Intangible Asset valuation model

Intangibles are defined as “non- physical assets such as franchises, trademarks, patents, copyrights, goodwill, equities, mineral rights, securities and contracts (as distinguished from physical assets) that grant rights and privileges, and have value for the owner.”

| All Industries, Financial Model, General Excel Financial Models |

| Brand, Excel, Intangible Assets, Know-How, NPV (Net Present Value), Patent, Trademark, Valuation |

This model values intangible assets such as brands, trademarks, patents, etc. via the royalty rate valuation method.

The model uses estimates of future estimated economic benefits or cash flows and discounts them, for the associated time and risks involved, to a present value.

The model is available as a PDF Demo version and as Excel Model.

Similar Products

Other customers were also interested in...

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Advanced Financial Model with DCF & Valuation

General Overview Advanced Financial Model suitable for any type of business/industry and fully cu... Read more

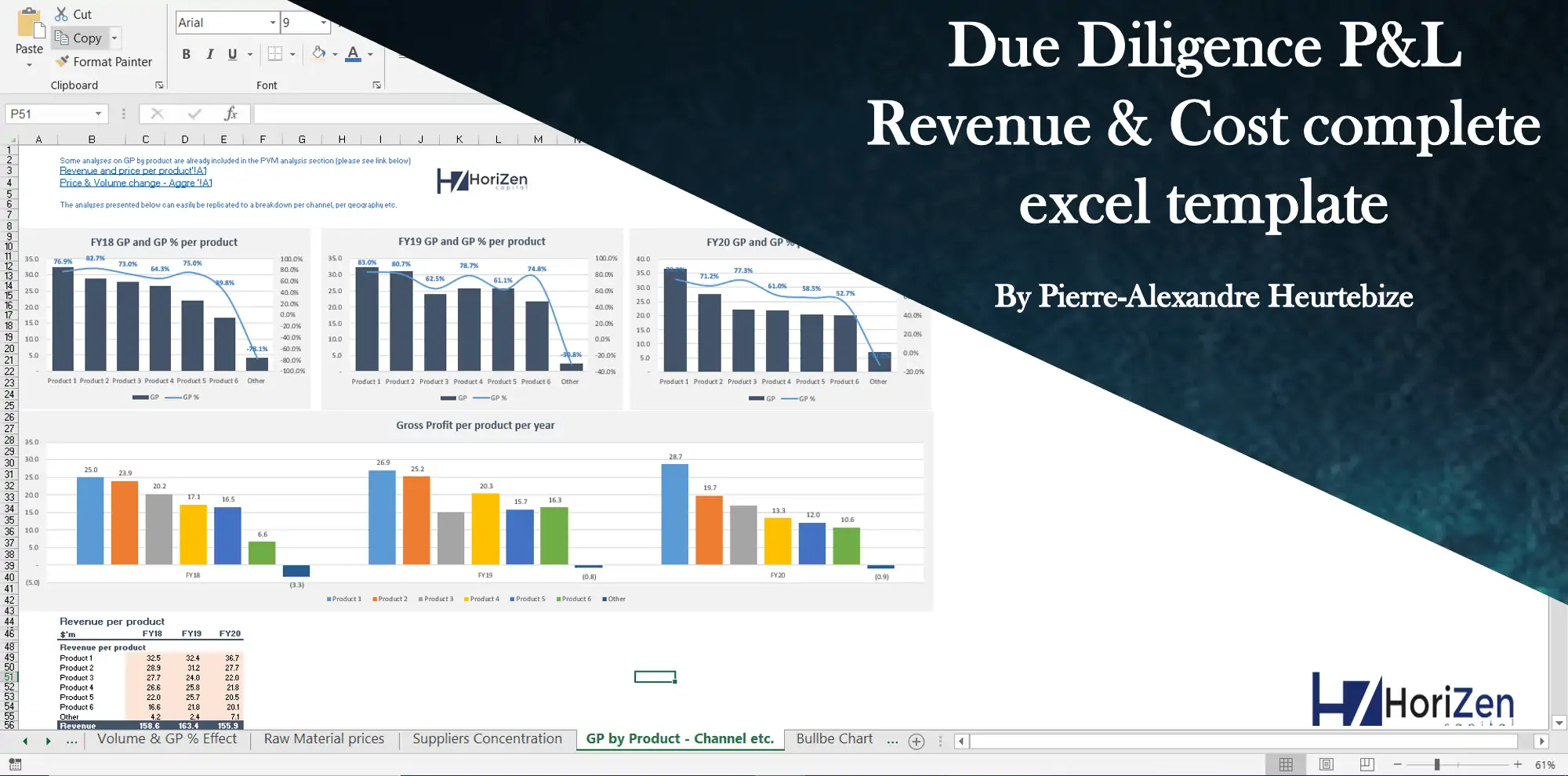

Due Diligence P&L – Exhaustive Revenue a...

Model for in depth understanding of high level profit and loss and revenue analysis. Big-4 like chec... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Investment Financial Models – All-in-One Bundle ...

A collection of templates suitable for investment decisions in various types of businesses/industrie... Read more

Franchisor Licensing: Financial Model with Cap Tab...

Build up to a 10 year financial forecast with assumptions directly related to the startup and operat... Read more

Mergers & Acquisitions (M&A) Model

The Mergers & Acquisition (M&A) Model provides a projection for a company looking to potentially... Read more

Waterfall Profit Distribution Model (up to 4 Tiers...

We are introducing our 4-Tier Waterfall Profit Distribution Model. The waterfall profit distribution... Read more

3 Statement Financial Modeling with DCF & Rel...

Financial Modeling Tutorial guides user via step by step approach on how to build financial models w... Read more

You must log in to submit a review.