Complete Private Equity (LBO) Financial Model

This is a professional financial model which performs a thorough assessment of a private equity project with debt leverage. The model is built to all standards of private equity and investment banking industry

This is a professional financial model that performs a thorough assessment of a private equity project with debt leverage. The model is built to all standards of the private equity and investment banking industry.

Key features of this model:

- Covers in detail all stages of a private equity investment

- Produces three financial statements and a detailed return analysis

- Makes a granular analysis of the target company (revenues, cost of sales, fixed overhead, working capital, capex, debt financing)

- Performs a deep sensitivity analysis and can handle up to seven scenarios (you can change scenarios from any sheet)

- Makes project valuation under several methods

- Includes professionally designed magazine-quality charts

The model is accompanied by a detailed text guide providing user instructions, explaining how the model functions and revealing tricky Excel issues.

1. Acquisition

At the acquisition stage, you can define the entry multiple and the purchase price. If the project is leveraged, you can define the loan portion (LTV ratio) and split the loan funding into a credit line and bridge (mezzanine) debt. You can also set the amount of transaction fees.

It is assumed that the investment target company sells up to seven products. The model takes historic actuals and makes projections related to prices, volumes, overhead costs, capex, working capital assumptions, other financial parameters.

2. Refinancing

At some point you might refinance the acquisition loan with a new loan under better terms, after the project is stabilized and the risk profile of it becomes more conservative. You can also refinance with higher leverage and distribute the resulting extra cash to the investors. The model shows both refinancing scenarios and allows to set the moment of refinancing and the conditions of a new loan.

3. Exit

At exit stage, you can define the year of exit, exit multiple and transaction fees. You can also choose the method of valuation (EBITDA multiple or terminal growth under the Gordon’s model).

The analysis is supported by the charts which include a valuation bridge chart, valuation ranges under different methods (a “football field” chart), income statement and cash flow bridge chart (for the target company) and others illustrating operating performance and debt service.

File Type:

– .xlsx (Excel Model)

– .pdf (Instructions eBook)

Similar Products

Other customers were also interested in...

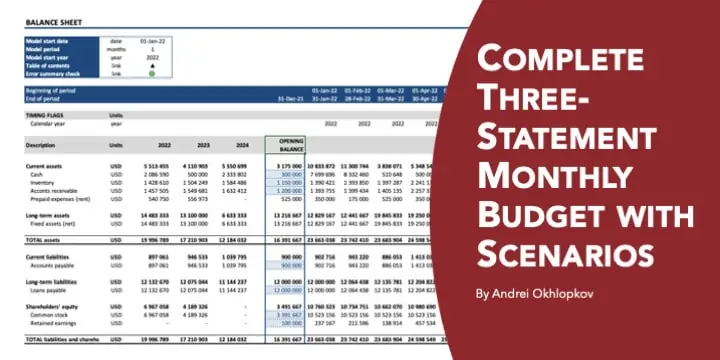

Complete Three-Statement Monthly Budget with Scena...

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

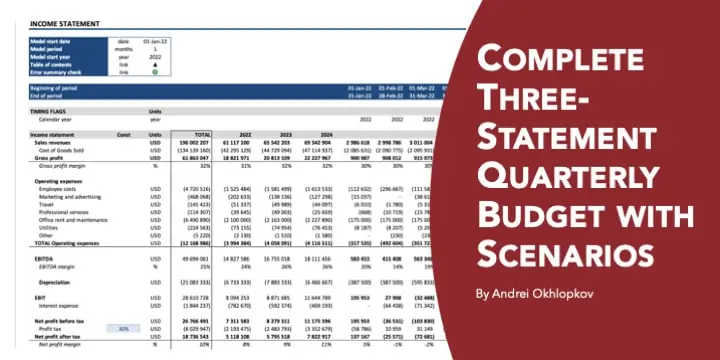

Complete Three-Statement Quarterly Budget with Sce...

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

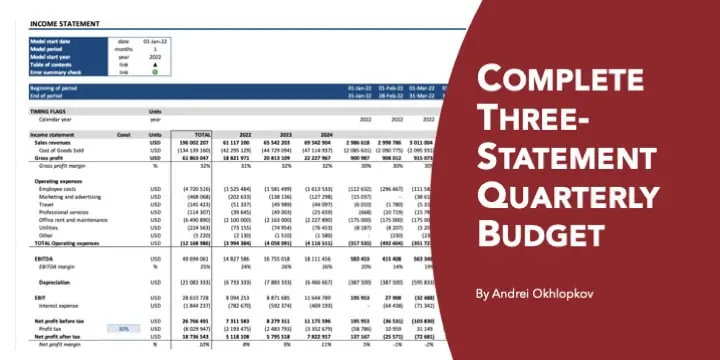

Complete Three-Statement Quarterly Budget

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

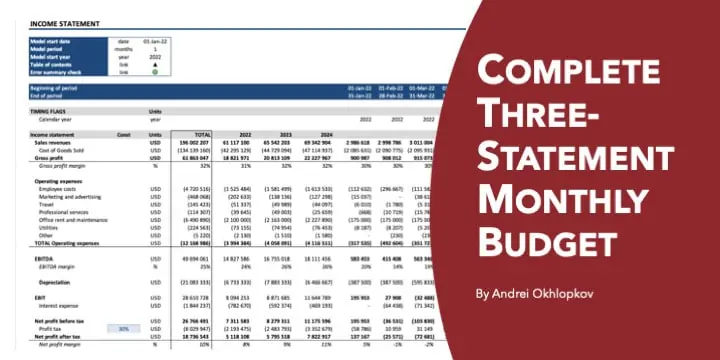

Complete Three-Statement Monthly Budget

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Franchisor Licensing: Financial Model with Cap Tab...

Build up to a 10 year financial forecast with assumptions directly related to the startup and operat... Read more

Leveraged Buyout (LBO) Model

Leveraged Buy Out (LBO) Model presents the business case of the purchase of a company by using a hig... Read more

Leveraged Buyout (LBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes (IRR, projected financia... Read more

You must log in to submit a review.