Rental Property Financial Model

| Financial Model, Investment, Real Estate |

| Excel, Financial Projections, Free Financial Model Templates, Gross Yield, IRR (Internal Rate of Return), Net Yield |

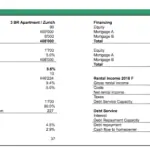

The rental property financial model calculates the homeowner’s IRR and long it takes to repay a mortgage when the property is rented.

The financial model contains:

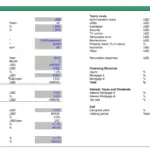

- Rental income and expenses

- Gross yield and net yield

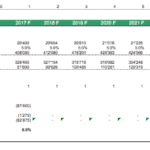

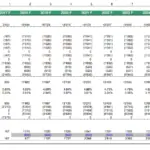

- 50 year forecast

- Development of property value and equity value

- Debt amortization calculation

- Internal rate of return to homeowner dependent on holding period

This financial model is made for owners of residential real estate such as apartment to to find out if the purchase price is attractive when compared to the achievable rental income. One can simulate the repayment of mortgage and calculate the return the homeowner can get when holding on to the property. Simply finetune the assumptions and see how the financial model reacts.

Similar Products

Other customers were also interested in...

Commercial Real Estate Valuation Model Template

A commercial real estate valuation model template assists in running a professional DCF Valuation fo... Read more

Real Estate Portfolio Template – Excel Spreadshe...

The Real Estate Portfolio Template forecasts the financial performance when building a real estate p... Read more

Real Estate Financial Model Templates Package

This is a collection of ready-made Excel financial model templates for real estate businesses and it... Read more

Airbnb Financial Model

Air BnB Financial Model Template presents the business case of the purchase of up to 5 properties wi... Read more

Real Estate Private Equity (REPE) Financial Model

New Version Updates:• The model supports now up to 50 properties• Updated Acquisition, Financing... Read more

Hotel/Guesthouse/Resort Development Model and Valu...

This Hotel / Holiday Resort Development Model will take you through a 20-year period of Three Statem... Read more

Real Estate Financial Model Bundle

This is a collection of financial model templates that provides the financial projections and valuat... Read more

Real Estate Multi-Family Development Excel Model

Real Estate Financial Model to evaluate a development project, with Equity Waterfall and Advanced Sc... Read more

Discounted Big Bundle Real Estate Valuation and Fi...

One Excel file for this bundle of Valuation and Financial forecasting models. Storage Parks, Hotels,... Read more

Commercial Real Estate Excel Model Template

Commercial Real Estate Excel model which generates the cash flows of the project as well as for equi... Read more

Reviews

Simple model that gave me all I needed to make decisions

13 of 23 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

Static cells throughout the file that is not linked to the summary of inputs. Formulas are incorrect (i.e., cost factor for the 1st year). Require further improvements by the author.

207 of 395 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

The model is simple and quite efficient

202 of 399 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.