Break Even Point Analysis Excel Explained: What You Need to Know

Break-even point analysis in Excel determines when a business will cover its costs. This metric guides financial decisions and risk assessments.

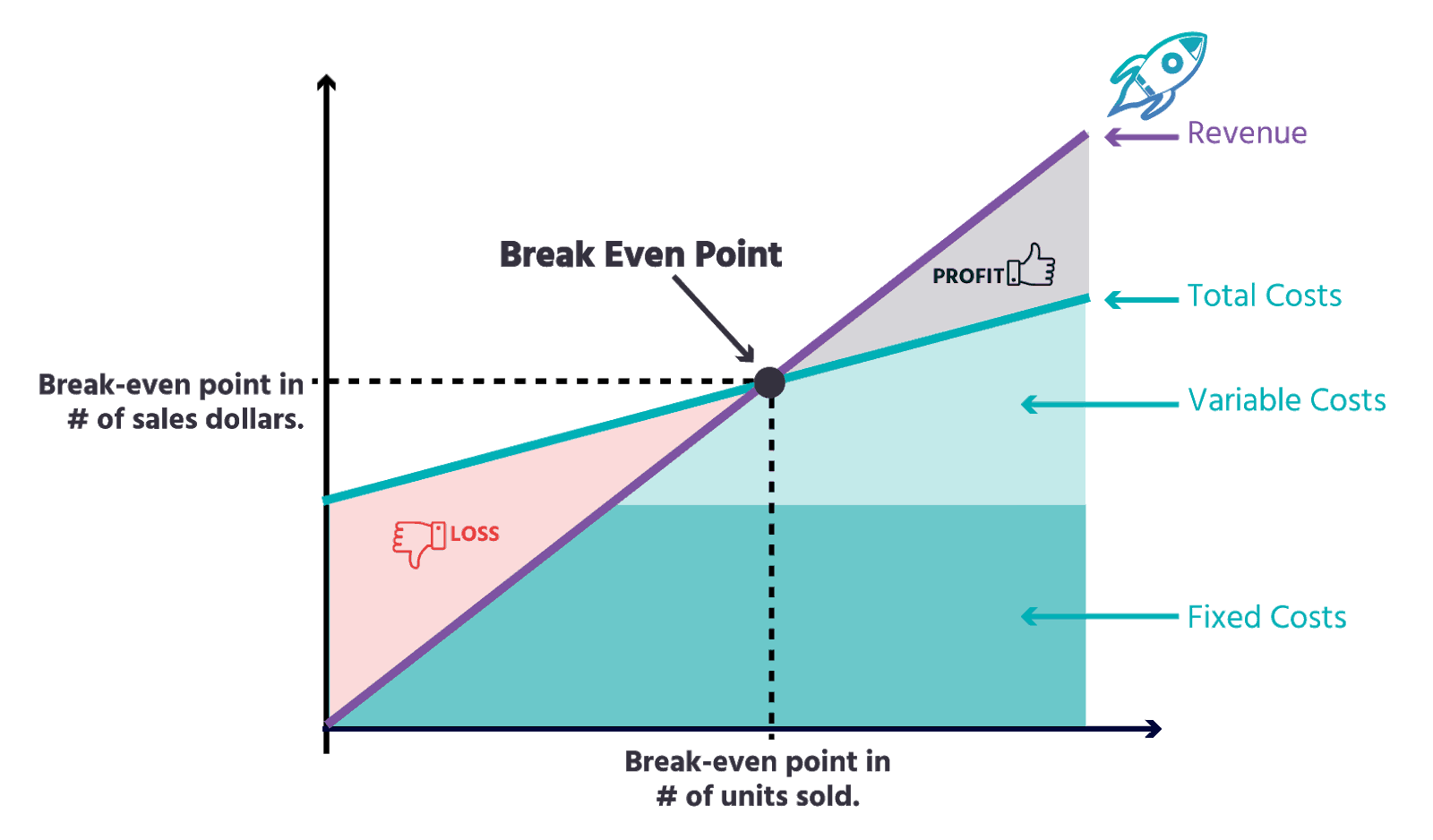

Excel is a powerful tool used by businesses for financial analysis, including break-even calculations. Understanding what a break-even point is crucial; it’s the moment where total costs and total revenues are equal, resulting in neither profit nor loss. Performing a break-even analysis in Excel helps visualize the intersection of expenses and income, providing clarity on how many units of a product or service must be sold to cover fixed and variable costs.

This analysis is instrumental for strategic planning, pricing, and managing cash flow. With Excel’s ability to crunch numbers and represent data graphically, stakeholders can make informed decisions and predict the financial future of their ventures effectively. By mastering break-even point analysis in Excel, managers ensure they have a roadmap to profitability and sustained business growth.

Unveiling Break Even Point Analysis

Welcome to the core of financial analysis in the world of business – the Break Even Point (BEP) Analysis. BEP is the compass that guides businesses through the tumultuous seas of economic decision-making. Unlocking the secrets of Break Even Point Analysis within Excel not only simplifies complex data but empowers stakeholders with the clarity needed to steer their ventures towards profitability. Let’s dive into the essentials of what you need to know about this critical financial calculation and how it impacts business choices.

The Basics Of Break Even Point

The Break Even Point signifies the moment when revenues perfectly match costs. At BEP, businesses neither profit nor lose money. Grasping this concept is a game-changer for anyone seeking financial success.

- Fixed Costs: These costs stay the same regardless of production levels.

- Variable Costs: These expenses change with production volume.

- Revenue Per Unit: The selling price for each item produced.

BEP analysis involves finding the point where:

Total Fixed Costs = (Revenue Per Unit – Variable Cost Per Unit) × Number of Units Sold

Significance In Business Decisions

BEP has a critical role in crafting business strategies. It tells companies how many units they need to sell to cover costs, guiding pricing, and production decisions.

| Role in Business | Impact of BEP |

|---|---|

| Price Setting | Helps in determining the minimum selling price to avoid losses. |

| Cost Control | Identifies how cost changes can affect the required sales volume. |

| Sales Goals | Sets clear targets for sales teams to achieve profitability. |

BEP thus becomes a lighthouse, guiding ships away from financial danger. To thrive, companies incorporate BEP analysis in their decision-making practices.

Excel As A Tool For Financial Analysis

Microsoft Excel stands as a beacon in the world of financial analysis. Its powerful computing ability, coupled with widespread availability, makes it a go-to resource for financial professionals. Whether you’re a seasoned analyst or a small business owner, Excel provides all you need to perform complex calculations, analyze data, and forecast financial health. Let’s delve into why Excel remains indispensable for tasks such as Break Even Point Analysis.

Advantages Of Using Excel

Excel boasts a multitude of benefits for those looking to conduct thorough financial analysis:

- User-Friendly Interface: Its grid layout and intuitive design allow for quick data entry and manipulation.

- Customizable Spreadsheets: Tailor your analysis to specific business needs by incorporating various formulas and functions.

- Advanced Analysis Tools: Use pivot tables and other advanced features to dive deep into your financial data.

- Visual Representation: Create graphs and charts to visualize complex datasets and communicate findings effectively.

- Scalability: Manage small to large volumes of data without the need for additional software.

- Accessibility: Access and share your Excel files from anywhere, fostering collaboration.

Key Features For Financial Modeling

Excel comes equipped with a host of features that make financial modeling more robust:

- Formulas and Functions: Leverage built-in formulas for quick calculations without errors.

- Cell Referencing: Use absolute and relative references to create dynamic models that auto-update.

- What-If Analysis: Apply scenario management tools like Goal Seek to predict outcomes.

- Data Tables: Organize and summarize data effectively for simplified analysis.

- Financial Functions: Employ specialized financial functions for loan amortizations, net present value, and more.

- Conditional Formatting: Highlight key metrics and trends with color-coding and formatting rules.

Incorporating these features, professionals can transform raw data into actionable insights swiftly.

Preparing For Break Even Analysis

Before diving into the waters of Break Even Point Analysis in Excel, it’s crucial to anchor oneself with preparation. Getting this right sets the course for a smooth journey. Let’s gather the essentials and set up our Excel workshop.

Gathering Necessary Data

Gearing up for Break Even Analysis begins with data collection. Like a chef preps ingredients before cooking, we must compile all relevant figures. Here’s what you need:

- Sales price per unit: How much you sell each item for.

- Variable costs per unit: Costs that change with production levels.

- Fixed costs: Costs that don’t change, like rent.

Setting Up Your Excel Workspace

A tidy workspace is key for efficiency. Let’s get Excel ready:

- Open a new Excel workbook.

- Label a sheet for Break Even Analysis.

- Column headings should include Product Name, Sales Price, Variable Costs, and Fixed Costs.

With these steps, you’re well on your way to a successful Break Even Analysis in Excel.

Crucial Components Of Break Even Analysis

Understanding Break Even Point Analysis in Excel can transform your business decision-making. It shows when your total revenues equal total costs. To master this analysis, we focus on two key parts. They are Fixed and Variable Costs, and Revenue Per Unit. Let’s explore these to optimize your business operations.

Fixed And Variable Costs Explained

Fixed Costs stay the same no matter how much you sell. They are the backbone of your business expenses. These include:

- Rent for your office or store

- Insurance premiums

- Salaries for your staff

Variable Costs change with your production volume. They include:

- Material costs

- Packaging

- Shipping fees

Break Even Analysis in Excel starts with listing all costs. You need to know your consistent monthly expenses. This is crucial for predicting your financial future.

Determining Revenue Per Unit

Figuring out how much money you make per item is key. This is your Revenue Per Unit. To find it, divide total revenue by the number of items sold. Here’s a simple breakdown:

| Item Sold | Total Revenue | Revenue Per Unit |

|---|---|---|

| Product A | $2000 | $20 |

| Product B | $1500 | $15 |

Calculate this for each product or service. It helps you set realistic sales targets. We aim to find the point where revenues cover both Fixed and Variable Costs. The result? Profitability!

Excel makes these calculations easy. Plug in your numbers, and use formulas to see results instantly. Pay special attention to Revenue Per Unit. Changes in this figure can shift your Break Even Point dramatically. Staying informed helps you adapt quickly in a competitive market.

Steps To Calculate Break Even Point In Excel

Exciting ventures often start with clear financial planning, and understanding when you’ll start making a profit is vital. Excel helps streamline this process with a Break-Even Point Analysis. Follow the steps below in Excel to get precise, fast results for your business finances.

Inputting Data Into The Worksheet

Start by setting up your Excel worksheet correctly.

- Label columns from A to D as: “Fixed Costs,” “Variable Costs per Unit,” “Price per Unit,” and “Break-Even Units”.

- Enter values under each heading.

- Fixed Costs are expenses that don’t change with sales volume.

- Variable Costs fluctuate with the units produced or sold.

- Price per Unit reflects your selling price.

Entering accurate data is crucial. Double-check your figures!

Applying Formulas And Functions

Next, unleash Excel’s power by utilizing formulas:

- In cell E1, label it “Break-Even Point Formula”.

- Click on cell E2, to apply the formula.

- Type =A2/(C2-B2) to calculate the units needed to break even.

- After typing in the formula, press Enter.

- Excel calculates the break-even point based on the data provided.

Remember, B2 is the variable cost per unit, C2 the price per unit, and A2 the fixed costs. The result in cell E2 is the number of units you need to sell to cover all costs.

Visualizing Data With Excel Charts

Break Even Point Analysis in Excel is a vital tool for businesses looking to understand when they will start making a profit. A key part of this analysis is visualizing data for clearer insight. Excel charts transform rows of data into vibrant visuals that make patterns and trends instantly recognizable.

Creating A Break Even Chart

A key step in Break Even Point Analysis is creating a chart. Excel makes this process user-friendly.

- Select the data range that includes cost, revenue, and sold units.

- Click the ‘Insert’ tab, then ‘Charts’ group for chart options.

- Choose a line or bar chart to best represent your data.

- Customize the chart with titles and axis labels.

With these easy steps, your Break Even Chart is ready, picturing your path to profitability.

Interpreting The Graphical Representation

Once created, the Break Even Chart is more than colors and lines. It speaks volumes about your business finances.

- Intersection Point – Where the revenue and cost lines meet.

- Cost Line – Shows total costs at varying levels of output.

- Revenue Line – Indicates overall revenue from sales.

Note the intersection point as it represents the Break Even Point. Before this point, the business incurs losses. After it, profits kick in. Excel charts make it simple to spot and plan ahead accordingly.

Analyzing The Results

When the complex world of financial analysis knocks, Excel opens the door. Break-even point analysis stands as a vital tool in management and accounting. It illustrates when a business neither makes a profit nor suffers a loss. Entering the arena of number crunching, ‘Analyzing the Results’ brings forth insights hidden within raw data.

Understanding Profit Margins

After calculating the break-even point, it’s crucial to delve deeper into profit margins. Profit margins reveal potential earnings after surpassing the break-even level. This metric is a beacon, guiding businesses toward pricing strategies and cost control measures.

Assessing profit margins commands a mix of art and science:

- Unit Cost: Gauge the cost incurred to produce one item.

- Selling Price: Determine the price at which an item is sold.

- Margin per Unit: Subtract unit cost from selling price.

Employ a simple formula for precise analysis:

Profit Margin = (Selling Price - Unit Cost) / Selling Price

Impact Of Changing Variables

Variations in costs and selling prices can shift the break-even point dramatically. Implementing what-if analysis in Excel allows for simulating different scenarios. This technique predicts how changes affect the bottom line.

Track these variables in a dynamic table:

| Variable | Impact on Break-even Point |

|---|---|

| Production Costs | Increase leads to higher break-even point |

| Selling Prices | Rise lowers the break-even point |

| Fixed Costs | More fixed costs push break-even further |

| Variable Costs | Decrease pulls break-even towards reach |

Link these variables in Excel to unlock the door to strategic financial planning. Dynamic changes on the spreadsheet instantaneously showcase how profit margins evolve.

Witness first-hand how each adjustment alters overall financial health. Smart modeling leads to informed decisions, paving the way for financial stability and growth.

Advanced Excel Techniques For Break Even Analysis

The power of Excel in performing break-even analysis extends far beyond simple calculations. With advanced Excel techniques, users can gain deeper insights into their financial scenarios. This section dives into sophisticated methods like using What-If Analysis and incorporating Sensitivity Analysis for thorough break-even exploration.

Using What-if Analysis

What-If Analysis is a powerful Excel tool. It helps users test different financial scenarios. To do a What-If Analysis for break-even points:

- Set up a basic break-even calculation table

- Go to the ‘Data’ tab

- Select ‘What-If Analysis’

- Choose ‘Data Tables’ to compare different variables

This tool allows changes in variables like price or costs. The impact is seen instantly in the break-even point. It aids in strategic decision-making.

Incorporating Sensitivity Analysis

Sensitivity Analysis examines how different values of an independent variable affect a particular dependent variable. To incorporate it:

- Create a base break-even model in Excel with your formulas

- Identify key variables, such as unit cost or sale price

- Use Excel’s ‘Data Table’ feature to vary these inputs

- Analyze the output range to understand potential break-even points

With Sensitivity Analysis, managers visualize how changes impact the break-even point. This leads to more informed business decisions.

Common Pitfalls And How To Avoid Them

Delving into Break Even Point Analysis in Excel can revolutionize your financial planning, yet stumbling blocks often trip up even seasoned analysts. Understand the common pitfalls in Break Even Point Analysis and how to side-step them for a foolproof assessment.

Accuracy Of Input Data

The cornerstone of any analysis is accurate data. A small oversight in data entry can lead to colossal misjudgments. Validate every figure and consistently cross-check against original documents. Erroneous inputs such as mistyping $5000 as $500 can skew your entire break even analysis.

Use these strategies to enhance data accuracy:

- Double-Check: Always verify your numbers twice.

- Source Data Validation: Ensure your data sources are reliable.

- Automatic Cross-Referencing: Use Excel functions to match figures with source data.

Avoiding Spreadsheet Errors

Even experts can fumble with complex formulas and data sets. Ensure the integrity of your spreadsheet with thorough checks. Simple missteps in formulae or cell references can derail your analysis.

Keep your Excel worksheets error-free:

- Formula Auditing Tools: Excel’s in-built tools can trace errors in formulas.

- Locking Cells: Prevent accidental alterations by locking critical cells or sheets.

- Version Control: Maintain versions of your spreadsheet to track changes and revert if needed.

Remember, meticulous scrutiny of every figure and formula ensures a robust Break Even Point Analysis. Prevent mistakes before they occur and your financial insights will be all the more powerful.

Leveraging Break Even Analysis For Strategic Planning

Imagine driving without a map. Now, think of Break Even Analysis in Excel as your financial roadmap. It clears the path for robust strategic planning. It does more than just tell you how many sales you need to cover costs. It guides key business decisions. Let’s dive into how Break Even Analysis becomes a compass for navigating the business landscape.

Informing Pricing Strategies

Break Even Analysis is crucial for setting prices that both cover costs and attract customers. It balances affordability with profitability. By calculating fixed and variable costs, business owners can determine the minimum price point. This strategy ensures sustainability and competitive edge. Here’s how Break Even Analysis aids pricing:

- Identifies the lowest price to cover costs

- Highlights the impact of different pricing scenarios

- Supports data-driven pricing adjustments

Guiding Investment Decisions

Using Break Even Analysis optimizes investment choices. It helps you understand when an investment will start paying off. This clarity is vital before committing funds. Excel makes it easy to forecast and tweak investment scenarios. The following points showcase its role in investment decisions:

- Shows the sales volume needed to justify an investment

- Assesses risk versus potential return

- Evaluates different investment opportunities with ease

| Investment | Fixed Costs | Variable Costs | Break Even Units |

|---|---|---|---|

| New Equipment | $5,000 | $50/unit | 200 units |

| Marketing Campaign | $2,000 | $20/unit | 150 units |

Excel offers dynamic features to customize Break Even Analysis, such as:

- Adjustable input fields for different cost factors

- Chart generation for visual representation

- Scalable templates to suit various business models

Expanding Beyond Break Even

Mastering the Break Even Point (BEP) in Excel opens up a new chapter for any business. It’s where costs and revenues meet but aiming for profit is the ultimate goal. Understanding the journey from BEP to profit maximization is crucial. It helps set the targets needed for a business to flourish.

From Break Even To Profit Maximization

To go beyond the break even point, we need a strategic plan. The goal is to find the sweet spot where profits soar. Factors like pricing, cost control, and sales volume play a big role.

Results must come from the right mix of:

- Optimizing prices: Price products to maximize profits.

- Boosting efficiency: Cut costs without sacrificing quality.

- Increasing sales: Drive more revenue.

To make this happen, you can use Excel to simulate different scenarios. Change the input numbers and watch how profits can change. This shows the best steps a business can take.

Integrating With Other Financial Models

A BEP analysis is just a start. Integration with other financial models gives a clearer picture. It reveals how various areas of a business work together to impact profitability.

Connect BEP analysis with:

- Cash Flow Forecasts: Understand money movement.

- Budget Variance Reports: Compare expected and actual finances.

- Financial Projections: See future financial health.

In Excel, linking these models is possible. You can create a dynamic dashboard. This gives insights into which actions can push profits higher.

Keeping Your Analysis Up-to-date

Break-even point analysis is a pivotal tool for business decision-making.

It’s vital to keep this analysis accurate and current.

As your business evolves, so should your calculations.

Here’s how to maintain the relevancy of your break-even analysis.

Regular Review And Adjustment

A break-even analysis isn’t a one-and-done task.

It requires regular check-ups.

Consider these steps to stay on track:

- Set a schedule for reviewing your analysis. Monthly or quarterly reviews work well for most businesses.

- Adjust for internal changes, such as cost alterations or new product lines.

- Use a structured approach: Compare current data with previous analysis and note the differences.

- Record updates in your Excel document, ensuring that all changes are documented and clear.

Staying Current With Market Changes

Markets shift constantly. Keeping your break-even analysis updated with these changes is crucial:

- Monitor market trends and prices. Update your costs and price points in the analysis accordingly.

- Anticipate seasonal changes that might affect your sales volume and factor them into your analysis.

- Keep tabs on your competition. Adjust your analysis to reflect changes in the competitive landscape.

A dynamic Excel break-even analysis will guide informed business decisions. Keep it updated, and it will serve your business well.

Frequently Asked Questions

How Do You Do A Break-even Point Analysis In Excel?

To perform a break-even point analysis in Excel, input your fixed costs, variable costs per unit, and price per unit. Use the formula “Fixed Costs / (Price per Unit – Variable Costs per Unit)” to calculate the break-even point in units.

What Do You Need To Know To Calculate Your Break-even Point?

To calculate your break-even point, you need fixed costs, variable costs per unit, and the price per unit sold.

What Should Be Included In A Break-even Analysis?

A break-even analysis should include fixed costs, variable costs per unit, sales price per unit, and the break-even point in units and dollars.

How Do You Explain Break-even Analysis?

Break-even analysis calculates when a business’s revenue equals its costs, indicating no profit or loss. It identifies the necessary sales volume to cover expenses, guiding financial planning and decision-making.

Conclusion

Mastering break-even analysis in Excel is a vital skill for businesses aiming for financial health. By understanding the intricacies, you empower your decision-making with solid data. Implement what you’ve learned and watch your enterprise thrive on informed strategies. Let the numbers guide your path to profitability.