Airbnb Arbitrage Forecasting Sheet

Designed for individuals interested in leasing properties then sub-letting those properties to short-term, rental booking sites such as Airbnb, Vrbo, etc.

Video Overview:

HOW: Business template designed in Microsoft Excel. This spreadsheet is dynamic but user-friendly!

WHY: This template/tool works for up to 100 properties for a period of (up to) 10 years. Designed in one of my areas of expertise, creating 5–10-year commercial real estate deal analyzers, this model demonstrates how higher monthly booking revenue can be generated compared to average monthly leases. The tool also allows users to test various feasibilities to determine what leasing/ expenses will result in the most advantageous scenario.

WHAT: This tool enables comprehensive financial planning for monthly expenses, including maintenance costs, application fees, furnishing costs, miscellaneous slush funds, and other monthly costs.

Includes visually appealing/ insightful visualizations (charts and graphs) which show total monthly lease, monthly cash flow, as well as cumulative cash and properties.

General assumptions and inputs from users (expenses and revenues) produce a monthly and annual cash flow analysis, annual pro forma, discounted cash flow analysis, internal rate of return, return on investment, and minimum equity requirement.

To determine revenue/ expenses, users will define:

• One-time startup costs, e.g., legal and consulting fees

• Base daily rate, start month, and monthly lease for each property

• Seasonality assumptions/ various daily rate for each property

• Variable and fixed monthly costs (based on seasonality assumptions)

• Annual increase in base rate

• If a discounted daily rate for first ‘n’ months will be used (to increase positive reviews on property)

• One-time costs upon lease signing

I did put in an optional joint venture cash flow waterfall that gives the user the option to fund any equity requirements with the help of an LP. It is a standard contribution and distribution schedule without complex IRR hurdles.

Similar Products

Other customers were also interested in...

Mixed-Use Real Estate Model: Leverage / JV Options

A general real estate model to plan all assumptions for up to 7 'uses' for a given property. Include... Read more

Real Estate Financial Model Bundle

This is a collection of financial model templates that provides the financial projections and valuat... Read more

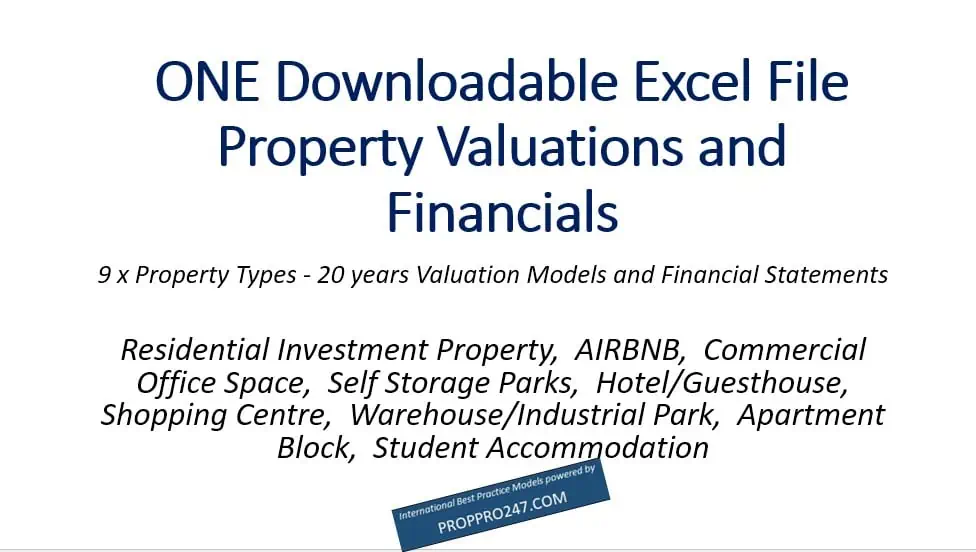

Discounted Big Bundle Real Estate Valuation and Fi...

One Excel file for this bundle of Valuation and Financial forecasting models. Storage Parks, Hotels,... Read more

Short Term Rentals (Airbnb) Financial Model –...

A short-term rental is a furnished living space available for short periods of time, from a few days... Read more

Airbnb Financial Model

Air BnB Financial Model Template presents the business case of the purchase of up to 5 properties wi... Read more

Multi (20) AIRBNB Acquisition and/or Portfolio Mod...

This AIRBNB 20 model will assist you in evaluating up to 20 x propositions simultaneously and compar... Read more

Bed And Breakfast Financial Model Excel Template

Buy Bed And Breakfast Financial Projection Template. This well-tested, robust, and powerful template... Read more

Rental Property Financial Model

The Rental Property financial model template, forecasts a rental property's expected financials 30 y... Read more

Single Airbnb Rental Unit Financial Model

If you're considering renting your property on Airbnb, downloading a financial model can help you es... Read more

Real Estate Acquisition Portfolio Model (Buy ̵...

Real Estate Acquisition Portfolio Model consists of a financial model in excel and an investment pro... Read more

You must log in to submit a review.