Payback Period Free Download

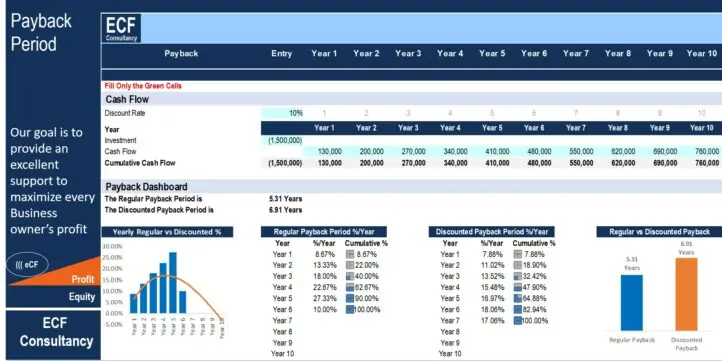

The template is an effective measure of investment risk by highlighting the number of years necessary to recover the initial investment

| All Industries, Financial Model, General Excel Financial Models |

| Excel, Financial Modeling, Financial Planning, Free Financial Model Templates, Payback Period |

What is payback period?

The payback period helps to determine the length of time required to recover the initial cash flow outlay in the project or investment, simply it is the method used to calculate the time required the earn back the cash invested through the successful cash inflows

Why payback is important

The payback period is an effective measure of investment risk. The period with a shorter payback period has less risk than with the project or investment with a longer payback period. The payback period is often used when liquidity is an important criterion to choose a project

Payback in capital budgeting

In capital budgeting, the payback period is the selection criteria, or deciding factor, that most businesses rely on to choose among potential capital projects. Small businesses and large alike tend to focus on projects with a likelihood or faster, more profitable payback.

The template includes regular and discount payback

The regular payback period is the number of years necessary to recover the funds invested without taking the time value into accounts

The discounted payback is the number of years necessary to recover the funds invested taking into consideration the time value of the money

Key inputs in the green tabs

Fill the green cells only

Key outcome in the dark blue tabs

The inputs in the green cells will dynamically flow into the following below:

-Regular payback period

-Discounted payback period

-Dashboard

Conclusion and customization

Highly versatile, very sophisticated financial template and friendly user

If you have any inquiry, modification or to customize the model for your business please reach me through: [email protected]

Similar Products

Other customers were also interested in...

Corporate Finance Toolkit – 24 Financial Mod...

They are essential models to increase your productivity, plan your future with budgeting and forecas... Read more

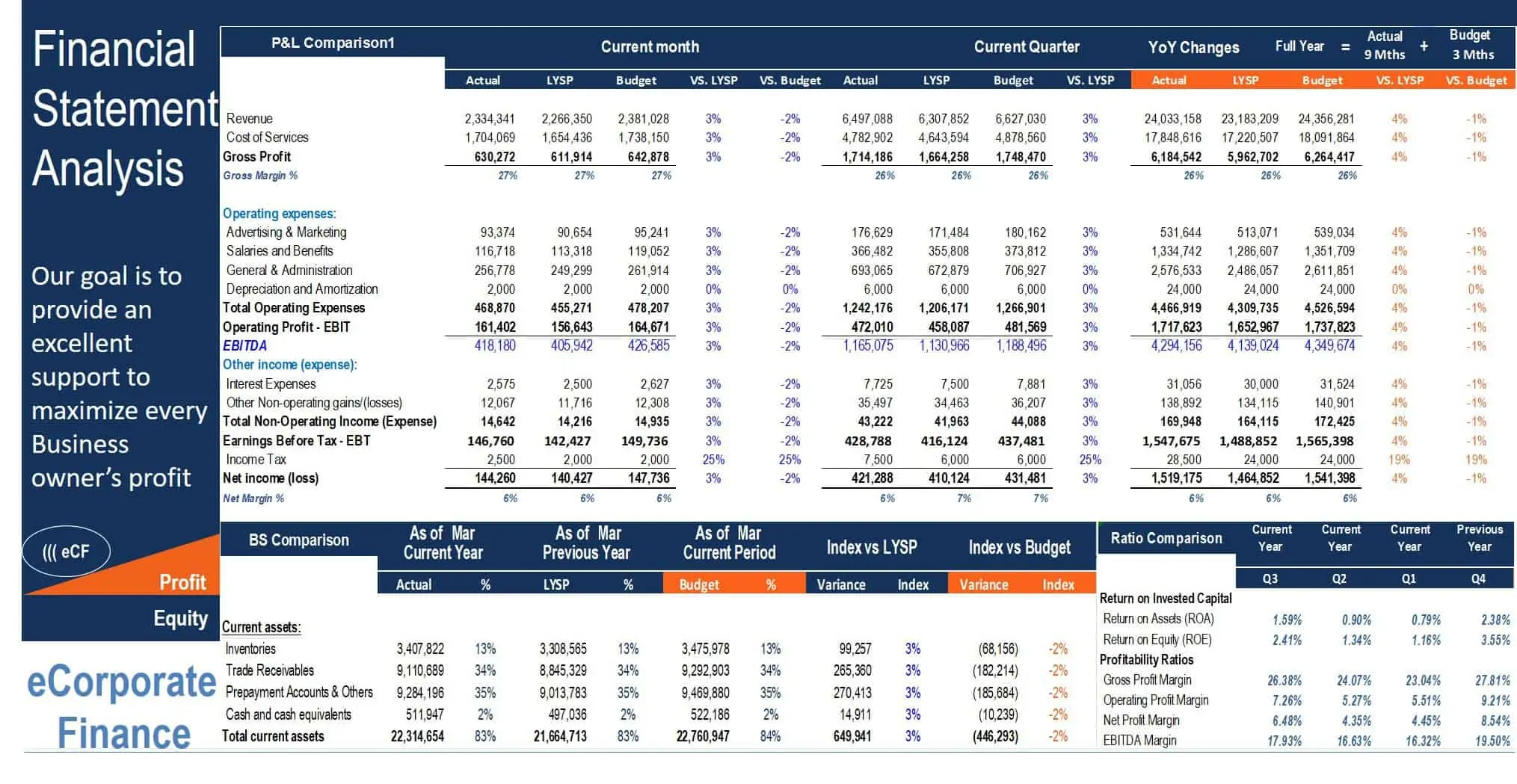

Financial Modeling Analysis

The main purpose of the model is to allows user to easily compare the financial performance result f... Read more

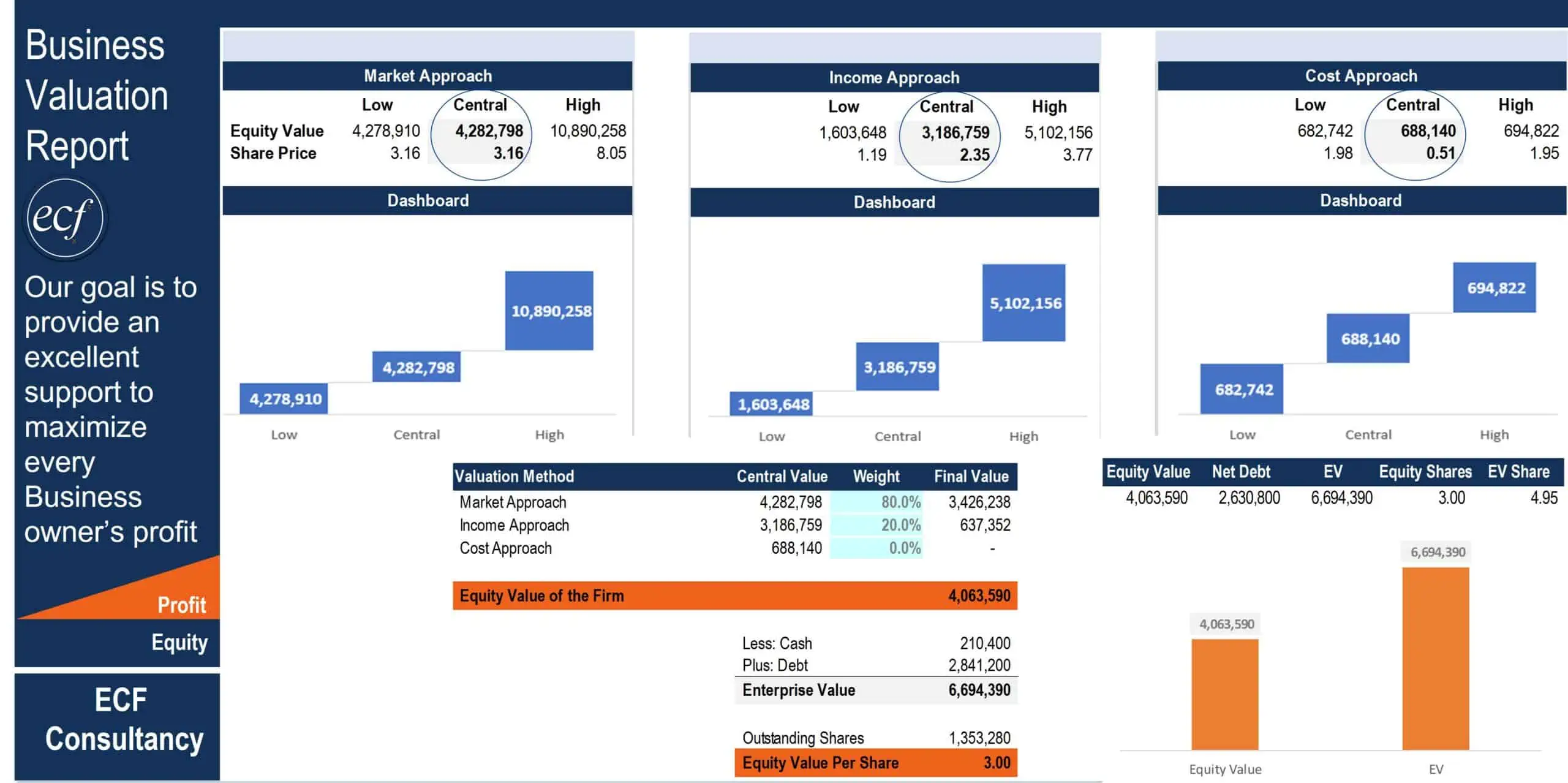

Comprehensive Business Valuation Model with Free P...

The report is detailed and easy template which allow the user to determine and monitor the value of ... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Advanced Financial Model with DCF & Valuation

General Overview Advanced Financial Model suitable for any type of business/industry and fully cu... Read more

Due Diligence P&L – Exhaustive Revenue a...

Model for in depth understanding of high level profit and loss and revenue analysis. Big-4 like chec... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Waterfall Profit Distribution Model (up to 4 Tiers...

We are introducing our 4-Tier Waterfall Profit Distribution Model. The waterfall profit distribution... Read more

Investment Financial Models – All-in-One Bundle ...

A collection of templates suitable for investment decisions in various types of businesses/industrie... Read more

Reviews

This model helped a lot with my project planning, its really awesome

41 of 87 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

Great product and looking forward in using this more and more

125 of 256 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.