Comprehensive Merger Financial Model

Our sophisticated merger financial model is a versatile and powerful solution tailored for intricate merger and acquisition (M&A) scenarios. It encompasses a wide array of features to provide a comprehensive understanding of merger dynamics. Key components include buyer and target projections, synergy assessments, sensitivity analysis, detailed assumptions, pro-forma analysis, scenario evaluations, Sources and Uses breakdown, and Purchase Price Allocation. With this model, you can delve into the financial implications of the merger from both the buyer’s and target’s perspectives. Evaluate potential synergies, analyze sensitivities to variable changes, and explore various scenarios to make well-informed decisions. The model’s detailed documentation of assumptions ensures transparency, while the integration planning and risk assessment components aid in strategic decision-making and risk mitigation. It’s an invaluable tool for organizations navigating complex M&A transactions, providing the insights needed to maximize the value of these critical business moves.

Comprehensive Merger Financial Model: Unveiling the Full Spectrum

Our complex merger financial model is a versatile and powerful tool designed for in-depth analysis of merger and acquisition (M&A) transactions. It is equipped with a wide range of features and functionalities to provide a holistic view of merger scenarios. Here’s an overview of its key components:

1. Buyer Projections:

- Dive into the financial projections for the acquiring company. Understand how the merger will impact the buyer’s financial performance, including income statements, balance sheets, and cash flow statements.

2. Target Projections:

- Explore the financial outlook of the target company post-merger. Gain insights into how the merger will affect the target’s financials and evaluate its attractiveness as an acquisition.

3. Synergies Estimation:

- Assess potential synergies arising from the merger. Identify cost-saving opportunities, revenue enhancements, and operational improvements that can drive value creation.

4. Sensitivity Analysis:

- Analyze the sensitivity of merger outcomes to changes in key variables such as revenue growth rates, cost structures, and discount rates. Understand the range of potential scenarios and their implications.

5. Detailed Assumptions Definitions:

- The model offers comprehensive documentation of assumptions, ensuring clarity and transparency in the analysis. Assumptions cover a wide array of financial and operational aspects.

6. Detailed Pro-Forma Analysis:

- Perform a thorough pro-forma analysis that integrates the financials of both the buyer and the target. This detailed analysis provides a consolidated view of the combined entity’s financial health.

7. Scenario Analysis:

- Explore multiple scenarios to assess different merger outcomes. Evaluate best-case, worst-case, and base-case scenarios to make informed strategic decisions.

8. Sources and Uses:

- Understand the financing structure of the merger. This section outlines the sources of funds (debt, equity, etc.) and their uses within the transaction.

9. Purchase Price Allocation:

- Allocate the purchase price to various assets and liabilities, ensuring compliance with accounting standards. This helps in proper financial reporting and transparency.

10. Integration Planning:

- Develop an integration plan that outlines the steps and strategies for merging the two companies successfully. Evaluate the timeline, costs, and potential challenges.

11. Risk Assessment:

- Identify and assess the major risks associated with the merger, including operational, financial, and regulatory risks. Develop mitigation strategies to address these challenges.

Our complex merger financial model is a versatile and comprehensive solution that empowers decision-makers to evaluate merger opportunities thoroughly. It offers unparalleled insights into the financial dynamics of mergers, helping organizations make informed choices and maximize the value of their M&A transactions.

File Types: .xlsx

- Merger Model – M&A Model only

- Template Bundle – includes M&A Model, Private Equity Template, and Venture Capital Template

Similar Products

Other customers were also interested in...

Private Equity Fund Financial Model & Economic...

Introducing our Comprehensive Excel Financial Model Template, a versatile and robust tool designed t... Read more

Accretion-Dilution Financial Model (Pro-Forma Anal...

The Accretion-Dilution Financial Model Template assesses the impact of acquisitions on earnings per ... Read more

Discounted Cash Flow (DCF) Financial Model

Overview of DCF Financial Model: Purpose: This DCF Financial Model was created to eva... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Franchisor Licensing: Financial Model with Cap Tab...

Build up to a 10 year financial forecast with assumptions directly related to the startup and operat... Read more

Small Business Playbook (Financial / Tracking Temp...

About the Template Bundle: https://youtu.be/FPj9x-Ahajs These templates were built with the ... Read more

Due Diligence P&L – Exhaustive Revenue a...

Model for in depth understanding of high level profit and loss and revenue analysis. Big-4 like chec... Read more

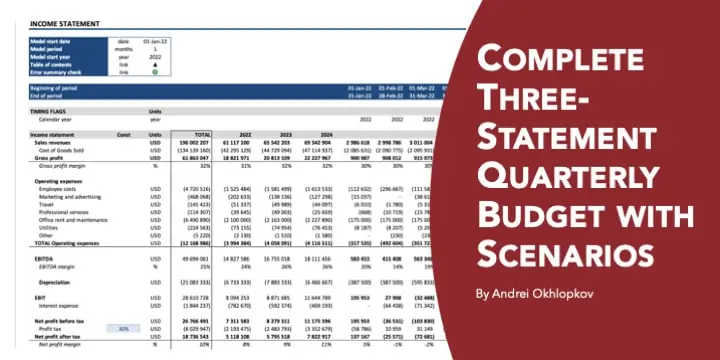

Complete Three-Statement Quarterly Budget with Sce...

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Reviews

You must log in to submit a review.