Divestiture (Spin Off) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes (valuation, projected financials, key ratios, uses of funds) of a divestiture transaction involving a spin off

PURPOSE OF MODEL

User-friendly financial model to project and analyze the financial outcomes of a divestiture transaction involving the spin-off of a subsidiary within a Group.

The model enables the user to:

• Determine how the sale proceeds fund will be used;

• Project the pro-forma opening balance sheet post divestiture;

• Project the financial performance and position (3-statement financial forecast) over a 5-year period, including and excluding divestiture transactions;

• Calculate the intrinsic value of the business, including and excluding divestiture transactions, using the discounted cashflow (DCF) approach.

• Understand transaction details in table and chart format

• Compare the financial outcome of the business, including and excluding divestiture transactions in table and chart format to support the decision-making process on divestiture transactions.

The model follows good practice financial modelling principles and includes instructions, checks, and input validations.

KEY OUTPUTS

The key outputs include:

– Projected full financial statements (Income Statement, Balance Sheet, and Cash flow Statement) across 5 years presented on a yearly basis for the business, including and excluding the divestiture transaction;

– Discounted cash flow valuation using the projected cash flow output, including and excluding divestiture transaction

– Ratio Analysis based on projected financial statements

– Summarised tables and charts showing:

o Key transaction impact and details

o Waterfall showing movement in net assets following divestiture transaction

o Key performance metrics and ratio comparison for business, including and excluding divestiture transactions, including revenue growth, EBITDA, net profit margin, ROE, and debt-to-equity ratios

o Key valuation comparison including and excluding divestiture transaction

KEY INPUTS

Setup Inputs:

– Names of business

– Name of subsidiary being divested

– Currency;

– Transaction close period;

Financials Inputs:

– Latest P&L and balance sheet actuals for overall Group and subsidiary being divested;

– Projection assumptions for business including and excluding subsidiary being divested, which include:

o Forecast revenue;

o Forecast cost of sales;

o Forecast operating expenses, including depreciation;

o Fixed asset additions;

o Borrowing additions/repayments;

o Dividend distributions;

o Tax rate and interest rates;

o Debtor and creditor days;

o Inventory percentage of the cost of sales;

o Discount rate and terminal growth rate.

Divestiture Inputs:

– Additional debt raised in spin-off entity

– Special dividend from spin-off entity

– Spin-off transaction fees

– Pro-forma Group opening balance sheet adjustments following the divestiture.

MODEL STRUCTURE

The model comprises 8 tabs split into input (‘i_’), calculation (‘c_’), output (‘o_’), and system tabs. The tabs to be populated by the user are the input tabs, which include ‘i_Setup’ for setup assumptions, ‘i_Financials’ for Group / subsidiary actual and projection assumptions, and ‘i_Divest Assump’ for the transaction assumptions and pro-forma opening balance sheet adjustments. The calculation tabs take the user-defined inputs to calculate and produce the projection outputs, which are presented in the calculation tabs and ‘o_Dashboard’ tab.

System tabs include:

– A ‘Front Sheet’ containing a disclaimer, instructions, and contents;

– A checks dashboard containing a summary of checks by tab.

KEY FEATURES

Other key features of this model include the following:

– The model follows good practice financial modelling guidelines and includes instructions, checks, and input validations to help ensure input fields are populated accurately;

– The model enables the user to prepare projections for the Group, including and excluding divestiture, to assess the full financial impact of divestiture;

– The model is not password protected and can be modified as required following download;

– The model is reviewed using specialized model audit software to help reduce the risk of formula inconsistencies;

– Apart from projecting revenue and costs, the model includes the possibility of modeling receivables and payables, inventory, fixed assets, borrowings, dividends, and corporate tax;

– Business names, currency, and transaction close date are fully customizable;

– The model included an integrated discounted cash flow valuation for the Group, including and excluding divestiture for comparison;

– The model includes a checks dashboard that summarises all the checks included in the various tabs making it easier to identify any errors.

MODIFICATIONS

If you require any be-spoke modifications to the tool, we are more than happy to assist with this. Please send us a message through the Contact Author button or to the support team at [email protected].

ABOUT PROJECTIFY

We are financial modelling professionals with experience working in big 4 business modelling teams and strong experience supporting businesses with their financial planning and decision support needs. Our aim is to provide robust and easy-to-use models that follow good practice financial modelling guidelines and assist individuals and businesses with key financial planning and analysis processes.

We are keen to make sure our customers are satisfied with the tools / models they purchase and will be more than happy to assist with any questions or support required following or in advance of purchase.

We are also always keen to receive feedback, so please do let us know any feedback you have on our models by sending us a message or submitting a review.

Similar Products

Other customers were also interested in...

Investment Holding Company 3 Statement Financial P...

3 statement 5 or 8 year rolling financial projection Excel model for an investment holding company h... Read more

Divestiture (Cash Sale) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes (valuation, projected fi... Read more

Leveraged Buyout (LBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes (IRR, projected financia... Read more

Management Buyout (MBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes of a management buyout (... Read more

Multi-Entity Group Generic Monthly 5-Year 3 Statem...

User-friendly 3 statement 5 year rolling financial projection Excel model for a Multi-entity Group (... Read more

Mergers and Acquisition (M&A) Financial Projec...

User-friendly financial model to project and analyze the financial outcomes and feasibility of an Me... Read more

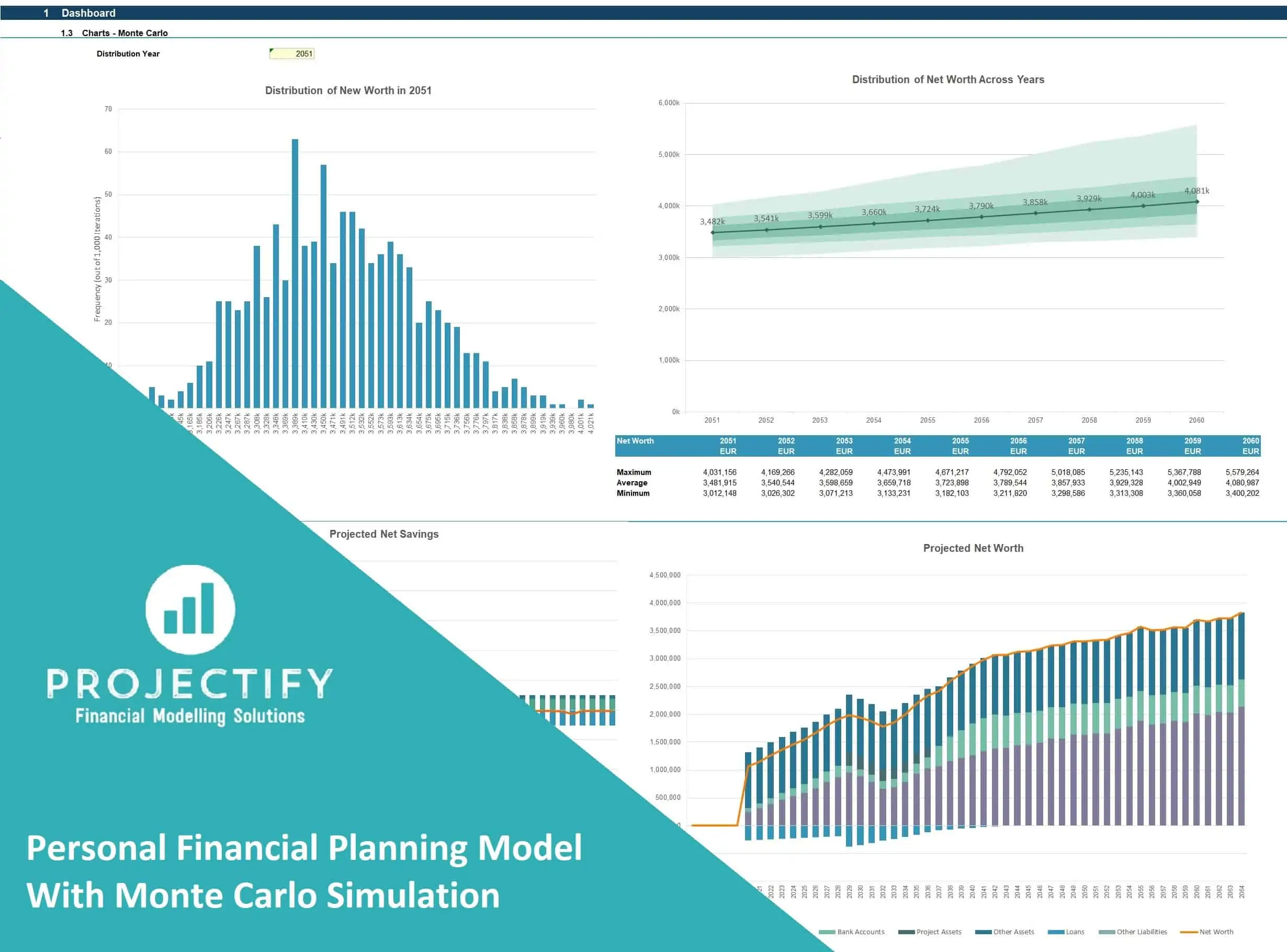

Personal Financial Planning Model with Monte Carlo...

User-friendly excel model to project personal or family cash flow and net worth across a 50-year tim... Read more

Actual vs. Budget Variance Analysis Template

Excel model and dashboard for the preparation of a monthly budget and to track actual performance ag... Read more

Generic 5-Year Monthy Rolling Financial Projection...

PURPOSE OF TOOL Highly versatile and user-friendly Excel model for the preparation of a 5-year rol... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

You must log in to submit a review.