Monthly Cash Flow Template Excel

Free Monthly Cash Flow Template Excel. 1 Click to Get It!

Monthly Cash Flow Template Excel projection is essential in any business, especially small businesses. If you ever want to succeed in your business, you need positive cash flow, and the only way you can achieve this is by having a monthly cash flow template forecast. The monthly cash flow statement template forecast explains the inflow of cash into a business. It helps entrepreneurs to know how to spend money, what to spend money on, and how much money comes into the business.

A financial projection, on the other hand, is a method of analyzing your business to detect any possible ‘shortfalls.’ It determines the weak areas in your business as well as potential solutions to them. In particular, the monthly cash flow statement template will be a significant contributor to the diminishing stress-load of business owners. But some business owners don’t realize the advantages of cash flow forecasting, so we’ve got the lowdown on why business owners should be using a cash flow forecast. This comprehensive template offers monthly worksheets. Create a detailed monthly cash flow statement template report to analyze performance or plan for the future. Each month has a separate sheet so that you can get a thorough picture of cash inflows and outflows for both short- and long-term periods.

MONTHLY CASH FLOW TEMPLATE EXCEL WILL HELP YOU

Avoid Cash Flow Shortfalls

Optimize the Timing of Accounts Payable and Receivable

Understand the impact of future plans and possible outcomes

Identify Your Inflows and Outflows

Make sure you have enough cash to pay suppliers and employees.

Identify potential shortfalls in cash balances.

Track whether spending is on target

Predict cash shortages and surpluses

Estimate incoming cash for next periods

Take Control Of The Cash Flow For Your Retail Business

BENEFITS OF USING A MONTHLY CASH FLOW TEMPLATE EXCEL

Simple-to-use

A very sophisticated cash flow planning tool, whatever size and stage of development your business is. Minimal previous planning experience and very basic knowledge of Excel is required: however, fully sufficient to get quick and reliable results.

Simple and Incredibly Practical

Simple-to-use yet very sophisticated cash flow planning tool. Whatever size and stage of development your business is, with minimal planning experience and very basic knowledge of Excel you can get complete and reliable results.

Gaining trust from stakeholders

Investors and financing providers tend to think in terms of the big picture. They want the c-level of the companies they invest in to do the same to ensure they maintain a clear idea of the future. Providing stakeholders with a monthly cash flow forecast will demonstrate a level of awareness that leads to confidence and trust and will make it easier to raise more investment.

Plan for Future Growth

Cash flow forecasts can help you plan for future growth and expansion. No matter you’re extending your company with new employees and need to take into account increased staff expenses. Or to scale production to keep up with increased sales, future projections help you see accurately where you’re running — and how you’ll get there. Forecasting is also a well-known goal-setting framework to help you plan out the financial steps your company has to take to reach targets. There’s power in Cash Flow Projections and the insight they can provide your business. Fortunately, this competitive advantage comes with little effort when you use the Cash Flow Statement Forecast Excel Template.

External stakeholders, such as banks, may require a regular forecast.

If the business has a bank loan, the bank will ask for a cash flow forecast regularly.

Identify potential shortfalls in cash balances in advance.

The cash flow forecast works like an “early warning system.” It is, by far, the most significant reason for a cash flow forecast.

Spot problems with customer payments

Preparing the cash flow forecast encourages the business to look at how quickly customers are paying their debts. Identify unpaid invoices and take necessary actions to make them pay.

Predict the Influence of Upcoming Changes

Does your company plan to purchase new equipment or to launch a new product? Cash Flow Projections enable you to obtain a complete picture of the effect that specific changes will have on your cash flow. When planning your finances in the Cash Flow Forecast Excel Template, you will forecast cash inflows and outflows based on future invoices, bills due, and payroll. You can then create multiple “what if” scenarios, such as buying new equipment to choose the best way for you. Forecasting shows you how the upcoming changes will affect your cash balance.

Similar Products

Other customers were also interested in...

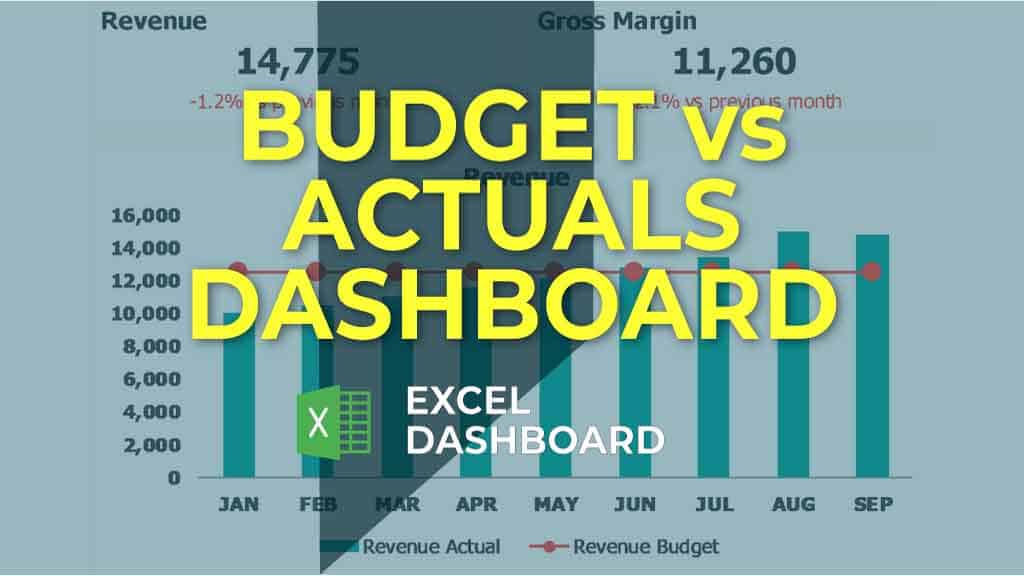

Budget vs Actual Excel Template

Create your very own budget vs actual analysis by trying out this Budget vs Actual Analysis Excel Te... Read more

Inventory Control Software Financial Model Excel T...

Try Inventory Control Software Financial Plan. Solid package of print-ready reports: P&L and Cas... Read more

Business Valuation Expert Financial Model Excel Te...

Get Business Valuation Expert Financial Plan. Includes inputs, outputs and charts to present it in a... Read more

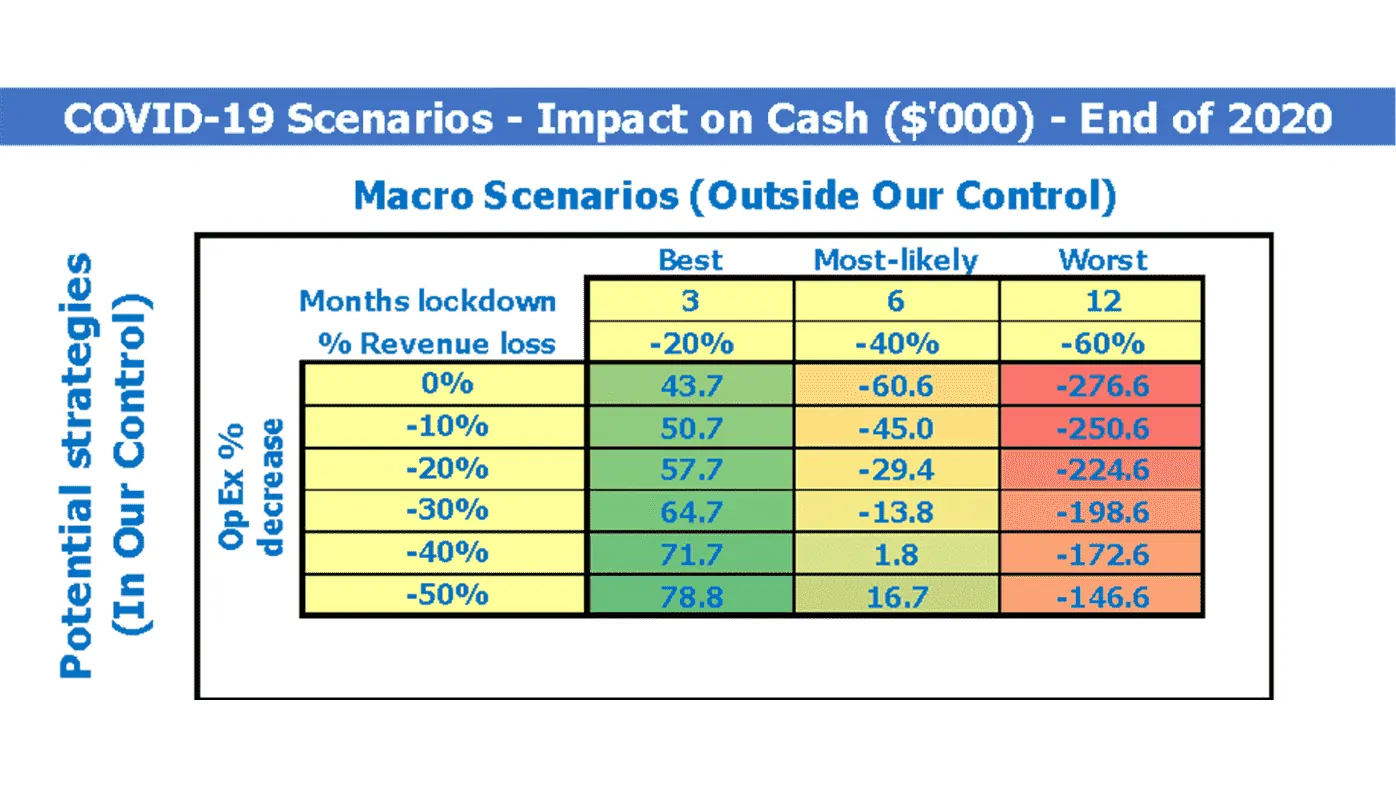

Financial Model Excel Template to fight COVID-19

The coronavirus has turned many small and big companies upside down. The decrease in sales, problems... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Due Diligence P&L – Exhaustive Revenue a...

Model for in depth understanding of high level profit and loss and revenue analysis. Big-4 like chec... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Franchisor Licensing: Financial Model with Cap Tab...

Build up to a 10 year financial forecast with assumptions directly related to the startup and operat... Read more

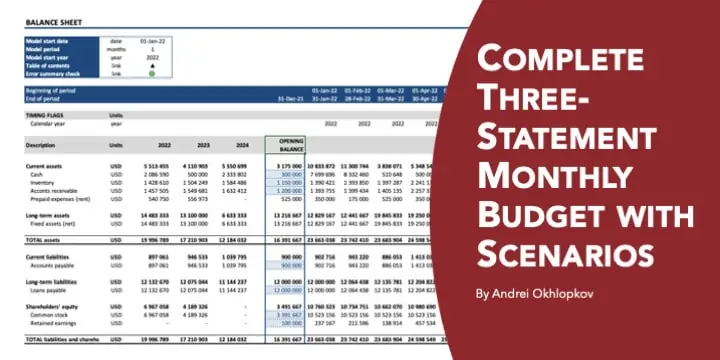

Complete Three-Statement Monthly Budget with Scena...

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

You must log in to submit a review.