Commercial Real Estate Investment Model

The Commercial Real Estate Investment Model allows calculating the investor return when investing in commercial real estate property. The financial model is especially helpful when identifying the uplift potential from the non-letted area and assessing the financial implications.

| Financial Model, Investment, Real Estate |

| Excel, Financial Feasibility, Gross Yield, IRR (Internal Rate of Return), Net Yield, PDF |

The Commercial Real Estate Investment Model allows calculating the investor return when investing in commercial real estate property. The financial model is especially helpful when identifying the uplift potential from the non-letted area and assessing the financial implications.

The excel model template provides the following:

- Executive Summary contains the key charts, key metrics, and key assumptions. Simply change the assumptions on the right and see immediately the financial impact in the charts.

- Monthly and Yearly projections of the rental income

- Detailed Tenancy List

- Comparison Market Rent vs. Current Rent

- Space to enter SWOT analysis and business plan for the property

- Area switch from square meters (sqm) to square foot (sq ft)

- Currency switch to show the financials in any currency you want

- Key Metrics

- Gross Yield

- Refurbishment costs

- Geared and ungeared IRR

- ROI and equity multiple

- Print-friendly layout including charts and graphs

The Executive Summary Pages gives the investor a comprehensive picture of the financial attractiveness and potential when investing in commercial real estate property.

The model is available in two versions, one with only the input cells editable (LITE) and all cells editable (Normal).

Filetypes:

.pdf (Adobe Acrobat Reader)

.xlsx (Microsoft Excel)

Similar Products

Other customers were also interested in...

Commercial Real Estate Valuation Model Template

A commercial real estate valuation model template assists in running a professional DCF Valuation fo... Read more

Real Estate Portfolio Template – Excel Spreadshe...

The Real Estate Portfolio Template forecasts the financial performance when building a real estate p... Read more

Real Estate Financial Model Templates Package

This is a collection of ready-made Excel financial model templates for real estate businesses and it... Read more

Airbnb Financial Model

Air BnB Financial Model Template presents the business case of the purchase of up to 5 properties wi... Read more

Real Estate Private Equity (REPE) Financial Model

New Version Updates:• The model supports now up to 50 properties• Updated Acquisition, Financing... Read more

Acquisition Model for Commercial Property

This is the Quintessential Commercial Property Acquisition Model that allows you to compare up to 20... Read more

Hotel/Guesthouse/Resort Development Model and Valu...

This Hotel / Holiday Resort Development Model will take you through a 20-year period of Three Statem... Read more

Real Estate Financial Model Bundle

This is a collection of financial model templates that provides the financial projections and valuat... Read more

Real Estate Multi-Family Development Excel Model

Real Estate Financial Model to evaluate a development project, with Equity Waterfall and Advanced Sc... Read more

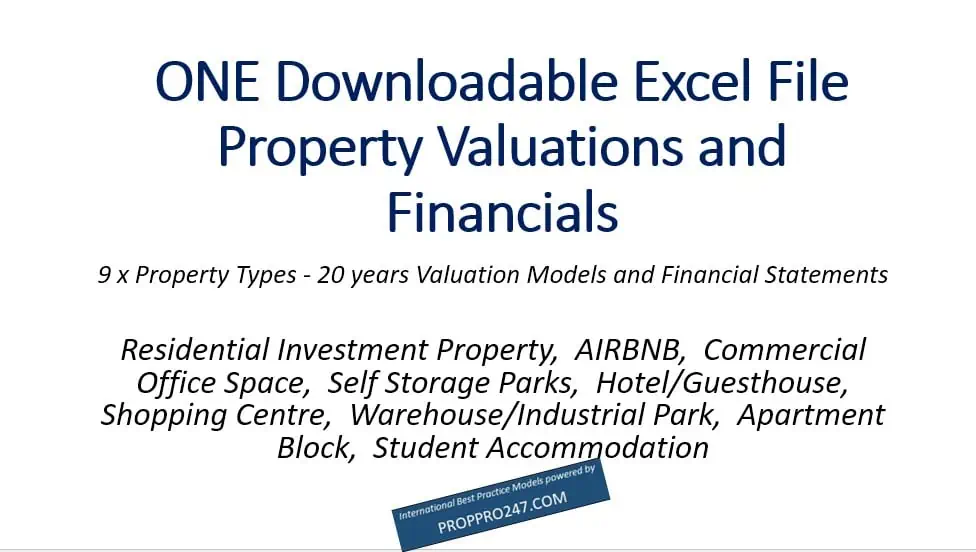

Discounted Big Bundle Real Estate Valuation and Fi...

One Excel file for this bundle of Valuation and Financial forecasting models. Storage Parks, Hotels,... Read more

Reviews

I have acquired several financial models from efinancialmodels.com and all I can say their product is outstanding.

86 of 175 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.