Flat Fee Lending Business: Operating Model

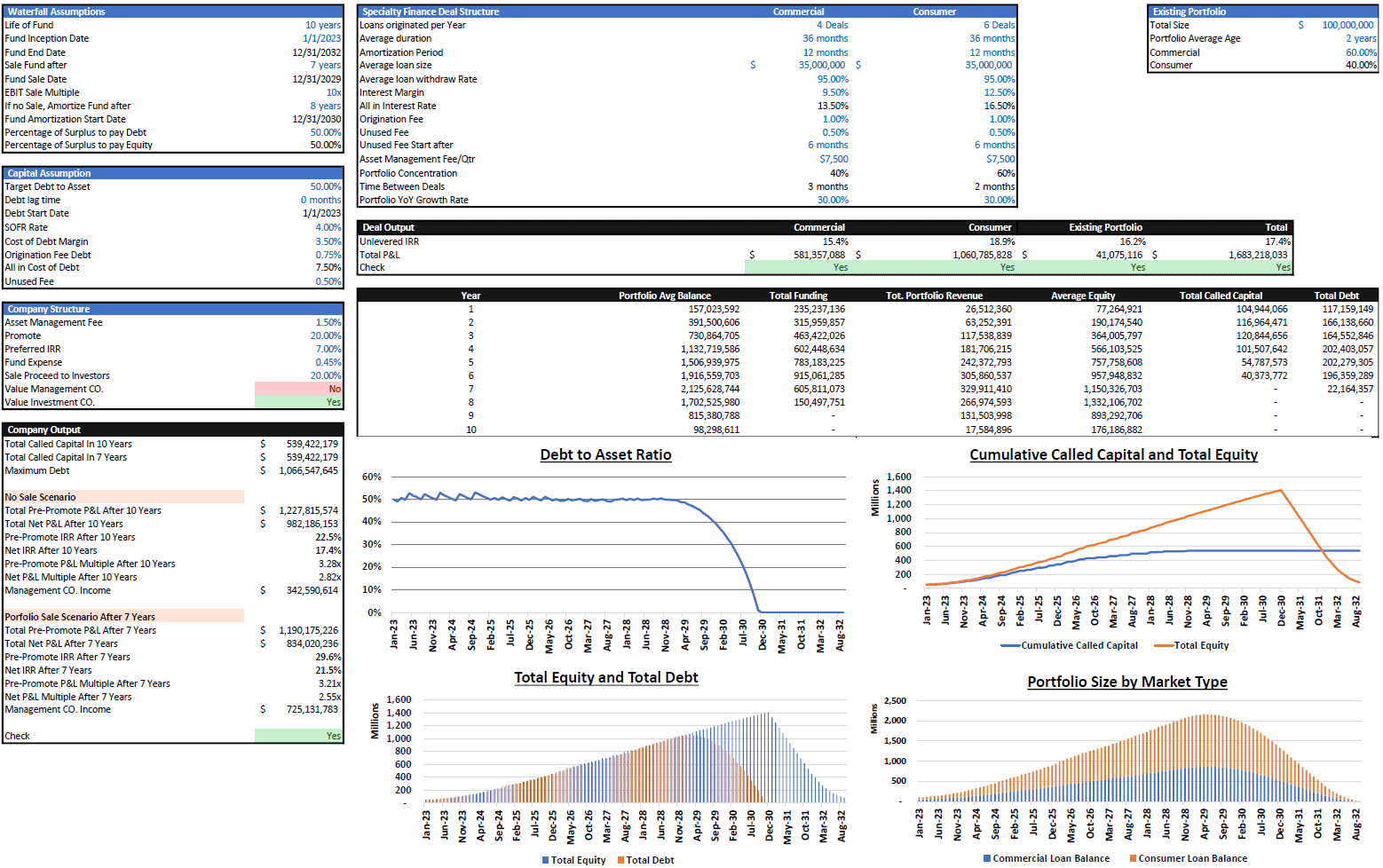

10-year financial model directly built for a flat fee / fixed fee lender. Includes leverage for originations if desired (toggled with yes/no switch) and two types of customer repayment methodologies (toggled with yes/no switch). Includes three statement model.

Video Overview:

Recent Upgrades: Fully integrated three-statement model (Income Statement, Balance Sheet, and Cash Flow Statement) as well as a capitalization table.

I’ve done a lot of modifications to other lending business models in order to convert them into flat fee organizations. So, I decided it is time to build a template that is specifically for flat fee / fixed fee lenders. This model has a few switches that let the user define how the lending works (there are a few different ways I have seen it down) as well as if a senior note facility is used as the primary source of loan origination funding or not, which will have its own interest rate.

What ‘flat fee’ or ‘fixed fee’ means is that loans are made to customers and the customer pays a simple fixed percentage of the loan amount back on top of the initial borrowed amount. There is no compounding interest or monthly interest payments. It is a bit easier to understand how it works and lenders (depending on the term of the loans and the flat fee amount) can make reasonable margins against borrowed capital. For example, you may be borrowing money at an 18% APR, but getting an annualized yield on loans of 40% (if you are charging 10% on 3-month term loans).

This model will allow the user to do the following:

– See the amount of leverage needed until the lending activity is self-sustainable (assuming revenue is recycled into new loans and any leftover flows to cash flow). This will be a function of the loan origination count assumptions / terms therein which can be configured. To get the highest usage rate of cash, you want to define loan origination counts so that the cash flow is close to 0 for the entire model (maximizing growth and receivables). Note, in this kind of business, the senior debt facility (if you toggle leverage to ‘on’) can usually only be used for lending activity and not operating expenses. This logic is built-in.

– Decide how the loan repayment works: 1) Total fee and principal are repaid in one big payment at the end of each term or 2) Total fee and principal are repaid in even monthly payments over the course of the loan term.

– Determine the total IRR of the entire endeavor for up to 10 years worth of time. Any leverage used is assumed to be paid back at the defined ‘exit month’ and any loans receivable are collected on the exit month as well. This was done for proper terminal value calculations. The user can pick a multiple they sell the receivables at.

– Determine the minimum equity requirement of the endeavor and if any is funded through an investor or if it is all through the operator (DCF Analysis exists for the project as a whole and for each equity pool). If leverage is used, then the investment required will be based on interest paid to the debt facility and any operating expenses not covered by cash generated from lending activities. If leverage is not used, then the initial investment will include all cash needed to originate the initial loans and any operating burn therein.

– Configure loan terms / assumptions for up to four loan types. Configuration inputs are adjustable per year and include: loans settled per month, average loan amount, fee percentage, and loan term (in months). This makes for better forecasting than a single configurator.

– Configure monthly fixed costs and other one-time startup costs, and for larger operations, configure scaling of customer service and sales reps (up to two headcount types per loan type).

Over 16 visualizations make the model more digestible to end-users that are trying to understand the financial assumptions and resulting forecast. Also, an annual executive summary is displayed for high-level views of key financial line items / operating profit/loss and cash flow. There is also a monthly and annual profit/loss and cash flow detail that populates based on all the model assumptions tied together.

There is a default rate assumption that applies to the repayment amount and flows through the model as an expense. It offsets the total repayment amount in cash flow.

In this model, the debt service coverage ratio (DSCR) is very important because it shows how much cash is being made relative to interest expense (interest paid to senior debt vs. flat fees earned from customers less operating expenses).

Similar Products

Other customers were also interested in...

Lending Model Startup Forecast: 10-Year Scaling &#...

This is a full 10-year startup lending business financial model, including a 3-statement model. Accu... Read more

Lending Platform Financial Model (LaaS)

Includes all the assumptions you need to project the gross revenues and profits of a LaaS platform (... Read more

Loan Tape Analysis / KPI Dashboard

A framework that makes it easy to drop in your loan data and automatically generate analytical insig... Read more

Debt Fund Excel Model

Explore the Debt Fund Excel Model, a comprehensive tool for evaluating new credit fund opportunities... Read more

Crowdlending (P2P) Platform – 5 Year Financi...

Financial Model providing an advanced 5-year financial plan for a startup Crowdlending (Peer-to-Peer... Read more

Leasing Company Financial Model – 5 Year Forecas...

Financial leasing companies engage in financing the purchase of several types of assets. Though a le... Read more

Buy Now Pay Later DCF Model & Valuation (10 Ye...

The Buy Now Pay Later (BNPL) Company financial model is a comprehensive tool designed to analyze the... Read more

Buy Now Pay Later (BNPL) Platform – 5 Year F...

Financial Model presenting an advanced 5-year financial plan for a startup BNPL Platform which provi... Read more

Lending Company Financial Model – 5 Year Forecas...

This Financial model template presents a business scenario of a corporation engaged in granting loan... Read more

Microfinance Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan for a Microfinance Lending Platform pro... Read more

You must log in to submit a review.