Financial Model – Valuation of Tax Loss Carryforwards

This valuation model provides a framework for the valuation of tax loss carryforwards and tax carrybacks via Net Present Value (NPV) calculation.

| Financial Model, General Excel Financial Models |

| Excel, Free Financial Model Templates, NPV (Net Present Value), Tax Assets, Valuation |

This valuation model provides a framework for the valuation of tax loss carryforwards and tax carrybacks via Net Present Value (NPV) calculation.

The financial model determines how long your historic tax losses can be carried forward to be offset against the taxable income. Optionally it also allows.

The assumptions used are:

- Discount rate

- Tax rate

- Time period tax loss carryforwards are allowed

- If you wish to consider also tax carrybacks (yes/no)

- Time period tax carrybacks can be offset

The model provides a detailed calculation which tax loss carryforward and carrybacks can be used at which point in time and what the value of the tax assets are.

Screenshots

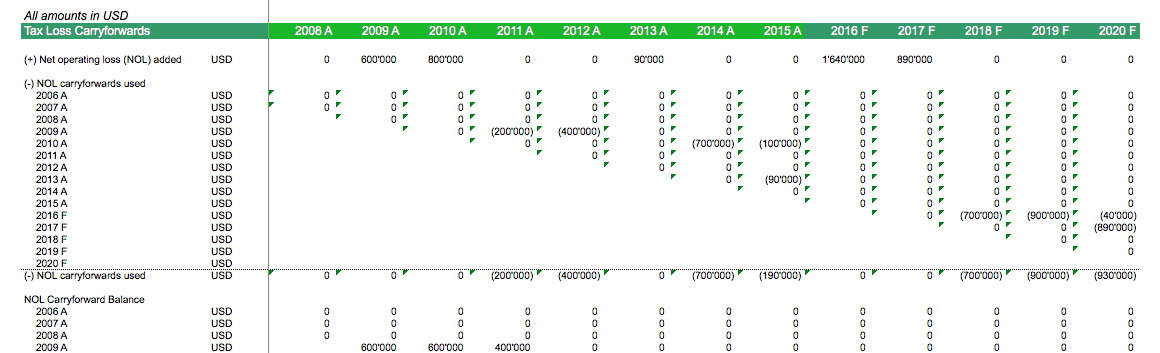

Schedule for the use of tax loss carryforwards

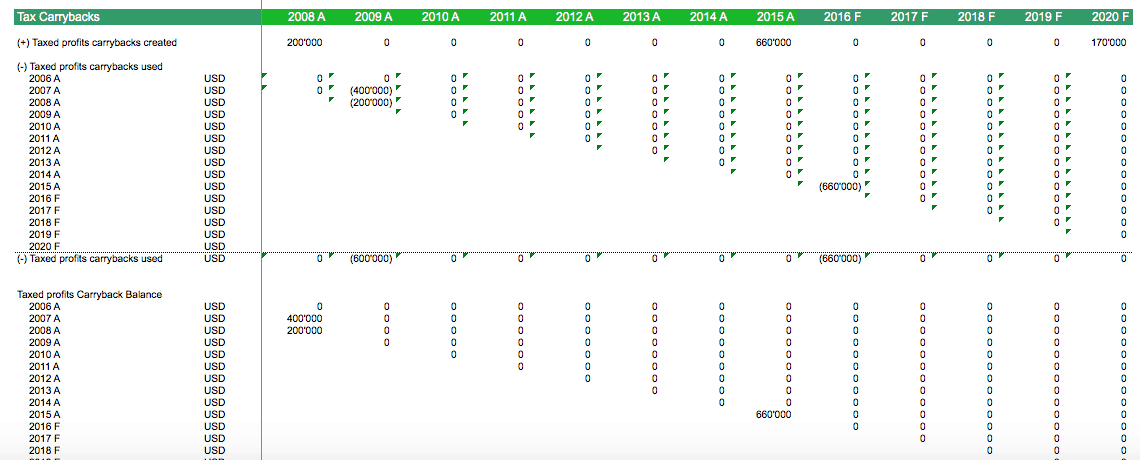

Schedule for the use of tax carrybacks

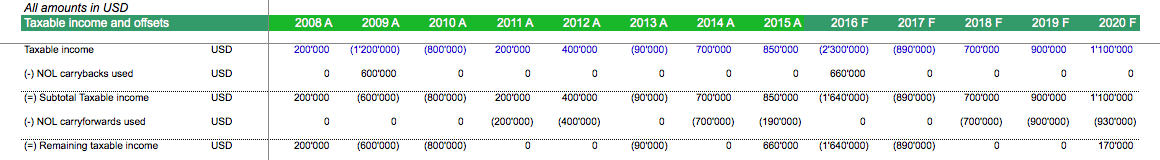

Taxable income and deductions of tax loss carryforwards and tax carrybacks

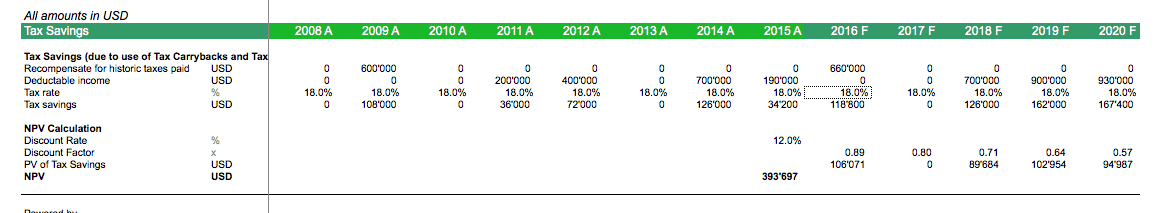

Calculation of tax savings and NPV valuation

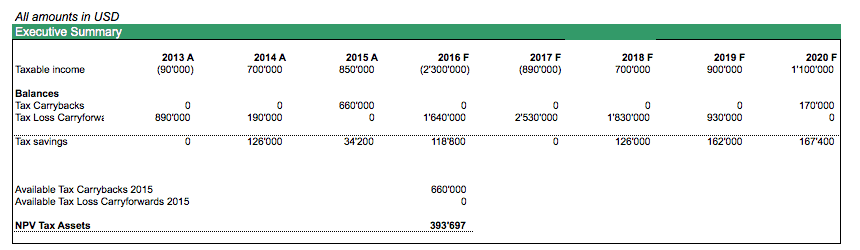

Executive Summary with Financial Overview

Similar Products

Other customers were also interested in...

Waterfall Profit Distribution Model (up to 4 Tiers...

We are introducing our 4-Tier Waterfall Profit Distribution Model. The waterfall profit distribution... Read more

Budget Template in Excel – Analysis in 4 Ste...

The Purpose of the 4 Step Budget Analysis Spreadsheet Template is to offer a user-friendly solution ... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

Advanced Financial Model with DCF & Valuation

General Overview Advanced Financial Model suitable for any type of business/industry and fully cu... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Due Diligence P&L – Exhaustive Revenue a...

Model for in depth understanding of high level profit and loss and revenue analysis. Big-4 like chec... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Investment Financial Models – All-in-One Bundle ...

A collection of templates suitable for investment decisions in various types of businesses/industrie... Read more

Cost Segregation Study: Estimated Benefit Summary ...

This calculator has inputs for many different asset categories and their resulting recovery periods.... Read more

Mergers & Acquisitions (M&A) Model

The Mergers & Acquisition (M&A) Model provides a projection for a company looking to potentially... Read more

You must log in to submit a review.