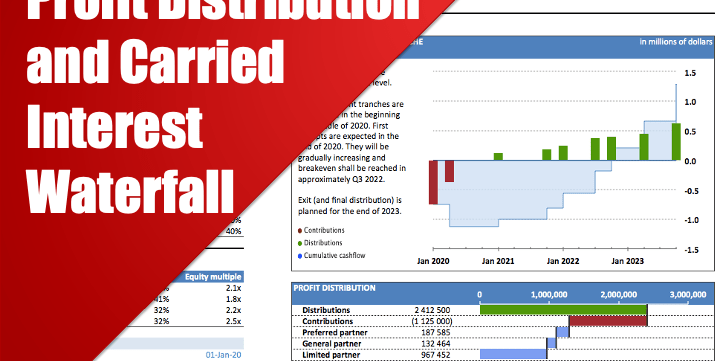

Profit Distribution and Carried Interest Waterfall

A template illustrating various setups of profit distribution between the JV partners. Includes a carried interest waterfall.

This template describes real-world mechanisms of distributing profits between project participants. It starts with modeling a distribution to a preferred partner, who has priority rights on the distributions and receives a guaranteed return on his investment until his contribution is repaid. Even thereafter he might be eligible for some equity incentives (kickers), which are included in this model as well.

The remaining profits are then distributed between common shareholders. A common setup in much private equity and other investment ventures is when a minority partner (general partner) carries out investment management activities. To motivate the general partner his proportion in profits can be made higher than merely his equity share if the project performs well.

This mechanism is called ‘carried interest’ and is normally set up in tiers, or buckets. Every tier corresponds to a certain level of profit to limited partners. Within every tier, profits are distributed between GP and LP in a certain proportion. When a tier is filled, distribution moves to the next tier. Every successive tier has a distribution proportion more favorable to the general partner.

Under most carried interest arrangements, there are three hurdles introduced:

Hurdle 1 – preferred return. This covers the initial investment and some minimum profitability (e.g. 20%). In this bucket, profits are distributed in proportion to equity participation. In some cases, limited partners keep all earnings.

Hurdles 2 – catch-up. Once the interests of limited partners are satisfied, the general partner ‘catches up’ on his profits. In this bucket, a more substantial portion of earnings is assigned to him.

Hurdle 3 – carried interest itself. The general partners start getting an even higher share of profits.

In some ventures, there can be more hurdles.

This template has four levels of tiers but can be amended to a higher number if needed very quickly. It can be built into your financial models, used for the calculations of actuals (also when payments occur at non-regular intervals), or for making accounting accruals.

The template is made in a very structured way which allows putting it, if required, into deal documentation and correspondence.

The model is supported by four charts:

1) A chart depicting every contribution and distribution on a timescale, with cumulative cashflow (exposure), estimated breakeven point, and cash position at the end of the project.

2) A chart illustrating the waterfall (total contributions, distributions, and split between the partners)

3) A chart showing annual and cumulative cashflows to every partner

4) A chart showing total contributions and distributions to every partner

Similar Products

Other customers were also interested in...

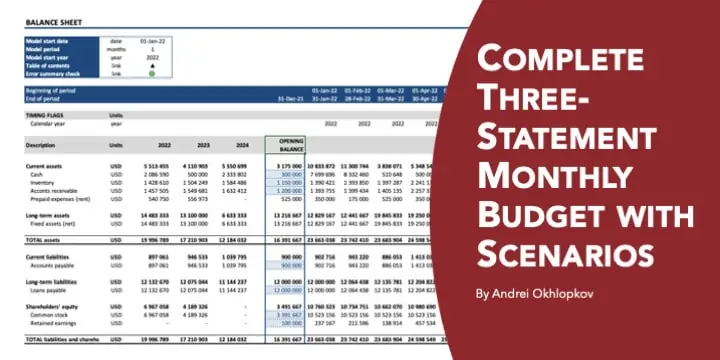

Complete Three-Statement Monthly Budget with Scena...

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

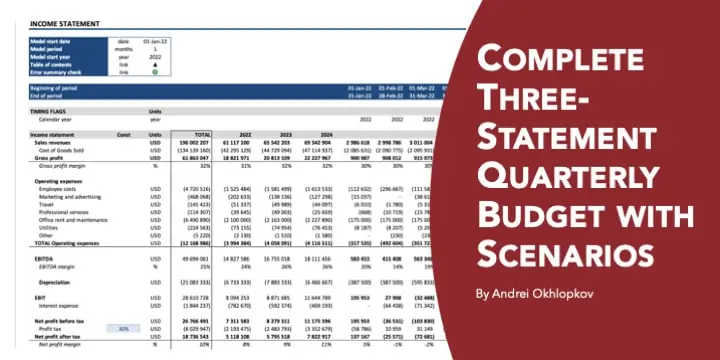

Complete Three-Statement Quarterly Budget with Sce...

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

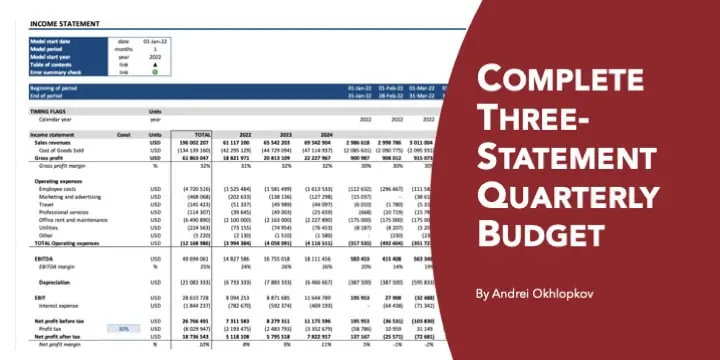

Complete Three-Statement Quarterly Budget

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

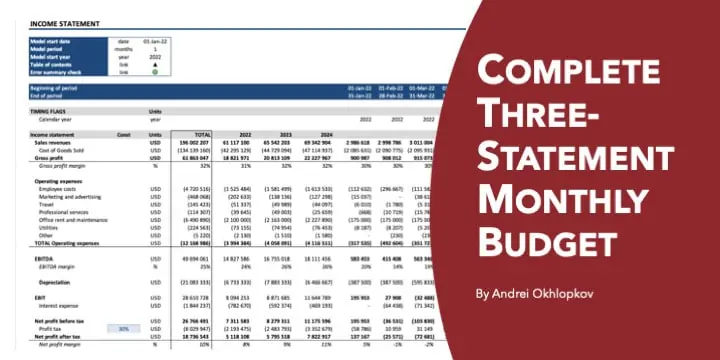

Complete Three-Statement Monthly Budget

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

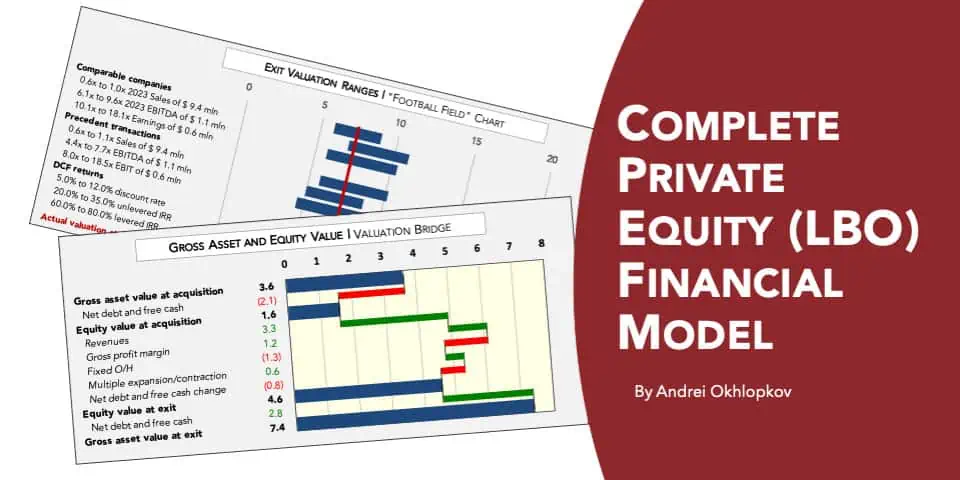

Complete Private Equity (LBO) Financial Model

This is a professional financial model which performs a thorough assessment of a private equity proj... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Joint Venture and Fund Cash Flow Waterfall Templat...

Here are all the spreadsheets I've built that involve cash flow distributions between GP/LP. Include... Read more

Preferred Equity Cash Distribution Model – 2...

A 10-year joint venture model to plan out various scenarios for the way cash is shared between a GP ... Read more

3 Statement Financial Modeling with DCF & Rel...

Financial Modeling Tutorial guides user via step by step approach on how to build financial models w... Read more

You must log in to submit a review.