10 Tips to Develop a First Class Business Valuation Report

A valuation report is a financial report determining the current (or projected) value of a business or asset (property, marketable securities, etc.) using the financial statements, assumptions, and various methods and approaches. It simply communicates how to value a business.

A business valuation report is not solely for business owners, investors, and potential buyers. A valuation report can also be used by lawyers for wills, estate, and litigation purposes. These can also be used by financial institutions such as banks to assess business loan applications. Also by regulatory agencies such as the collection of taxes and enforcement of tax laws and securities and exchange commission. Valuation in business is an important process; preparing and developing it can be complex.

Major Sections of a business valuation report

Not all business valuation reports are the same. A business valuation report can be prepared for different reasons; buying or selling a business, assess business performance, obtain bank financing, or simply just to understand what the business is worth. A valuation report can vary in length and complexity depending on the business being valued. Businesses do not sell a product or service that is one-size-fits-all, a successful company goes the extra mile to make their business ahead of their competitors. So the business valuation report is no exception; it should not be one-size-fits-all too.

However, a valuation report contains key information that must be present across varying businesses and industries. Before we learn how to develop a proper valuation report, we have to understand what is inside such report.

A valuation report sample below presents the major sections.

Valuation report summary/Introduction.

Basically, the who, what and why of the valuation. Decision-makers (unlike fiction readers) do not have to flip over many pages to get to the end and know the result. This section summarizes the objective and scope of the valuation including what is being valued (business, property, majority or minority stake, etc.), valuation method and approaches used, the standard and premise of value, the concluded business value, date of the business valuation report, etc.

Sources of information.

A section of the valuation report is devoted to the sources of information used to value the business. What sources were used (financial statement of the business, industry data, economic data, etc.) and who were the providers (business owners/management, 3rd party providers, etc.) are found in this section. This shows the end-users the type of information used and how the valuation is well-backed by empirical and reliable data.

Review of Economic Outlook that may affect the business.

This section presents the general state of the economy (macroeconomic view) and economic trends. Its key information includes GDP, Interest Rates, Commodity Prices, Exchange Rates, Fiscal and Monetary Policy, Demographics, Unemployment Rate and other key economic benchmarks relevant in how to value a business type.

A great example of reviewing the economic outlook is when experts forecasted that the USA Economic Outlook for the year 2019 – beyond will have steady growth according to the economic indicators. By considering such economic factors that will affect any business, the value of a business could fluctuate to high or low.

Review of Industry Outlook that may affect the business.

This section of the valuation report discusses in detail the industry characteristics the business belongs to. For example, key market players, market segments, cost structures, growth rates, etc.

Analysis of non-financial information.

A discussion on the business itself such as the nature, background, and history of the business, organizational structure and key management, its products and services, key customers and suppliers, etc. This section shows the non-financial information of the business that will help make the estimated value more meaningful.

Analysis of the Financial Statement and Adjustments.

This section delves into the past performance of the business as well as its forecasts and projections. Historical financial statements are adjusted or “normalized” to reflect the business’ true economic position by removing non-recurring or extraordinary events, discontinued operations, or other unusual items. Key financial ratios are also calculated to evaluate the business performance in relation to its past performance, peers, and industry.

Valuation Approaches and Methods.

This section of the business valuation report is critical as it describes the techniques used in estimating value. It discusses in detail the valuation methods used, the reasons these were considered, and the reasons why selected.

Conclusion of Value.

This section reconciles the values calculated by each of the valuations approaches considered and concludes on a single value or range of values to form an opinion of the business value. Some valuation reports place explicit weights on the value calculated by various valuation approaches. Usually, values determined by income and market-based approaches are consistent and are given full weight when higher compared to the adjusted net asset value. Regardless of the approach, the value should be well supported by the methods selected.

List of Assumptions and Limiting Conditions.

This section of the valuation report discloses the assumptions, limitations, parameters, and restrictions encountered in the valuation analysis that may have implications on the concluded value.

Exhibits and Appendices.

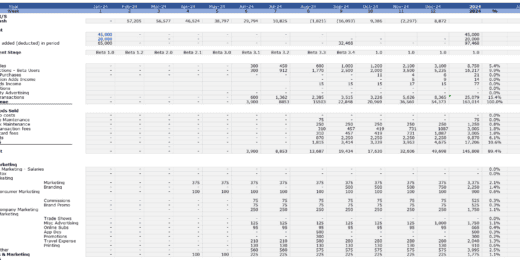

The last section of the valuation report presents the financial statements, calculations, 3rd party data and other information compiled to support the valuation.

Essentials of Developing a Business Valuation Report

A good valuation report is like a biography of the business. It presents the story of the business; its history, its strengths, and weaknesses, and importantly the business’s potential. A good business valuation report provides the user an independent, objective, and reliable estimate of the business value. The end-user of the valuation report should have a basic knowledge of the business, understands the valuation process (follows how and why the valuation was reached), and sees how the value makes sense, even if he disagrees with it.

Here are the essentials for developing a proper business valuation report.

- Avoid typographical errors in both words and numbers.

- This may be trivial but this is the most common error in any report. A misplaced or missing apostrophe and misspelled words (companies vs. company’s, their vs. there) are easily overlooked but are the easiest ways of reducing the report’s credibility. These errors are simply eliminated by taking the time to proofread the report.

- Also, typographical errors in numbers can be a big mistake. An erroneous additional zero in a department’s total expense can spell lower profits, over budget and poor performance. The former photo industry giant Kodak restated a quarterly earnings report and added $9million to its losses just because there was one incorrect zero added.

- Refrain from stating unquantifiable statements.

- Stating the company’s management is “capable” or “competent” can be expressed better by a detailed presentation of the management team’s educational background, employment history, experience, and expertise.

- It is best to present numerical values for growth, variances, etc. in amount or percent rather than stating in the valuation report the business and industry is experiencing “strong” or “robust” growth or the company’s bottom line has improved “significantly” or “deteriorated”.

- Set your sight on Relevant Information only.

- If you are valuing a small business up for sale with customers and suppliers located in the immediate area, then the country’s bond rating or where the Russell 2000 Index is projected to be in the quarter or so may not be important pieces of information. Likewise, if you are preparing a business valuation report for a microchip technology distributor whose only customers are automakers, then a discussion and analysis of the automobile industry may be more relevant than the microchip industry.

- Curb your enthusiasm and avoid making overly optimistic forecasts.

- Revenue can be considered as one the most important part of valuation since all business, regardless of its size, starts with revenue. If the revenue forecast for the valuation report is wrong (too optimistic) then the determined value for the business will be wrong too. Understanding the business’ products and services, branding, marketing, sales cycle, delivery, and after-sales service are key areas to look into to grasp the company’s growth potential. When doing a valuation report, sample questions like below can be helpful:

- Does the company have a growth plan? What are the strategies?

- Is their market share lagging, growing or slowing down?

- What are the products or services’ growth constraints?

- Did the management conduct a market analysis? Does management have a strong understanding of the competitive landscape, trends, etc.?

- Revenue can be considered as one the most important part of valuation since all business, regardless of its size, starts with revenue. If the revenue forecast for the valuation report is wrong (too optimistic) then the determined value for the business will be wrong too. Understanding the business’ products and services, branding, marketing, sales cycle, delivery, and after-sales service are key areas to look into to grasp the company’s growth potential. When doing a valuation report, sample questions like below can be helpful:

- Stick to the correct Standard and Premise of Value.

- The results of a business valuation report can vary considerably depending on the selected standard and premise of value.

- A standard of value is the measurement of how to value a business. Fair market value, fair value, intrinsic value, investment value, and strategic value all have different meanings. The selected standard of value also helps identify whether discounts and premiums are applicable to the business.

- The premise (basis) of value relates to the assumptions and projections made in the valuation report. Is the value determined to assume the business will continue operating (going concern) or does it assume it is for sale (liquidation)?

- Avoid Common Errors in the Valuation Approaches.

- The unsupportable or unrealistic discount rate has a material impact on how to value a business. Top 10 Mistakes in DCF Valuation Models

- Failing to identify all of the assets of the business, both tangible and intangible, when using the Asset Approach.

- Considering precedent transactions occurring after the valuation date when using the Market Approach. Or using too few and too many comparable public companies. Valuation with Multiples: Basics of Enterprise Value Multiples and Equity Multiples in Comparable Analysis.

- Depending on the type of business and the circumstances, the valuation report may apply one, two or all three approaches, a proper report should explain the selection process and why certain valuation methods were considered and rejected.

- Ensure relevant tax implications have been properly considered.

- A proper valuation report must see to it the value calculated incorporates the relevant income tax treatment.

- For example, a valuation report for a real estate holding business, which is driven by the underlying value of its properties (assets), income tax considerations must be analyzed to form part of the value conclusion report.

- The after-tax discount rate applied to pre-tax income results in a significant misstatement in the valuation analysis.

- Assess the appropriateness of valuation discounts and control premium applied.

- Premium and discounts affect the value of a business, evaluate the “level” of value determined by the valuation methods and approaches. A minority interest valuation is quite different from a controlling interest valuation.

- Using a lack of control discount on the income approach when a non-controlling cash flow stream was already used to calculate the value will undervalue the business. This is important when you are developing a business valuation report for a private business. What you need to know about Private Company Valuation

- Always investigate mathematical errors in the spreadsheet.

- Mathematical errors have a big impact on the valuation report. A simple error, like a missing parenthesis in a formula, that occurred early on in the analysis can affect assumptions made. A mistake on the number’s positive and negative signs can mean differentiating gains and losses. Imagine treating a loss as gain! It will be equivalent to overestimating earnings and causing the results of the business valuation report to be grossly overvalued.

- Don’t get lost in translation, interpreting the valuation conclusion

- Confusing Value vs. Price. Value is dependent on a set of assumptions and forecasts, normally it will have different values for buyers as well as for sellers. We can say that value is relative. A $1 million company value calculated in a spreadsheet might be lower or higher for a potential buyer. This is especially true of a strategic buyer, strategic value and fair market value are different. The strategic value of business contains an extra value, normally due to synergies, the buyer believes he can get from the business on top what might be considered “normal” for other buyers. Understanding Valuation vs Pricing: Weighing Value vs Price can make a BIG difference

Double-check and when in doubt, get a professional opinion

Financial accounting and analysis are areas in Finance that rely on and benefit from Excel spreadsheets. There are numerous resources for valuation report samples and business valuation templates available. Preparing a valuation report is a complex process with large stakes involved.

If you notice one or more errors and shortcomings from reading the 10 Tips then double-check your analysis and consider getting a second opinion. There are many professionals and organizations whose sole focus is to prepare business valuation reports. Seek professionals who are independent and certified (credentials) such as Chartered Business Valuator (CBV) professionals in Canada and Accredited in Business Valuation credential granted exclusively by the American Institute of CPAs (AICPA). Don’t let a flawed business valuation report lead to unsound business decisions.

Commercial Real Estate Valuation Model Template

A commercial real estate valuation model template assists in running…

Feel free to download these valuation model templates to help you build a valuation report model on your own.