Annual Indirect Method Cash Flow

Annual Indirect Cash Flow Statement – Get Free Excel Template Annual Indirect Cash Flow Statement – Get Free Excel Template Annual Indirect Method Cash Flow.

Annual Indirect Method Cash Flow. Download our FREE template of the annual indirect cash flow statement with ease

Model Overview

The indirect method cash flow format is prepared using the indirect method of cash flow statement format that adjusts net income for the balance sheet account changes to calculate the operating cash flow.

Simply, changes in assets and liabilities, that impact cash on hand throughout the year are added to or subtracted from net income to estimate the cash flow from operating activities.

The difference between the direct and indirect methods is in the operating activities section calculation. The direct method lists all operating inflows and payments, and the indirect method cash flow uses net income adjustments instead.

Annual Indirect Method Cash Flow Benefits

Manage surplus cash

Identify Your Inflows and Outflows

See Where The Cash Is Coming In and Going Out

See and compare business expenses and income for periods

Make sure you have enough cash to pay suppliers and employees.

Understand the impact of future plans and possible outcomes

Keep track of overdue payments

Spot problems with customer payments

Identify potential shortfalls in cash balances in advance

Track whether spending is on target

Predict the Influence of Upcoming Changes

Does your company plan to purchase new equipment or to launch a new product? Cash Flow Projections enable you to obtain a complete picture of the effect that specific changes will have on your cash flow.

When planning your finances in the Cash Flow Forecast Excel Template, you will forecast cash inflows and outflows based on future invoices, bills due, and payroll.

You can then create multiple “”””what if”””” scenarios, such as buying new equipment to choose the best way for you.

Forecasting shows you how the upcoming changes will affect your cash balance.

External stakeholders, such as banks, may require a regular forecast.

If the business has a bank loan, the bank will ask for a cash flow forecast regularly.

Generate growth inspiration

By running various scenarios and looking at the effects they could have on your cash balance, you will begin to see which options are best for your business. Ones that are possible, and what is involved in making them work.

Organic growth isn’t the only option – there are growing funding options becoming available, and cash flow forecasting could be a way of looking at the impact an injection of cash could have on your business and its growth plans.

Prove You Can Pay Back the Loan You Requested

When you apply for a business loan, bankers will study your cash flow forecast in an attempt to answer this question: Can this business pay back the loan?

Requesting a loan without showing your Cash Flow Forecast for paying it back is a common way to land in the rejection pile. It is exceptionally accurate if your current cash flow won’t cover all of your monthly operating expenses — plus your loan payment.

Don’t fall into this kind of situation. Use Cash Flow Projections to strengthen your case by showing the banker exactly how you plan to use the loan and when you will start repaying the debt.

This type of forecasting helps you create a road map that can impress a lender with the confidence they need to approve your loan.

Simple-to-use

A very sophisticated cash flow planning tool, whatever size and stage of development your business is. Minimal previous planning experience and very basic knowledge of Excel is required: however, fully sufficient to get quick and reliable results.

Saves you time

Allows you to spend less time on cash flow forecasting and more time on your products, customers and business development

Avoid Cash Flow Shortfalls

Unexpected Cash Flow shortfalls can cause significant damage to your business, and it may take months to recover.

Negative Cash Flow can appear if you don’t continuously track the incoming cash and outgoing of your business.

Fortunately, you can solve Cash Flow shortfalls with a bit of effort.

Forecasting your Cash Flow will help you identify — and plan for — market fluctuations, sales seasonality, and other cases that can lead to unpredictable Cash Flow.

Cash Flow Forecast can even help you visualize Cash Flow trends with the help of automatically generated charts and graphs.

Manage accounts receivable.

By creating a Cash Flow Forecast that takes invoices and bills into account, you’ll be more easily able to identify who is systematically paying late. You could even go on to model different payment dates on overdue invoices to see the real effect of late payments on your cash flow.

– Henry Sheykin

Similar Products

Other customers were also interested in...

Inventory Control Software Financial Model Excel T...

Try Inventory Control Software Financial Plan. Solid package of print-ready reports: P&L and Cas... Read more

Business Valuation Expert Financial Model Excel Te...

Get Business Valuation Expert Financial Plan. Includes inputs, outputs and charts to present it in a... Read more

Budget vs Actual Excel Template

Create your very own budget vs actual analysis by trying out this Budget vs Actual Analysis Excel Te... Read more

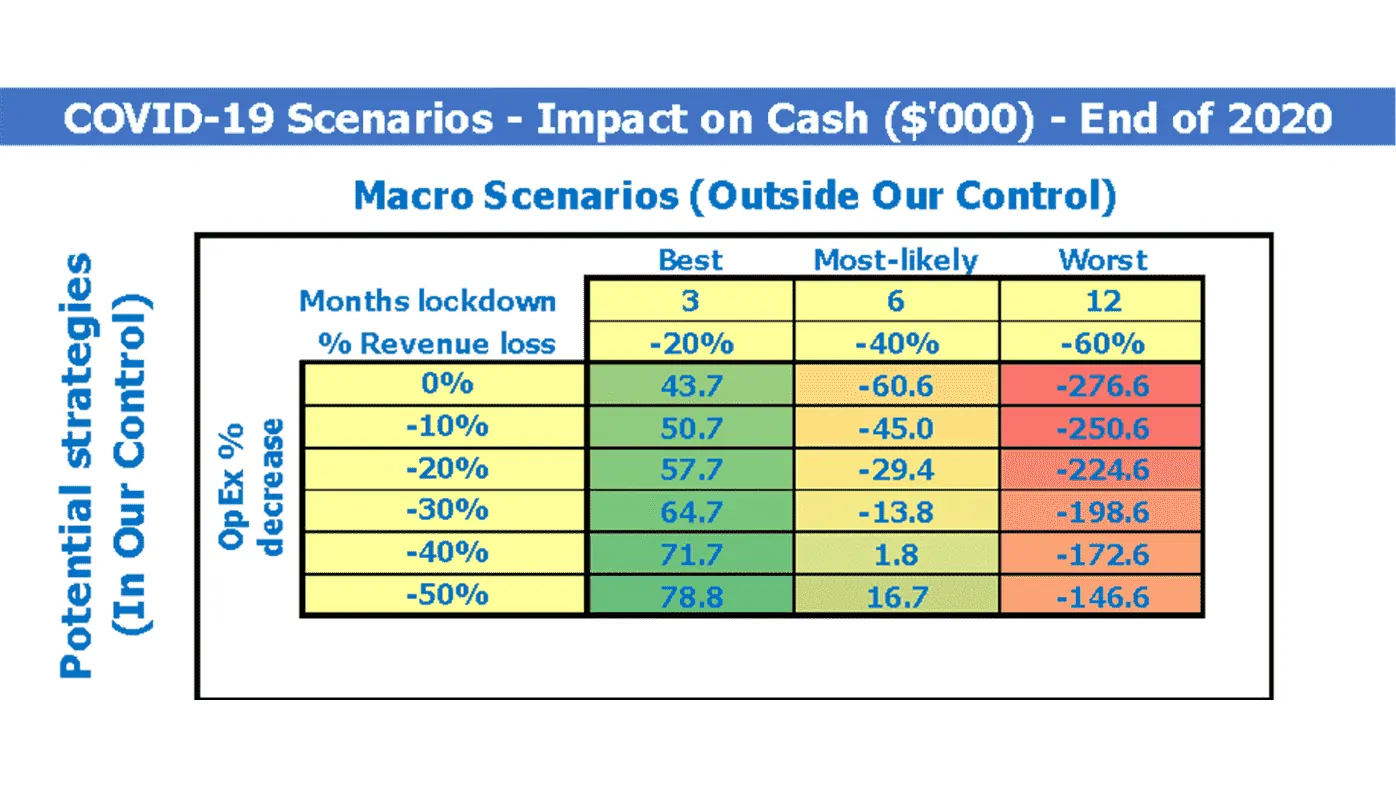

Financial Model Excel Template to fight COVID-19

The coronavirus has turned many small and big companies upside down. The decrease in sales, problems... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Advanced Financial Model with DCF & Valuation

General Overview Advanced Financial Model suitable for any type of business/industry and fully cu... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Due Diligence P&L – Exhaustive Revenue a...

Model for in depth understanding of high level profit and loss and revenue analysis. Big-4 like chec... Read more

Franchisor Licensing: Financial Model with Cap Tab...

Build up to a 10 year financial forecast with assumptions directly related to the startup and operat... Read more

You must log in to submit a review.