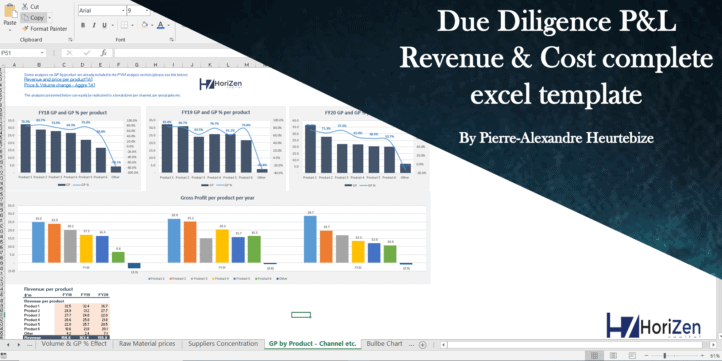

Due Diligence P&L – Exhaustive Revenue and Costs Analysis Template

Model for in depth understanding of high level profit and loss and revenue analysis. Big-4 like checklist of due diligence analyses. This Financial Due Diligence model is already used by dozens of corporate finance professionals to assist in their M&A due diligence processes.

* *** Model is fully unlocked! *****

*** This template includes all the analyses from my “P&L Due Diligence – Exhaustive Revenue Analysis model” and adds extensive Cost analyses ****

This excel file is also the support of my Financial Due Diligence P&L online course.

Already used by dozens of corporate finance professionals, this P&L financial due diligence model is focused on full, exhaustive P&L analysis both on the Revenue and the Cost side. It represents several days of work and is based on 5 intensive years of experience as part of the PwC transaction services Financial Due Diligence team, over 2 years of work in highly demanding Private Equity Investment jobs, and 3 additional years of SaaS financial due diligence and M&A due diligence.

This financial due diligence model can be used as a Financial Due Diligence checklist of main financial analyses to perform in an M&A process and is perfectly suitable for an M&A (merger & acquisition) process, Transaction Service consultant but can also greatly help any financial analyst or CFO to understand better the overall P&L, revenue and cost trends of a company.

All the analyses included in this financial due diligence template are as follows :

– Overview of P&L, variations, and KPIs (Key Performance Indicators)

– Revenue bridge (by product, channel, geography, etc.)

– EBITDA bridge (by type of cost)

– Current Year Trading (ie. analysis of the current fiscal year vs. the same period in previous years)

– Current Year Outturn (ie. Year to Date, Year to go vs. budget compared to previous years)

– Budget Accuracy (ie. how accurate was management at budgeting in previous years)

– Constant Currency Analysis

– Analysis of Transaction effect vs. Translation effect

– Impact of Hedging on revenue

– Revenue Seasonality

– Revenue Concentration

– Revenue Mix

– Revenue growth (Month over month, Quarter over Quarter, Rolling LTM, L6M, L3M, and comparison of month vs. same month last year)

– Impact of accrual revenue vs. cash accounting (ie. impact of deferred revenue)

– Refunds review (ie. how refunds have moved over the years)

– Discount and Rebates (ie. how discounts and rebates have changed over the years + discount and rebated per main customers)

– Dashboard of Variation of Revenue, price, and volume per product for each year

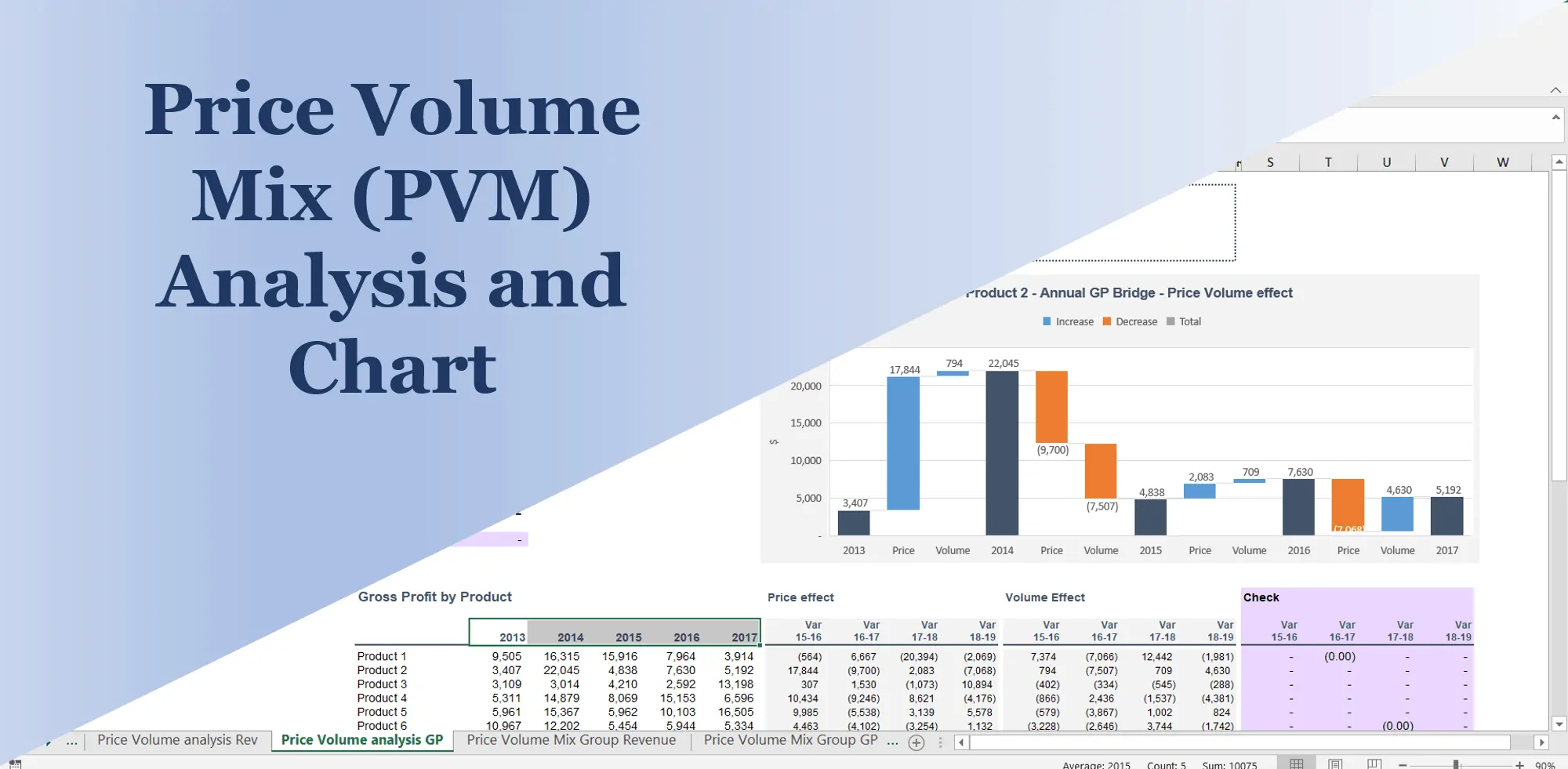

– Full Price Volume Mix analysis including impact on Gross Profit Margin of new products (if you are interested only in this part, I also sell the PVM model on a standalone)

– Customer count Churn bridge an average monthly churn rate

– Monthly Recurring Revenue (MRR) bridge (ie, the impact of an upgrade, downgrade, new and churn customers)

– Cohort analysis and Revenue retention % profile by year of onboarding

– Advanced revenue analysis by vintage (ie. analysis of customer revenue based on their year of onboarding and the year they churned)

– Revenue ramp-up by new customers

– Revenue ramp-up by new product

– Like for Like analysis (ie. analysis of the trend of a “core” category of product or of revenue-generating assets, like a portfolio of boutiques, for instance)

– Recurring revenue vs. One-off

– Monthly plans vs. Annual plans

– Pipeline and Backlog analysis

– Contract Renewal Dates

– Average revenue per client

– Evolution of Mix of customers by price plan by year

– Lifetime Value per client per date of onboarding (ie. how much revenue each client generated from his date of onboarding)

– Price elasticity

– COGS breakdown

– Raw Material price analysis

– Suppliers concentration

– GP by product

– Bubble Chart to analyze Rev and GP by product/department etc.

– Opex overview

– Fixed vs. Variable costs analysis

– Team Organigramme

– Employee costs breakdown

– Employee costs per department

– Staff Turnover and aging

– Revenue per relevant FTE per department

– Lease analysis

– Marketing costs breakdown

– Marketing & lead conversion

– Other Opex breakdown

Overall, this FDD model should be seen as an exhaustive M&A due diligence playbook that you can use and apply to your own specific situation, twisting the analyses to fit your particular needs and deep diving into the most relevant ones. In any case, it will provide any financial analyst doing M&A due diligence with a clear step-by-step approach of all the usual revenue & cost analyses that can be performed on a company.

This model also supports a full financial due diligence online course that I have created on how to perform Financial Due Diligence. If you are interested in learning more, please feel free to reach out by DM or by email.

Similar Products

Other customers were also interested in...

Price Volume Mix Charts and Analysis – On re...

Best practice model for a complete Price Volume Mix (PVM) analysis on revenue and on gross profit by... Read more

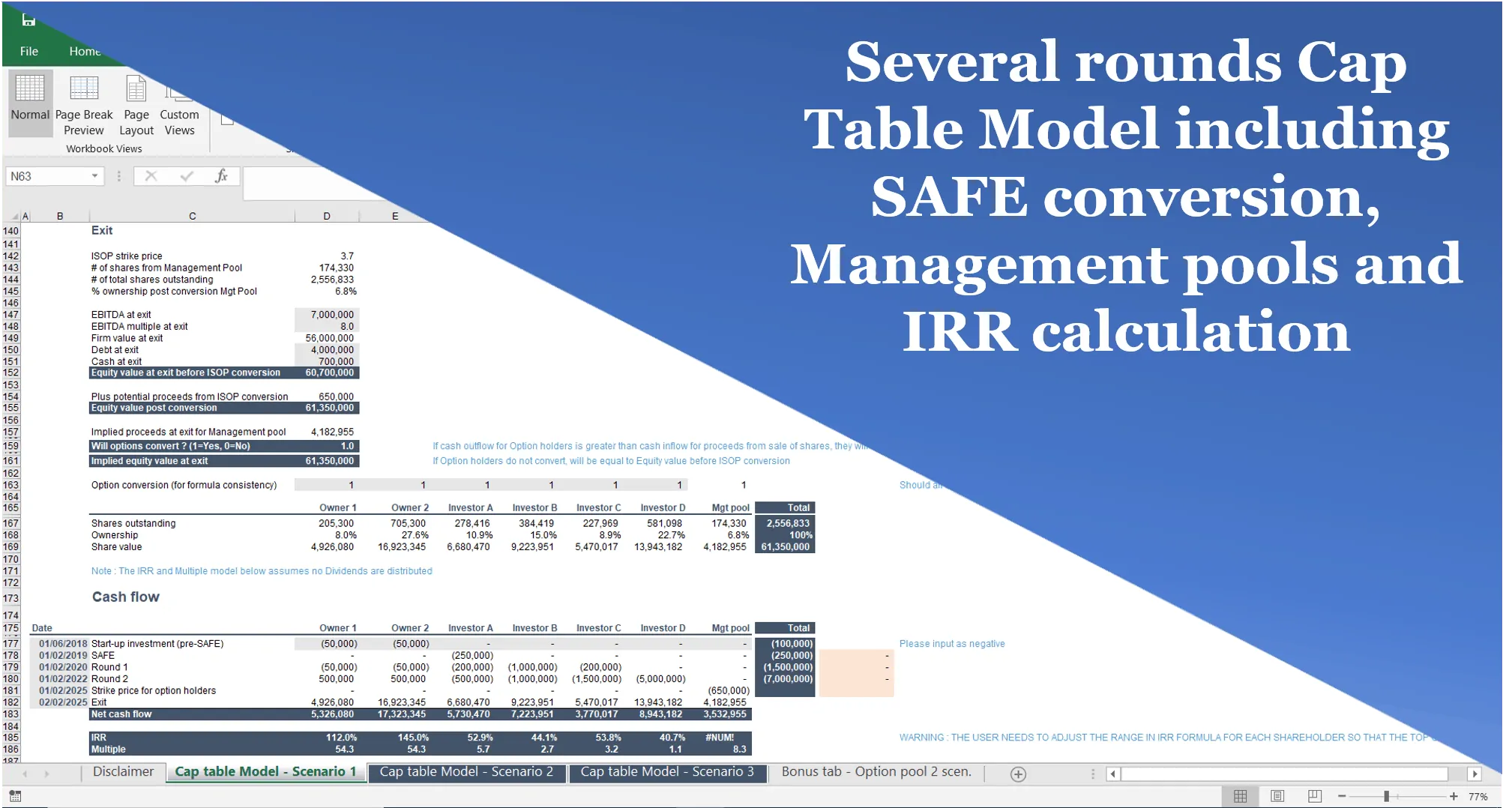

Multiple rounds Cap Table including Safe, pro-rata...

Multiple rounds cap table including SAFE conversion, Management option pool and investment performan... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Advanced Financial Model with DCF & Valuation

General Overview Advanced Financial Model suitable for any type of business/industry and fully cu... Read more

Top 16 Google Sheet Templates

This is a bundle of all the most useful and efficient google sheet templates I have built over the y... Read more

Small Business Playbook (Financial / Tracking Temp...

About the Template Bundle: https://youtu.be/FPj9x-Ahajs These templates were built with the ... Read more

Corporate Finance Toolkit – 24 Financial Mod...

They are essential models to increase your productivity, plan your future with budgeting and forecas... Read more

Franchisor Licensing: Financial Model with Cap Tab...

Build up to a 10 year financial forecast with assumptions directly related to the startup and operat... Read more

You must log in to submit a review.