Multiple Loan Repayment Planning with Extra Principal Applied

Optimize where an extra principal payment should go and see the total cash flow savings when you have multiple loans.

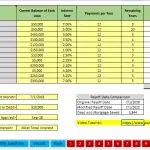

This Multiple Loan Repayment Excel Template is a great tool for building a schedule for repaying multiple loans that consider the calculation of extra principal.

Video Tutorial (shows how to build from scratch):

If you have multiple principals and interest loans (not interest-only debt) and you know you will have some extra cash flow to try and pay that debt back faster, you may want to know where to allocate this extra principal so that it saves you the most interest over time.

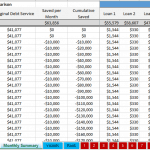

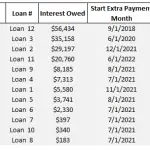

What this multiple loan repayment Excel template model does is rank your loans in two different ways (you can toggle the ranking style to see how they affect your total repayment). The first way you can define the extra payment allocation is by having the loan repayment Excel template model apply it according to the total lifetime interest of each loan. That means it starts at the loan with the greatest interest and once that loan gets paid back, the allocation automatically starts affecting the next-highest loan and so on.

If a loan ends up already getting paid back by the time the loan ahead of it is paid back, the allocation knows to skip to the next available loan. This goes on until everything is paid back. This just shows how useful the multiple loan payoff calculator excel template works.

The other ranking style is by highest interest rate. Because the loans can have different terms, the highest interest rate doesn’t always mean the most effective to pay off first. This is what makes the optimization so difficult to automate. However, this loan repayment spreadsheet or loan repayment template works properly as it should and you can simply use the template to build a model for multiple loan amortization schedules in Excel.

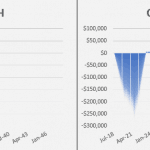

Finally, you will see a monthly summary of debt service with no extra payment vs. debt service with extra payment, the amount of days ahead of time you pay back all the loans, and the total savings when you do apply extra principal in this optimized way.

If you have any questions regarding the multiple loan payoff calculator Excel template, feel free to contact me via the Contact Vendor button or via: [email protected]

Similar Products

Other customers were also interested in...

Crowdlending (P2P) Platform – 5 Year Financi...

Financial Model providing an advanced 5-year financial plan for a startup Crowdlending (Peer-to-Peer... Read more

Lending Company Financial Model – 5 Year Forecas...

This Financial model template presents a business scenario of a corporation engaged in granting loan... Read more

Lending Platform Financial Model (LaaS)

Includes all the assumptions you need to project the gross revenues and profits of a LaaS platform (... Read more

Lending Model Startup Forecast: 10-Year Scaling &#...

This is a full 10-year startup lending business financial model, including a 3-statement model. Accu... Read more

Flat Fee Lending Business: Operating Model

10-year financial model directly built for a flat fee / fixed fee lender. Includes leverage for orig... Read more

Loan Tape Analysis / KPI Dashboard

A framework that makes it easy to drop in your loan data and automatically generate analytical insig... Read more

Multi-Member Investment Fund Portfolio and Distrib...

A fund management tool to track many positions over time as well as distributions to up to 20 member... Read more

Buy Now Pay Later DCF Model & Valuation (10 Ye...

The Buy Now Pay Later (BNPL) Company financial model is a comprehensive tool designed to analyze the... Read more

Leasing Company Financial Model – 5 Year Forecas...

Financial leasing companies engage in financing the purchase of several types of assets. Though a le... Read more

You must log in to submit a review.