Bowling Business Plan Financial Model Excel Template

Discover Bowling Financial Plan. Enhance your pitch decks and impress potential investors with a proven, strategy template. Five-year Bowling Excel Financial Model for fundraising and business planning for startups and entrepreneurs. Key financial charts, summaries, metrics, and funding forecasts built-in. Created with the mind of the Bowling business. Bowling Financial Projection Model Template used to evaluate startup ideas, plan startup pre-launch expenses, and get funded by banks, angels, grants, and VC funds. Unlocked – edit all – last updated in Sep 2020. Generate fully integrated Bowling Profit And Loss Statement Proforma, Pro Forma Cash Flow Projection, a Sources And Uses projections for 5 years (on a monthly basis). Automatic aggregation of annual summaries on the financial summary report.

NOTE: Single-User pertains to a limited Single User License where the template can only be used by one single user; while Multi-User is a license for users sharing the template with up to 20 members. Please refer to Terms of Use and License and Permitted Use for clarification.

BOWLING FINANCE PROJECTION KEY FEATURES

Video tutorial:

Structured

You want a Bowling Excel Pro Forma to be as easy to understand as possible. You also want to make it easy for others to be able to audit if needed.

We make this Pro Forma a simple as possible.

Save Time and Money

Bowling Excel Pro Forma Template allows you to start planning with minimum fuss and maximum help. No writing formulas, no formatting, no programming, no charting, and no expensive external consultants. Plan the growth of your business instead of fiddling around with expensive techy things.

External stakeholders, such as banks, may require a regular forecast.

If the business has a bank loan, the bank will ask for a Bowling Financial Model In Excel Template regularly.

Avoid Cash Flow Shortfalls

Unexpected Cash Flow Projection shortfalls can cause significant damage to your business, and it may take months to recover. Negative Cash Flow can appear if you don’t continuously track the incoming cash and outgoing of your business. Fortunately, you can solve Statement Of Cash Flows shortfalls with a bit of effort. Forecasting your Statement Of Cash Flows will help you identify — and plan for — market fluctuations, sales seasonality, and other cases that can lead to unpredictable Cashflow Forecast. Pro Forma Cash Flow Projection can even help you visualize Cash Flow Statement For 5 Years trends with the help of automatically generated charts and graphs.

Integrated

The entire Bowling 3 Way Financial Model Template is integrated. If you make a change in one sheet, every dependent tab will update automatically. If you decide to scale down or up your assumptions, automation will scale too. Now you will know and understand how decisions impact your business.

Convince investors and lenders

Enhance your pitches and impress potential financiers with a Financial Projection Excel delivering the right information and expected financial and operational metrics. Facilitate your negotiations with investors for successful funding. Raise money more quickly and refocus on your core business.

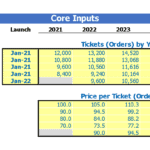

REPORTS and INPUTS

Costs

A Bowling 3 Way Forecast Excel Template is a significant financial device that empowers clients to recognize real and estimated uses, just as financial assets expected to take care of these expenses. With an all-around created cost 3 Way Financial Model, you can see the territories where you can set aside cash and the regions of high need. As a piece of a business plan, the cost spending supports the process of pitching to investors and credit applications.

Financial Statements

The Bowling Three Statement Financial Model Template has pre-built proformas for the balance sheet, the Profit And Loss Pro Forma, and the Projected Cash Flow Statement Format. These proformas allow users to create statements both on a monthly and annual basis.

Users can create detailed financial statements using the financial assumptions inputted in the Excel Pro Forma Template.

Financial KPIs

In the Five Year Financial Projection Template you can visually track your key financial indicators (KPIs) for 24 months and up to five years.

The model all KPIs you might need for your company:

– EBITDA/EBIT shows your company’s operational performance;

– CASH FLOWS show your company’s inflows and outflows;

– CASH BALANCE this is the forecast of cash in hand you will have.

Valuation

With our pre-collected valuation template in the Bowling P&L Projection, you will get all the information your investors may require. The weighted average cost of capital (WACC) will show your accomplices the base return on huge business accounts put assets into its activities capital. Free cash stream valuation will show a cash stream open to all investors, including investors and advance managers. Discounted cash stream will reflect the value of future cash streams as per the current time.

CAPEX

Capex, or capital expenditures, represents the total company’s expenditures on purchasing assets in a given period. These expenditures include both assets acquired and built by the company.

Usually, the company’s investments, or expenditures, related to these assets are significant. These capital assets provide value to the company over a more extended period than one reporting period. Therefore, the company reflects these CapEX calculations in the Balance Sheet and does not recognize the whole amount of investments in the Profit And Loss Statement in one reporting period.

Burn and Runway

The cash consumption rate produced by the Financial Projection Model shows the distinction between the cash inflows and cash outpourings of the organization. It is basic to screen this metric since it shows how long the organization will last with its present funding level. Business proprietors can likewise observe an away from how different business systems change the cash consumption rate.

Similar Products

Other customers were also interested in...

Golf Course Financial Model Excel Template

Golf Course Financial Plan Enhance your pitches and impress potential investors with the expected fi... Read more

Recreation Center Business Plan Financial Model Ex...

Download Recreation Center Pro Forma Projection. Creates 5-year financial projection and financial r... Read more

Recreation & Community Center – Dynamic 10 Y...

Financial Model presenting a development and operating scenario of a Recreation & Community Cent... Read more

Tennis Club Financial Model – 5 Year Forecast

This Financial Model presents an advanced 5-year financial plan for a startup Tennis Club and is a f... Read more

Indoor Golf Business Model

This template is a detailed and user-friendly financial model that takes into account the specifics ... Read more

Nightclub Financial Model Excel Template

"Get Nightclub Pro-forma Template. Investor-ready. Includes a P&L and cash flow statement, balan... Read more

Waterpark Business Plan Financial Model Excel Temp...

Shop Waterpark Budget Template. There's power in Cash Flow Projections and the insight they can prov... Read more

Spa Financial Model Excel Template

Download Spa Financial Projection Template. This well-tested, robust, and powerful template is your ... Read more

Skin Care Financial Model Excel Template

Order Skin Care Pro-forma Template. Generate fully-integrated Pro-forma for 5 years. Automatic aggre... Read more

Laser Tag Business Plan Financial Model Excel Temp...

Get Your Laser Tag Financial Model. Investor-ready. Includes a P&L and cash flow statement, balance ... Read more

You must log in to submit a review.