B2C Versus B2B – The Meaning for Startups

Table of Content

- A Brief Introduction about Business Models

- B2C Meaning – Business Sells to Consumers

- B2B Means Business Sells to Businesses

- Key Differences Between B2B and B2C

- Decide How to Sell Your Products – B2B or B2C

- Are There Business Models Other Than B2B or B2C?

- The Bottom Line – Which Model B2B or B2C will create more Value for your Business?

A Brief Introduction about Business Models

Are you planning to start a new business? First, let us congratulate you on your entrepreneurial spirit! Starting a new venture typically offers a stepping stone to financial freedom. As a Startup, how you plan to sell your products and services is among the many decisions you will need to make when you create a new company and are ready to go to the market. To whom you like to sell your products and services? What are the main characteristics of your target client base?

One topic you will come across is a fundamental choice of what type of company you want to become:

- Business to Consumers (B2C): Selling your products and services to end consumers

- Business to Business (B2B): Selling your products and services to other businesses

- OR even a mix of the former two?

In many cases, choosing which customer segment you plan to sell to – B2C vs. B2B – will significantly affect your business strategy, monetization options, and risk profile. This article will explain the main characteristics of each option as well as detail the differences between focusing on B2B or B2C business models.

We hope that our article is helpful for Startups to understand the implications better when choosing one – or a mix of both – of B2C or B2B business models. We look at these topics from a value maximization point of view as our financial models can be used to understand better the financial implications when deciding which option to go.

B2C Meaning – Business Sells to Consumers

What is B2C translates to business-to-consumer. It is when a business sells directly to the consumer, buying the product or service for personal use and not resale. It involves the exchange of goods and services between traditional brick-and-mortar shops and customers who go in to make a purchase or use a service. Nonetheless, B2C has developed in the modern era to incorporate digital channels, including business websites, online shops, and social media. The B2C market is large and comprises businesses that sell tangible products like electronics and clothing and digital products like apps, books, music, and more. All in all, they market consumer goods that satisfy human needs and want.

Some Examples of B2C Companies

A B2C business model has many categories. Some of the most common are:

- Advertisers – online sites like Reddit and YouTube receiving large traffic volume.

- Community-Based Forums – social media communities with promising leads like Facebook, Instagram, and Twitter.

- Direct Sellers – companies like Apple and Microsoft selling products directly to consumers.

- Online Intermediaries – who do not own their products put sellers in direct contact with their buyers like eBay, Etsy, and Uber.

- Subscription Services – such as Hulu, Lynda, Netflix, and Spotify, offer fee-based access.

- Traditional Retail Shops – including auto-mechanics, car washes, supermarkets, etc.

B2B Means Business Sells to Businesses

On the other hand, B2B is an acronym for business to business. From a financial modeling perspective, what B2B means is a model in which the target product customer is another company. B2B clients may include institutions, producers, and resellers.

B2B marketing might occur between a manufacturer and a wholesaler, a wholesaler and a retailer, or two businesses that use one another’s services or goods. Under a B2B financial model, both businesses profit from each other in B2B business strategies. The company providing the good or service makes money, while the other acquiring it receives what its operation requires. Some B2C models may also engage in B2B transactions. For instance, a pharmaceutical corporation sells drugs to customers and provides goods and services to hospitals, clinics, and other pharmacies.

Some Examples of B2B Companies

- Coca-Cola is a famous carbonated soft drink brand in the world. Its manufacturer sells to distributors and retailers.

- Slack offers a suite of collaboration tools and services. It is the go-to B2B communication tool for organizations since it allows for file sharing, one-on-one messaging, searchable message archives, and software integration.

- Solar Panel manufacturers sell solar systems to contracting companies and roof installation providers.

White labeling means manufacturing a generic product and selling it to multiple retailers. It is under the B2B umbrella. An excellent example of a white-label retailer is Kirkland. Bumblebee makes Kirkland tuna, Duracell makes Kirkland batteries, Grey Goose makes Kirkland vodka, etc.

Key Differences Between B2B and B2C

Business-to-business (B2B) and business-to-consumer (B2C) are business models with unique characteristics and needs. Understanding their characteristics and differences is essential when deciding how to sell your products and services. Several vital differences define what B2C vs. B2B is. Below, we have laid down the most distinctive ones.

Customers or End Users

The main difference between B2B and B2C is the end user of their products. Under B2B, the end users are businesses, where the purchase intent is bulk buying at low cost and steady supply. In contrast, B2C serves consumers whose purchase intent may be emotionally driven, impulse buying, peer pressure, or personal need.

For instance, a business selling chocolate to another company may offer discounts without creative packaging to encourage bulk orders. At the same time, a business selling chocolates directly to consumers may sell the products at a higher price to cover the cost of appealing packaging and store shelves.

Besides, the customer acquisition cost (CAC) of a B2C financial model can be estimated based on average value per customer or average cost per click campaigns, which is relatively low-cost. On the other hand, B2B CAC tends to be higher because of expensive sales cycles and multiple decision-makers involved in a purchase decision.

Product

You’ll find more complex products and services in a B2B business. Each of them is tailored based on the client’s needs and preferences. B2C products are much simpler than B2B sales. They are typically the same standard as other competitors. What makes them competitive is either the packaging g or significant technology investments.

For example, a B2B company like Salesforce offers customized Customer Relationship Management (CRM) platforms. The company designs a one-of-a-kind CRM technology for every client. The CRM may also require further assistance or support for the client to learn to use the product better. Unlike Prada, a B2C company that offers limited edition items with the same features. All the store needs to brand and present them well to sell them.

Customer Concentration

Customer concentration is typically high in a B2B model. B2B industries focus on a limited customer base buying in large volumes. They make up a significant portion of their revenue. B2B sales are often based on long-term relationships and trust between the supplier and the customer. It may be difficult for existing B2B customers to switch to a new supplier because of complex product offerings, customized solutions, specialized equipment, or training.

Unlike in B2C industries, customer concentration tends to be lower. Because of a large customer base, they are less likely to rely on a single or small group of customers for a significant portion of their revenue. Yet, individual customers can easily switch to a different brand or product if they are unsatisfied.

Sales Cycle

Typically, B2B marketing includes having a dedicated sales force to manage complex sales. The team will handle a one-to-one distribution, marketing, and sales approach for every client to leverage growth. So, the sales cycle is longer.

In B2C marketing, the entire organization may be involved in the sales process since the customer is the consumer and the sole decision-maker. B2C sales transactions are primarily simple and have shorter sales cycles.

Ticket Size

Ticket Size refers to the amount a customer spends per transaction. That’s where the big difference between B2B sales and B2C marketing lies. B2C generally has a small ticket size, while B2B has a large one.

Businesses are generally more price sensitive than consumers. But they tend to buy products or services in bulk and log-termed. Consumers care more about the presentation than businesses. But they commonly have a small budget for every purchase.

Brand

Selling B2C requires developing your brand because you deal directly with end-users. These types of customers are more likely to make purchasing decisions based on their perception of a brand. In B2C industries, consumers have a wide range of choices, and they often make buying decisions based on factors such as brand reputation, perceived value, and emotional connection. A unique brand identity can help differentiate your product or service from competitors in the market.

When selling B2B, you have two options: sell under your brand or offer a white-label solution. A white-label solution is where another company puts its brand on your product and markets it as such. Such a solution allows you to quickly enter new markets and expand your customer base without significant investment in branding and marketing. At the same time, it can increase revenue streams by allowing you to sell your product or service to multiple customers under different brand names.

Decide How to Sell Your Products – B2B or B2C

After having an overview of what is B2B and B2C, the next question that comes is which is better? The rational way of deciding whether you go B2B or B2C may include the following steps:

Step 1 – Define the business and financial plan for each scenario.

Step 2 – Figure out the profitability & growth of each model.

Step 3 – Identify the risks and merits of each scenario.

Step 4 – Evaluate and compare the scenarios in terms of their Financial Attractiveness

Step 1 – Define the business and financial plan for each scenario.

Defining your business and financial plan is an essential first step in determining whether your business should focus on a business-to-business (B2B) or business-to-consumer (B2C) model.

a) Conduct Market Research

You can start by researching your target market to identify their needs, preferences, and buying behaviors. It will help you determine if your product or service is better suited for a B2B or B2C model.

It may be good to offer standard products and services directly to the consumers and end-users. These offerings are commonly in demand and easier to market. So, a B2C model, like a brick-and-mortar, online shop, or retail store, will do.

But targeting businesses may be better if your product or service is complicated or requires special sales services like software. It is because you may need different teams to close the sale. So, a higher revenue per transaction is necessary.

b) Determine Your Revenue Streams

Consider how you plan to generate revenue. Are you selling directly to consumers or working with other businesses as a supplier or vendor? Understanding your revenue streams will help determine which model is more appropriate for your business.

The sales cycle for B2B and B2C businesses can be very different. B2B sales cycles are typically longer and involve multiple decision-makers, while B2C sales generally are faster and more impulsive. Understanding your sales cycle will help determine which model is more appropriate for your business.

c) Recognize Your Resources

Finally, consider your available resources, including your budget, team, and expertise. If you have more experience in B2B sales or have connections in the business world, a B2B model may be more appropriate. If you have more experience marketing to consumers, a B2C model may be a better fit.

Typically, B2B needs a large workforce to manage various business operations effectively. Since B2C are less formal and has more straightforward procedures, it can smoothly operate with a small team.

By following these steps, you can decide whether a B2B or B2C model is best for your business. However, remember that your business model may evolve as you learn more about your customers and market.

Step 2 – Figure out the profitability & growth of each model.

Everyone’s goal is to ensure that a business model – whether B2B or B2C, is driving profitability and growth. You should thoroughly analyze several factors to determine the expected financial profitability and growth potential of a B2C or B2B business model for your business. You especially might want to understand the implications of the following factors:

a) Customer Lifetime Value (CLTV)

CLTV is the total revenue you can expect from a customer for their relationship with your business. B2B customers tend to have higher CLTVs than B2C customers since B2B customers typically make larger and more frequent purchases.

b) Customer Acquisition Cost (CAC)

CAC refers to the cost of acquiring a new customer. In general, B2C businesses tend to have lower CACs than B2B since B2C companies can leverage mass marketing techniques and have a more extensive potential customer base.

c) Gross Margins

Gross profit margin (GPM) or return on invested capital (ROIC) represents the percentage of revenue you keep after deducting the cost of goods sold. In general, B2B businesses tend to have higher gross margins than B2C businesses since B2B businesses can often negotiate bulk discounts from suppliers.

d) Sales Cycle Length

The sales cycle is the time it takes from initial contact with a customer to closing a sale. B2B sales cycles tend to be longer than B2C sales cycles, which can impact a business’s profitability and growth potential.

e) Market Size

The size of the potential market is a critical factor in determining the growth potential of a business. B2C businesses often have larger potential markets since they can target a broader range of consumers, while B2B businesses have a smaller potential market but often have more concentrated demand.

By analyzing these factors, you can better understand which model will likely be more profitable and have more significant growth potential for your business.

Step 3 – Identify the risks and merits of each scenario.

Identifying the risks and merits of a B2B or B2C model can help you decide which model is right for your business. Before making a choice, make sure you consider the risks and merits of both.

Regarding B2B sales, you must be prepared to engage with large-scale partners and provide them with higher customer service than you would offer B2C customers. You’ll also need to ensure that your company can provide a steady stream of products or services to maintain contracts with B2B customers.

A B2B model may involve higher risks because losing a client can significantly disrupt the business’s revenue. B2B companies often rely on a small number of key customers. If one or more of these critical customers were to reduce or stop their business with the B2B company, it could significantly negatively impact the company’s revenue and profitability. Often, they extend credit to their customers, which can result in payment delays or even non-payment. It can be particularly problematic if a few customers account for a significant portion of the B2B company’s revenue.

With a B2C model, you can reach a much more comprehensive range of consumers, giving your business more exposure and potential revenue streams. Even if you lose your top 5 customers, it may be easier to bounce back and replace them. It could decrease revenue and profits, but you can acquire new ones to maintain a stable revenue stream. Additionally, selling directly to customers allows you more control over pricing and margins. However, this model requires higher marketing costs to maintain visibility in an increasingly crowded marketplace.

Ultimately, the decision on how to sell your products will depend largely on your target audience, budget constraints, and long-term objectives for growth.

Step 4 – Evaluate and compare the scenarios regarding their Financial Attractiveness.

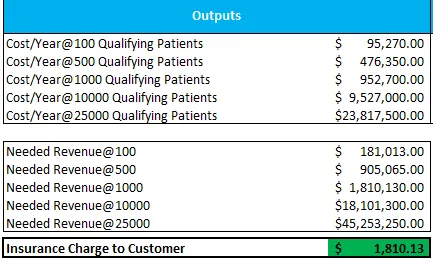

One helpful method is to use financial analysis when evaluating the financial attractiveness of business-to-business (B2B) and business-to-consumer (B2C) models. The financial analysis uses Exit Value, Net Present Value (NPV), and Internal Rate of Return (IRR) to help you decide which model would yield higher returns for your business.

a) Exit Value

Exit value is a measure of the value of a company at the time of exit. By understanding your company’s exit value, you can better predict how much money you’ll make when you decide to move on from a certain model. Valuing a business can either be simple or complex, but in any case, you will need to understand which business valuation methods to use.

b) Net Present Value (NPV)

Net Present Value (NPV) is the value of all future cash flows discounted to the present. This metric helps you understand the overall value of a particular transaction or project and identify any cost savings that could be achieved by switching from one model to another. You can use an NPV calculator for easy calculations to determine if a B2B or B2C will yield a higher monetary value.

c) Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) is the discount rate that makes all cash flows (NPV) zero. Like NPV, the greater the value of IRR, the more desirable the business model. There isn’t a set formula to calculate IRR. It takes a lot of trial and error until you find the rate that makes the NPV equal to zero. So, it will be easier to use an IRR calculator. This metric helps you determine if it would be more profitable to switch from one model to another.

From a financial point of view, the results of financial ratio analysis matter to making a solid decision about which is better, B2C versus B2B. By understanding your current financial situation in terms of these three indicators, you can gain valuable insight into what type of selling model would best fit your needs – B2B or B2C – and maximize return on investment over time.

Are There Business Models Other Than B2B or B2C?

While B2C (Business-to-Consumer) and B2B (Business-to-Business) are the most common business models, there are other business models that you may want to consider:

- Business-to-Consumer-to-Business (B2C2B): This model involves selling products or services to consumers, who then sell those products or services to other businesses.

- Business-to-Government (B2G): This model involves businesses selling products or services to the government. The government is the customer, and the company is the supplier.

- Consumer-to-Business (C2B): This model involves consumers selling products or services to businesses. For example, a freelance writer sells their services to a company.

- Consumer-to-Consumer (C2C): This model involves consumers selling products or services to other consumers, typically through online marketplaces.

- Direct-to-Consumer (D2C): This model involves businesses selling products or services directly to consumers, bypassing traditional retail channels.

The Bottom Line – Which Model B2B or B2C will create more Value for your Business?

Choosing between a B2B or B2C business model early on in your enterprise will enable you to create the necessary business infrastructure and successfully market your goods and services to your target customers. With correct information and understanding of each model, companies can correctly identify the most suitable for their needs and create a pathway to success.

B2B and B2C customers have unique needs that must be addressed for the company to experience growth and profitability. Businesses must review customer segments and consider their current and desired strategies to determine the best business model.

Financial modeling for both B2B and B2C scenarios can help you better understand which model can add more value to your business. Different profitability ratios and financial ratio analyses can help determine if a B2B or B2C generates higher revenue.

Besides, these financial models allow you to compare B2B vs. B2C models based on their financial feasibility over time, so you can determine which makes more sense for you at any given moment. With this knowledge, you can make an informed decision to help you achieve long-term success in your industry.

Ultimately, it’s essential to thoroughly research your industry and target market before deciding on a business model. It’s also worth noting that some businesses may use B2B and B2C models, depending on the products and services.

Looking for industry-specific financial model templates in Excel? Please feel free to browse our selection of some of our Excel Model Templates here: