Your Comprehensive Guide to Hotel Investment Analysis Template

A hotel investment analysis template is an essential tool for assessing the viability and profitability of hospitality ventures. It aids in forecasting financial outcomes and measuring potential returns.

Navigating the complexities of the hotel industry requires astute financial planning and analysis. Investors and developers benefit from a structured approach to examining the myriad of data points and metrics that inform sound investment decisions. An effective hotel investment analysis template captures key financial indicators such as revenue projections, operating costs, cash flow, and return on investment.

By synthesizing this data, stakeholders can gain insights into the feasibility of a prospective hotel project or the performance of an existing property. This level of scrutiny is crucial in an industry where consumer trends and market dynamics can shift rapidly, impacting profitability. With the right template, stakeholders can make informed decisions to optimize their investment strategies, increase efficiencies, and ultimately drive success in the competitive landscape of hotel investment.

The Essence Of Hotel Investment Analysis

Diving into hotel investment requires careful analysis. Investors need to understand the sector’s unique characteristics. Financial success in hospitality hinges on more than just property value—it’s about guest experiences, operational efficiency, and market dynamics. A well-crafted hotel investment analysis template is key for informed decision-making. It transforms raw data into actionable insights. Let’s explore the crucial components.

A Dive Into Hospitality Market Trends

Staying ahead in a competitive industry means knowing the current trends shaping hospitality. This involves evaluating factors such as traveler habits, technology adoption, and economic indicators. Key trends include:

- Sustainable practices: Eco-friendly hotels attract modern travelers.

- Smart technology: Automation enhances guest experience and operations

- Experience-centric services: Unique offerings can set a hotel apart.

Essential Metrics And Performance Indicators

Success in hospitality is measured by specific metrics. Investors should focus on:

- Occupancy rates: A hint at property demand.

- Average daily rate (ADR): Reflects pricing strategies.

- Revenue per available room (RevPAR): Combines occupancy and ADR.

Other metrics include guest satisfaction scores and operational costs. These figures need monitoring to ensure a hotel’s health.

A template for hotel investment analysis delivers structure to this evaluation. It provides a clear framework for assessing a property’s potential. With a proper template, investors can spot valuable opportunities and avoid costly missteps.

Anatomy Of A Hotel Investment Template

If you’re delving into the world of hotel investment, knowing the ins and outs of your investment template is key. This guide lays out the essential sections and calculations you’ll have to master. With the right template, analyzing potential hotel investments becomes straightforward and strategic.

Critical Components Of Template Design

A strong hotel investment template is your roadmap to success. It ensures no detail gets overlooked. Here, we break down the must-have elements:

- Executive summary: This part gives a snapshot of investment highlights and goals.

- Market analysis: Understand the location with data on competitors, demand, and growth.

- Projection model: This includes calculations for revenue, expenses, cash flow, and more.

- Risk assessment: Recognize potential pitfalls and plan to mitigate them.

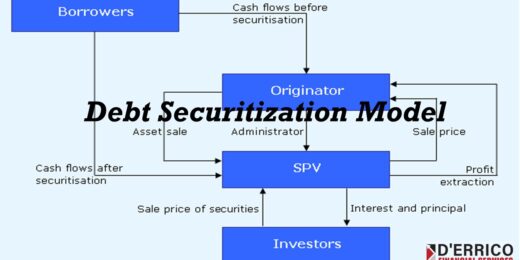

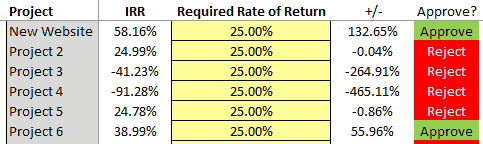

- Financial indicators: Focus on key metrics like IRR, NPV, and ROI to evaluate profitability.

The design intertwines accuracy with clarity so that investors can make informed decisions quickly.

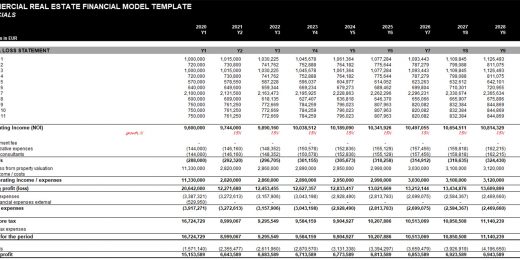

A Closer Look At Revenue And Cost Projections

Revenue and costs are the heartbeat of your hotel investment analysis. Let’s dive into how projections should be structured:

Revenue projections: Break down the different income streams:

- Room sales

- Food and beverage services

- Event hosting

- Other amenities

Cost projections: Tally up the expenses:

- Operating costs

- Maintenance expenses

- Marketing outlay

- Staff salaries

| Year | Revenue | Costs | Net Income |

|---|---|---|---|

| 1 | $X | $Y | $Z |

| 2 | $X+ | $Y+ | $Z+ |

Analysts forecast trends and adjust figures annually to depict a realistic financial journey.

Maximizing Your Investment Potential

Investing in hotels can unlock a trove of profit opportunities. But it calls for smart strategies and keen insight into the hospitality industry. Your hotel investment analysis template is the roadmap to steering this investment to its fullest potential. By evaluating key factors and applying effective methods, you position your hotel not just to succeed but to thrive. Prepare to explore how to optimize returns and satisfy guest needs.

Strategies For Yield Management

Yield management is critical for maximizing hotel revenue. It involves setting the right prices and managing inventory effectively. Use these strategies:

- Analyze historical data to predict demand.

- Adjust pricing based on occupancy levels.

- Employ automated revenue management systems.

These steps help ensure your prices match consumer willingness to pay, boosting your bottom line.

Understanding Guest Demographics And Preferences

Knowing your guests shapes your services and amenities. Here’s a quick look at how:

| Demographic | Preferences |

|---|---|

| Millennials | Experiences, tech integration |

| Business travelers | Efficiency, connectivity |

| Families | Convenience, family-oriented services |

Customize your offerings to these preferences to increase guest satisfaction and loyalty.

Financial Assessment Tools

The key to making a wise hotel investment lies in the numbers. A thorough financial assessment points investors in the right direction. Let’s break down the essential tools that reveal the true value of a hotel investment.

Net Present Value

Net Present Value (NPV) offers a straightforward answer to one burning question: Is this hotel investment worth it?

By considering future cash flows and discounting them back to today’s value, investors are armed with critical insight. A positive NPV means expected earnings outweigh the initial outlay, signaling a thumbs-up for the investment. Here’s a simple NPV calculation example:

FV / (1 + r)^n = NPV- FV: The future cash flow (e.g., hotel revenue)

- r: Discount rate (reflects the risk level)

- n: Number of periods (e.g., years)

Internal Rate Of Return

The Internal Rate of Return (IRR) is akin to a hotel’s financial speedometer. It indicates the yearly growth percentage the investment is poised to generate.

Reaching or exceeding a target IRR justifies pursuing the investment. It’s the break-even point that tells investors when they’ll start realizing profits. Here’s how to highlight IRR:

- Forecast all cash inflows and outflows

- Calculate the rate that makes the NPV zero

Using Cap Rates And Cash On Cash Returns

Capitalization rates (cap rates) focus on the here and now. They measure annual return against the property’s original cost or market value.

Higher cap rates hint at a potentially juicier deal. But beware, they can also signal a riskier investment. Here’s the cap rate formula:

Net Operating Income / Current Market Value = Cap RateCash on cash returns dive into the actual cash earned versus the cash put in. This ratio paints a vivid picture of cash flow, which helps in forecasting the investment’s liquidity. Keep in mind:

- A higher percentage means more cash benefits annually

- This metric doesn’t factor in mortgage costs

Mitigating Risks In Hotel Investments

Diving into the hotel industry can be as exciting as it is daunting. Smart investors know that risks come hand-in-hand with opportunities. In the realm of hotel investments, analyzing risks and crafting a solid strategy are crucial steps. They help ensure that returns are maximized whilst vulnerabilities are minimized.

Analyzing Market And Economic Risks

Understanding the market dynamics is the first step in risk mitigation. Key factors to consider include:

- Location: Is the area experiencing growth or decline?

- Competition: Are there enough guests for all hotels?

- Supply and Demand: What’s the occupancy rate in the region?

Economic indicators also play a vital role. They predict future trends which may affect a hotel’s profitability. These include:

| Economic Indicator | Relevance to Hotel Investment |

|---|---|

| Unemployment rates | Lower unemployment may signal higher hotel demand. |

| GDP Growth | Positive growth could mean more business travel. |

| Inflation | Affects room rates and operating costs. |

Risk Management Through Diversification

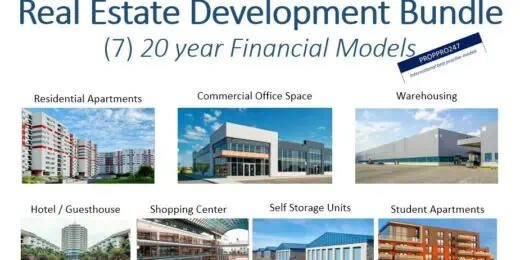

Spreading investments across different markets or hotel types can buffer against downturns. A blend of properties may include:

- Urban hotels in bustling cities.

- Resort locations for tourist appeal.

- Budget accommodations for price-sensitive travelers.

- Luxury estates for high-end clientele.

Diversification does not just stop at the type of hotels. Considerations include:

- Mixing geographies: Different regions respond differently to economic changes.

- Varying lease lengths: A mix of short and long-term can stabilize income.

- Operational models: Franchise, leased, and independent operations offer varied risks and returns.

Risk analysis templates can help to track these diversification strategies. They ensure decisions are data-driven and not just based on hunches.

The Impact Of Location And Branding

When entering the world of hotel investment, two critical factors demand your focus: location and branding. Just like prime real estate, a hotel’s address can dictate its success. Pair location with a strong brand, and the combination can power a hotel’s profitability. Let’s explore the pivotal roles these elements play in shaping hotel investment outcomes. These insights form a core part of any astute Hotel Investment Analysis Template.

Regional Comparative Analysis

To discern a hotel’s potential, investors engage in a comparative analysis of the region. This means they look at hotels in and around the desired location to gauge performance. Key indicators such as occupancy rates, average daily rates, and revenue per available room are compared. This provides a deeper understanding of the area’s attraction, competition, and economic dynamics.

Key Location Factors:

- Proximity to tourist attractions

- Access to transport hubs

- Local business environment

- Competitor presence

In a table, investors can quickly review how a potential hotel stacks up against regional competitors:

| Hotel | Occupancy Rate (%) | Average Daily Rate ($) | RevPAR ($) |

|---|---|---|---|

| Hotel A | 75 | 150 | 112.5 |

| Hotel B | 60 | 130 | 78 |

| Hotel C | 80 | 180 | 144 |

The Strength Of Brand Equity

A hotel’s brand can carry immense weight. Strong brand equity means recognition, customer loyalty, and often allows for premium pricing. Brands can influence guest preferences and create a sense of trust. Top hotel brands have perfected their guest experience, and their name alone can command higher room rates. Brand analysis is non-negotiable in investment considerations.

Facts showing the power of brand equity:

- Recognition brings guests

- Loyal customers return and refer others

- A strong brand can charge more

Real-world data helps. Look for hotels under the same brand in different regions. Compare their financial performance. Any trends? These insights help predict how a similar hotel might perform in your chosen location.

Technological Advancements Shaping Investments

Hotel investment is changing fast. As investors, you need the best tools. This guide helps. It shows how tech changes the game. It makes your decisions smarter. Your guests happier. And your profits bigger.

Adopting Ai And Big Data In Investment Decisions

Investors are now using AI and Big Data. This combo is a powerhouse. It digs deep into market trends. Understands guest preferences. And even predicts future demand. All of this helps you choose hotels that will succeed.

- Predict market trends with precision

- Analyze guest behavior in seconds

- Get investment insights fast

Leveraging Technology For Enhanced Guest Experience

Tech makes guests smile. It adds convenience. Stress-free check-ins with digital keys. Personalized room settings. Smart tech uplevels the whole stay experience.

| Feature | Benefit |

|---|---|

| Mobile Check-In/Out | Saves time |

| Personalized Rooms | Makes guests feel at home |

| Smart Room Controls | Gives convenience |

Legal And Regulatory Considerations

Legal and regulatory considerations form the backbone of a successful hotel investment analysis. As an investor, it’s crucial to understand and navigate the intricate web of laws that govern property usage, development, and operations within the hospitality sector. These include zoning laws, land use regulations, and specific hospitality laws ensuring hotels operate smoothly while adhering to legal standards. Let’s explore these areas in detail.

Navigating Zoning And Land Use Regulations

Zoning and land use regulations determine how a property can be used. These codes vary widely by location and reflect a community’s planning objectives. Before investing in a hotel, you must ensure the property is zoned for hospitality use. Key zoning considerations include:

- Permitted uses: Verify that the land is zoned for a hotel.

- Building heights and setbacks: Check for restrictions on building size and placement.

- Parking requirements: Understand the mandated parking space allocation.

- Accessibility provisions: Ensure compliance with the Americans with Disabilities Act (ADA).

Failure to comply with these regulations may lead to legal complications. It’s advisable to consult local zoning boards or a land use attorney to guide you through the process.

Staying Compliant With Hospitality Laws

Hospitality laws cover a range of issues that affect daily hotel operations. Adhering to these laws ensures the safety, satisfaction, and rights of both guests and employees. Key hospitality laws include:

- Licensing: Hotels must have the correct licenses to operate legally.

- Health and safety: Comply with regulations that guarantee guest and staff wellbeing.

- Employee relations: Understand labor laws and employment standards.

Regularly updating compliance checklists and having legal counsel can mitigate risks. By staying current with legislation, hotel investors safeguard their investments from legal entanglements and penalties.

Frequently Asked Questions

What Is A Hotel Investment Analysis Template?

A Hotel Investment Analysis Template is a tool used by investors to assess the financial viability and potential returns of a hotel project. It incorporates variables such as revenue forecasts, operating costs, and cash flow projections to evaluate profitability.

How Does Hotel Investment Analysis Improve Decision-making?

By providing a detailed financial overview, a hotel investment analysis aids investors in making informed decisions. It evaluates risks, estimates returns, and compares potential outcomes, guiding investors towards wise investment choices.

What Key Metrics Are Included In Hotel Investment Analysis?

Hotel investment analysis typically includes metrics like occupancy rates, average daily rate (ADR), revenue per available room (RevPAR), cash flow, net present value (NPV), and internal rate of return (IRR) to determine profitability.

Can Hotel Investment Templates Predict Market Trends?

While templates cannot predict market trends, they can incorporate current data to forecast financial performance. Users should regularly update assumptions to reflect market changes for more accurate projections.

Conclusion

Mastering hotel investment analysis is crucial for any ambitious investor. With the template we’ve provided, you’re now equipped to make informed decisions. Take this guide, apply its principles, and stay ahead in the dynamic hospitality industry. Start analyzing, invest wisely, and watch your portfolio grow.