Tattoo Shop Financial Model Excel Template

Order Tattoo Shop Pro-forma Template. By running various scenarios of your inputs, you will begin to see which options are best for your business. The tattoo shop cashflow projection is a full-dimensional 5-year financial planning template for a company operating in a tattoo shop business niche. The template would suit both a tattoo shop startup as well as a running small tattoo shop. Tattoo Shop Financial Model Excel Template helps you evaluate your startup idea and/or plan a startup costs. Unlocked – edit all – last updated in Sep 2020. Solid package of print-ready reports, including a tattoo shop forecasted income statement, cash flow statement, a break-even analysis, and a complete set of financial ratios.

NOTE: Single-User pertains to a limited Single User License where the template can only be used by one single user; while Multi-User is a license for users sharing the template with up to 20 members. Please refer to Terms of Use and License and Permitted Use for clarification.

TATTOO SHOP PRO FORMA TEMPLATE EXCEL KEY FEATURES

Video tutorial:

Prove You Can Pay Back the Loan You Requested

When you apply for a business loan, bankers will study your Statement Of Cash Flows in an attempt to answer this question: Can this business pay back the loan? Requesting a loan without showing your Cash Flow Pro Forma for paying it back is a common way to land in the rejection pile. It is exceptionally accurate if your current cash flow won’t cover all of your monthly operating expenses — plus your loan payment. Don’t fall into this kind of situation. Use Projected Cashflow Statement to strengthen your case by showing the banker exactly how you plan to use the loan and when you will start repaying the debt. This type of forecasting helps you create a road map that can impress a lender with the confidence they need to approve your loan.

Confidence in the future

Using our financial model, you can effectively plan, prevent risks, manage stocks and Cash Flow Statement Forecast and foresee your prospects for the next 5 years.

Identify potential shortfalls in cash balances in advance.

The Tattoo Shop Financial Model In Excel Template works like an ‘early warning system.’ It is, by far, the most significant reason for a Projected Cashflow Statement.

All necessary reports

When creating a Tattoo Shop Startup Financial Model, you will not need to independently prepare financial reports and study the requirements for them. Our Excel template contains all the necessary reports and calculations that correspond with the lenders demand.

Simple and Incredibly Practical

Simple-to-use yet very sophisticated Tattoo Shop Finance Projection. Whatever size and stage of development your business is, with minimal planning experience and very basic knowledge of Excel you can get complete and reliable results.

Save Time and Money

Tattoo Shop Budget Financial Model allows you to start planning with minimum fuss and maximum of help. No writing formulas, no formatting, no programming, no charting, and no expensive external consultants. Plan the growth of your business instead of fiddling around with expensive techy things.

REPORTS and INPUTS

Valuation

This Tattoo Shop Financial Model Excel Template contains a valuation analysis template that will allow users to perform a Discounted Cash Flow valuation (DCF). It will also help users analyze such financial metrics as residual value, replacement costs, market comparables, recent transaction comparables, etc.

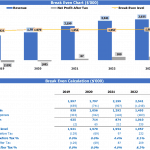

Break Even

This Tattoo Shop Financial Model Excel has a break even excel tab that predicts the period within which the company is supposed to move to a new level, i.e., start to bring profits to its owners. break even point excel uses forecasted revenues and expenses and makes Pro Forma Budget on the period when its overall revenues become significantly bigger than costs.

CAPEX

A capital expenditure (CAPEX) reflects the company’s investment in a business. Such an investment can be made in a piece of manufacturing equipment, an office supply, a vehicle, or others.

A CAPEX is typically steered towards the goal of rolling out a new product line or expanding a company’s existing operations. The company does not report the money spent on CAPEX purchases directly in the profit and loss projection. It reflects these expenses as an asset in the balance sheets and, at the same time, deducts a part of this amount in the form of depreciation expenses for several years.

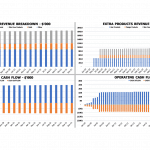

Dashboard

The financial dashboard in our Excel Financial Model Template is a great financial planning tool that helps to display the results of financial analysis. This financial summary in the form of charts and graphs will help analysts to explain clearly numbers from the financial statements.

With this dashboard’s help, users can analyze and present to other stakeholders’ revenue forecasts, financial margins, profit charts, and separate items from the balance sheet, profit and loss proforma, and cash flow statement forecast.

Burn and Runway

This Tattoo Shop P&L Projection automatically calculates the cash burn rate based on the inputs from other spreadsheets, in particular, from the cash flow statement projection.

Financial Statements

The template has a three-statement P&L Projection with integrated proformas. It allows users to create a company’s Balance Sheet, profit and loss statement proforma, and a cashflow forecast with minimum efforts. For these proformas, users can input either historical or forecasted financial data. Forecasted financial statements show how a company will perform under various circumstances and allow users to integrate different assumptions in the 3 Way Forecast Model.

For example, the company’s management can see the economic impact of its decisions, such as price changes.

Our well-built Tattoo Shop Financial Projection shows stakeholders how the company’s functions work together and how management’s decisions impact its overall financial performance.

Liquidity KPIs

Quick Ratio or Acid-Test Ratio. The quick ratio or acid-test ratio uses a firm’s balance sheet data to analyze if it has sufficient short-term assets to cover its short-term liabilities. This metric ignores less liquid assets like such as inventory.

File types:

Excel – Single-User: .xlsx

Excel – Multi-User: .xlsx

Free Demo – .xlsx

Similar Products

Other customers were also interested in...

Spa Financial Model Excel Template

Download Spa Financial Projection Template. This well-tested, robust, and powerful template is your ... Read more

Nail Salon Financial Model Excel Template

Check Nail Salon Financial Model Template. Excel - well-tested, robust and powerful. Get you solid f... Read more

Hair Salon Financial Model Excel Template

Check Hair Salon Pro Forma Projection. Fortunately, you can solve Cash Flow shortfalls with a bit of... Read more

Barber Shop Financial Model Excel Template

Check Barber Shop Financial Projection Template. Creates 5-year financial projection and financial r... Read more

Skin Care Financial Model Excel Template

Order Skin Care Pro-forma Template. Generate fully-integrated Pro-forma for 5 years. Automatic aggre... Read more

Dog Grooming Financial Model Excel Template

Download Dog Grooming Financial Projection Template. Excel Template for your pitch deck to convince ... Read more

Hair Salon Chain Financial Model Excel Template

Discover Hair Salon Chain Pro Forma Projection. There's power in Cash Flow Projections and the insig... Read more

Beauty Salon Financial Model Excel Template

Get Your Beauty Salon Financial Model Template. Creates 5-year financial projection and financial ra... Read more

Dog Grooming Services Financial Model (10+ Yrs DCF...

The Dog Grooming Services financial model is a comprehensive tool designed to analyze the financial ... Read more

Hair and Beauty Salon Business Plan – 5Yr Financ...

Highly-sophisticated and user-friendly Hair and Beauty Salon financial model providing advanced fina... Read more

You must log in to submit a review.