Optimize Your Strategy: A Deep Dive into Cap Table Calculator

For a comprehensive approach to optimizing your strategy, explore the deep dive into the Cap Table Calculator. Uncover how this tool can support your business growth and financial planning.

Understanding the intricacies of your capitalization table is vital for making informed decisions and attracting potential investors. With the Cap Table Calculator, you can efficiently manage equity distribution and explore various funding scenarios. Dive into the details of this valuable tool and discover how it can enhance your strategic planning.

By leveraging the insights and analysis provided by the Cap Table Calculator, you can align your strategy with your long-term objectives and position your business for success in a competitive market.

What Is A Cap Table Calculator?

When embarking on the journey of managing a startup, the clarity and understanding of equity distribution among founders, investors, and employees are paramount. This is where the use of a Cap Table Calculator becomes indispensable. It serves as a crucial tool that aids startup owners in visualizing and comprehending the ownership breakdown of their company, ensuring that all parties have a clear view of their stakes.

Definition

A Cap Table Calculator stands out as a financial tool designed specifically to offer a comprehensive breakdown of the ownership stakes within a company. It meticulously outlines the percentage of ownership, the value of equity stakes, and the dilution effect of future investments or expansion of the equity pool. This tool is invaluable for startups at any stage, offering a clear snapshot of who owns what, thus facilitating transparency and trust among stakeholders.

Importance

The significance of understanding your Cap Table cannot be overstated. It is the backbone of strategic planning for any startup. By having a detailed insight into the equity distribution of your company, you can make informed decisions regarding fundraising efforts, the issuance of stock options, and the overall management of equity. This clarity ensures that when opportunities for growth arise, or when navigating the complexities of financial strategies, startup owners are equipped with the necessary information to steer their company in the right direction. Additionally, a well-managed Cap Table helps in avoiding common pitfalls related to equity distribution that could potentially lead to disputes among shareholders or dilute the founders’ shares to a level that could deter future investments.

In summary, a Cap Table Calculator is not just a tool but a strategic asset for startups. It fosters a culture of transparency, aids in strategic decision-making, and ensures that the company’s equity structure is aligned with its long-term goals. Whether you are at the seed stage, eyeing your next round of funding, or planning the issuance of new stock options, the insights provided by a Cap Table Calculator are invaluable in navigating the complex landscape of equity management.

How Does A Cap Table Calculator Work?

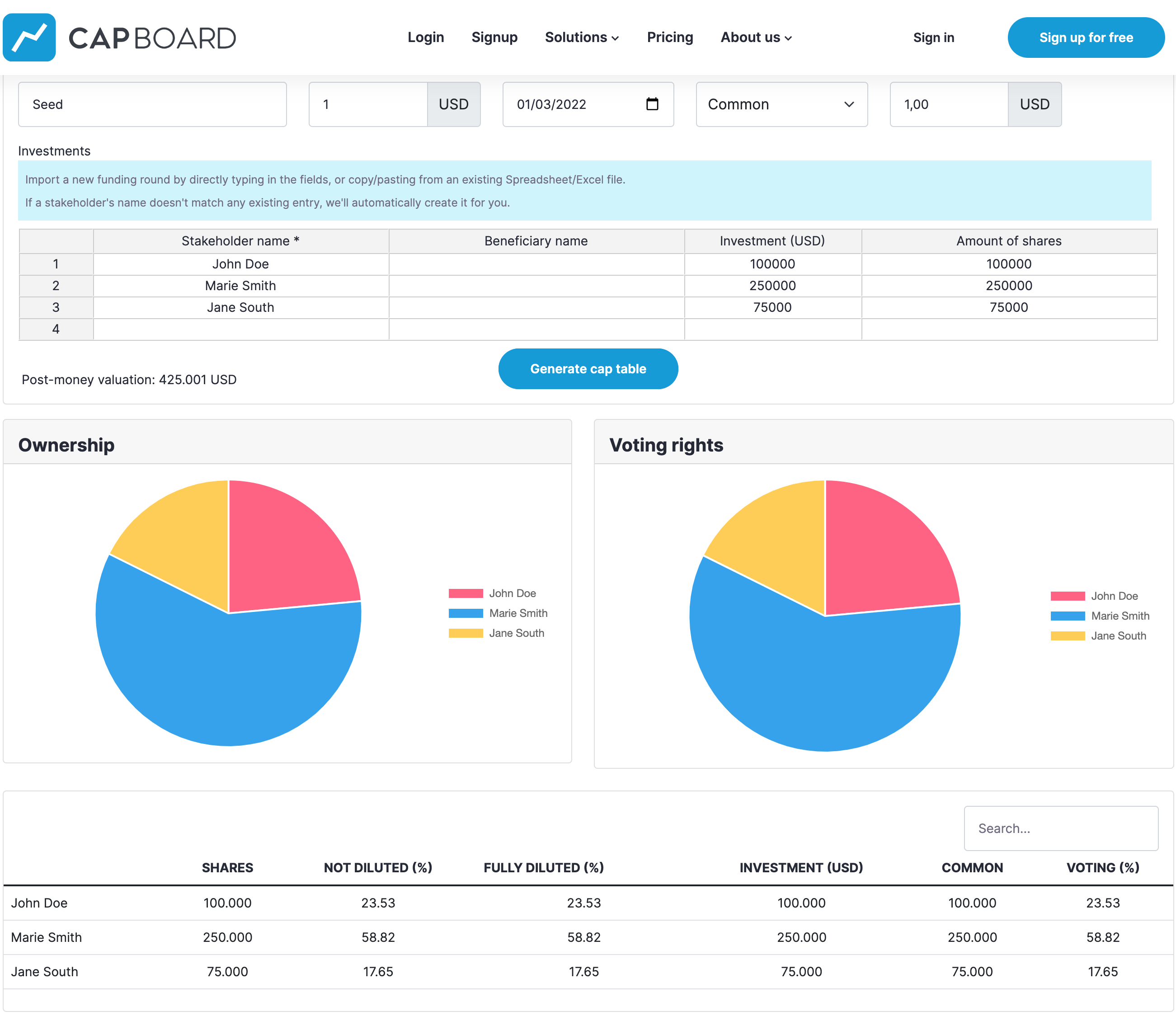

Discover how a Cap Table Calculator functions by inputting data like equity ownership, valuations, funding rounds, and options to analyze equity distributions in a startup. This strategic tool helps stakeholders visualize and optimize their equity strategy effectively.

Input Variables

A Cap Table Calculator requires inputs like the number of shares, ownership percentages, and valuation. These variables are crucial for determining equity distribution.

Calculations

The calculator runs complex algorithms based on inputs to calculate post-money valuation, dilution, and share values. It handles mathematical computations automatically.

Output

After processing the input data, the Cap Table Calculator generates detailed reports showing the equity distribution among shareholders. It simplifies the process of understanding company ownership.

Benefits Of Using A Cap Table Calculator

Using a Cap Table Calculator offers numerous benefits, making it an essential tool for businesses of all sizes. Whether you’re a startup founder or an investor, accurately managing your company’s capitalization table is crucial for tracking ownership stakes and understanding the financial implications of different scenarios. A Cap Table Calculator brings accuracy, time efficiency, and strategic planning to the forefront, ensuring you make informed decisions for your business. Let’s explore the key benefits in detail:

Accuracy

One of the significant advantages of using a Cap Table Calculator is the unparalleled accuracy it provides. Manually updating a cap table can be error-prone and time-consuming, potentially leading to misunderstandings and costly mistakes. However, a Cap Table Calculator eliminates the risk of human error, ensuring that every ownership stake, investment, and transaction is accurately recorded and represented. With up-to-date and error-free data, you can confidently make informed financial decisions for your company.

Saves Time And Effort

A Cap Table Calculator saves you valuable time and effort that would otherwise be spent on manual calculations and data entry. With just a few clicks, you can easily update and customize your cap table, instantly reflecting changes in ownership or funding rounds. This automated process eliminates the need for complex manual spreadsheets and allows you to reallocate your time to more critical tasks, such as investor relations or business strategy. By streamlining the cap table management process, you can focus on growing your business and achieving your goals.

Scenario Planning

Effective scenario planning is vital for making well-informed financial decisions and preparing for potential future events. A Cap Table Calculator empowers you with the ability to simulate various scenarios, such as new investments, stock options, or even an exit strategy. By adjusting different variables, you can assess the potential impact on ownership percentages and valuations, allowing you to make strategic decisions based on accurate projections. This level of scenario planning helps you optimize your strategy and navigate potential challenges with confidence.

Key Features To Look For In A Cap Table Calculator

A cap table calculator is a vital tool for startups and growing businesses to manage their ownership stakes and equity distributions. When choosing a cap table calculator, there are key features to consider that can significantly impact your business strategy and financial planning. Let’s delve into the essential functionalities that a cap table calculator should offer to optimize your strategy.

Real-time Updates

A reliable cap table calculator should provide real-time updates on equity ownership, enabling you to instantly view the impact of any changes. This dynamic feature ensures that all stakeholders have access to the most current ownership information, resulting in transparent and accurate decision-making.

Multiple Scenarios

Opt for a cap table calculator that allows for the creation and comparison of multiple scenarios. This capability enables you to evaluate the impact of various funding rounds, exits, and other transactions on equity distribution, empowering you to make informed decisions based on a range of potential outcomes.

Comprehensive Reporting

A robust cap table calculator should offer comprehensive reporting features that provide detailed insights into the equity structure of your business. Look for functionalities that enable you to generate customizable reports, visualize ownership data, and export essential information for internal and external stakeholders.

Best Practices For Using A Cap Table Calculator

Consistent Data Entry

Consistency is key when it comes to using a cap table calculator. Ensure that all data entered into the calculator is accurate and follows a standardized format. This will eliminate errors and discrepancies, providing a reliable foundation for your analyses.

Regular Updates

Keep your cap table calculator updated with the latest information. Regularly inputting new data ensures that your calculations reflect the most current equity ownership and dilution scenarios. Remember that accurate and up-to-date data is essential for making informed decisions.

Collaboration

Encourage collaboration among your team members by using a cap table calculator that allows for shared access and input. This fosters transparency and alignment, as everyone can contribute to and benefit from the most accurate and comprehensive data.

Common Mistakes To Avoid With Cap Table Calculators

A cap table calculator is an essential tool for startups and investors to manage equity ownership and plan for various financing scenarios. However, using this tool without caution can lead to potential errors that may have serious implications for your company’s financial future. In this article, we will explore three common mistakes to avoid when using a cap table calculator, ensuring accurate results that can guide your strategic decisions.

Incomplete Data

One of the most common mistakes made when using a cap table calculator is inputting incomplete data. The accuracy of your calculations heavily depends on the information you provide. Failure to include all necessary data points can lead to inaccurate results and a distorted understanding of your company’s equity distribution.

To avoid this mistake, ensure that you have gathered all relevant information before using the cap table calculator. This includes data on existing shareholders, the number of shares issued, vesting schedules, convertible securities, option grants, and any other items that impact equity ownership. By incorporating all the necessary data, you can obtain a comprehensive and reliable picture of your cap table.

Misinterpretation Of Results

Another common mistake when using a cap table calculator is the misinterpretation of the results. The calculations provided by the tool may seem complicated, especially if you’re not familiar with cap tables or previous financing rounds. It’s crucial to thoroughly understand the meaning and implications of the numbers generated.

To avoid misinterpretation, take the time to educate yourself on the fundamentals of cap tables and the terminology used in the calculator. Familiarize yourself with terms like fully diluted shares, pre and post-money valuations, and ownership percentages. Additionally, consider seeking expert guidance or consulting a legal professional to ensure accurate interpretation of the results.

Failure To Account For Dilution

Failure to account for dilution is another critical mistake that can occur when using a cap table calculator. Dilution refers to the reduction in ownership percentage due to the issuance of additional shares, such as during funding rounds or employee stock options. Neglecting to consider the impact of dilution can lead to significant errors in predicting future equity distribution.

When using a cap table calculator, make sure to incorporate future financing scenarios and employee equity grants to anticipate the effects of dilution accurately. This will enable you to plan for potential changes in ownership percentage and avoid any surprises down the line.

Examples Of Cap Table Calculators On The Market

When exploring cap table calculators, it’s essential to consider various tools available in the market that can simplify and streamline your equity management process. Here are notable examples you can explore:

Tool A:

Tool A offers a user-friendly interface with features for precise equity percentage calculations.

- Intuitive design for easy navigation

- Detailed breakdown of ownership stakes

Tool B:

Tool B stands out for its robust scenario analysis capabilities, allowing for better decision-making.

- Dynamic modeling for hypothetical situations

- Real-time updates for accurate simulations

Tool C:

Tool C excels in providing comprehensive reporting functionalities, ideal for sharing with stakeholders.

- Customizable reports for tailored insights

- Automatic data syncing for seamless updates

Frequently Asked Questions

What Is A Cap Table Calculator?

A Cap Table Calculator is a tool used to determine the ownership stakes in a startup, including equity dilution and valuation over time. It helps founders and investors visualize the impact of different funding rounds.

How Does A Cap Table Calculator Benefit Startups?

A Cap Table Calculator helps startups understand the impact of funding rounds on ownership dilution, valuation, and potential payouts to founders and investors. It enables strategic decision-making and financial planning for the future growth of the company.

What Key Metrics Can Be Analyzed Using A Cap Table Calculator?

A Cap Table Calculator can analyze metrics such as founder equity, employee stock options, convertible notes, preferred stock, and equity distribution after multiple funding rounds. It helps in understanding the impact of different scenarios on ownership and valuation.

How Can A Startup Use A Cap Table Calculator To Attract Investors?

A Cap Table Calculator can be used to create various funding scenarios, showing potential investors how their investment will affect ownership and valuation. This demonstrates transparency and strategic planning, which can attract investors looking for a well-managed and organized startup.

Conclusion

The Cap Table Calculator is an invaluable tool for businesses looking to optimize their strategy. By providing an accurate snapshot of ownership and equity distribution, it enables companies to make informed decisions when it comes to fundraising, employee stock options, and exit scenarios.

With its user-friendly interface and comprehensive features, incorporating this tool into your financial planning can save time and increase efficiency. Stay ahead of the game by utilizing the power of the Cap Table Calculator in your business endeavors.