Consulting Firm Startup Financial Model

A 5-year financial model for starting your own consultancy firm. Includes 3-statement model integration.

Video Tutorial:

NOTE: Upgraded recently to include fully integrated monthly and annual Income Statement, Balance Sheet, and Cash Flow Statement, a cap table, and dynamic capex with depreciation logic as well as improved formatting conventions.

This template would work for a CPA or law firm or any kind of organization that has professionals billing clients for hourly work and taking a portion of those billings as revenue. The consultants or professionals are happy to give some of their earnings away for the steady stream of client work.

There is some unique revenue logic in this model that I have not done in any other build before. It allows for the user to account for attrition of new hires as well as the new hires slowly building up to a monthly quota of billed hours. For example, you can define an average hire as having a tenure of 8 years and reaching their quota of hourly billings after 5 months of being hired. The percentage they get closer to a full 100% quota can be as granular as needed. For example, 20% in month 1, 25% in month 2, and so on. This works dynamically depending on the new hires in each new month.

The main revenue driver runs off the count of hires for up to 3 different earning categories. For ease of use they are just called ‘low, medium, and high’ but this is how you can plan for different types of professionals with different rate ranges. A percentage filed will populate for the amount of new hires that fall into each of the three categories.

There is fixed expense logic designed to flow based on a start month and monthly amount in each of the 5 years as well as variable expenses based on the total number of professionals working at the end of a given month. i.e. coffee or lunch per professional per month.

There is logic to account for debt from a bank, funds from investors, and funds from owners. There is a DCF analysis for the project, for the investors, and for the owners. If you don’t plan on having debt funding or investor funding then that can be zeroed out.

A monthly and annual detail is included as well as an executive summary to see high level financial performance. A separate distributions tab has the cash flows to all pools as well as NPV (net present value) and IRR (internal rate of return) calculations for each pool.

Similar Products

Other customers were also interested in...

Industry Based Financial Models (Variety Bundle)

There are currently 52 unique financial models included in this bundle. Nearly all of that include a... Read more

Top 16 Google Sheet Templates

This is a bundle of all the most useful and efficient google sheet templates I have built over the y... Read more

Accounting Firm Financial Model – Dynamic 10...

Financial Model providing a dynamic up to 10-year financial forecast for a startup or existing Accou... Read more

Digital Hiring (Talent) Marketplace – 5 Year Fin...

Financial Model providing an advanced 5-year financial plan for an online, two-sided hiring platform... Read more

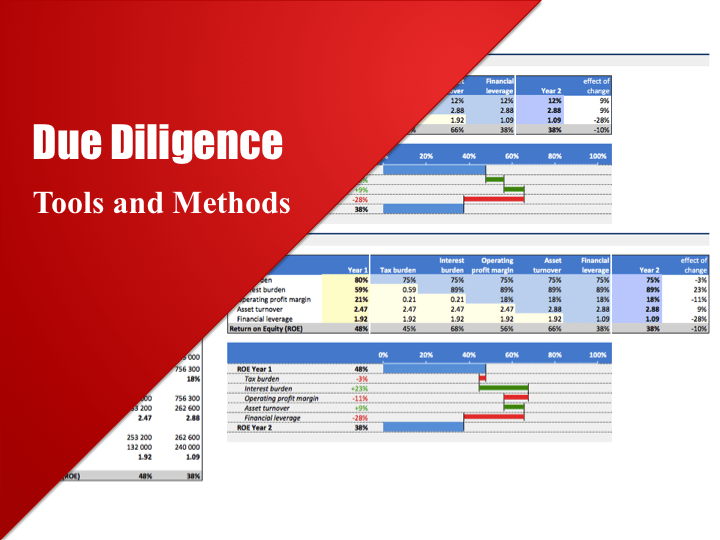

Due Diligence Tools and Methods

A suite of best practices to perform financial and commercial due diligence. Use it if you are consi... Read more

Consulting Firm Financial Model – Dynamic 10 Yea...

Financial Model providing a dynamic up to 10-year financial forecast for a startup or existing Consu... Read more

Human Resources Company – Dynamic 10 Year Financ...

Financial Model providing a dynamic up to 10-year financial forecast for a startup or existing Human... Read more

Law Firm Financial Model – Dynamic 10 Year Forec...

Financial Model providing a dynamic up to 10-year financial forecast for a startup or existing Law F... Read more

Tech/I.T. Services Company – 5 Year Financial Mo...

An IT support company provides a technical service whereby they offer assistance to another business... Read more

Interior Design Firm Financial Model – 5 Year Fi...

Financial Model provides an advanced 5-year financial plan for a startup or operating Interior Desig... Read more

Reviews

I would like to see an instruction manual and also how the model can be adapted for an existing business not a startup.

25 of 60 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.