Treasury Monitor Excel Template

This financial model attempts to give a CFO a daily monitor of the existing bank balances for all entities in a multi-currency and multi-entity environment, as well as the future cash position for the current month.

| All Industries, Financial Model, Financial Services, General Excel Financial Models |

| Budget, Cash Flow Analysis, Cash Flow Projections, CFO, Dashboard, Financial Model, Financial Planning, Forecasting |

CFOs are under increasing pressure to manage cash in tough market conditions and volatile economic cycles. Even in stages of business growth, cash becomes the most important asset in fueling the growth of a business. This becomes more significant when a CFO of a group of companies must optimize the use of cash across all entities. It becomes a day-to-day rigorous task for the treasury team to shuffle cash around numerous bank accounts to handle hundreds of payments and make the best use of collections in the group.

This financial model attempts to give a CFO a daily monitor of the existing bank balances for all entities in a multi-currency and multi-entity environment, as well as the future cash position for the current month. This will allow a CFO to have a careful cash planning capability month by month to cover fixed overheads and planned capital expenditures on development projects or buying assets. It also allows tracing of issued cheques, planned payments, and anticipated collections till the end of the month. This model will help avoid cash flow hick-ups that face even the largest and most solvent corporations.

MODEL SPECS

Up to 10 currencies, one base currency and nine others.

One rate for each currency is fixed for the remaining of the month.

Up to 20 different payment categories.

Up to 20 different entities can be defined.

Up to 20 different bank accounts can be defined.

Up to 300 payments can be scheduled for the group.

Up to 300 collections can be scheduled for the group.

Up to 200 issued cheques can be listed.

MODEL STEPS:

1) Setup of accounts, currencies, companies, and payment categories in the SETUP sheet.

2) Insert the report date in the TREASURY POSITION sheet.

3) Insert or update the scheduled payments with dates, amounts, and from which account payments will be made in the PAYMENTS sheet.

4) Insert the expected collections from revenue contracts or daily collections forecasted in the COLLECTIONS sheet.

Similar Products

Other customers were also interested in...

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

Investment Holding Company 3 Statement Financial P...

3 statement 5 or 8 year rolling financial projection Excel model for an investment holding company h... Read more

Leveraged Buyout (LBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes (IRR, projected financia... Read more

Mergers and Acquisition (M&A) Financial Projec...

User-friendly financial model to project and analyze the financial outcomes and feasibility of an Me... Read more

Amortization Schedules Template (Loans, Mortgages,...

User friendly template including Amortization Schedules for Loans, Mortgages, Operating and Finance ... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Due Diligence P&L – Exhaustive Revenue a...

Model for in depth understanding of high level profit and loss and revenue analysis. Big-4 like chec... Read more

Advanced Financial Model with DCF & Valuation

General Overview Advanced Financial Model suitable for any type of business/industry and fully cu... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

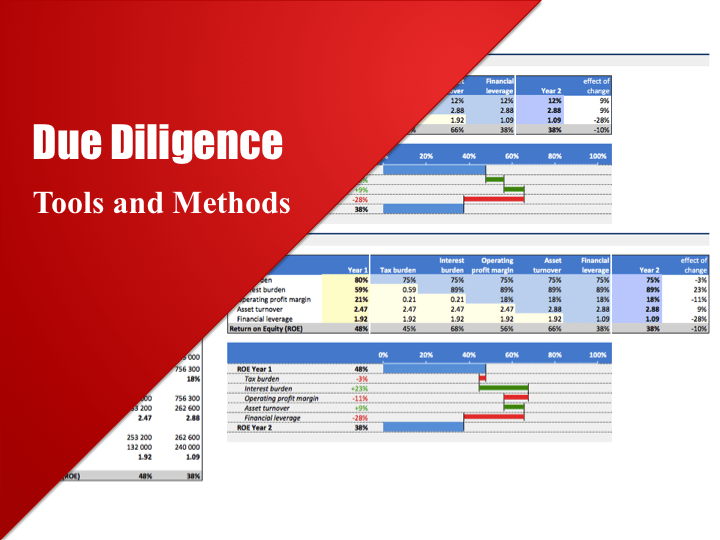

Due Diligence Tools and Methods

A suite of best practices to perform financial and commercial due diligence. Use it if you are consi... Read more

You must log in to submit a review.