Budget Vs. Actual: 3-Year

A simple way to measure your projections by month against what you actually did. Includes visual variance analysis. Goes out 3 years.

| All Industries, Financial Model, General Excel Financial Models |

| Accounting, Budgeting, Cash Flow Projections, CFO, Excel, Variance Analysis |

Video Tutorial:

*Recent edition: Cash flow variance.

Tabs include: Input, Projection, Actual, Variance, and Visual analysis.

I did add a few inputs for 3 different revenue streams to measure that have projected growth as a monthly %. That could be a 0% growth or you could manually input your revenue projections if needed. COGS and expense projections are also manual entries, but they could run off of assumptions if needed (hourly charge applies). Net profit will then populate on its own.

The variance analysis is done on a third tab that is granular enough to show the variance on any given month for any given revenue item or expense item. The chart will then pull off those variances %’s to show you how you have performed relative to your projections over time on any line that you want to measure.

If you want to just look at the main categories such as total revenue, total expenses, or total net profit by month, that function is available.

Similar Products

Other customers were also interested in...

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Joint Venture and Fund Cash Flow Waterfall Templat...

Here are all the spreadsheets I've built that involve cash flow distributions between GP/LP. Include... Read more

Small Business Playbook (Financial / Tracking Temp...

About the Template Bundle: https://youtu.be/FPj9x-Ahajs These templates were built with the ... Read more

Top 16 Google Sheet Templates

This is a bundle of all the most useful and efficient google sheet templates I have built over the y... Read more

Franchisor Licensing: Financial Model with Cap Tab...

Build up to a 10 year financial forecast with assumptions directly related to the startup and operat... Read more

Preferred Equity Cash Distribution Model – 2...

A 10-year joint venture model to plan out various scenarios for the way cash is shared between a GP ... Read more

Cumulative LP Distribution Joint Venture Waterfall...

A 6 Tier cash flow waterfall template. Plug in the distributable cash flow (+/-) and set the hurdle ... Read more

Inventory Valuation Using FIFO – Automatical...

Any accountant that needs to comply with IFRS will have to use the FIFO valuation method for calcula... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

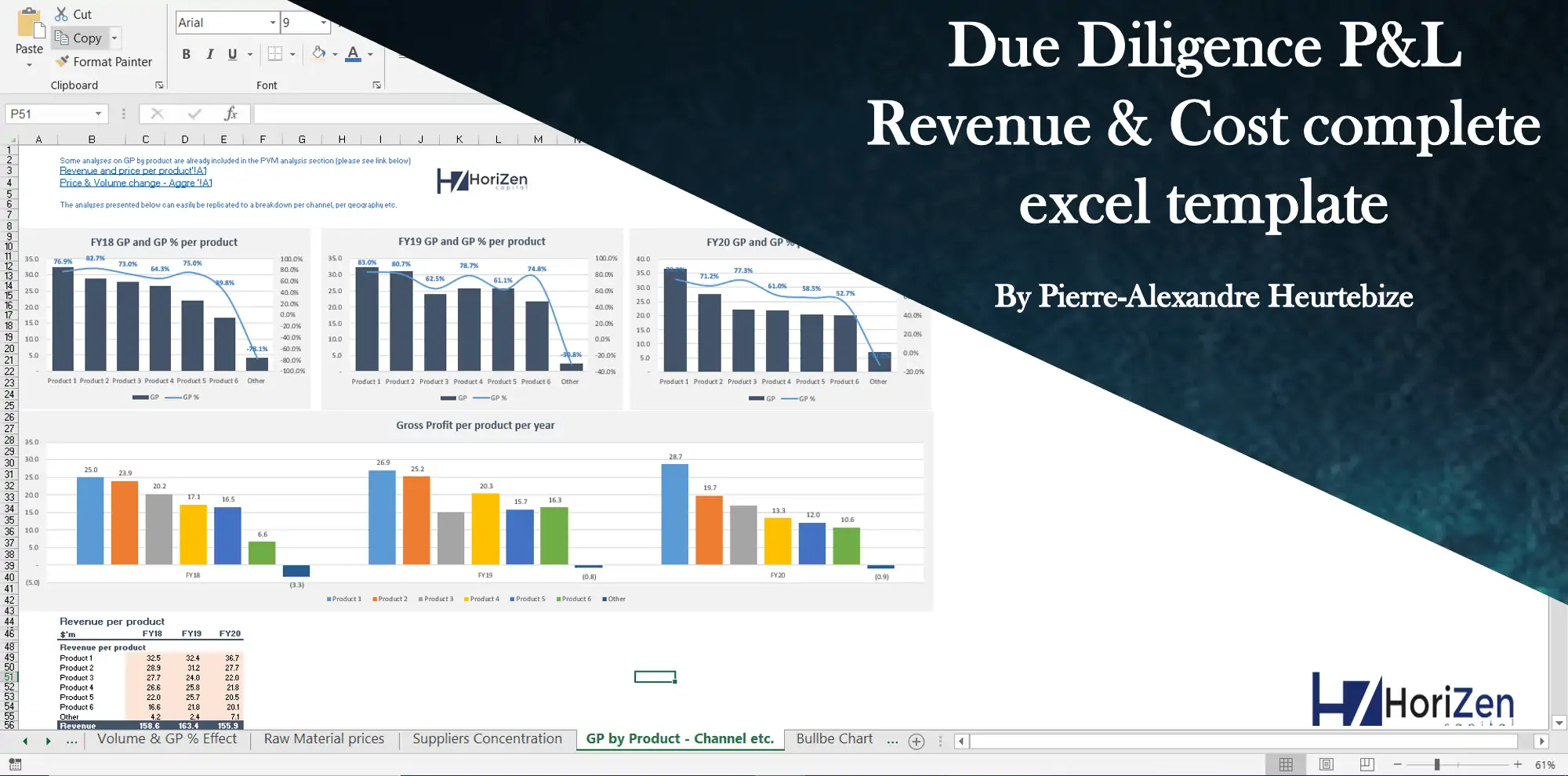

Due Diligence P&L – Exhaustive Revenue a...

Model for in depth understanding of high level profit and loss and revenue analysis. Big-4 like chec... Read more

You must log in to submit a review.