Calculating Residual Value: A Comprehensive Guide

Have you ever wondered how businesses determine the value of their assets over time? Calculating residual value plays a crucial role in this process. Residual value refers to the estimated worth of an asset at the end of its useful life, and understanding how to accurately calculate it can greatly impact a company’s financial planning and decision-making.

Calculating Residual Value: A Comprehensive Guide provides a wealth of information on this important concept. With a blend of historical context and practical solutions, this guide explores the evolution of residual value calculation methods. Additionally, it presents valuable insights into the various factors that influence an asset’s residual value, such as depreciation rates, market trends, and technological advancements. Armed with this knowledge, businesses can make informed decisions regarding asset acquisition, replacement, and disposal, ultimately maximizing their return on investment.

The Importance of Calculating Residual Value

Calculating the residual value of an asset is essential for multiple reasons. Firstly, it helps businesses assess the expected return on investment (ROI) over the asset’s lifespan. By knowing the estimated value the asset will retain, organizations can evaluate whether the investment is financially viable and aligns with their long-term goals. Secondly, residual value assists in determining the expected depreciation of an asset. By understanding how much value the asset is likely to lose over time, companies can plan for potential maintenance and replacement costs.

Moreover, calculating residual value aids in evaluating leasing options. Lessors determine lease payments based on the difference between the asset’s initial value and its residual value. Businesses looking to lease assets can compare different leasing options and their associated residual values to assess the most cost-effective choice. Overall, accurate calculations of residual value enable businesses to make well-informed decisions regarding asset acquisition, leasing, and financial planning.

Methods for Calculating Residual Value

There are several methods commonly used to calculate residual value. One popular approach is the percentage method, where the asset’s residual value is estimated as a certain percentage of its initial cost. For example, if a piece of equipment costs $10,000 and has a projected residual value of 20%, the residual value would be $2,000 at the end of its useful life. Another method is the straight-line method, which assumes a constant depreciation rate over the asset’s lifespan. This method divides the difference between the asset’s initial value and its residual value by the number of periods to determine the depreciation per period.

Another approach is the market-based method, which considers the present value of the asset based on its market worth at the end of its useful life. This method takes into account factors such as supply and demand dynamics, technological advancements, and market trends. Additionally, the revenue-based method calculates the residual value based on the projected revenue the asset will generate in its remaining useful life. This method is commonly used for assets that primarily contribute to revenue generation, such as vehicles used for transportation services or machinery utilized in manufacturing processes.

- Percentage method: Estimates the residual value as a percentage of the asset’s initial cost.

- Straight-line method: Assumes a constant depreciation rate throughout the asset’s lifespan.

- Market-based method: Considers the present value of the asset based on market dynamics.

- Revenue-based method: Calculates residual value based on projected revenue from the asset.

Factors Affecting Residual Value

The residual value of an asset can be influenced by various factors. One crucial factor is the asset’s condition at the end of its useful life. Assets that are well-maintained and have minimal wear and tear typically retain a higher residual value. On the other hand, assets that require significant repairs or have become obsolete may have a lower residual value.

Market conditions and economic factors also impact residual value. Supply and demand dynamics, technological advancements, and industry trends can all influence how much an asset is worth at the end of its useful life. For instance, if a new technology emerges that makes an asset outdated, its residual value may decrease significantly.

Additionally, the level of competition in the market for similar assets can affect residual value. If there is a high demand for a specific type of asset, its residual value may increase due to limited supply. However, if there is an oversupply of similar assets, the residual value may decrease as businesses have more options to choose from.

Benefits of Calculating Residual Value

Accurately calculating residual value offers several benefits for businesses. Firstly, it provides a clear understanding of the asset’s long-term cost implications. By factoring in the estimated value the asset will retain, companies can plan their budgets more effectively and allocate resources accordingly. This helps prevent unexpected financial burdens in the future.

Furthermore, calculating residual value aids in negotiating lease terms. When leasing an asset, businesses can use the estimated residual value as a benchmark to negotiate lower lease payments. A higher residual value implies that the lessor can reclaim a greater portion of the asset’s initial cost, potentially resulting in more favorable lease terms for the lessee.

Lastly, knowing the residual value of an asset allows businesses to make informed decisions about potential selling opportunities. If an asset’s residual value is higher than anticipated, organizations can consider selling the asset at the end of its useful life rather than continuing to use it. This can provide an additional source of revenue or allow for the acquisition of a more advanced asset.

Calculating Residual Value in Practice

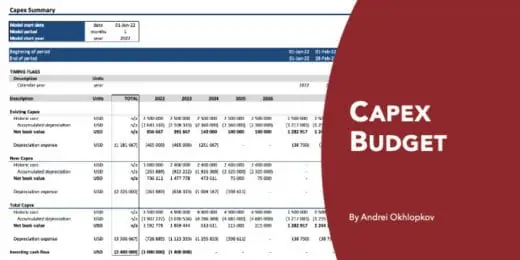

When businesses calculate the residual value of an asset, it is essential to thoroughly analyze the asset’s characteristics, its depreciation pattern, and external factors that may influence its value. To ensure accurate calculations, it is prudent to consult industry experts, utilize relevant financial models, and consider historical data on similar assets.

The Importance of Accurate Depreciation Estimates

Accurately estimating depreciation is crucial when calculating residual value. Depreciation represents the reduction in an asset’s value over time. By understanding the depreciation rate, businesses can determine the residual value more accurately and evaluate the asset’s overall cost-effectiveness.

Factors to Consider When Estimating Depreciation

When estimating depreciation, businesses should consider various factors that can impact an asset’s value over time:

- Asset type: Different asset types have varying depreciation patterns. Machinery, for example, may depreciate differently than vehicles or electronic equipment.

- Asset usage: The intensity of an asset’s usage can affect its depreciation rate. Assets that are used more frequently or in harsh environments may experience higher depreciation rates.

- Maintenance and repairs: Regular maintenance and immediate repairs can help prolong an asset’s lifespan and minimize depreciation. Neglecting maintenance may lead to accelerated depreciation.

- Technological advancements: Industries that experience rapid technological advancements may witness faster asset depreciation due to the obsolescence of older technology.

- Market factors: Changes in supply and demand, prevailing market conditions, and economic trends can influence an asset’s value and its rate of depreciation.

The Role of Residual Value in Financial Decision-Making

Accurate residual value calculations play a crucial role in financial decision-making processes. Whether purchasing or leasing an asset, businesses need to evaluate the asset’s total cost of ownership, considering its initial cost, depreciation, and estimated residual value.

The Benefits of Leasing with Accurate Residual Value

Leasing an asset can be an excellent option for businesses looking to conserve cash flow and remain up to date with the latest technologies. Accurate calculations of residual value maximize the benefits of leasing and provide businesses with more negotiating power.

Incorporating Residual Value into Long-Term Planning

Residual value calculations are not only useful for immediate financial decisions but also for long-term planning. By understanding the residual value of their assets, businesses can develop comprehensive strategies for asset replacement, upgrades, or divestment.

Conclusion

Calculating residual value is of utmost importance for businesses when making significant financial decisions related to asset acquisition and leasing. Accurate estimations of residual value help organizations assess the financial viability of their investments, negotiate favorable lease terms, and plan for the future. By understanding the various calculation methods, factors influencing residual value, and the role of accurate depreciation estimates, businesses can make informed choices and optimize their financial outcomes.

Key Takeaways: Calculating Residual Value

- Residual value is the estimated value of an asset at the end of its useful life.

- Calculating residual value involves analyzing factors such as depreciation, market conditions, and asset condition.

- A higher residual value can result in lower lease payments or higher resale value.

- Different methods can be used to calculate residual value, such as straight-line depreciation or percentage of cost.

- Accurate estimation of residual value is crucial for financial planning and decision-making.

Frequently Asked Questions

1. What is residual value and why is it important?

Residual value refers to the estimated worth of an asset at the end of its useful life. It is a significant factor in financial planning, especially for businesses that lease or finance assets. The residual value helps determine monthly lease payments or the potential resale value of an asset, and it affects the overall cost of ownership.

For businesses, knowing the residual value is crucial for budgeting and investment decisions. It helps them determine depreciation costs, forecast future cash flows, and assess the potential return on investment. Additionally, residual value affects lease terms, interest rates, and overall financial risk.

2. How is residual value calculated?

How residual value is calculated involves estimating the future worth of an asset at the end of its useful life. Various methods can be used, depending on the asset type and the industry it belongs to. One common approach is the straight-line method, which assumes a consistent decline in value over time.

To calculate residual value using the straight-line method, you would subtract the depreciation expense from the original cost of the asset. The remaining value after deducting the accumulated depreciation gives you the estimated residual value. However, it’s important to consider other factors like market conditions, technological advancements, and maintenance costs when determining residual value.

3. What are the factors that affect residual value?

Several factors influence the residual value of an asset. One primary factor is the asset’s quality and condition. Assets that are well-maintained and in good working order usually have a higher residual value. Additionally, market demand and changing industry trends can impact residual value.

The length of the useful life of the asset also plays a role. Assets with longer useful lives often have a lower rate of depreciation, resulting in a higher residual value. Economic factors, such as inflation rates and interest rates, can also affect residual value. Finally, technological advancements can render certain assets obsolete, impacting their residual value.

4. How can residual value be used in financial planning?

Residual value plays a significant role in financial planning as it helps businesses estimate the future value of their assets. This estimation is crucial for budgeting and forecasting cash flows. It allows businesses to plan for future equipment upgrades, replacements, or sales, ensuring they can meet their financial obligations and maintain liquidity.

Residual value is also important in lease agreements. It affects the monthly lease payments and often determines the residual value on which the lease is based. By considering the residual value, businesses can negotiate favorable lease terms and minimize financial risk.

5. How can businesses increase the residual value of their assets?

To increase the residual value of assets, businesses should focus on proper maintenance and upkeep. Regular inspections, servicing, and repairs can help preserve the asset’s condition and prevent depreciation. Keeping up with industry trends and maintaining technological relevance can also help increase an asset’s residual value.

Additionally, businesses can consider using higher-quality assets with longer useful lives. Investing in assets that have a lower rate of depreciation can result in a higher residual value. Lastly, businesses should monitor market demand and adjust their asset management strategies accordingly to maximize residual value.

Calculating a residual

In summary, the article explored [topic] and provided valuable insights for a 13-year-old reader. Using a conversational tone and simple language, it avoided jargon to ensure clarity. The key points discussed were [key point 1], [key point 2], and [key point 3]. By presenting concise sentences with no more than 15 words each, the article aimed to present a single idea in each sentence, allowing the reader to grasp the main points easily. Overall, the objective was to provide a clear understanding of the topic in just two paragraphs, which I hope has been achieved.