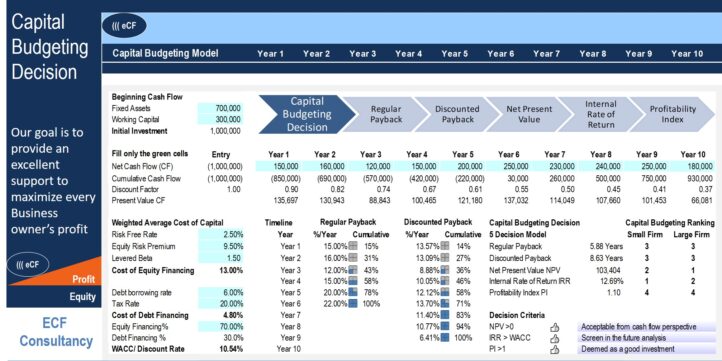

Capital Budgeting Decision Model

The model helps the users to avoid failure or going out of business and improve the power for knowing the numbers to make business decision

General overview

The capital budgeting model is constructed to evaluate potential major projects or investments that would require capital budgeting before they are approved or rejected, it helps CEO, CFO, and entrepreneurs to assess a prospective project’s cash flow to determine whether the potential returns that would be generated meet a sufficient target benchmark.

The capital budgeting model allows the user to calculate the net present value (NPV), internal rate of return (IRR), regular payback, discounted payback, and profitability index from a simple cash flow stream with a dynamic investment decision.

The model helps the users to avoid failure or going out of business and improve the power for knowing the numbers to make business decisions.

Inputs

Update the general info in the Front Page

Enter the initial investment in the green cells on cell C8 & C9

Enter the discount rate element in the green cells from cell C19 to cell C27

Enter the cash flow in the green cells from cell E13 to cell N13, this model is for a maximum of 10 years of investment

Outcome

Weighted average cost of capital or Discount rate

Regular payback period

Discounted payback period

Net present value NPV

Internal rate of return IRR

Profitability index PI

Investment criteria and decision

Capital budgeting ranking between a small firm and big firm

Dashboard with 3 scenario analysis by choosing the selection box showing on top on the chart

Conclusion and customization

Highly versatile, very sophisticated financial template and user-friendly.

If you have any inquiries, modification requests to help customize the model for your business, please reach me through: [email protected]

Similar Products

Other customers were also interested in...

Corporate Finance Toolkit – 24 Financial Mod...

They are essential models to increase your productivity, plan your future with budgeting and forecas... Read more

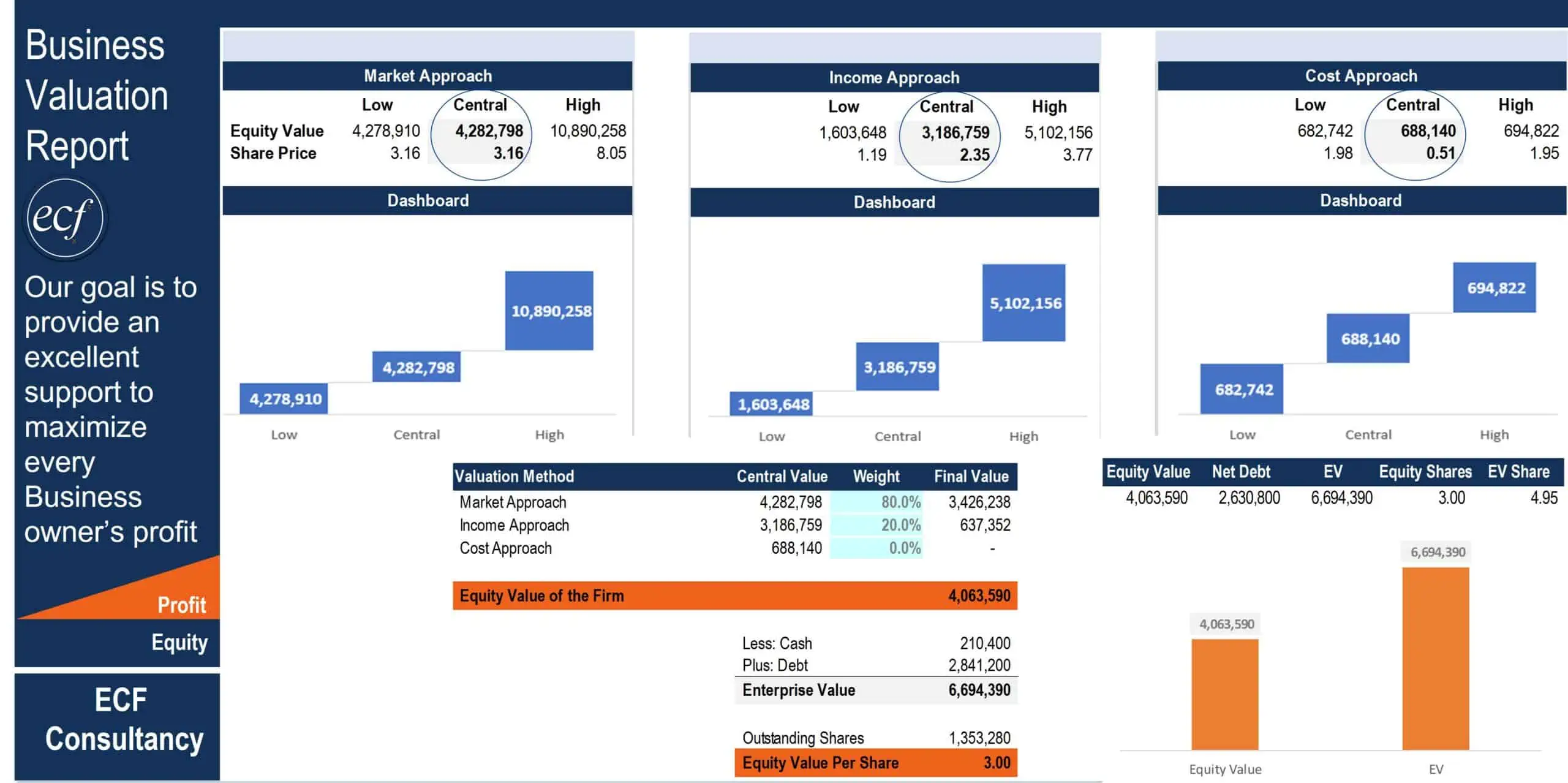

Comprehensive Business Valuation Model with Free P...

The report is detailed and easy template which allow the user to determine and monitor the value of ... Read more

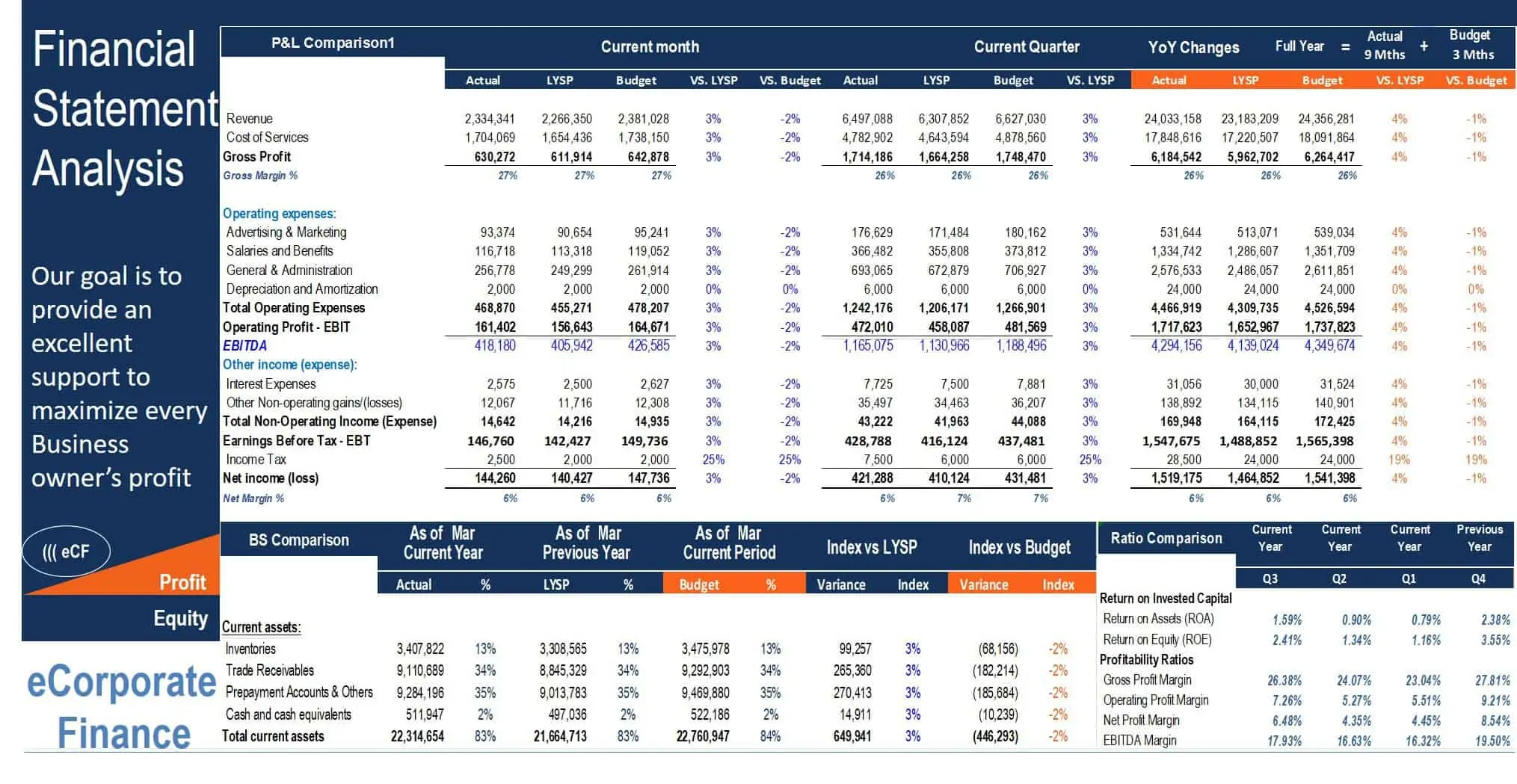

Financial Modeling Analysis

The main purpose of the model is to allows user to easily compare the financial performance result f... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Advanced Financial Model with DCF & Valuation

General Overview Advanced Financial Model suitable for any type of business/industry and fully cu... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Franchisor Licensing: Financial Model with Cap Tab...

Build up to a 10 year financial forecast with assumptions directly related to the startup and operat... Read more

Investment Financial Models – All-in-One Bundle ...

A collection of templates suitable for investment decisions in various types of businesses/industrie... Read more

3 Statement Financial Modeling with DCF & Rel...

Financial Modeling Tutorial guides user via step by step approach on how to build financial models w... Read more

You must log in to submit a review.