Optimize Your Strategy: A Deep Dive into Digital Marketing Agency Financial Statements

Understanding digital marketing agency financial statements is crucial for optimizing your strategy. They reveal insights into profitability, expense management, and investment potential.

Optimize your digital marketing strategy by diving deep into the financial statements of digital marketing agencies. These documents offer a goldmine of information, guiding agencies to make data-driven decisions. By analyzing metrics such as revenue streams, cost structure, and ROI, agencies gain the clarity needed to steer financial health and support sustained growth.

Crafting a strategy around such financial insights ensures smarter budget allocation, identification of profitable services, and effective management controls. In today’s competitive landscape, leveraging this financial data equips digital marketing agencies with the foresight to innovate and adapt in a rapidly evolving digital world.

The Heart Of Agency Financial Health

Peek behind the curtains of any successful digital marketing agency, and you’ll spot the robust core that holds everything together: financial health. Strong financial statements are crucial for steering an agency towards growth and stability. They paint a clear picture of financial performance and forecast potential for future endeavors.

Key Components Of Agency Financial Statements

A thorough understanding of these components is vital:

- Balance Sheet: Snapshot of assets, liabilities, and equity.

- Income Statement: Revenue, minus expenses, equals profit.

- Cash Flow Statement: Tracks cash in and out.

Revenue reveals the agency’s earning power. Expenses shine light on operational costs. Together, they determine Net Profit, the true measure of success.

Importance Of Regular Financial Analysis

Just like a health check-up, regular reviews of financial statements keep an agency fit. They help in:

- Spotting trends: Are sales climbing or slumping?

- Managing cash flow: Avoid financial droughts.

- Gauging profitability: Ensure the agency is on a profitable path.

Balanced books build the foundation for informed decisions and strategic planning. Without them, agencies navigate in the dark, risking unexpected setbacks.

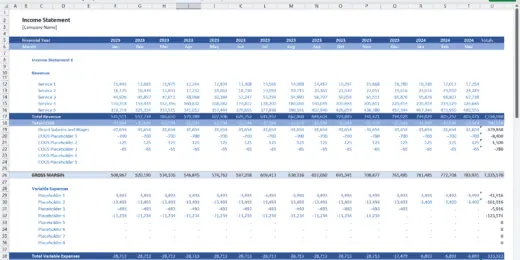

Income Statement Essentials

Understanding your digital marketing agency’s financial health is crucial. The income statement offers a clear view of financial performance. This vital document sheds light on earnings, expenses, and profitability. Now let’s delve into the essentials of the income statement.

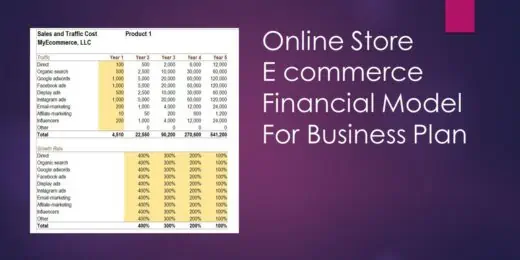

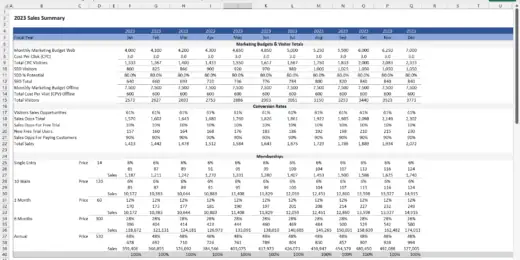

Breaking Down Revenue Streams

Digital marketing agencies have diverse sources of income. To gauge success, you need to dissect each revenue stream. This breakdown helps pinpoint profitable services and areas for growth. Let’s explore common revenue streams:

- Service Fees: Payments for SEO, PPC, social media management, and more.

- Project Work: One-off campaigns or website builds with defined start and end dates.

- Retainers: Ongoing services charged monthly or annually.

- Affiliate Income: Commissions from promoting other businesses’ products or services.

Understanding Costs And Expenses

Costs and expenses are the backbone of an agency’s outgoings. Managing them ensures sustainability. Here’s a list of typical agency expenses:

| Cost Type | Description |

|---|---|

| Direct Costs | Costs related to service delivery, like subcontractor fees. |

| Operational Expenses | Everyday running costs, including rent, utilities, and software subscriptions. |

| Marketing & Advertising | Investments in promoting the agency itself. |

| Salaries and Wages | Payments to employees and freelancers for their expertise. |

Interpreting Net Income

Net income is the final line on your income statement. It’s what’s left after subtracting expenses from revenues. It’s a clear indicator of your agency’s profitability.

Consider these points to understand net income better:

- Determine if the net income supports business growth.

- Compare it with previous periods to spot trends.

- Use it to make informed decisions about future investments or cost savings.

A positive net income suggests your agency is on the right track. On the other hand, a negative figure means it’s time to reassess your strategy.

Insight Into The Balance Sheet

Understanding a balance sheet is like peering through a window into the financial soul of a digital marketing agency.

It showcases what the agency controls, owes, and what’s left for the owners.

Assets: What The Agency Owns

Assets are everything the agency owns with value.

They help the agency create more riches. Let’s break them down.

- Current Assets: Cash, accounts receivable, and inventory.

- Fixed Assets: Equipment, software, and furniture.

- Intangible Assets: Brands, patents, and copyrights.

Liabilities: What The Agency Owes

Liabilities are what the agency must pay back.

Think of them as the opposite of assets.

- Current Liabilities: Bills, loans, and credit cards due soon.

- Long-Term Liabilities: Loans and obligations due later.

Agency Equity And Its Implications

Agency equity shows the owner’s share.

It’s what remains after liabilities are paid from assets.

This includes:

| Component | Definition |

|---|---|

| Retained Earnings | Profit kept in the agency. |

| Common Stock | The original investment by owners. |

Cash Flow Clarity

Understanding your digital marketing agency’s cash flow is vital. It helps you know where your money comes from and goes. We will look closely into cash flow statements. These statements show the health of your business finances.

Operating Activities: The Core Cash Movements

Cash inflows and outflows from everyday business activities are key for survival. They show how well your agency earns and spends on services.

- Money from clients for marketing services.

- Payments to employees and vendors.

- Interest received or paid.

- Tax payments.

A table can help us see this clearly:

| Activity | Cash Inflow (+) | Cash Outflow (-) |

|---|---|---|

| Services Rendered | $20,000 | |

| Employee Salaries | $10,000 | |

| Office Rent | $2,000 | |

| Advertising Spend | $5,000 |

Investing And Financing: Long-term Cash Flow Effects

Different from daily costs, these are investments or loans related movements. They have a long-term impact on your agency’s cash.

Investing activities might include:

- Buying equipment for new services.

- Selling old assets.

While financing activities might be about:

- Taking a bank loan for expansion.

- Issuing shares to investors.

Both these activities shape the future of your digital marketing agency. They may not happen often, but they are large and important. Agencies must plan for these cash flows to stay strong.

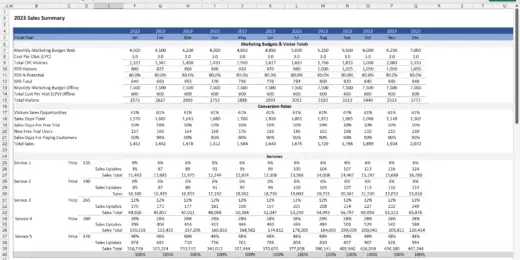

Profitability Metrics Unveiled

Digital marketing agencies need to keep a pulse on their profitability. It is vital for long-term success. Today, we’ll uncover the key metrics that break down financial health. You’ll learn how to measure and interpret these signals within an agency’s financial statements.

Gross Margin Relevance

Gross margin reflects the cost efficiency of your services. It shows the percentage of revenue that is not eaten up by the cost of goods sold (COGS). A higher gross margin suggests a more profitable agency. It allows more room for growth and investment.

Understand your gross margin by examining:

- Service pricing: Are you charging enough?

- Vendor costs: Can you reduce them?

- Efficiency: Are you optimizing time and resources?

EBITDA as a Performance Gauge

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It measures an agency’s operational performance. This metric strips away external factors. It helps you focus on the profitability of your core business activities.

Why is EBITDA important? It compares profitability without the noise of financial and accounting decisions. Companies with high EBITDA are often seen as more attractive. They are poised for growth and reinvestment.

Net Profit Margin and Agency Success

The net profit margin is the percentage of revenue left after all expenses. It includes COGS, operating expenses, interest, and taxes. It’s the ultimate indicator of an agency’s financial health.

A sound net profit margin means your agency is doing well. It suggests you can invest in new projects. It also reassures investors and stakeholders of your financial viability.

| Revenue | Total Expenses | Net Profit Margin |

|---|---|---|

| $500,000 | $450,000 | 10% |

Strategic Financial Planning

Strategic Financial Planning is the engine that drives a digital marketing agency’s success. This deep dive looks into how an agency can set strong foundations. Financial planning helps align marketing actions with business goals. Creating a plan ensures smart use of resources and solid investments. Let’s break down the pillars of this strategy.

Setting Financial Goals

Financial goals act as a roadmap for your agency. These goals define success and provide direction. Start with clear, measurable objectives. These may include increasing revenue, reducing costs, or growing market share. Set short-term and long-term goals for clear milestones. Goals should be Specific, Measurable, Achievable, Relevant, and Time-bound (SMART).

Budgeting For Marketing Initiatives

- Identify costs: List all potential expenses for upcoming campaigns.

- Allocate funds wisely: Divvy up your budget across various initiatives based on past performance and expected ROI.

- Monitor spend: Keep track of spending to avoid overruns and ensure you’re investing in the most effective channels.

Having a budget prevents overspending and under-investing. It guides decision-making and prioritizes high-impact activities.

Long-term Investment Strategies

Agencies need to think long-term to thrive. Invest in tools, technology, and talent that will pay off in the future. This includes:

- Software: Tools that improve efficiency or provide better insights into your campaigns.

- Training: Educating your team cultivates skills that boost your agency’s capabilities.

- Innovation: Allocate funds to experiment with new strategies that could lead to breakthroughs.

Return on Investment (ROI) should guide these decisions. Aim to strike a balance between current needs and future growth.

Identifying And Mitigating Financial Risks

Identifying and mitigating financial risks is crucial for the success and stability of digital marketing agencies. Unforeseen financial challenges can disrupt business operations. This section delves into common pitfalls and techniques to manage risks effectively. Understanding these concepts helps agencies remain robust in a competitive landscape.

Common Financial Pitfalls For Digital Agencies

- Erratic Cash Flow: Inconsistent revenue streams lead to cash flow problems.

- Client Dependence: Overreliance on a few clients can be risky.

- Improper Budgeting: Inadequate allocation of funds affects sustainability.

- Unchecked Expenses: Failure to monitor spendings can erode profits.

- Revenue Forecasting Errors: Inaccurate predictions can misguide decisions.

Risk Management Techniques

Deploying risk management techniques minimizes potential financial disturbances.

- Diversify Client Portfolio: Balance revenue by servicing various clients.

- Regular Financial Review: Conduct audits to spot irregularities early.

- Cash Flow Management: Keep a buffer fund for unforeseen expenses.

- Cost Control: Regularly compare costs to industry standards.

- Contingency Planning: Create strategies to handle unexpected events.

Agencies stay in control of their finances by adopting these techniques. Effective financial management ensures agencies thrive amidst uncertainties.

Harnessing Financial Statements For Growth

The backbone of every successful digital marketing agency lies in understanding and utilizing the gold mine of data within financial statements. It’s not just about the numbers but the story they tell about the business. Turning these pages filled with rows and columns into actionable insights is crucial for growth.

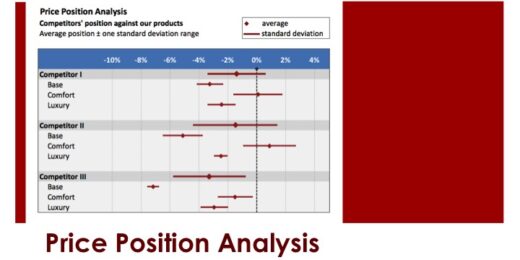

Performance Benchmarks And Competitor Analysis

Setting and comparing performance benchmarks provides a landscape view of an agency’s financial health. By dissecting income statements and balance sheets, agencies can assess profitability, liquidity, and solvency. These ratios stand as the first checkpoint for measuring up against competitors.

- Gross Margin: Indicates the efficiency in service delivery.

- Net Profit Margin: Reveals overall profitability.

- Current Ratio: Assesses the ability to cover short-term obligations.

Comparative analysis against competitors highlights opportunities for improving operational efficiency and market positioning.

Leveraging Financial Insights For Expansion

Financial insights are the compass for expansion. They pinpoint where investments yield the highest return. Reviewing cash flow statements sheds light on the capacity for investing in new markets or services.

| Financial Aspect | Influence on Expansion |

|---|---|

| Revenue Growth | Determines market demand and scalability. |

| Operating Expenses | Identifies cost-saving areas to reinvest. |

| Free Cash Flow | Assesses the ability to fund new projects. |

Financial projections also assist in setting realistic targets for growth while managing risk.

Incorporating Financial Data In Decision Making

Sound decision-making requires a foundation built on robust financial data. Key performance indicators from financial statements guide agencies in strategizing business moves. Return on investment (ROI) calculations for different marketing campaigns can steer budget allocations effectively towards higher returns.

- Identify performance trends over time.

- Evaluate marketing campaign ROI.

- Adjust strategies based on financial health indicators.

By consistently integrating financial data in decision-making processes, agencies ensure every choice is economically sound and aligned with their growth trajectory.

Frequently Asked Questions

What Are Digital Marketing Agency Financials?

Digital marketing agency financials refer to key financial documents. These documents show an agency’s financial health, including income statements, balance sheets, and cash flow statements. They are crucial for strategy optimization.

How To Analyze Marketing Agency Profit Margins?

To analyze profit margins, examine the income statement. Compare revenue against expenses to assess profitability. Agencies aim for higher margins, denoting efficient operations and strategic pricing.

Importance Of Cash Flow In Digital Marketing Agencies?

Cash flow is vital for agency operations and growth. It determines the agency’s ability to manage expenses, invest in new resources, and handle client projects without financial strain.

Can Client Acquisition Costs Affect Agency Finances?

Yes, client acquisition costs directly impact financial health. Lower acquisition costs can potentially increase profit margins, while higher costs might require strategy adjustments for sustainable growth.

Conclusion

Navigating the intricacies of digital marketing agency financials is pivotal. Your mastery in reading these statements can refine tactics, boosting growth and stability. Remember, clear insights lead to informed decisions, vital for thriving in the competitive digital landscape. Propel your agency forward with smart, data-driven strategies.

Stay curious, stay ahead.