Lending Model Startup Forecast: 10-Year Scaling – 3 Loan Types

This is a full 10-year startup lending business financial model, including a 3-statement model. Accurately scale the origination of 3 loan categories. Includes credit facility option.

Video Tutorial:

Update: Improved cash flow analysis reporting, the way contributions are defined, and deprecated dividend distributions logic as it was redundant.

Update: Added the option to use a credit facility to fund a percentage of the lending activity as well as a percentage that defines how much of the interest / fee revenue is recycled into new loans vs. how much is kept for working capital needs (to fund interest expenses / opex).

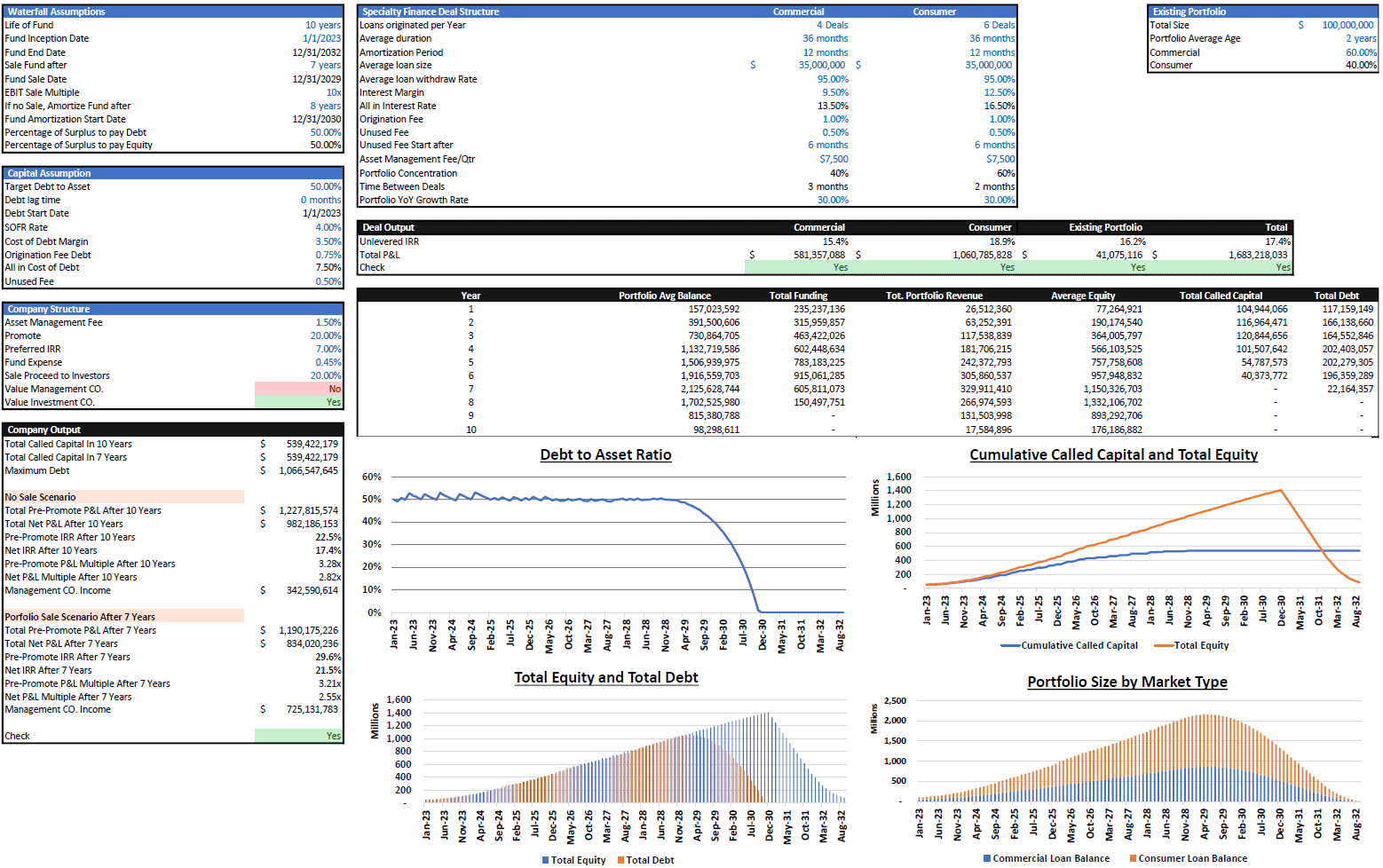

Flat out, this was one of the most complex financial models I have ever gotten into. The difficulty is scaling the origination of loans by month on the same 10-year timeline. Each set of loans added per month acts like its own cohort, which is a little bit like a SaaS model. The difference is that there is no churn, but rather loans get paid off eventually, depending on the terms. Also, the principal and interest need to be tracked, as well as if there is an interest-only period in the beginning.

Essentially, to build this accurately, I had to go with a bunch of different matrix tabs, which created a scalable amortization aggregation infrastructure. The final result is that you can plan out how many loans you think will be settled over time based on 3 loan-type configurations. Based on that, the model will tell you the monthly cash required for loan disbursements, principal collections, origination fees, and interest earned.

This model is also very useful for anyone that wants to participate in a p2p lender as a lending source. You can clear out all the OpEx assumptions and simply enter assumptions about the loan terms over time and see what kind of capital is required and the expected return as well as when you can start reinvesting profits by keeping the distributable cash flow close to 0.

The three loan types include:

1. Interest Only followed by principal and interest repayment amortization

2. Interest Only followed by full principal repayment at the end of the term

3. Standard Principal and interest repayment amortization

For each of those loan types, the user can define the month each one starts, the starting loan count, and then adjust the following loan terms/attributes across 10 years of time:

1. Loans Added per Month

2. Interest Only Period (months)

3. Weighted Avg. Interest Rate (Interest Only)

4. Weighted Avg. Interest Rate (p+i)

5. Term (years) – p+i

6. Weighted Avg. Loan Amount

7. Loan Origination Fees

The model assumes payments always start the month after origination.

The other aspect of this model is building a monthly and annual 3-statement model that plugs right into the resulting lending activity. The reason I did this was to see what a balance sheet may look like for such activity, as I have never balanced this type of transaction. The result was satisfying, and it turns out the valuation of such a lending business is simply based on a multiple of the net assets at exit (meaning the value of loans receivable less any debt owed in this case).

The user would get a full DCF analysis for the project as a whole and on an investor / owner-operator basis if funding sources included investors. Lots of visuals were included, and they make it really easy to see how changing various loan assumptions over time changes the overall financial picture over time.

There is also an input for the default rate, which will apply to principal collections.

If this is the lending branch of a bank or just a lending business in general that needs customer service reps (CS) and/or sales reps (SR), those OpEx costs are defined based on a ratio (customer service reps based on cumulative active loans and sales reps based on added loans per month). There are two types of CS and Salespeople for each loan type configuration. User will define their fully loaded salaries as well as improvement in how much a given CS/SR can handle.

Latest Version:

Similar Products

Other customers were also interested in...

Lending Platform Financial Model (LaaS)

Includes all the assumptions you need to project the gross revenues and profits of a LaaS platform (... Read more

Flat Fee Lending Business: Operating Model

10-year financial model directly built for a flat fee / fixed fee lender. Includes leverage for orig... Read more

Loan Tape Analysis / KPI Dashboard

A framework that makes it easy to drop in your loan data and automatically generate analytical insig... Read more

Crowdlending (P2P) Platform – 5 Year Financi...

Financial Model providing an advanced 5-year financial plan for a startup Crowdlending (Peer-to-Peer... Read more

Debt Fund Excel Model

Explore the Debt Fund Excel Model, a comprehensive tool for evaluating new credit fund opportunities... Read more

Buy Now Pay Later DCF Model & Valuation (10 Ye...

The Buy Now Pay Later (BNPL) Company financial model is a comprehensive tool designed to analyze the... Read more

Leasing Company Financial Model – 5 Year Forecas...

Financial leasing companies engage in financing the purchase of several types of assets. Though a le... Read more

Buy Now Pay Later (BNPL) Platform – 5 Year F...

Financial Model presenting an advanced 5-year financial plan for a startup BNPL Platform which provi... Read more

Lending Company Financial Model – 5 Year Forecas...

This Financial model template presents a business scenario of a corporation engaged in granting loan... Read more

Commercial Bank Financial Model – Dynamic 10...

Financial model presenting an operating and valuation scenario for a Commercial Bank The model ca... Read more

You must log in to submit a review.