up valuable capital in storage costs, carrying costs, and the risk of obsolescence. Efficient inventory management helps minimize excess stock and reduce associated costs. It also helps minimize holding costs such as storage fees, insurance, and other overhead expenses associated with keeping inventory on hand.

- Improved Cash Flow: With optimal inventory levels, businesses can better align their cash inflows and outflows, improving cash flow and financial stability. Holding excess inventory increases the risk of obsolete products. Efficient inventory management helps minimize this risk by ensuring that inventory turnover remains high for better cash inflows.

- Working Capital Optimization: By reducing the amount of capital tied up in inventory, businesses can free up working capital to invest in other business areas, such as expansion, innovation, or debt reduction. Furthermore, effective inventory management enables businesses to optimize their storage space, leading to more efficient use of warehouse facilities and reduced storage costs.

- Minimized Stockouts: Efficient inventory management requires accurate demand forecasting. By analyzing historical data and market trends, businesses can make more informed decisions about their inventory needs. Stockouts occur when demand exceeds supply. It can lead to lost sales, dissatisfied customers, and missed revenue opportunities. Efficient inventory management helps prevent stockouts by ensuring adequate stock levels are maintained.

- Competitive Advantage: Businesses with efficient inventory management can respond more effectively to market changes, new product introductions, and customer demands, giving them a competitive edge. It helps strike the right balance between having enough inventory to meet demand and minimizing the costs and risks associated with excessive stock levels.

Understanding Days Inventory is Key to Manage Your Business Effectively

Days inventory turnover emerges as a critical metric for optimizing operations, streamlining cash flow, and enhancing overall profitability. By understanding the concept, calculating the ratio, and implementing efficient days inventory management strategies, businesses can succeed in today’s competitive landscape.

Inventory represents a cash outlay. The longer inventory sits on the shelf, the longer the company’s cash is tied up. By forecasting DIO, a financial model can predict when cash will be received from sales of that inventory. Companies can effectively manage their working capital needs by understanding and forecasting DIO.

Holding inventory comes with risks, including obsolescence, theft, and damage. By understanding DIO trends, companies can assess these risks and take preventive measures. If a company plans to grow its sales, it might need to increase its inventory levels. Forecasting DIO can help determine the additional capital required to support this growth.

In conclusion, days inventory is a vital metric in financial modeling, providing insights into a company’s operational efficiency, cash flow management, and capital requirements. Properly forecasting and managing DIO can lead to better financial planning and more informed decision-making.