Optimize Your Strategy: A Deep Dive into Free Bill Pay Template

Optimize your financial management using a free bill pay template. Streamline your billing process effortlessly with this intuitive tool.

Navigating your finances can be complex, but a free bill pay template simplifies keeping track of expenses and payments. It serves as a user-friendly roadmap to manage your bills, ensuring you never miss a due date. This tool is essential for individuals seeking a structured approach to their financial obligations.

With the rise of digital budgeting, a bill pay template allows easy customization and can be updated in real-time. Both personal and small business finances stand to benefit from its clear layout and reminder system. Embrace this financial hack to enhance accuracy in your payments and improve your overall monetary health.

Introduction To Free Bill Pay Templates

Managing bills can often be a tedious task. Yet, it’s crucial for staying financially organized. Free bill pay templates simplify this process. They help to keep track of payments and due dates. Templates are especially useful for those who want an efficient, cost-free method to manage their finances. Individuals and small business owners alike can benefit from these tools. Let’s explore some of the benefits and features of these templates.

Benefits Of Using Bill Pay Templates

- Cost Efficiency: Save money as there’s no need to purchase expensive software.

- Time-saving: Quickly log and track your bills, reducing the time spent managing payments.

- Better Organization: Keep all your payment information in one place for easy reference.

- Avoid Late Fees: With due dates clearly marked, you’re less likely to miss payments.

- Improves Credit Score: Regular, on-time payments contribute to a healthy credit score.

Common Features Of Effective Templates

| Feature | Description |

|---|---|

| Date Tracking | Helps you remember when each bill is due |

| Amount Columns | Keeps a record of how much you owe and have paid |

| AUTOMATIC CALCULATIONS | Total your expenses quickly |

| Customization | Alter to fit personal or business needs |

| Visual Elements | Graphs or charts to visualize payment activity |

Choosing the right template involves ensuring it has the key features that meet your specific needs.

Personal Finance And Bill Management

Managing money and paying bills on time are keys to financial health. A free bill pay template helps track due dates and expenses. It simplifies the process. This leads to better money management and peace of mind.

The Role Of Organization In Personal Finance

Organization reduces stress and keeps finances in check. With organization, tracking income and outgoings becomes easier. A bill pay template serves as a financial dashboard. It ensures no bill gets forgotten. Having a good system in place improves control over your funds.

Here’s what a well-organized bill pay system can do:

- List all monthly bills to see them at a glance.

- Keep payment deadlines at the forefront.

- Help set reminders for upcoming payments.

Impact Of Billing Systems On Budget Planning

A billing system affects budget success. Knowing upcoming bills helps plan spending. It prevents last-minute scrambles to find money for bills. Accurate bill tracking aligns with smart spending habits.

| Expense Category | Due Date | Amount |

|---|---|---|

| Rent/Mortgage | 1st of the Month | $1,200 |

| Utilities | 15th of the Month | $250 |

| Credit Card | Last day of the Month | $500 |

The table above shows a sample budget overview. It gives clear visuals on what is due and when.

Strategic Budgeting With Templates

Mastering money management starts with a plan. Free bill pay templates pave the way. A clear strategy shapes a healthy financial future. Smart budgeting could be your game changer. Backbone of this approach—you guessed it—templates.

Aligning Budget Goals With Bill Templates

Successful finance strategies align with personal goals. Bill pay templates serve as a roadmap. Outlining expenses and dues, they guide spending decisions. Here’s how:

- Identify monthly bills – View all with ease.

- Set pay dates – Never miss a deadline.

- Track progress – See goal alignment over time.

Using a bill pay template ensures no expense goes unnoticed. Each dollar aligns with your financial journey.

Customizing Templates For Financial Targets

Every individual’s financial goals differ. Customization is key. Even the best template needs tweaking. Tailor it to fit your unique financial landscape.

- Adjust categories – Reflect your spending areas.

- Modify due dates – Sync up with your cash flow.

- Set reminders – For upcoming payments.

A personalized bill pay template turns a generic tool into a personal financial assistant. Hit specific targets with a template that bends to fit your needs.

Analyzing Different Bill Pay Template Formats

Managing finances requires organization and efficiency. Bill pay templates are essential tools to streamline this process. Variety in formats means finding the perfect fit for unique needs. Let’s explore the popular formats and their benefits.

Excel And Spreadsheet-based Templates

Excel templates are a go-to for financial tracking. The reasons are clear:

- Customization: Edit and format to match personal budgeting style.

- Formulas: Automate calculations to save time.

- Analysis: Use graphs and charts for a visual understanding of spending.

Spreadsheets like Google Sheets offer similar advantages:

- Accessibility: Access and update from any device.

- Collaboration: Share and work with family or financial advisors in real-time.

| Feature | Excel | Google Sheets |

|---|---|---|

| Offline Access | Yes | Limited |

| Real-time Updates | No | Yes |

| Data Visualization | Advanced | Basic |

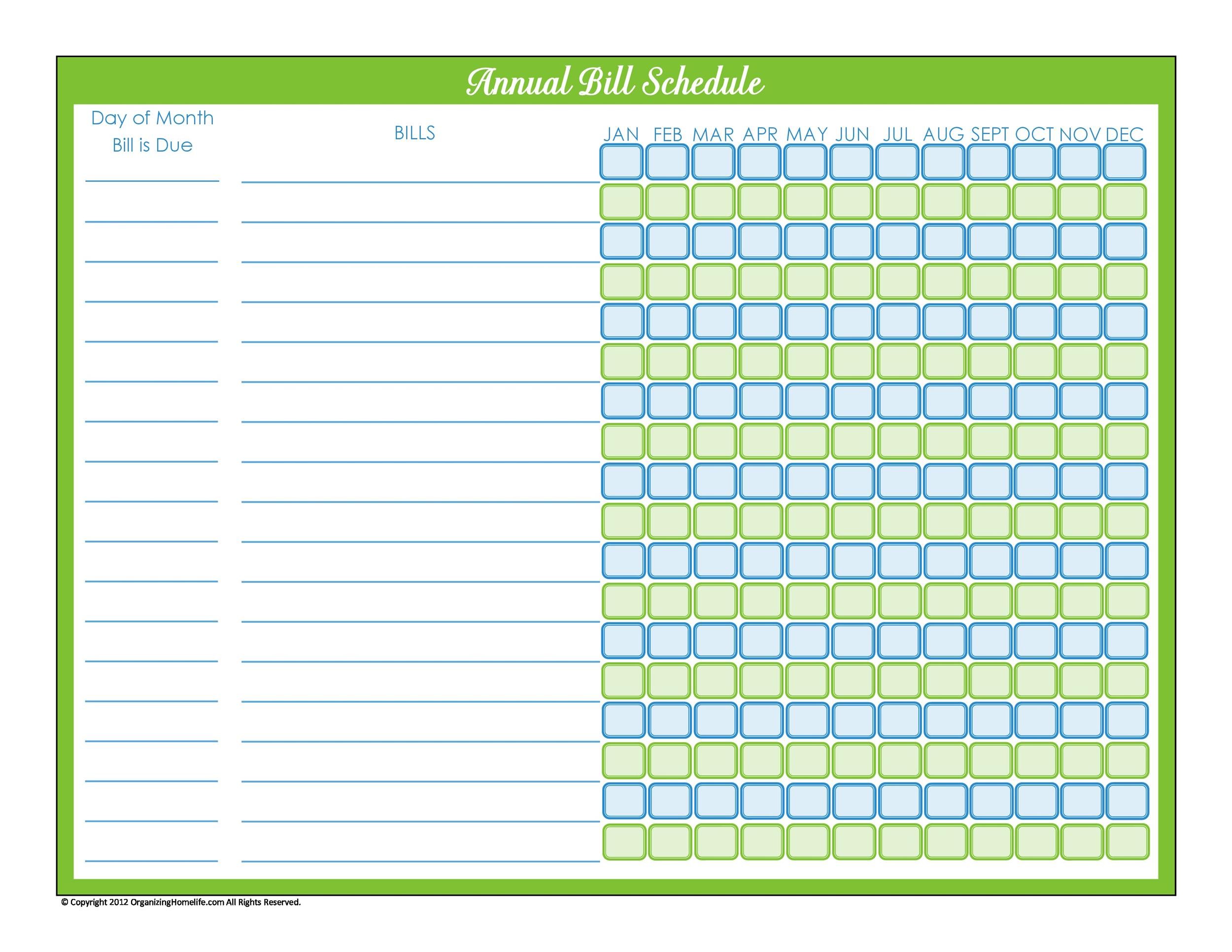

Pdf And Printable Template Advantages

PDFs and printable templates have unique strengths:

- Portability: Carry a physical copy or a digital file everywhere.

- Security: PDFs can be password protected.

- Simplicity: Ideal for those preferring pen and paper.

These templates often come in convenient designs:

- Checklists: Ensure no bill is forgotten.

- Calendars: Visualize due dates easily.

- Payment Logs: Track payments over time.

PDF editors can tweak templates, but typically less than spreadsheets. Even so, pencil and paper invite simple, immediate edits.

Choosing the right bill pay template means weighing personal preferences against each format’s offerings. Whether it’s the dynamic capabilities of Excel or the straightforwardness of PDFs and printables, the right template streamlines bill management for effective personal finance.

Automation In Bill Payments

Automation turns the tedious task of bill payments into a breeze. With the right tools, you forget about due dates and late fees. In a world where convenience is king, automating your finances is the crown jewel.

Integrating Templates With Banking Solutions

Bill pay templates streamline your financial workflow. Banks offer them as time-savers. Let’s see how to integrate:

- Access your online banking platform.

- Locate the bill pay section.

- Choose or upload a bill payment template.

- Connect your accounts and payees.

- Review and save.

Your bills now have a direct line to your bank account.

Setting Up Automated Reminders And Payments

No more missed payments. Autopay does the remembering for you.

Start with setting reminders:

- Into your banking app, go.

- Find reminders or notifications.

- Add dates when bills are due.

Next, enable automated payments:

- Tap on recurring payment options.

- Link to the bill pay template you set.

- Input payment details once.

- Select a payment schedule—monthly or weekly.

- Confirm and activate.

Sit back. Your bills pay themselves now!

Security Concerns With Template Use

When it comes to managing finances, templates can be a game-changer. Especially, a free bill pay template simplifies the process of tracking your expenses and payments. But, with convenience also comes the concern for security. Let’s explore how to secure your financial information when using templates.

Protecting Sensitive Information

Keeping your financial data safe is crucial. A free bill pay template may require you to input sensitive details. These details could include bank accounts, payment amounts, and billing cycles. It’s important to ensure this information remains confidential. Here are some tips:

- Use password-protected files: Always protect your templates with a strong password.

- Update security software: Make sure the device where you store the template has the latest antivirus software.

- Backup regularly: Keep backups of your template in a secure location to prevent data loss.

Best Practices For Digital Financial Security

Managing finances online requires adherence to best practices for digital security. Below are some steps to follow:

- Enable Two-Factor Authentication (2FA): If your template lives in an online ecosystem, activate 2FA for an added layer of security.

- Be wary of phishing scams: Never click on suspicious links that may be targeting your financial information.

- Regularly update passwords: Change your passwords periodically and avoid using the same password across multiple platforms.

Remember, your financial safety relies on how well you secure your data. A free bill pay template is a helpful tool, but it must be used wisely and safely.

Customization Tips For Your Bill Pay Template

Welcome to the guide on Customization Tips for Your Free Bill Pay Template. Crafting a personalized bill pay template ensures an organized financial plan. It reflects unique spending habits and income streams. Dive into these essential customization strategies!

Adjusting Categories For Personal Needs

Every person’s expenses are different. Your bill pay template should mirror your financial life. Start by renaming default categories to fit your actual expenses. Add new categories as needed.

- Household: rent, mortgage, utilities, maintenance

- Personal: groceries, healthcare, gym memberships

- Savings goals: emergency fund, vacation, retirement

Delete categories that don’t apply. Keep the template relevant and clutter-free. A streamlined category list makes tracking easier and more accurate.

Visual Enhancements For Quick Overview

Enhancing your template visually helps you understand your finances at a glance. Use colors to differentiate between types of expenses. High-priority bills in red, for instance. Link each category to its corresponding expenses for easy navigation.

| Category | Color Code |

|---|---|

| Mortgage/Rent | Pink |

| Utilities | Light Blue |

| Groceries | Light Green |

| Savings | Yellow |

Use bold to highlight due dates and amounts. Insert simple charts for a monthly expense breakdown. Icons next to each category enhance visual flow. Your eyes quickly locate pertinent information.

Implement these tips and your bill pay template becomes a powerful, personalized financial tool.

Continuous Improvement Of Billing Processes

The journey to perfect your billing process never stops. Continuous improvement is vital. A free bill pay template can be a game-changer. But it’s not just about using it. It’s about evolving it. Understand the importance of refining your billing workflow.

Assessing And Adjusting Templates Periodically

Business needs change. Customer expectations shift. Your billing templates should too. Make sure they align with up-to-date practices and regulations.

- Review your templates every quarter.

- Check for new features or integrations that could improve efficiency.

- Ensure your templates are user-friendly and error-free.

Adjusting templates keeps your billing process smooth and professional.

Learning From Billing Mistakes And Feedback

Feedback is crucial. It’s a direct line to what’s working and what’s not. Take customer and staff feedback seriously. Address mistakes quickly.

- Compile feedback and review regularly.

- Identify common errors. Create a plan to prevent them.

- Update training and documentation based on this feedback.

Mistakes are lessons in disguise. Use them to sharpen your billing process.

Advanced Strategies For Maximizing Template Efficiency

Using a free bill pay template can streamline personal and business finances. But to truly optimize this tool, advanced strategies come into play. Harnessing data analysis and financial tracking boosts the template’s power. Let’s explore how these features can upgrade your financial routine.

Integrating Data Analysis Tools

Effective decision-making hinges on accurate data analysis. By incorporating data analysis tools into your bill pay template, you seize control over your expenses.

- Chart your spending with visual aids that pinpoint where your money goes each month.

- Use automatic calculations to avoid errors and save time.

- Identify trends in your bills to anticipate future expenses.

Implement these tools:

| Tool | Function |

|---|---|

| Pivot Tables | Summarize data for quick analysis. |

| Graphs and Charts | Visualize spending and saving patterns. |

| Formulas | Automate complicated calculations. |

Exploiting Financial Tracking And Forecasting Features

Go beyond simple bill payments with forecasting. This can predict future cash flow and help with savings goals.

- Track due dates to avoid late fees and maintain good credit.

- Forecast future bills using historical data for better planning.

- Set alerts for upcoming payments or budget targets.

Conclusion And Next Steps

We’ve explored the rich features of free bill pay templates. Now, let’s solidify our newfound knowledge and plan our financial future.

Recap Of Template Benefits

Effortless organization and enhanced accuracy shine in bill pay templates. Never miss a payment with structured schedules. Quick glances at due dates and amounts ensure no surprise withdrawals disrupt your budget. Here’s what we’ve learned:

- Track payments with ease.

- Enjoy visual budgeting and spending oversight.

- Customizable options make it fit any financial situation.

Moving Beyond Templates For Financial Mastery

Free templates provide a solid foundation. Grow your financial skillset further by exploring advanced tools. Software like Quicken or online platforms like Mint offer deeper insights. Key next steps include:

- Choose a software that fits personal goals.

- Automate more to save time.

- Set long-term goals and track progress.

By taking these steps, you secure financial confidence and independence. Ready to take charge of your financial destiny? Let’s start today!

Frequently Asked Questions

What Is A Free Bill Pay Template?

A Free Bill Pay Template is a document that helps manage and track your bill payments. It typically includes sections for billing dates, amounts owed, and payment statuses. It simplifies budgeting by providing a clear overview of financial obligations.

How Can A Bill Pay Template Optimize Finances?

Using a Bill Pay Template streamlines the process of managing bills, ensures no payment is missed, and aids in avoiding late fees. It enables users to effectively budget, foresee future expenses, and maintain a regular payment schedule, optimizing their financial health.

Are There Customizable Bill Pay Templates?

Yes, many Bill Pay Templates are customizable, allowing users to tailor them according to specific needs. They often come in formats like Excel or PDF, and can be edited to include additional categories, payment methods, or tracking features.

Benefits Of Using A Bill Pay Template?

The primary benefits of using a Bill Pay Template are improved organization, punctual bill payments, financial accountability, and reduced stress related to managing expenses. It serves as a visual reminder of upcoming dues and keeps finances in order.

Conclusion

Embracing a free bill pay template simplifies financial management. It streamlines tracking expenses, ensuring payments are prompt and budgets stay balanced. Start leveraging these templates to enhance your fiscal strategies today. The right tools make a measurable difference, propelling you towards financial clarity and control.

Elevate your bill management; download a template now and experience the change.