Startup Business Plan – FMCG Distribution

If you dream to start an FMCG Distribution business, the template is the first step in making your dream into reality, it is constructed based on solid experience and highly analytical skills that will lead to guaranteed your success

General overview

It is no secret that starting any business plan from scratch is not easy. If you dream to start an FMCG Distribution business, the template is the first step in making your dream into reality, it is constructed based on solid experience and highly analytical skills that will lead to guarantee your success.

The model clearly shows the profit and loss result, the required capital for startup, the fixed assets needed to start, the use of the funds, the description of the operating expense needed to run the operation, etc.

This plan is also essential to document to the bank when applying for a loan or to an investor when applying for equity funding; having a well-thought-out business plan shows you have analyzed your idea and helps give investors an overview of the risk and potential rewards of investing.

It is very simple to use; the user only needs to fill in the green cells in the green tabs, and the outputs are updated instantly.

So, here is a quick overview of the model: in the contents sheet, you can see the structure of the model, and by clicking on any of the headlines, you will automatically be redirected to the relevant sheet.

Inputs

- Update the general info on the Front Page

- Fill the green cells only in the green tabs

Outcome

The data will dynamically flow into the following below:

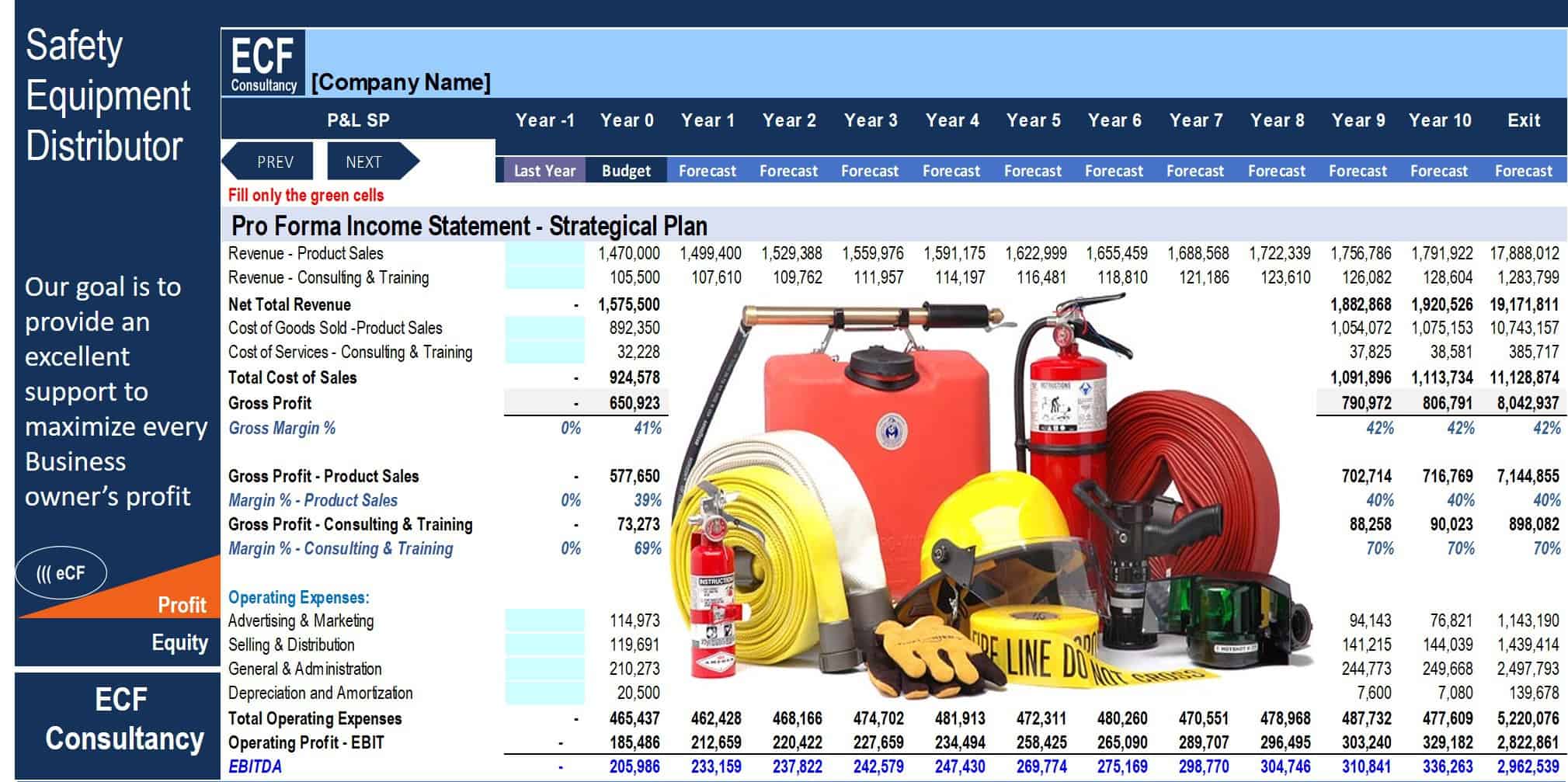

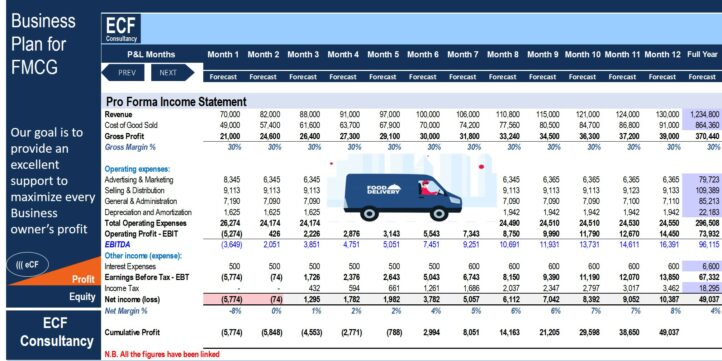

- Profit & loss statement by month, including 3 major components, gross profit, EBITDA, and net profit

- Balance sheet by month, including total assets, total liability, and owners’ equity

- Cash flow by month with 3 outputs such as operating cash flow, investing cash flow, and financing cash flow

- Ratios with 4 main components such as profitability ratio, efficiency ratio, liquidity ratio, and solvency ratio

- Break-even point including value as well as margin of safety

- Profit and loss statement for 10 years including 3 major components, gross profit, EBITDA, and net profit

- Business valuation using discounted cash flow, with 2 main outputs such as intrinsic value and market capitalization

- Calculation for the WACC and capital required

- Regular and discounted payback period

- Financial summary

- Dashboard summary

Conclusion and customization

Highly versatile, very sophisticated financial template, and user-friendly If you have any inquiry, modification, or customization requests for a financial model of your business, please reach us through: [email protected]

File Types:

Excel Version – .xlsx

Free Version – .pdf

Similar Products

Other customers were also interested in...

Clothing Store Financial Model Excel Template

Get Your Clothing Store Budget Template. Creates 5-year Pro-forma financial statements, and financia... Read more

Business Plan – Safety Equipment Distributor

In summary, the model easy to use, you need to fill the green cells in the green tabs, clear to read... Read more

Budget Template for FMCG

General overview The template is a statement of estimated income and expenses based on future pla... Read more

Mini Grocery Store Financial Model – Dynamic...

Financial Model providing a dynamic up to 10-year financial forecast for a startup or existing Mini ... Read more

Bakery Financial Model Excel Template

Shop Bakery Budget Template. Solid package of print-ready reports, including P&L and cash flow s... Read more

Jewelry Shop / Store 5 Year Startup Business Model

A bottom-up financial model that is designed specifically for a jewelry store, but could easily be u... Read more

Grocery Store Financial Model Excel Template

Try Grocery Store Financial Projection. Creates 5-year Pro-forma financial statements, and financial... Read more

Industrial Warehouse Business 10-Year 3 Statement ...

10 year rolling financial projection Excel model for a startup or existing business developing and l... Read more

Oil & Gas Marketing and Distribution DCF Valu...

A detailed and user friend financial model that captures 5 years of Historical + 1 Year of Budget + ... Read more

Candy Store Financial Model Excel Template

Order Candy Store Financial Model Template. Sources & Uses, Profit & Loss, Cash Flow stateme... Read more

You must log in to submit a review.