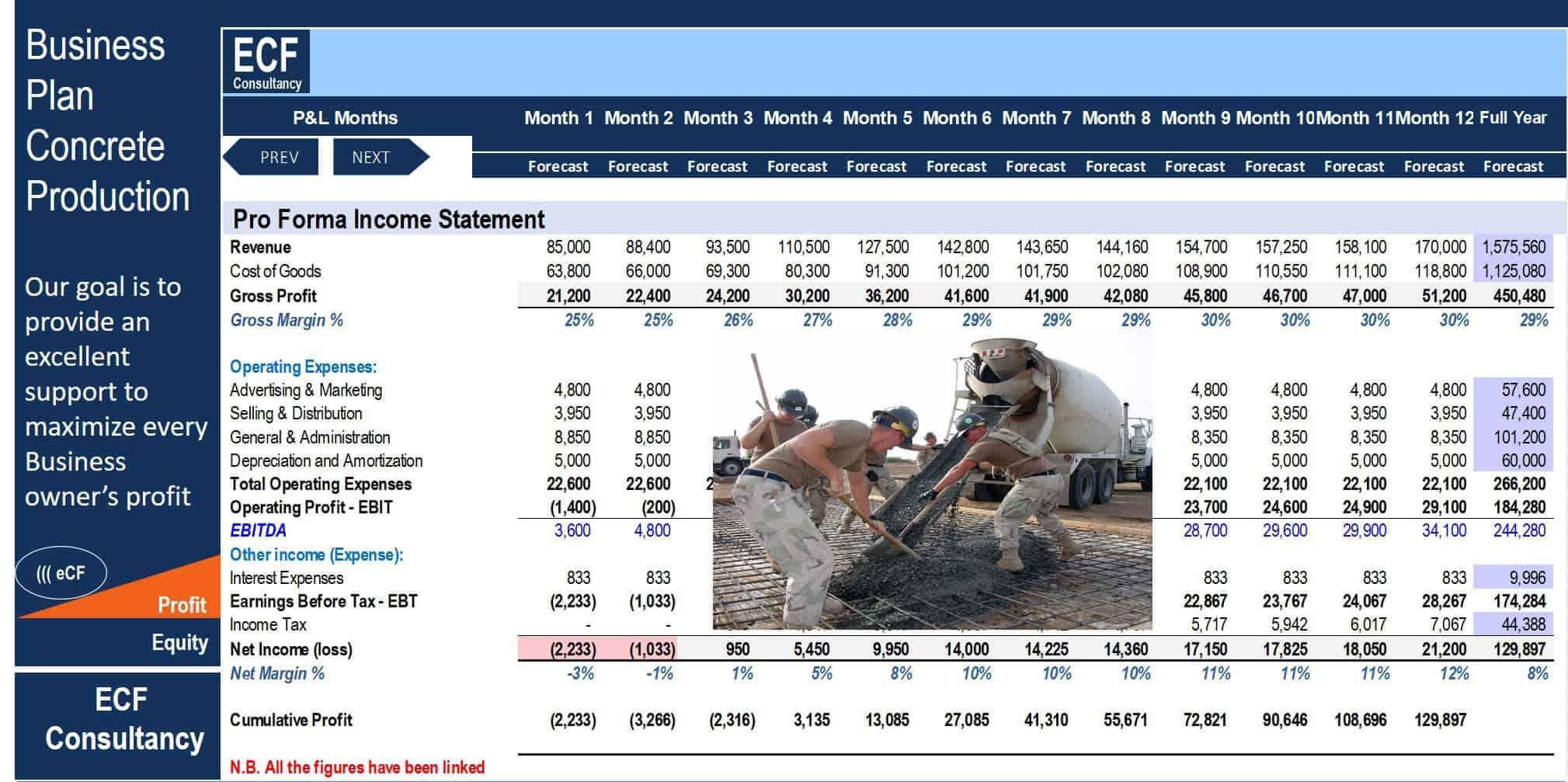

Cash Flow Projection for Project Contracting

The model helps the user to project the cash flow for the total period and identify when the project will face cash flow deficit

| Construction, Contractor, Financial Model |

| Cash Flow Projections |

General overview

The importance of steady fund income is crucial in construction projects. Cash flow can procure the material, pay salaries, fund new projects, and finance other functions of the companies’ day to day operations. … This can be catastrophic for a project in terms of time and money.

The cash flow in a contracting project is more complicated than any other industry because of the many finance elements such as advance payment, retention, performance bond, etc.

The model helps the user to project the cash flow for the total period and identify when the project will face cash flow deficit in order to cover the deficit from banks or a third party to keep the operation going on and avoid losing time and money.

Inputs

Update the general info in the Front Page

Fill the green cells in the “Input Data” sheet

Outcome

Cash inflow from invoices

Cash inflow from advance payment

Cash inflow from retention

Cash outflow from different expenses

Net cash balance

Conclusion and customization

Highly versatile, very sophisticated financial template, and user-friendly.

If you have any inquiries, need help with the modification of an existing financial model template, or creating from scratch a financial model for your specific business case, please reach us through: [email protected].

Similar Products

Other customers were also interested in...

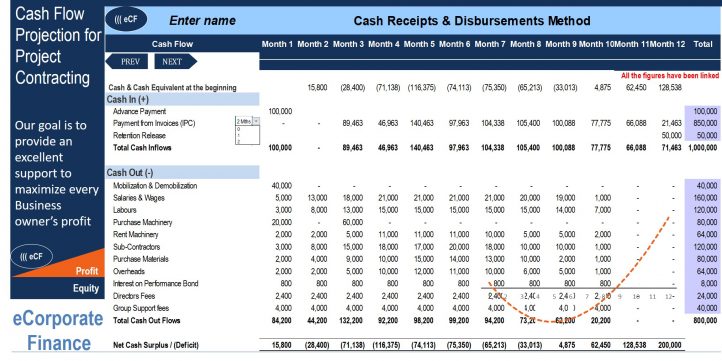

Startup Business Plan – Concrete Production ...

If you're dreaming of starting a Concrete Contractor business, try this Startup Business Plan - Conc... Read more

Financial Feasibility Study – Excavation Con...

The report is containing full set of financial feasibility study project for Excavation Contractor, ... Read more

Construction Contractor Business – Cash Flow...

This financial model lets the user plan out cash requirements and expected returns of running a cons... Read more

Construction/Engineering Project Business Financia...

3 statement 5 year rolling financial projection Excel model for a startup /existing business engaged... Read more

Carpentry Business – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a startup or operating Carpentry Bus... Read more

Electrician Business Financial Model – 5 Year Fo...

Financial Model presenting an advanced 5-year financial plan for a startup or operating Electrician ... Read more

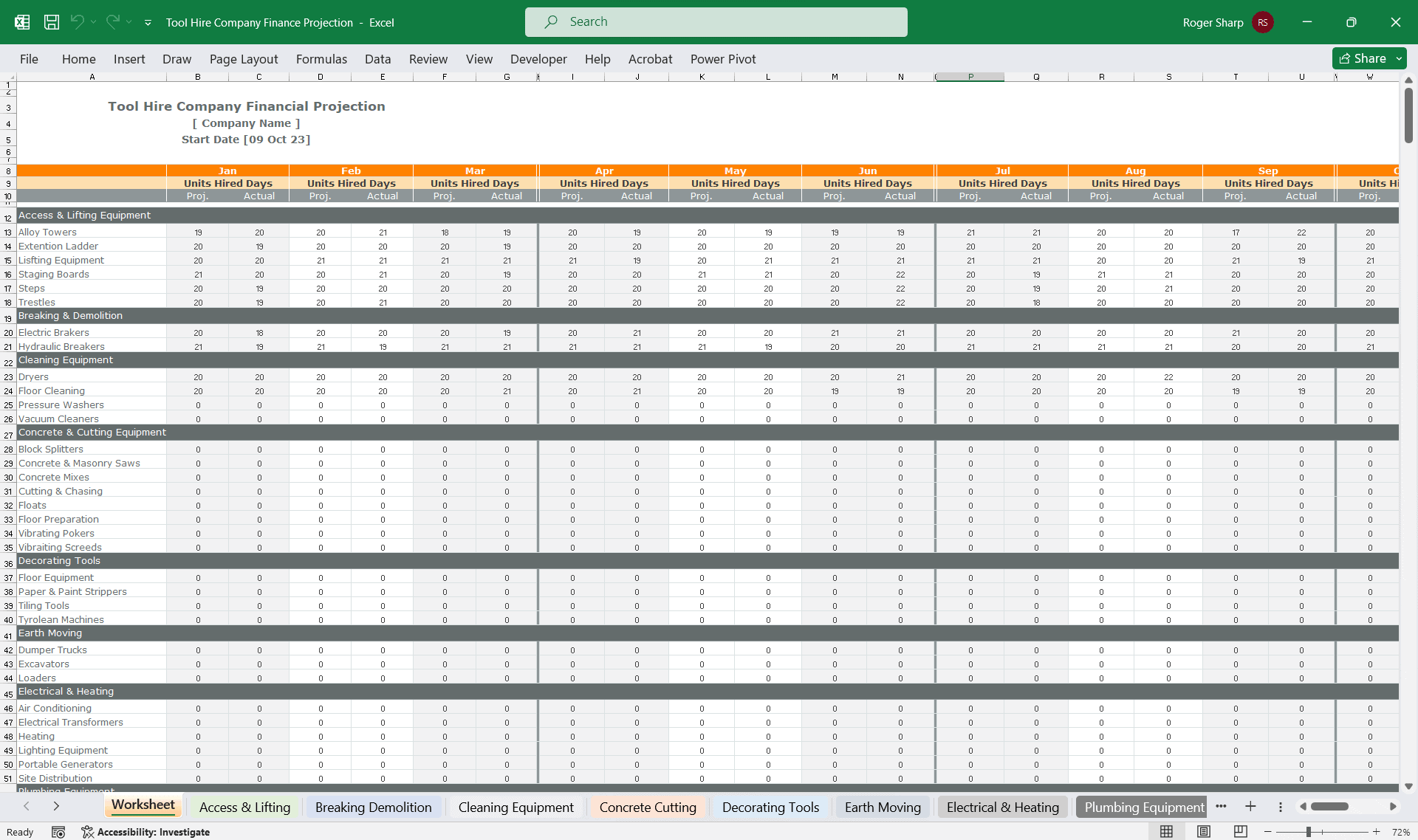

Tool Hire Company Finance Model

A very comprehensive editable Excel spreadsheet for tracking your tool hire financials throughout th... Read more

Plumbing Business Financial Model – 5 Year Forec...

Financial Model presenting an advanced 5-year financial plan for a startup or operating Plumbing Bus... Read more

Artisan Contractor Business – 5 Year Financial M...

Financial Model providing an advanced 5-year financial plan for an Artisan Contractor Business scena... Read more

Electrical Contractor Financial Model Excel Templa...

Electrical Contractor Financial Model Enhance your pitches and impress potential investors with the ... Read more

You must log in to submit a review.