Simple Rental Units (Apartments) Model – 5 Year Forecast

Five years rental unit model, includes appreciation and return waterfall with mortgage payments. Ideal for people evaluating a high level rental business.

General considerations for the model:

- All blue elements are inputs you need to adjust according to your assessment.

- Forecast feeds from all your inputs.

What is the model for?

The model is designed to evaluate a simple rental unit business, based on a linear increasing rental and expenses adjusted for inflation that could affect your business along with all the required elements to design your capital structure (Equity and Debt assumptions), including the costs of closing and possible upgrades the building requires or unit.

What is included in the template?

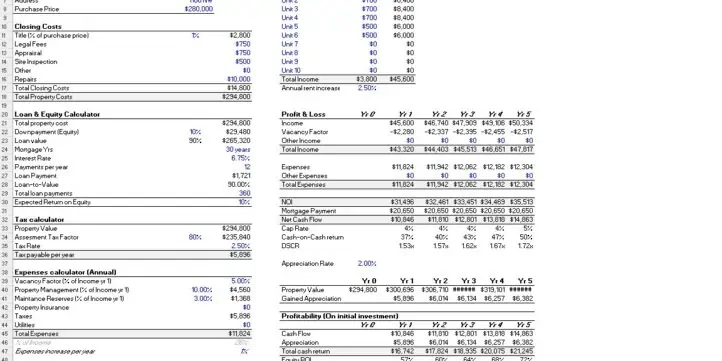

The template is divided into two major sections, assumptions, and forecasting. On the first one, you will be able to detail all the closing costs of the building such as title, legal fees, appraisal, and site inspection among others to gather the all-in price of the building.

Afterward, you will find the Loan & Equity calculator which will help you detail your equity and loan details to derive your monthly debt payments. In the third section of the assumptions part, there will be the tac calculator based on the assessment tax factor will is inputted into the model according to your reality, the same goes for the tax rate.

The expenses calculator allows you to detail expenses according to your major expense lines such as the vacancy factor, the property management fee, the maintenance, and repair reserves required for the units or building, insurance, calculated taxes, and utilities.

On the forecasted P&L there is also an “others” line in case you need to include additional expenses. Below the expenses input, you will find the expense increase per year, simulating inflation increases. Lastly, you will have the income and appreciation section, on the first one you will be able to detail the rental for each apartment on the monthly basis and the model will automatically calculate the yearly basis, annual rent increases can be input as well.

On the appreciation side, after the P&L you will see the appreciation of the building following your annual cash flow and appreciation rate to get to your Return on Investment (ROI) and Capitalization Rate (Cap Rate). For credit purposes, the P&L includes Debt Service Coverage Ratio (DCSR) so you can monitor your debt service cushion.

For any inquiries on the model or specific modifications, please feel free to reach out using the Contact Author button on the right side of this page. Happy modelling!

Similar Products

Other customers were also interested in...

Mixed-Use Real Estate Model: Leverage / JV Options

A general real estate model to plan all assumptions for up to 7 'uses' for a given property. Include... Read more

Airbnb Financial Model

Air BnB Financial Model Template presents the business case of the purchase of up to 5 properties wi... Read more

Real Estate Financial Model Templates Package

This is a collection of ready-made Excel financial model templates for real estate businesses and it... Read more

Property Development & Rental Financial Proje...

3-Statement 5-year rolling projection model with a valuation for new or existing business developing... Read more

Real Estate Agency Financial Model Excel Template

Download Real Estate Agency Pro-forma Template. Enhance your pitches and impress potential investors... Read more

Real Estate Portfolio Dashboard Model

Real Estate Portfolio Dashboard model presents a series of dashboards that will allow the user to ch... Read more

Real Estate Financial Model Bundle

This is a collection of financial model templates that provides the financial projections and valuat... Read more

Multi (20) AIRBNB Acquisition and/or Portfolio Mod...

This AIRBNB 20 model will assist you in evaluating up to 20 x propositions simultaneously and compar... Read more

Real Estate Development Financial Models Bundle

A collection of seven Real Estate Development Financial Models offered at a discounted price you can... Read more

Serviced Apartments Financial Model Excel Template

Download Serviced Apartments Financial Plan. Enhance your pitch decks and impress potential investor... Read more

You must log in to submit a review.