Scenario Analysis 3-Statement Projection Excel Model

User-friendly Excel model for the preparation of a 3 statement (Income Statement, Balance Sheet and Cash flow Statement) financial projection for a generic new or existing business across 3 scenarios (e.g. base, optimistic and pessimistic cases). The model follows the best practice financial modelling principles and includes instructions, line item explanations, checks, and input validations.

| All Industries, Financial Model, General Excel Financial Models |

| Dashboard, Excel, Financial Model, Financial Projections, Financial Statements |

PURPOSE OF MODEL

User-friendly Excel model for the preparation of a 3 statement (Income Statement, Balance Sheet and Cashflow Statement) financial projection for a generic new or existing business across 3 scenarios (e.g. base, optimistic and pessimistic cases). The model follows the best practice financial modeling principles and includes instructions, line item explanations, checks, and input validations.

KEY OUTPUTS

The model is generic and not industry-specific. The key outputs include:

– Projected full financial statements (Income Statement, Balance Sheet, and Cashflow Statement) for any of the 3 scenarios, presented on a monthly basis across 3 years and summarised on an annual basis.

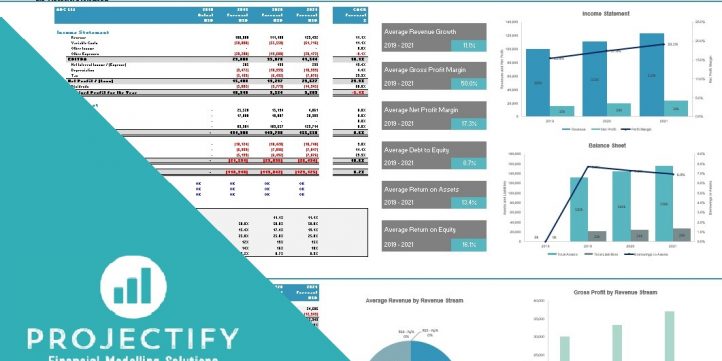

– Dashboard which can be run on any of the 3 scenarios and which includes the following:

o Summarised projected Income Statement and Balance Sheet

o Compounded Annual Growth rate (CAGR) for each summarised income statement and Balance Sheet line item

o List of key metrics including Average revenue growth, Average profit margins, Average return on assets and equity, and Average Debt to Equity ratio.

o Bar charts summarising income statement and Balance Sheet projections

o Gross Profit margin by revenue stream in table and bar-chart format

KEY INPUTS

Inputs are split into Income Statement and Balance Sheet Inputs. All inputs include user-friendly line item explanations and input validations to help users understand what the input is for and populate correctly.

Setup Inputs:

– Name of business

– Currency

– First Projection Year

– Naming for Scenarios, Revenue Streams, Other Income, Other Expenses, and Fixed Assets

Actuals Inputs:

– Opening Balance Sheet (for existing Businesses)

– Monthly Seasonality patterns for each revenue stream

Projection Inputs (for each of the 3 scenarios):

– Revenue inputs including sales volume, sales prices, and average credit terms offered;

– Variable cost inputs including variable cost per unit and average credit terms received;

– Other Costs including staff costs, marketing costs, and fixed costs;

– Taxation Inputs including rate and payment periods;

– Dividend inputs including amount (percentage of retained earnings) and frequency;

– Cash balance interest rates

– Inflation rates

– Fixed Assets including additional amounts and useful life

– Borrowings including addition amounts and interest rate

– Share Capital additions

MODEL STRUCTURE

The model contains, 8 tabs split into input (‘i_’), calculation (‘c_’), output (‘o_’) and system tabs. The tabs to be populated by the user are the input tabs (‘i_Setup’, ‘i_Actuals’ and ‘i_Assumptions’). The calculation tab uses the user-defined inputs to calculate and produce the projected outputs which are presented in ‘o_Fin Stats’ and ‘o_Charts’

System tabs include:

– A ‘Front Sheet’ containing a disclaimer, instructions, and contents;

– A Checks dashboard containing a summary of checks by tab.

KEY FEATURES

Other key features of this model include the following:

– The model follows best practice financial modeling guidelines and includes instructions, line item explanations, checks, and input validations;

– The model allows for a 3-year projection on a monthly basis and summarised on an annual basis for both new and existing businesses;

– The model allows the user to model 3 separate revenue streams on a Price x Volume basis;

– Costs are split into: variable and other costs. Other costs can be input on a per unit, per month, or one-off basis for better driver-based forecasting;

– Apart from projecting revenue and costs, the tool includes the possibility to model receivables and payables, fixed assets, borrowings, dividends, and corporate tax;

– Business Name, currency, starting projection period are fully customizable

– Revenue, Cost and Fixed Asset descriptions are fully customizable;

– The model includes instructions, line item explanations, checks, and input validations to help ensure input fields are populated accurately;

– The model includes a checks dashboard that summarises all the checks included in the various tabs making it easier to identify any errors.

ABOUT PROJECTIFY

We are a small team of financial modeling professionals with experience working in Big 4 Business Modelling teams and strong experience supporting businesses with their financial planning and decision support needs. Our aim is to provide robust and easy-to-use tools that follow best practice financial modeling guidelines and assist individuals and businesses with common financial planning and analysis processes.

We are keen to make sure our customers are fully satisfied with the tools/models they purchase and will be more than happy to assist with any questions or support required following or in advance of purchase.

We are also always keen to receive feedback so please do let us know what you think of our products/offerings by sending us a message or submitting a review.

Similar Products

Other customers were also interested in...

Multi-Entity Group Generic Monthly 5-Year 3 Statem...

User-friendly 3 statement 5 year rolling financial projection Excel model for a Multi-entity Group (... Read more

Leveraged Buyout (LBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes (IRR, projected financia... Read more

Investment Holding Company 3 Statement Financial P...

3 statement 5 or 8 year rolling financial projection Excel model for an investment holding company h... Read more

Management Buyout (MBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes of a management buyout (... Read more

Divestiture (Spin Off) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes (valuation, projected fi... Read more

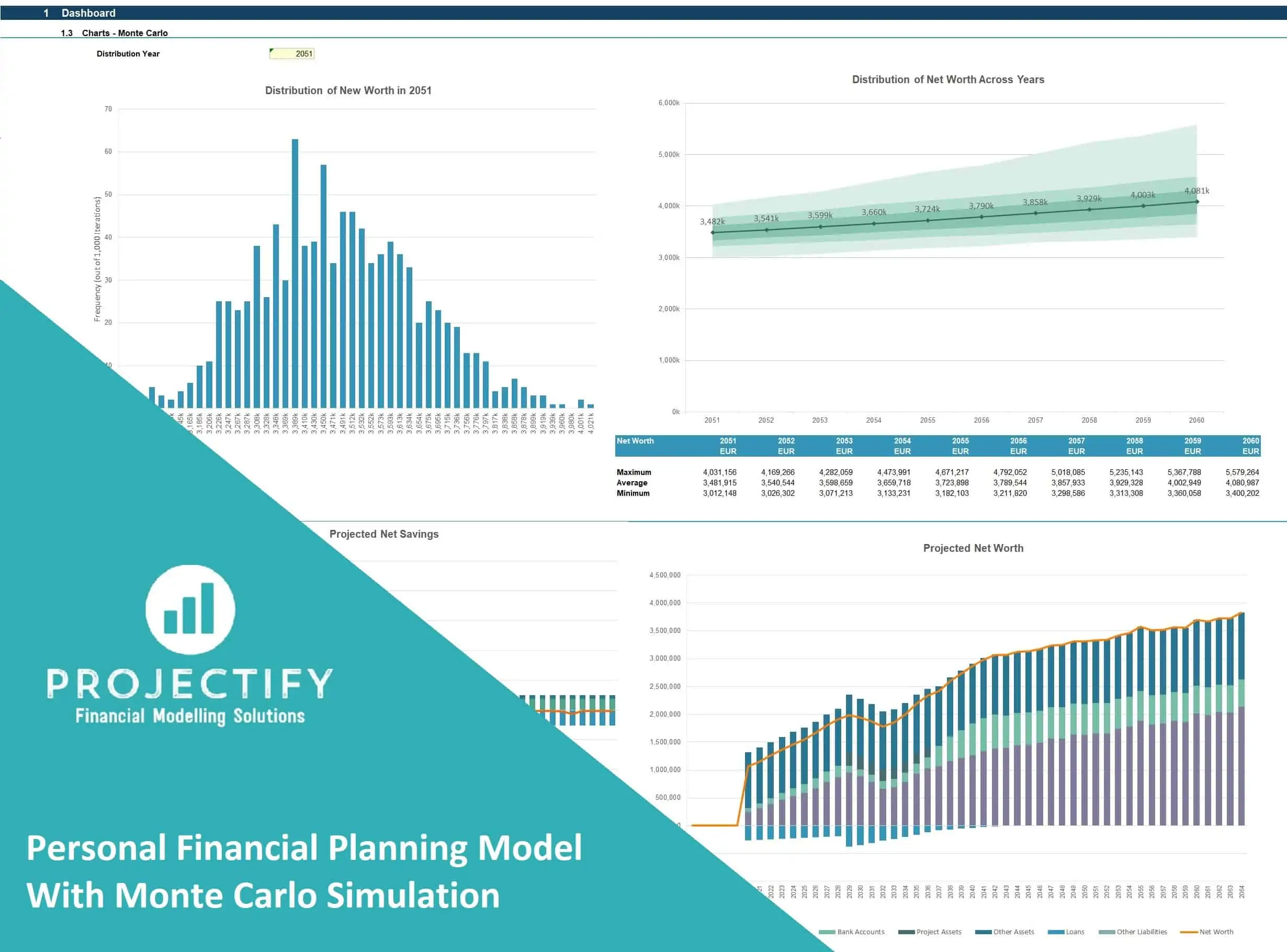

Personal Financial Planning Model with Monte Carlo...

User-friendly excel model to project personal or family cash flow and net worth across a 50-year tim... Read more

Divestiture (Cash Sale) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes (valuation, projected fi... Read more

Actual vs. Budget Variance Analysis Template

Excel model and dashboard for the preparation of a monthly budget and to track actual performance ag... Read more

Generic 5-Year Monthy Rolling Financial Projection...

PURPOSE OF TOOL Highly versatile and user-friendly Excel model for the preparation of a 5-year rol... Read more

Mergers and Acquisition (M&A) Financial Projec...

User-friendly financial model to project and analyze the financial outcomes and feasibility of an Me... Read more

You must log in to submit a review.