Financial Feasibility Study – Excavation Contractor

The report is containing full set of financial feasibility study project for Excavation Contractor, how much start-up capital is needed, sources of capital, use of funds, returns on investment, exit strategy and valuation, SWOT and PEST analysis, and other financial considerations.

Report Overview

The report contains a full set of financial feasibility study projects for Excavation Contractors, including how much start-up capital is needed, sources of capital, use of funds, returns on investment, exit strategy, and valuation, SWOT and PEST analysis, and other financial considerations.

The report is constructed based on solid experience and highly analytical skills that lead to guarantee your success.

Report Summary

In summary, the model easy to use, you need to fill the green cells in the green tabs, clear to read and understand the report and fully dynamic, no hidden formulas, 100% customizable, it is great planning tools and essential document to bank when applying for loan or to investor when applying for equity funding.

Objectives of the Model

- Startup business

- Business expansion

- Investing money in potential industry

- Fundraising

- Learning how to plan

- Investment decision

- Investment analysis

- Annual operating plan

- Answers all questions to investors.

Inputs

- Erase all the data in the green cells only.

- Update the general info in the Front Page

- Fill the green cells only in the green tabs.

Outcome

The data will dynamically flow into the following below.

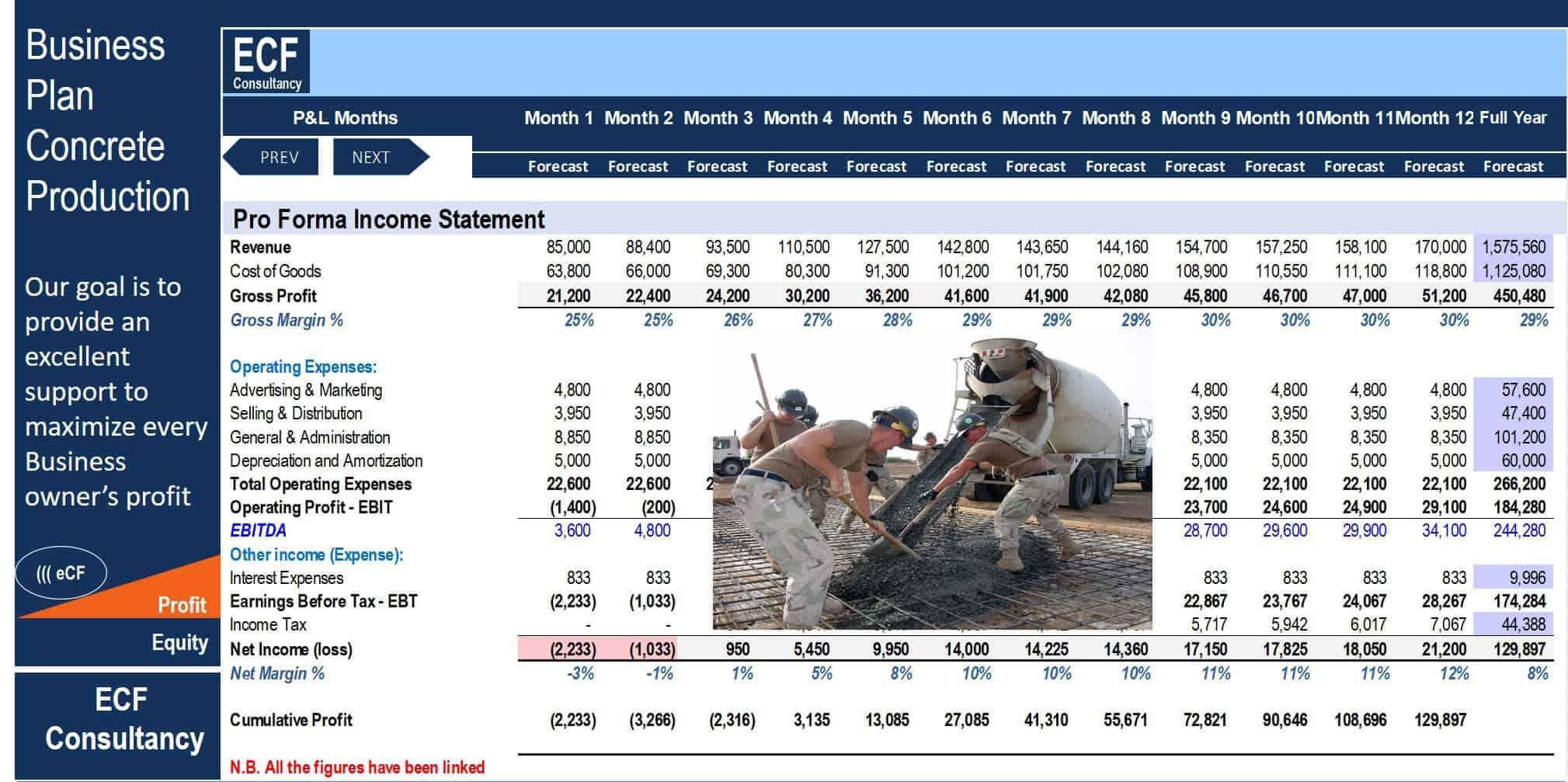

- Profit and loss statement by month including 3 major components, gross profit, EBITDA and net profit.

- Balance sheet by month including total assets, total liability and owners’ equity.

- Cash flow by month with 3 outputs such as operating cash flow, investing cash flow and financing cash flow

- Ratios with 4 main components, such as profitability ratio, efficiency ratio, liquidity ratio and solvency ratio

- Break-even point clearly showing the margin of safety.

- Profit and loss statement for 10 years including 3 major components, gross profit, EBITDA and net profit.

- Balance sheet for 10 years including total assets, total liability and owners’ equity.

- Cash flow for 10 years with 3 outputs such as operating cash flow, investing cash flow and financing cash flow.

- Business valuation using discounted cash flow approach.

- Free cash flow to the firm and free cash flow to equity

- Calculation for the WACC and capital required.

- Regular and discounted payback period

- Financial summary showing full set of financial feasibility matrix.

- Dashboard summary

- The model contains SWOT analysis, PESTEL analysis, and comparable analysis.

Conclusion and customization

Highly versatile, very sophisticated financial template, and is user-friendly.

If you have any inquiries, modifications, or want to customize the model for your business, please reach us through: [email protected]

File Types:

Excel Version – .xlsx

Free Version – .pdf

Similar Products

Other customers were also interested in...

Startup Business Plan – Concrete Production ...

If you're dreaming of starting a Concrete Contractor business, try this Startup Business Plan - Conc... Read more

Carpentry Business – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a startup or operating Carpentry Bus... Read more

Artisan Contractor Business – 5 Year Financial M...

Financial Model providing an advanced 5-year financial plan for an Artisan Contractor Business scena... Read more

Electrician Business Financial Model – 5 Year Fo...

Financial Model presenting an advanced 5-year financial plan for a startup or operating Electrician ... Read more

Plumbing Business Financial Model – 5 Year Forec...

Financial Model presenting an advanced 5-year financial plan for a startup or operating Plumbing Bus... Read more

Construction Contractor Business – Cash Flow...

This financial model lets the user plan out cash requirements and expected returns of running a cons... Read more

Construction/Engineering Project Business Financia...

3 statement 5 year rolling financial projection Excel model for a startup /existing business engaged... Read more

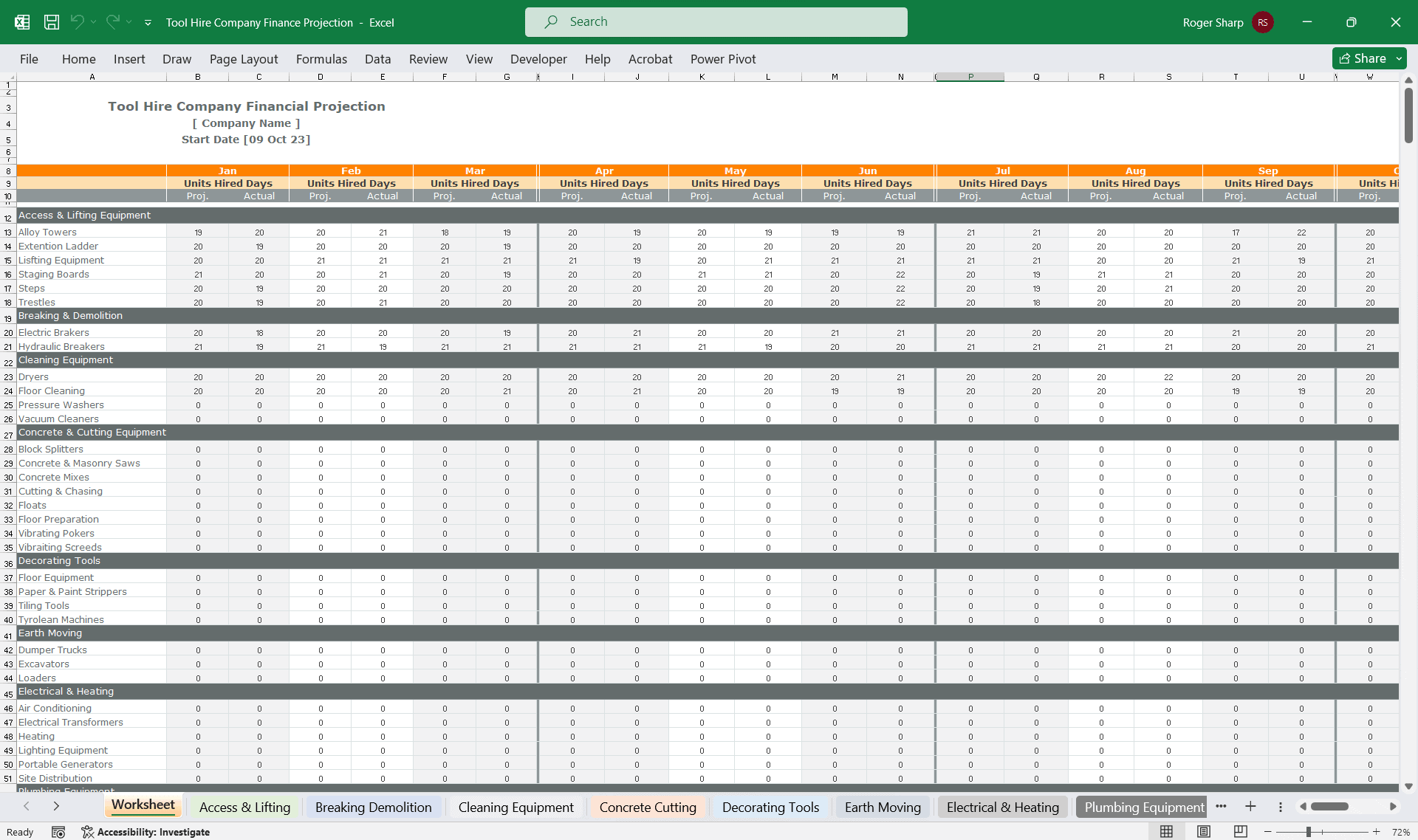

Tool Hire Company Finance Model

A very comprehensive editable Excel spreadsheet for tracking your tool hire financials throughout th... Read more

Electrical Contractor Financial Model Excel Templa...

Electrical Contractor Financial Model Enhance your pitches and impress potential investors with the ... Read more

Startup Business Plan – Rental Heavy Machine...

If you dream to start a heavy machinery rental business, the template is the first step in making yo... Read more

You must log in to submit a review.