EPC Model for Builders and JV Partners

The EPC Financial Model Template for Builders and JV Partners targets to assist companies and entrepreneurs focused on securing using Engineering, Procurement, and Construction (EPC) contracts in building a sophisticated financial forecast of their activities. The spreadsheet model in Excel especially targets to assist builders of Pipelines, Wind Turbines, Solar Parks, Tents, and Storage Tanks, among many other possible applications, to analyze EPC opportunities and transform cost and contract assumptions into multi-year comprehensive financial forecasts and offers a detailed analysis of such. This template is a great tool to analyze and understand EPC business opportunities or prepare a joint venture proposition in this space. The forecast project operational and financial results monthly and then aggregates the figures over a 10-year forecast horizon.

The EPC Model for Builders and JV Partners allows the input of contract and cost assumptions for up to 10 EPC Contracts. The assumption is that the same core product can be manufactured (e.g., pipes, wind turbines, or similar products) and must be delivered and installed on-site. Contracts can start at different start times and durations. The contract value is calculated by adding a required profit markup to the total cost of the EPC contract.

These assumptions are then translated into monthly and yearly financial projections from which forecasted Income Statement, Balance Sheet, and Cash Flow Statement can be derived. These financial projections then allow us to calculate the project’s required funding and understand the likely Key Performance Indicators, Financial Ratios, and Financial Feasibility metrics of such EPC contracts.

Please refer to this video which explains how to work with this template.

Types of EPC Businesses supported by this Template

The EPC Financial Model Template for Builders and JV Partners was designed to assist pipeline builders, manufacturers of wind turbines, solar parks, builders of storage tanks, tents, biomass electricity generation plants, and other infrastructure projects with the analysis and preparation of financial projections for their delivering their EPC Contracts. Here is a list of example businesses for which this template might be very suitable:

- Pipeline builders

- Wind turbine manufacturers

- Installation and manufacturing of Solar Parks

- Fabrication of Biomass Electricity Generation Plants

- Builders of Storage Tanks

- Cable car manufacturing

- Fabrication of industrial processing equipment

- Builders of Tents

- Etc.

The EPC Financial Model Template focuses on the required activities for delivering a main manufactured product in large quantities on site, covering the activities and financial implications during the sourcing of components, manufacturing, transport, and installation on site. The model also keeps track of manufacturing capacities and builds up an order backlog in case insufficient capacities are added or made available in time which can lead to penalty payments.

The model offers flexibility to simulate a variety of contractual payment schemes and clauses, such as penalties for late delivery, by offering to input the assumptions for upfront payments, milestone payments, penalties, or monthly payments. Depending on the inputted timeline of activities, the model then allocates the budgeted cost items to the different stages and can simulate the expected cash in and outflows during the delivery of the EPC contract every month.

With this template, you can model future financial scenarios for an EPC business specializing in manufacturing, delivering, and installing work products for EPC Contracts. It allows you to project revenues, costs, cash flows, and other financial parameters and facilitates assessing potential investment and operational decisions.

Features of the EPC Builder Model

This is a sophisticated Excel spreadsheet template that offers many great features so that EPC businesses can better and quickly understand the financial implications when securing new EPC contracts:

- Detailed EPC Contract & Cost Assumption to capture up to 10 EPC Contracts, their cost budgets, timings, profit margins, and payment terms. The model offers three alternatives to compare different sourcing options of materials and their financial implications.

- General assumptions which capture the model’s currency, labels to make the model more flexible, presets concerning the type of EPC Manufacturer, start year, overhead operating expenses (OPEX), Capital Expenditures (CAPEX), debt financing, and if applicable valuation assumptions in case the business turns into a steady business. Furthermore, assumptions about a potential Joint Venture investment structure are also offered.

- Monthly Operational Model: The contract assumptions are translated into detailed monthly projections tracking the expected product quantities, revenues, costs, and CAPEX delivery.

- Comprehensive Financial Statements Forecast: The model derives detailed pro-forma statements, including monthly and yearly Income statements, Balance Sheets, and Cash Flow statements which are dynamically created based on the entered assumptions into the model.

- Financial Ratios, Breakdowns, and Metrics: The Excel spreadsheet includes various schedules and breakdowns to obtain deep insights into the cash flow projection and calculates the required financial ratios to understand them. Key metrics of interest to decision-makers, such as the Payback Period and the Internal Rate of Return (IRR), are also calculated.

- Manufacturing Tax Credits: The model allows to specify for each of the three sourcing options how much Manufacturing Tax Credits can be expected to obtain.

- Debt Financing: Two debt financing facilities are offered for input if the project is expected to receive debt financing.

- Funding Required and Key Metrics: The model calculates the funding required based on the entered assumptions and the timing of the resulting financial projections.

- Joint Ventures: The model calculates the investor cash flows for five different investors who might want to team up to set up a Joint Venture company. Therefore, the model allows the analysis of Joint Ventures focused on winning EPC contracts.

- Business Valuation: The model includes a business valuation model which offers to either value the EPC business using a Discounted Cash Flow Valuation approach of the remaining expected cash flows to the business or by using a standard EV/EBITDA multiple to come up with a business valuation in case the profits are viewed as recurring.

- Executive Summary and Summary: A summary sheet includes a variety of charts and tables summarizing the derived financial projections, breakdowns, contract delivery schedules, manufacturing capacity utilization, cash flows, and key metrics.

- Scenario Analysis: The model is built dynamically. Any change of the entered assumptions (in blue) lets us see the impact on the resulting financial forecast immediately. The model allows to include/exclude each contract to understand its implications on the overall financial projections. The model also allows comparing three different sourcing scenarios to understand their cost and cash flow implications better.

The model includes many other useful details and has navigation links for quick navigation inside the model. For a walkthrough on how to use the model, please refer to the video.

Get the EPC Financial Model for Builders and JV Partners

This EPC financial model was prepared for builders of Pipelines, Wind Turbines, and similar businesses. Analyzing EPC contracts with this template allows for obtaining a detailed understanding of how securing EPC contracts will impact the projections in the next years.

This Excel spreadsheet model template comes as a fully editable Excel Spreadsheet or as a PDF demo version which outlines the model structure in detail. Download the FREE PDF Demo version to understand the structure of this template in more detail.

File Type: .xlsx

Similar Products

Other customers were also interested in...

Construction/Engineering Project Business Financia...

3 statement 5 year rolling financial projection Excel model for a startup /existing business engaged... Read more

Bundle – Business Financial Forecasting Mode...

The purpose of this Bundle of Business Forecasting and Financial Models is to assist Business Owners... Read more

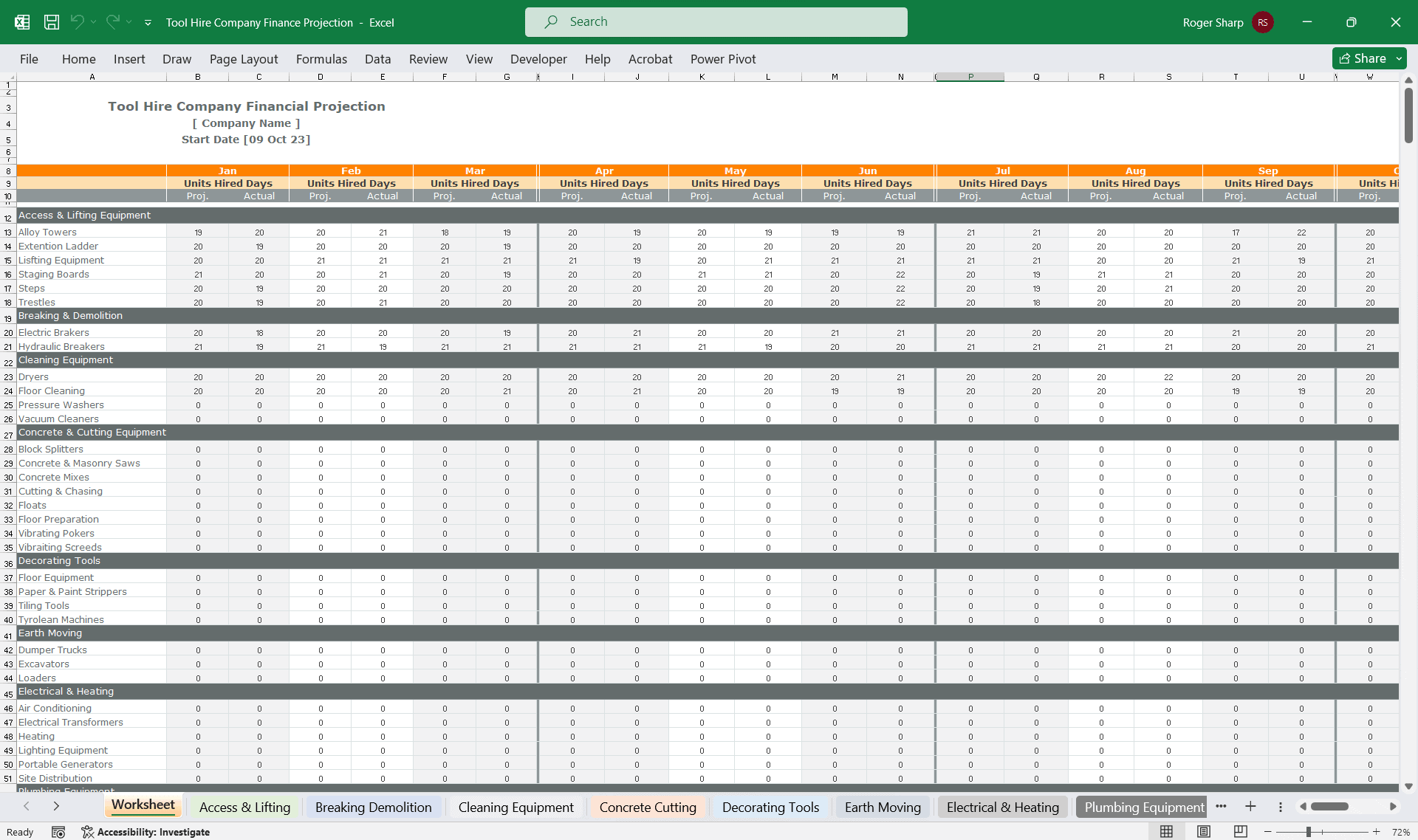

Tool Hire Company Finance Model

A very comprehensive editable Excel spreadsheet for tracking your tool hire financials throughout th... Read more

Distillery Financial Plan Template

This Distillery Financial Plan template prepares a sophisticated financial plan for a small distille... Read more

Business Plan for a Biodiesel Manufacturing Plant

Setting up a biodiesel manufacturing plant requires a comprehensive and executed business strategy. ... Read more

Carbon Capture and Sequestration Project Analysis

The Carbon Capture and Sequestration (CCS) Project Analysis Template is an indispensable tool for bu... Read more

Crane Truck Rental Company Financial Model

Step into the world of crane rental business success with our Crane Truck Rental Company Financial M... Read more

Manufacturing Financial Model Templates Bundle

This is a collection of financial model templates in Excel for businesses in the Manufacturing indus... Read more

Manufacturing Company Financial Model – Dyna...

Financial Model providing a dynamic up to 10-year financial forecast for a startup Manufacturing Com... Read more

Ethanol and Sugar Production Plant Financial Model

Fin-wiser’s Ethanol and Sugar Plant PPP project model helps users to assess the financial viabilit... Read more

Reviews

To me, this is a financial model that can be applied to large multi-industry corporations

40 of 74 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.