Financial Model for Recycling

A user friendly excel model that allows the user to plan out possible scenarios specific to the recycling business (up to 10 years). (Acquiring materials (cast-offs) and turning this into something valuable for others to use.

Video Tutorial:

This would be the business you start that slows the building of landfills. If you have demand in your area for things that can be created from recycled materials, then it may be worth a look to model out some scenarios.

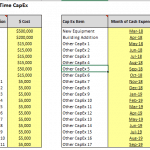

This model does a good job of allowing for dynamic material types to get assigned a cost per unit and sell price per unit. Based on this, you can build up various margins as well as define running costs / startup costs / and any CapEx or financing assumptions.

There are detailed monthly and annual P&L summaries as well as more high-level executive summaries that include charts with a clear view of all the cash flows that are relevant to starting and exiting such a business. You can pick the revenue multiples used to determine an exit value.

There is a discounted cash flow analysis built into this as well as IRR, ROI, and net $’s returned per year. Everything is dynamic and gives the user a lot of flexibility in a wide range of scenarios, and business types can fit within the recycling world. This is done by drilling down the basics of revenue generation and cost allocation.

Similar Products

Other customers were also interested in...

Business Plan for a Biodiesel Manufacturing Plant

Setting up a biodiesel manufacturing plant requires a comprehensive and executed business strategy. ... Read more

Energy Recovery Facility (ERF) – Dynamic 10 Year...

Financial model presenting a business scenario of a company owning and/or leasing Energy Recover Fac... Read more

Hydrogen Gas Equipment Manufacturing and Sales Mod...

This is a very detailed and user-friendly financial model with three financial statements ... Read more

Ethanol and Sugar Production Plant Financial Model

Fin-wiser’s Ethanol and Sugar Plant PPP project model helps users to assess the financial viabilit... Read more

Renewable Energy Financial Model Template Bundle

Take this opportunity and get a discount by getting the Renewable Energy Bundle where you get Solar,... Read more

EV Battery Recycling Plant Financial Model (10+ Yr...

The EV Battery Recycling Plant financial model is a comprehensive tool designed to analyze the finan... Read more

Biogas Plant (Waste to Energy) Financial Model Tem...

Biogas Plant (Waste to Energy) Financial Model with 3 Statements, Cash Waterfall, NPV, & IRR, an... Read more

Gasoline and Charging Station Financial Model

Investors can assess the viability of setting up and investing in gasoline stations with a charging ... Read more

Hydrogen Gas Sales & Tolling Business Plan an...

Hydrogen Gas Sales & Tolling Fee business plan and valuation model is an excellent tool to asses... Read more

Solar Panel Manufacturing Plant Business Plan Fina...

Get the Best Solar Panel Manufacturing Plant Financial Model. Spend less time on Cash Flow forecasti... Read more

Reviews

Its a good sheet

201 of 384 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.