Peer to peer (P2P) lending Investing Model

A useful projection tool to use within the Peer to Peer (P2P) or Peer to Business (P2B) lending space. These platforms have popped up everywhere and retail customers have great opportunity.

Video Tutorial:

The primary inputs are designed to account for the dynamics that go on within the investing cycle of Peer to Peer (P2P) lending platforms. If you want to buy debt, it is a good idea to plan out all of the various factors that will affect your returns, as well as see what the returns look like.

This model assumes all interest payments received are compounded monthly.

You can project out as far as 55 years, and there is a monthly detail summary.

Cash drag is accounted for in assumptions and can be adjusted.

IRR included (cash invested, cash withdrawn, and interest value over life of the endeavor).

Have included a tool for you to figure out what your weighted average net annual rate of return (interest rate charged to borrowers) is.

Deposit and withdrawal schedules are also included.

Overall, the financial model offers a useful projection tool to use within the Peer to Peer (P2P) or Peer to Business (P2B) lending space. These platforms have popped up everywhere, and retail customers have great opportunities.

Similar Products

Other customers were also interested in...

Loan Tape Analysis / KPI Dashboard

A framework that makes it easy to drop in your loan data and automatically generate analytical insig... Read more

Lending Company Financial Model – 5 Year Forecas...

This Financial model template presents a business scenario of a corporation engaged in granting loan... Read more

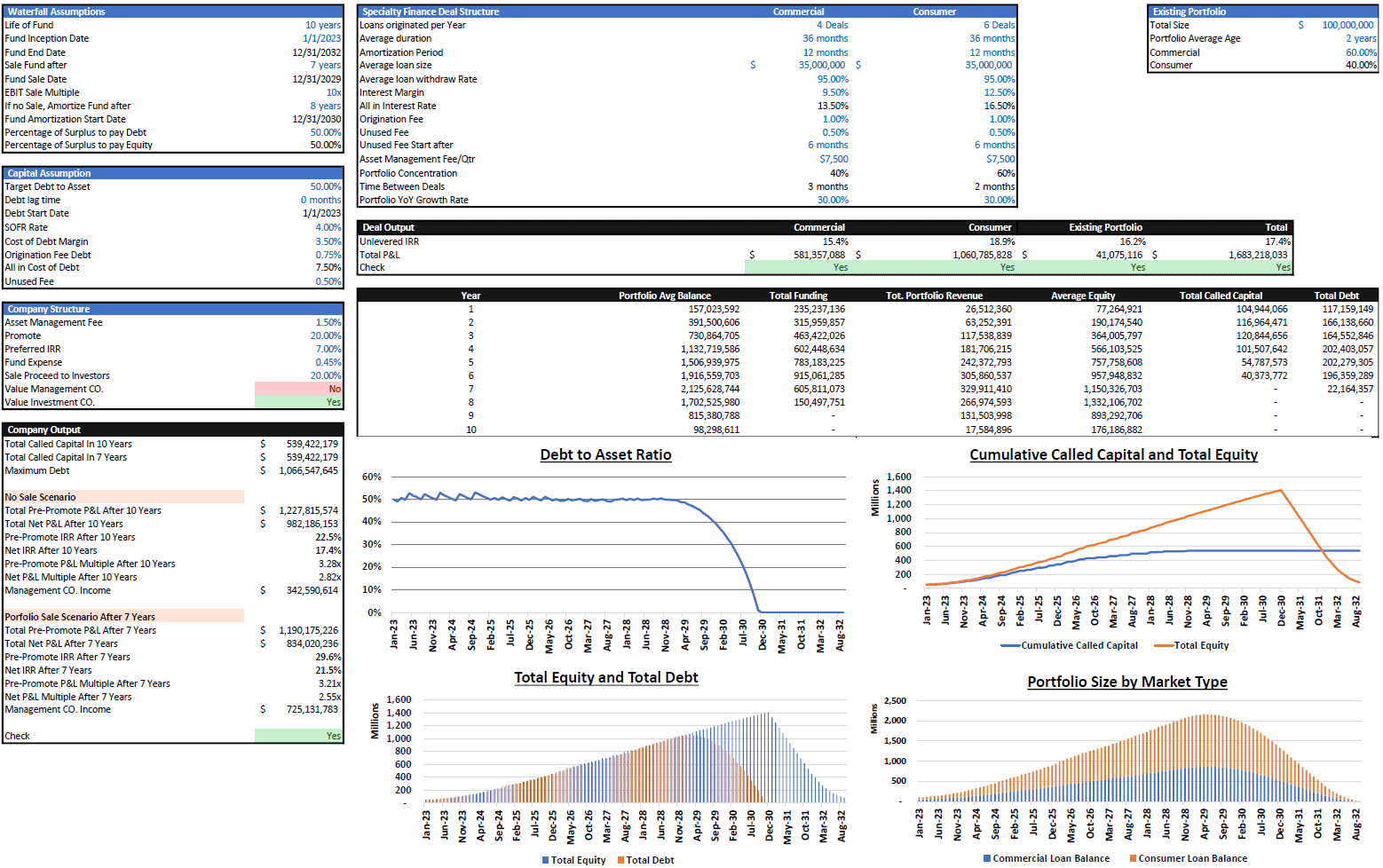

Debt Fund Excel Model

Explore the Debt Fund Excel Model, a comprehensive tool for evaluating new credit fund opportunities... Read more

Crowdlending (P2P) Platform – 5 Year Financi...

Financial Model providing an advanced 5-year financial plan for a startup Crowdlending (Peer-to-Peer... Read more

Fintech Financial Models Bundle

Financial technology (better known as fintech) is used to describe new technology that seeks to impr... Read more

Lending Platform Financial Model (LaaS)

Includes all the assumptions you need to project the gross revenues and profits of a LaaS platform (... Read more

Lending Model Startup Forecast: 10-Year Scaling &#...

This is a full 10-year startup lending business financial model, including a 3-statement model. Accu... Read more

Flat Fee Lending Business: Operating Model

10-year financial model directly built for a flat fee / fixed fee lender. Includes leverage for orig... Read more

Commercial Bank Financial Model

Commercial Banking Financial Model presents the case of a commercial bank with regulatory thresholds... Read more

Leasing Company Financial Model – 5 Year Forecas...

Financial leasing companies engage in financing the purchase of several types of assets. Though a le... Read more

You must log in to submit a review.