Clothing Franchise Valuation Model

The management of your company has asked you to make a 5 years Financial Model (in excel) for setting up a franchise of a well-renowned clothing brand. The objective is to analyze the feasibility to set up this business. The model contains an executive summary, revenue computation of each inventory item, Income Statement, Balance Sheet, Cashflow Statement, Feasibility study, and Ratio analysis. The assumptions for price of goods, inventory items, number of products and SDGA are provided. These are flexible assumptions and one can change them as per their requirement.

The model template includes:

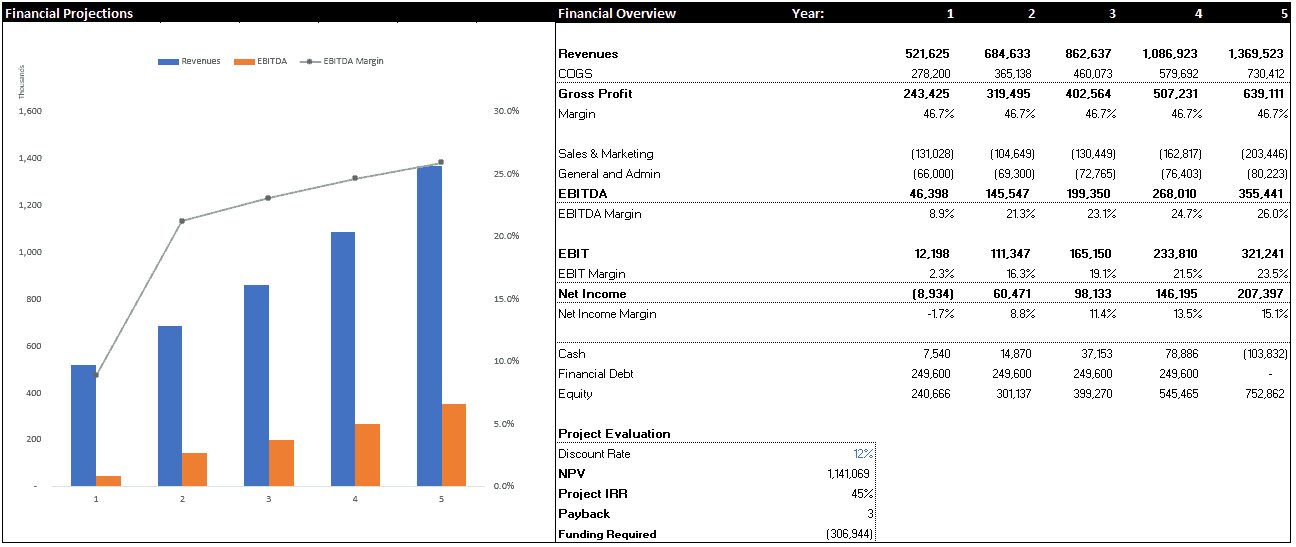

– Executive Summary section with charts and key financials

– Key assumptions sheet specific

– Yearly financial projections (Income Statement, Balance Sheet and Cash Flow Statement)

– Simple debt schedule

– Fixed asset depreciation schedule

– Forecasted financial ratios such as Debt/EBITDA, current ratio, quick ratio, ROE, etc.

– Projected Free Cash Flows to Firm which are used to calculate the internal rate of returns (Project IRR) and the Net Present Value (NPV)

– Payback period based on Free Cash Flows to Firm (FCFF)

– Calculation of the Equity IRR by using the levered cash flows from the shareholder’s point of view

– Reader and print-friendly layout including charts and graphs

The IRR Model provides the financial model to evaluate the IRRs and NPV of a greenfield project.

The model is based on a set of changeable assumptions for revenue growth, inflation, cost growths, Working capital growth. It follows a strict bottom-up approach: starting from revenues from individual clothing items, COGS, Income Statement, Balance Sheet, Cash flow statements are prepared.

Feasibility template is used to do NPV, IRR and Payback period analysis. The model was developed for a job interview so it has a strict professional outlook with easily changeable assumptions, formulas, and formatting.

Similar Products

Other customers were also interested in...

General Retail Store Financial Model – Dynamic 1...

Financial Model providing a dynamic up to 10-year financial forecast for a startup or existing Retai... Read more

Product Dealer Startup – The Customer Centri...

With this financial model, you can create a financial plan for the startup of your product dealershi... Read more

Bundle – Business Financial Forecasting Mode...

The purpose of this Bundle of Business Forecasting and Financial Models is to assist Business Owners... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Franchisor Licensing: Financial Model with Cap Tab...

Build up to a 10 year financial forecast with assumptions directly related to the startup and operat... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Online Car Rental – 3 Statement Financial Mo...

Online Car Rental Platform Business Plan Model is a perfect tool for a feasibility study on launchin... Read more

Subscription Box Financial Model – Up to 72 ...

Test many variables in this financial model for a subscription box company. Includes up to six prici... Read more

Jewelry Shop / Store 5 Year Startup Business Model

A bottom-up financial model that is designed specifically for a jewelry store, but could easily be u... Read more

You must log in to submit a review.