House Cleaning Subscription Financial Model Excel Template

Get Your House Cleaning Subscription Pro-forma Template. Spend less time on Cash Flow forecasting and more time on your products. Five-year horizon excel pro forma template for the house cleaning subscription business for early-stage startups to impress investors and raise capital. House Cleaning Subscription Financial Model In Excel helps to estimate required startup costs. Unlocked – edit all – last updated in Sep 2020. Basic Excel knowledge and minimal previous financial planning experience is required to use a sophisticated house cleaning subscription profit loss projection: however, fully sufficient to impress bankers and investors with a proven, solid financial model.

NOTE: Single-User pertains to a limited Single User License where the template can only be used by one single user; while Multi-User is a license for users sharing the template with up to 20 members. Please refer to Terms of Use and License and Permitted Use for clarification.

HOUSE CLEANING SUBSCRIPTION PRO FORMA TEMPLATE KEY FEATURES

Video tutorial:

Simple and Incredibly Practical

Simple-to-use yet very sophisticated House Cleaning Subscription Pro Forma Template Excel. Whatever size and stage of development your business is, with minimal planning experience and very basic knowledge of Excel you can get complete and reliable results.

Predict the Influence of Upcoming Changes

Does your company plan to purchase new equipment or to launch a new product? Projected Cash Flow Statement enable you to obtain a complete picture of the effect that specific changes will have on your Projected Cash Flow Statement. When planning your finances in the Cash Flow Statement For 5 Years, you will forecast cash inflows and outflows based on future invoices, bills due, and payroll. You can then create multiple ‘what if’ scenarios, such as buying new equipment to choose the best way for you. Forecasting shows you how the upcoming changes will affect your cash balance.

Manage surplus cash

Most companies don’t have excess cash in the bank. It is a well-known situation. But managing surplus cash for reinvestment in new market opportunities, or debt repayments can be essential to keeping stay in the business. Managers are entirely ready to plan for what to do with the cash surplus if they have the forecast of when and where the business will have surplus cash in the bank account. Cash Flow Statement By Month will provide supplementary guidance on what to do with a cash surplus.

Simple and Incredibly Practical

Simple-to-use yet very sophisticated House Cleaning Subscription 3 Way Financial Model tool. Whatever size and stage of development your business is, with minimal planning experience and very basic knowledge of Excel you can get complete and reliable results. Additionally, you will receive uncompromised after-sales service and access to valuable tutorial videos and blog posts.

It is part of the reports set you need.

It doesn’t matter you are worried about cash or not, setting up, and managing a House Cleaning Subscription Financial Projection Template should be a cornerstone of your reporting set. It’s the main report of your business that must have in place to grow sustainably. Before you rush into rent more office space or making a new hire, you should always run a Startup Cash Flow Statement scenario. You can model how that action would impact your cash balance in the nearest future. Knowing whether or not plans are possible is crucial to minimizing risk.

Generate growth inspiration

By running various scenarios and looking at the effects they could have on your cash balance, you will begin to see which options are best for your business. Ones that are possible, and what is involved in making them work. Organic growth isn’t the only option – there are growing funding options becoming available, and Cash Flow Forecast could be a way of looking at the impact an injection of cash could have on your business and its growth plans.

REPORTS and INPUTS

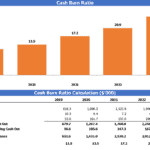

CAPEX

A capital expenditure (‘CapEx’ for short) table reflects the company’s expenses, either cash or credit, on purchases of goods that are capitalized on the balance sheet. Such capitalized expenses, the company does not reflect directly in the forecasted income statement as expenses, and such expenses are considered as an investment in the company’s expansion.

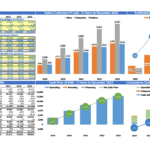

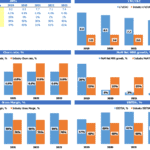

Financial KPIs

Key performance indicators (KPIs) in the Excel Pro Forma are crucial for both the company owner and for an investor. With the help of these metrics, you track your company’s financial performance and assess the efficiency of business models and cost structures. You can use them to make you and your co-founders laser-focused on the targets you set.

Performance KPIs

Return on capital. The return on capital reflects the correspondence of the Balance Sheet and Income Statement. Return on capital measures the accomplishment of earnings to the capital employed.

Companies with good financial management have good returns.

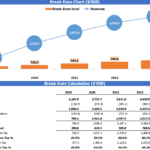

Valuation

This House Cleaning Subscription Excel Financial Model Template contains a valuation analysis template that will allow users to perform a Discounted Cash Flow valuation (DCF). It will also help users analyze such financial metrics as residual value, replacement costs, market comparables, recent transaction comparables, etc.

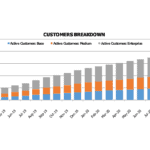

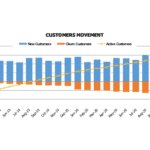

Operational KPIs

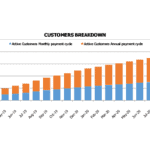

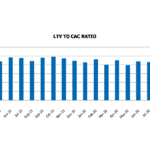

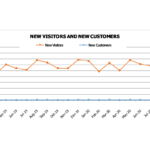

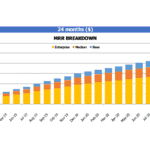

Our House Cleaning Subscription Excel Financial Model has various operational performance graphs that will help business owners manage their business’ finances and measure their overall performance. These operational performance graphs also help in making wise business decisions that consider the company’s financial capability.

The financial graphs in this House Cleaning Subscription 3 Way Financial Model Template help measure the company’s financial health showing the operating cash flows’ analysis, return on investment, debt to equity ratio, liquidity ratios, and other relevant financial information. Business owners can use these operational performance graphs both for internal and external purposes.

In particular, they can use these graphs to assess the company’s overall financial performance or for the assessment of the project’s financial feasibility. Such an approach will improve the financial management efficiency of the company. Business owners can also use these charts and graphs for the presentations for potential investors and bankers. The operational performance graphs have all the necessary pre-built formulas, and they are fully formatted. So, the users can just print out them and bring for the meeting with investors.

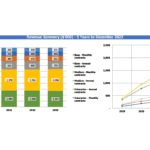

Top Expenses

It is very important for a start-up and existing company to monitor, plan, and manage its costs and expenses to maintain a good profitability level.

For this purpose, it is necessary to analyze the highest costs and always work on their optimization. In our Pro Forma Budget we have created a Top expense report helps users with this task. It summarizes the four biggest expense categories and the rest of the expenses as the ‘other’, so the users can easily monitor these expenses and track the tendencies related to their increase or decrease from year to year.

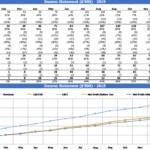

Sources and Uses

As you can understand from the title, a Sources and Uses of Funds statement represents the company’s financing sources and spending policies.

In respect of the ‘Sources’, this statement shows the company’s money for its business activities and how it gets this money. Usually, companies have a mix of funding sources, such as business loans, investors’ money, share issue, and others.

The ‘Uses’ section of the Sources and Uses statement shows the stakeholders how the company spends its money. For example, this statement may reflect the cost of land, building, or equipment the company plans to acquire. It also may reflect the start-up costs.

File types:

Excel – Single-User: .xlsx

Excel – Multi-User: .xlsx

Free Demo – .xlsx

Similar Products

Other customers were also interested in...

Vitamins Subscription Box Financial Model Excel Te...

Try Vitamins Subscription Box Pro-forma Template. Spend less time on Cash Flow forecasting and more ... Read more

Monthly Recurring Revenue SaaS Financial Model Exc...

Check Monthly Recurring Revenue SaaS Financial Model. This well-tested, robust, and powerful templat... Read more

SaaS Actuals Opt-In Financial Model Excel Template

Get Your SaaS Actuals Opt-In Financial Model Template. Enhance your pitches and impress potential in... Read more

Beauty Subscription Box Financial Model Excel Temp...

Check Beauty Box Subscription Financial Plan. Use this Excel to plan effectively, manage Cash Flows ... Read more

SaaS Financial Model Excel Template

Try Saas Financial Projection. This well-tested, robust, and powerful template is your solid foundat... Read more

SaaS Freemium Financial Model Excel Template

Get Your Saas Freemium Pro-forma Template. There's power in Cash Flow Projections and the insight th... Read more

SaaS Application Freetrial Financial Model Excel T...

Check SaaS Application Freetrial Pro-forma Template. Enhance your pitches and impress potential inve... Read more

CRM Software Financial Model Excel Template

Buy CRM Software Pro-forma Template. Includes inputs, outputs and charts to present it in an investo... Read more

Online Classes Subscription Financial Model Excel ...

Order Your Online Classes Subscription Financial Plan. This well-tested, robust, and powerful templa... Read more

Fresh Flowers Subscription Financial Model Excel T...

Impress bankers and investors with a proven, solid Fresh Flowers Subscription Budget Template. Five ... Read more

You must log in to submit a review.