Carpentry Business – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a startup or operating Carpentry Business.

Financial Model presenting an advanced 5-year financial plan for a startup or operating Carpentry Business.

The model is a flexible tool for owners to forecast business financial and operational activities. It includes assumptions and calculations of Customer acquisition through Location metrics and Marketing (paid and organic), Revenue from 6 different service types, Direct & Indirect Payroll, Cost of Services & Operating Expenses, Fixed Assets & Depreciation, Financing through Debt & Equity, and Exit Valuation assumptions in case of a potential sale of the business.

The structure of the template follows Financial Modeling Best Practices principles and is fully customizable.

Detailed instructions for the functionality of the model are included in the Excel file.

Model Inputs and Setup Reports:

• General Setup Assumptions, incl. Starting Expenses (in case the business is a startup), Revenue & Cost of Service Assumptions, and Financing (Debt & Equity)

• Yr1 Direct & Indirect Payroll, incl. Hiring Schedule of FTEs per Position/Month, Salary per FTE, Payroll Taxes & Benefits, and two different Bonus Schemes.

• Yr1 OpEx and Annual Capex, incl. Depreciation Schedule

• Yr1 Revenue & Cost of Services Calculations per service type

• Forecast Scenarios

• Payroll and Operations Forecast Calculations

Starting Year Output Reports:

• Yr1 Budget and Actual Reports

• Yr1 Profit & Loss Statement Summary

• Yr1 Budget vs. Actual Variance Analysis at a YTD and Monthly level

5-Year Forecast Output Reports:

• Annual Financial Statements (3 Statement model)

• Break-Even Analysis

• Profitability Analysis per service category and Year

• Financial Ratios, including several Profitability, Efficiency, Liquidity, and Leverage (Solvency) Ratios

• Dupont Analysis

• Performance Dashboard

• Business Valuation, including DCF Model, Return Metrics (NPV, EV, IRR, MOIC, ROI, etc.), and Sensitivity Analysis

• Professional Executive Summary

The Model is available in 2 Versions (Standard and Premium)

Standard Version Includes:

• All Input Reports

• Yr1 Budget and Actual Reports

• Yr1 Profit & Loss Statement Summary

• Annual Financial Statements (3 Statement model)

• Financial Ratios

• Performance Dashboard

Premium Version includes all features of the Standard Version plus:

• Budget vs. Actual Variance Analysis

• Break-even Analysis

• Profitability Analysis

• Dupont Analysis

• Business Valuation, including DCF Model, Return Metrics (NPV, EV, IRR, MOIC, ROI, etc.), and Sensitivity Analysis

• Executive Summary

A PDF Free Demo of the Premium Version is provided if you wish to view all model worksheets before your purchase.

Help & Support

Committed to high quality and customer satisfaction, all our templates follow best-practice financial modeling principles and are thoughtfully and carefully designed, keeping the user’s needs and comfort in mind.

Whether you have no experience or are well-versed in finance, accounting, and the use of Microsoft Excel, our professional financial models are the right tools to boost your business operations!

If you experience any difficulty while using this template and cannot find the appropriate guidance in the provided instructions, please feel free to contact us for assistance.

If you need a template customized for your business requirements, please e-mail us and provide a brief explanation of your specific needs.

Similar Products

Other customers were also interested in...

Plumbing Business Financial Model – 5 Year Forec...

Financial Model presenting an advanced 5-year financial plan for a startup or operating Plumbing Bus... Read more

Electrician Business Financial Model – 5 Year Fo...

Financial Model presenting an advanced 5-year financial plan for a startup or operating Electrician ... Read more

Artisan Contractor Business – 5 Year Financial M...

Financial Model providing an advanced 5-year financial plan for an Artisan Contractor Business scena... Read more

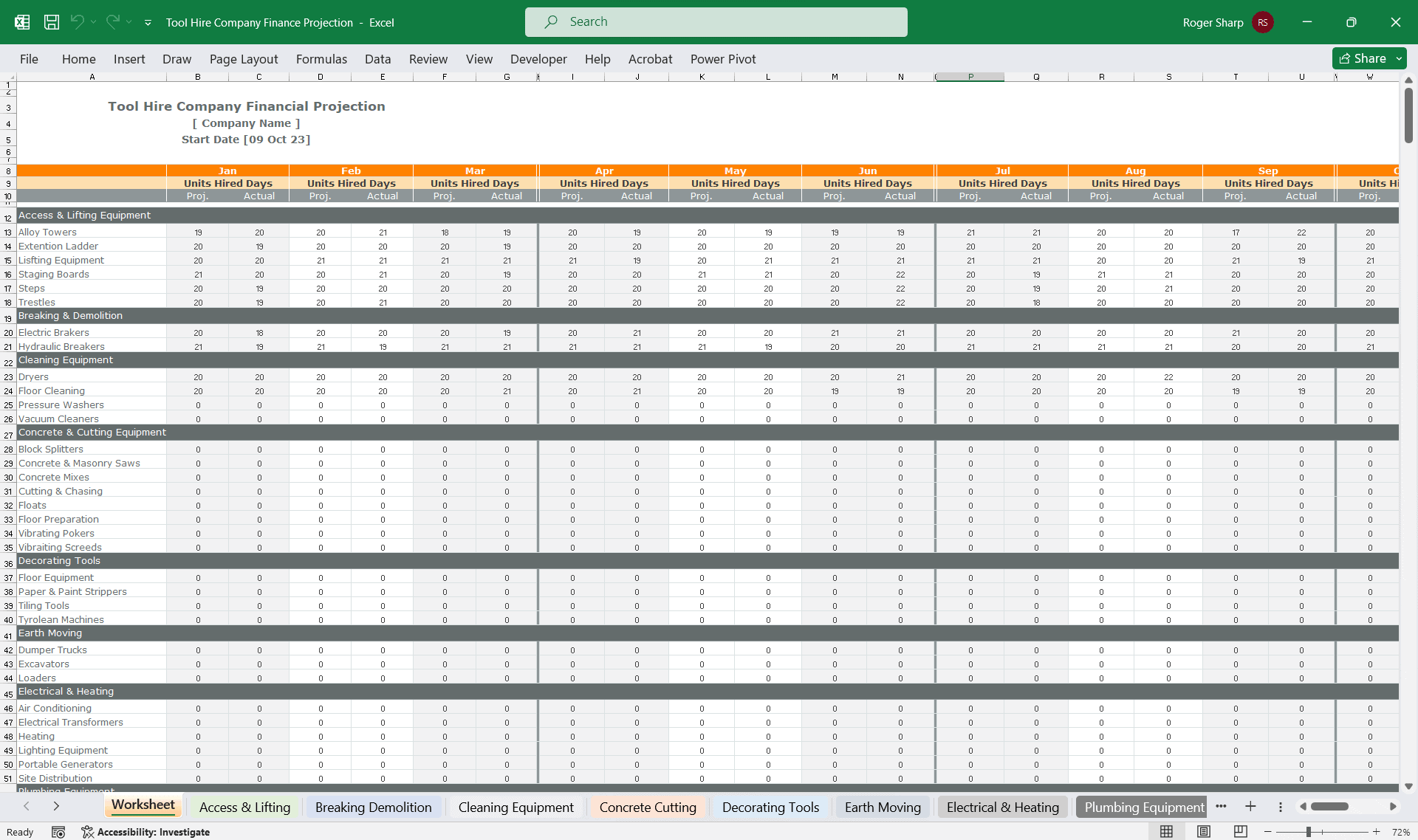

Tool Hire Company Finance Model

A very comprehensive editable Excel spreadsheet for tracking your tool hire financials throughout th... Read more

Equipment Leasing Company Financial Model – Dyna...

Financial model presenting a business scenario of an Equipment Leasing Company, which offers Monthly... Read more

Crane Truck Rental Company Financial Model

Step into the world of crane rental business success with our Crane Truck Rental Company Financial M... Read more

Construction Contractor Business – Cash Flow...

This financial model lets the user plan out cash requirements and expected returns of running a cons... Read more

Construction/Engineering Project Business Financia...

3 statement 5 year rolling financial projection Excel model for a startup /existing business engaged... Read more

Financial Feasibility Study – Excavation Con...

The report is containing full set of financial feasibility study project for Excavation Contractor, ... Read more

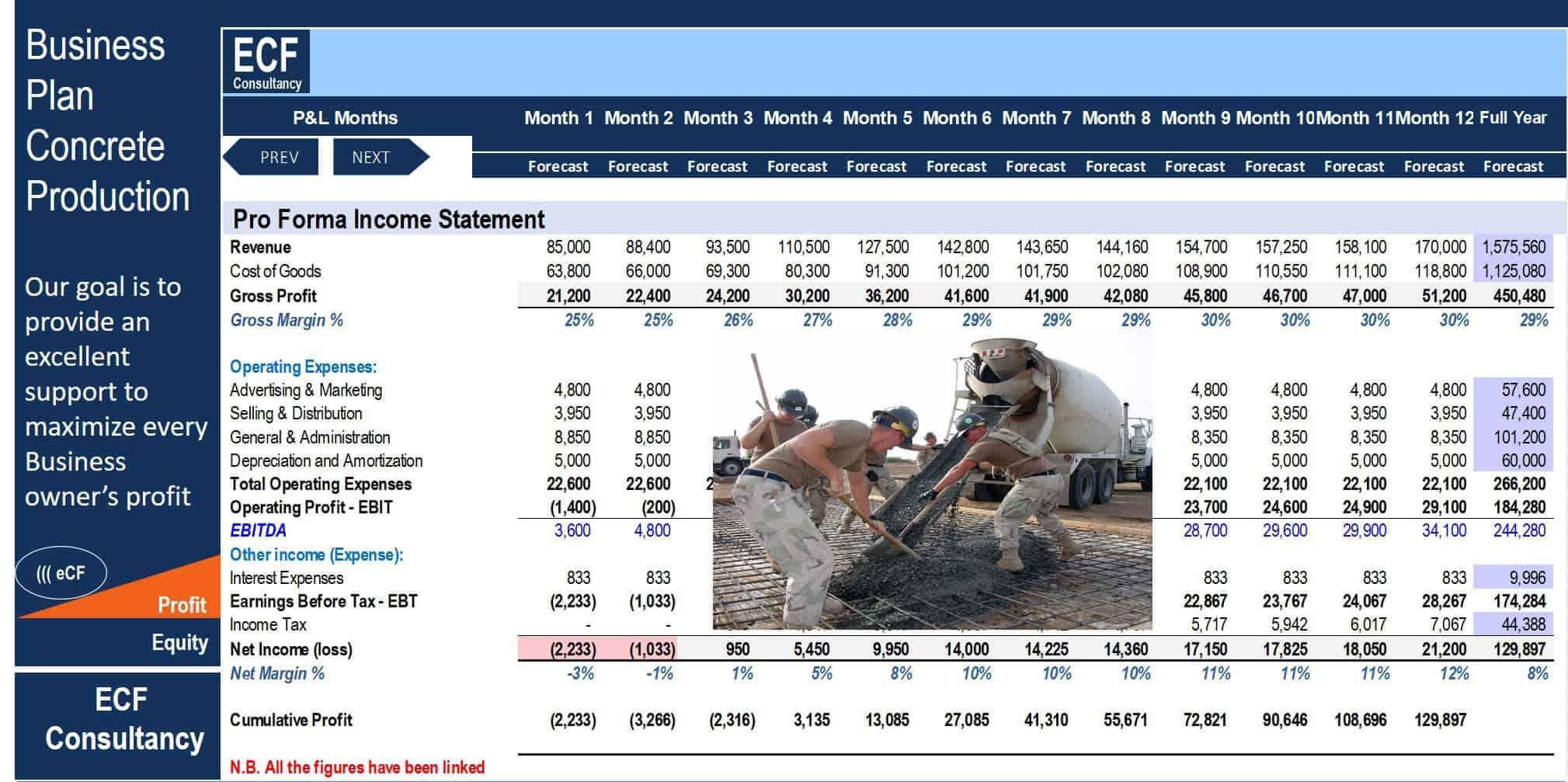

Startup Business Plan – Concrete Production ...

If you're dreaming of starting a Concrete Contractor business, try this Startup Business Plan - Conc... Read more

You must log in to submit a review.