The Ten Key Principles of Financial Modeling

Financial modeling is a powerful tool that can help businesses and investors make better decisions, optimize their financial performance, and achieve their long-term goals. These users need help building an efficient model example with logically sound assumptions. This guide will equip you with all the necessary skills to create an efficient financial model Excel template incorporating best practices and principles of financial modeling confidently.

If you’re trying to learn how to create sophisticated spreadsheets or want to up your Excel game so that you can build accurate financial model templates with confidence, then you’re in the right place. Let us walk you through the core principles and key attributes of building financial models using Excel — from setting up all the key assumptions and calculations that drive your model to ensuring a thorough model check is carried out front-to-back.

Financial Modeling Definition

Financial modeling definition is the process of creating a mathematical representation of a company’s financial situation. It typically uses historical data, industry trends, and market conditions to project future revenue, expenses, cash flows, and other financial metrics. Furthermore, financial modeling definition involves forecasting future financial performance and creating scenarios to help decision-makers make informed choices.

A well-designed financial model in Excel can provide a comprehensive view of a company’s financial health, allowing investors, analysts, and other business owners to understand the company’s potential risks and opportunities. It provides a clear and concise picture of the company’s financial position and can be used to identify potential risks and opportunities.

Financial modeling in Excel is widely used for various purposes in finance and business. These goals commonly include budgeting, financial analysis & planning, risk analysis, sensitivity analysis, and valuation. The most common financial model templates are capital budgeting, comparable analysis, discounted cash flow analysis, sensitivity analysis in Excel, and the three-statement model.

Key Principles of Financial Modeling

Most dictionaries define a principle as a basic generalization accepted as true. It is an idea or rule that guides everyone. In the financial modeling definition, the fundamental principles revolve around effectively acquiring and managing funds to meet financial needs and objectives.

Building financial models in Excel requires careful planning, a solid understanding of logic, and the utmost precision. It is why adhering to the core principles is essential when constructing a financial model Excel template. Let’s break down the fundamentals you should consider while building your financial model.

The ten principles of financial modeling are the following:

- Clear Model Objective

- Foundational Research

- Analyzing for Success

- Grasping Business Logic

- Separate Assumptions from Calculations

- Intuitive Model Structure

- Dynamic Calculations

- Well-Organized Presentation of Results

- Interpreting Forecasted Performance

- Identify Errors

1) Clear Model Objective

One of the core principles of financial modeling in Excel is having a clear objective to guide the modeling process. A financial model Excel template should answer the following questions:

- What is the purpose of the model? The financial model should have a clear goal as to what it needs to accomplish.

- Who is the target audience? Who needs to understand this model? Recipients or users of a financial model may include financial professionals, investors, management executives, shareholders, stakeholders, etc. The technical sophistication the model needs to offer should match their circumstances and individual requirements.

- Which key questions should the model answer? Financial Modelers should use their expertise and analysis to identify key questions that users would be clarifying. By focusing on specific questions or problems, the financial model Excel template will be designed to provide actionable insights.

- What level of detail is required? The financial modeling definition indicates that the level of detail needed in financial models depends on the model’s purpose and scope, as well as the preferences and standards of the modeler and the intended users. The benefits and implications of adding details must be carefully evaluated because doing so could increase work and reduce clarity.

Answering these questions makes the financial model goal-oriented or focused on accomplishing the objectives. As such, the modeler will do their best to provide everything one needs to know to make solid financial decisions and understand the risks and opportunities.

2) Foundational Research

Conducting an industry overview is the foundation of financial model templates. Gaining a comprehensive understanding of the industry’s characteristics and structure will support the model’s logic, assumptions, calculation methodology, and results. Research elements include industry reports, trade publications, and other reliable sources to gather information on market size, growth rates, trends, and major developments.

A solid financial model template is built on research for several reasons:

- Accuracy and Validity – Research ensures that the information, method, and assumptions used in the financial model are accurate and valid. By gathering reliable data, industry insights, and up-to-date information, researchers can be sure that the model effectively captures the key features of the business or industry under study.

- Informed Assumptions – Research provides financial data to make informed and justifiable assumptions. Understanding historical trends, industry dynamics, and economic factors allows financial modelers to set realistic assumptions that reflect the business’s unique context. It enhances the model’s credibility and increases confidence in the results.

- Realistic Projections – Through research, industry-specific knowledge enables the creation of more realistic projections and forecasts, as it considers past performance and external factors that may impact the future.

- Decision-Making Support – A financial model built on a solid research foundation provides valuable decision-making support. It helps identify key factors, risks, and opportunities specific to the industry or business, allowing modelers to explore various scenarios, assess potential outcomes, and make informed strategic choices for the business.

Remember that financial modeling in Excel requires continuous research and updates as it is crucial to adapt to changing market conditions, industry trends, and business dynamics.

3) Analyzing for Success

Financial analysis is the study of the connections between the figures in the financial statements to assist users, such as investors, lenders, and managers, to understand a company’s strengths and weaknesses, make informed decisions, and set realistic targets. It also includes looking at the project from different angles so that the analysis is complete and correct.

The following are the key analyses financial modelers need for successful financial modeling in Excel:

- Historical Analysis: Financial models typically start with historical financial statements, including income statements, balance sheets, and cash flow statements. By analyzing relevant historical data, researchers gain valuable insights into past performance, trends, and patterns of financial variables. Researchers should ensure that the data is reliable, accurate, and covers sufficient periods to capture meaningful trends, which helps inform future projections and decision-making.

- Competitive Analysis: Conduct thorough research on the market and assess the competitive landscape by examining key competitors and understanding the trends and factors that may impact the business. Research factors such as market pricing, product differentiation, customer preferences, market dynamics, and potential barriers to entry help determine the size and growth potential of the target market or customer segment.

- Business Risk Analysis: Analyzing potential risks and uncertainties associated with the business or industry allows modelers to incorporate appropriate risk management techniques and sensitivity analyses into the model.

Financial analysis plays is crucial in understanding a business’s financial health and performance, enabling investors to make informed decisions and manage risks effectively.

4) Grasping Business Logic

In financial modeling definition, business logic refers to the underlying concept that determines how financial data is processed, analyzed, and presented within the model. A deep understanding of the business and its operations enables modelers to design and build the financial model to accurately represent the company’s structure, revenue streams, cost drivers, and other essential aspects. Investors are also more likely to trust and rely on a financial model when it accurately reflects the business’s reality.

As a result, the financial model Excel template’s value is enhanced by being relevant, credible, and specifically designed for the business being analyzed.

5) Separate Assumptions from Calculations

An effective financial model Excel template should enable users to distinguish assumptions from calculations to understand how the model will work clearly. The input assumptions, therefore, should be separated from the calculations, making it easier and transferrable for different users to confidently and comfortably work best with the models by changing the assumptions.

The cell color code sample below illustrates how to build your financial model templates by separating the assumptions from the calculations. Color coding assumptions in blue and output in black promote clarity.

The color-coding scheme should be consistent throughout the model.

Important Financial Model Assumptions

While specific assumptions can vary depending on the context and purpose of the financial model templates, here are some important assumptions to consider:

- Time Horizon of a financial model Excel template represents the period a financial analysis or projection is conducted. The model can be built as a monthly and yearly forecast or just yearly, depending on the relevance.

- Revenue assumptions in a financial model Excel template refer to the key factors and variables that drive the projected revenue for a business or project. These may include sales volume, market size, prices, growth and inflation rates, etc.

- Cost assumptions in the financial modeling definition refer to the estimated values or parameters used to project and calculate various expenses incurred by a business or organization. These may include fixed costs and variable costs.

- Capital Expenditures (CAPEX) refer to the funds a company invests in acquiring, upgrading, or maintaining long-term assets, such as property, plant, and equipment (PP&E). These expenditures are essential for the company’s operations and are expected to generate benefits over an extended period.

- Financing assumptions are an integral part of financial modeling in Excel and involve making projections and assumptions about how a company will finance its operations and growth. Consider interest rates, repayment terms, borrowing costs, and any potential changes in capital structure.

- Tax Assumptions: When building a financial model Excel template, it is common to make certain tax assumptions to estimate the impact of taxes on the financial statements and cash flows. These assumptions help in projecting the tax liabilities and effective tax rates.

Disclosing the underlying assumptions in the model and its calculation is crucial to get people to understand and trust it. It is also important to note that these assumptions are based on the best available information when the financial model is developed and may only sometimes hold true in practice. As a result, financial model templates should be regularly updated and adjusted based on new information and changing circumstances.

6) Intuitive Model Structure

Using a standard structure for a financial model Excel template involves organizing data and calculations consistently and logically outlined step-by-step for an easy-to-follow financial model structure and easier auditing. The time and effort needed to create and maintain financial models is also decreased with a standardized structure, making it simpler to update and adjust models as necessary.

A systematic and intuitive financial model Excel’s modeling flow should consider clarity, consistency, and logical flow. The structure may be from top to down or left to right and avoids jumping between different sections. If the model involves multiple stages or intermediate calculations, create a separate section to display the results at each stage.

Modeling this way allows users to easily comprehend the structure, inputs, and outputs, making it simple to utilize and navigate the model.

Standard Financial Model Structure

The standard structure of financial modeling in Excel typically includes the following approaches

1.Top-Down vs. Bottom-Up

In top-down modeling, you start with the company’s overall strategy or goals and break them into individual components as you progress through the model. For example, start making broad assumptions about the overall market and then work down to the specific financials of the business.

In contrast, a bottom-up financial model takes a more granular approach. It starts with lower-level details to build them to the big picture. For example, you begin identifying the volumes and prices of a business to calculate the revenue.

Bottom-up models generally have more explanatory power than top-down models. But it depends on the project. Some call for more complicated financial model templates — in these cases, bottom-up modeling is often the best choice. It allows for a more granular view of the data and helps you zero in on the areas that matter most. On the other hand, if you’re working on a simpler model, top-down modeling will probably be quicker and easier.

2. Inter-Worksheet Links: It is essential to ensure that financial model templates work as a cohesive unit with all its parts linked. Each section of the financial model Excel template must be connected; the most critical connection is between the model’s sections. Inter-worksheet links are vital for creating error-free logic in Excel. If you change one cell of your financial model, any effects on other parts will be automatically calculated and updated in the other worksheets.

For example, adjusting an expense on the Income Statement will affect the Balance Sheet and Cash Flow statements accordingly. Thus, inter-worksheet links ensure that changes made to one statement have repercussions throughout the spreadsheet. You can create inter-worksheet links by referencing them directly from one worksheet to another.

7) Dynamic Calculations

Financial model templates must be dynamically built where it is flexible enough to accommodate the industry’s requirements, such as the start of operations and productions. The changes in assumptions and inputs should cascade throughout the model, updating all relevant calculations and outputs.

Financial modeling in Excel achieves flexibility by using appropriate, accurate, and consistent formulas and references that link different cells or sections together. By structuring the model in this way, changes in one cell can automatically update all dependent cells, allowing for quick and efficient recalculation of results. In addition to updating formulas based on changes in assumptions, removing unnecessary calculations are essential. These formulas do not contribute to the overall purpose of the model. Including unnecessary calculations can complicate the financial model Excel template and introduce potential errors or inefficiencies.

8) Well-Organized Presentation of the Results

A financial model template’s primary goal is to communicate financial data and results to users for decision-making. An executive summary is an essential principle of financial modeling as it helps provide a high-level overview of the model’s inputs, assumptions, methodology, and outputs by condensing large and complex financial data into concise, easily understandable information.

The content and structure of a financial model Excel template summary should be well-organized, clearly and concisely representing its key aspects, findings, and results. This structure lets the reader quickly grasp the main points without getting lost in excessive details.

Fundamental Elements of a Financial Model Summary

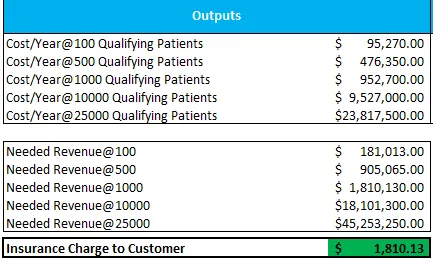

A financial model summary should include the following elements:

- Objectives: The purpose of the model and its intended use.

- Inputs: The fundamental assumptions and variables used.

- Outputs: The results generated by the model, including key financial metrics.

- Limitations: Discuss the limits and risks associated with the financial model Excel template.

By incorporating these elements into the financial model results, stakeholders can quickly understand the critical aspects of the model and make informed decisions based on the results. Summarizing a financial model using charts and graphs can quickly communicate key insights and trends. Where necessary,

include brief descriptions or captions to help interpret the visualizations and provide additional insights or explanations.

9) Interpreting the Results

Every financial model Excel template needs to include analysis to make the model results easier to understand and interpret. These include financial ratio analysis, sensitivity analysis, and the key performance indicators or metrics the model corresponds to. By examining financial statements, one can assess how well a company generates revenue, manages its expenses, utilizes its assets, and generates cash flow. They also compare the company’s financial performance to industry benchmarks and competitors to gauge its relative position in the market.

10) Identify Errors

Model checks are essential to ensure the accuracy and reliability of a financial model Excel template. They are a core principle of financial modeling because they help identify errors, inconsistencies, and potential risks in the model. Model checks help ensure that the model’s inputs, formulas, and calculations are accurate and that the model produces the expected results. They help avoid errors when data is copied or formulas are modified. Some standard model checks in financial modeling include formulation, input, and output checks.

Building an Efficient and Well-Designed Financial Model Excel Templates

Adhering to the ten key principles of financial modeling empowers financial modelers to design and build a solid financial model Excel template. From identifying a clear objective and building on a research foundation, a financial model Excel template built with an intuitive and reliable model structure becomes a valuable tool to support strategic planning and informed decision-making.

Here at eFinancialModels we focus on building great financial model templates to make it easier for buisnesses to prepare financial plans which are needed to support your business plan. Benefit from our vast know-how on how to build sophisticated financial models to faciliate financial feasibility analysis, investment analysis, fundraising, business valuation, budgeting and financial planning.

Feel free to contact us, if you wish your financial modeling project with a trusted financial modeler.