Financial Modelling PDF Examples

eFinancialModels provides a wide range of Financial Modelling PDF Examples which show you how to build a financial model and how to structure a model. Going through the Financial Modelling PDF examples, can give you an idea how a model is built and can also be an excellent way to learn more about financial modelling.

Download FREE Financial Modelling PDF Examples showing financial model templates for topics such as Company Valuations, M&A, Capital Raising, Budgeting and Forecasting, Financial Planning, Scenario and Sensitivity Analysis, Breakeven Analysis and more.

See our list of FREE PDF Financial Modelling Resources available for download.

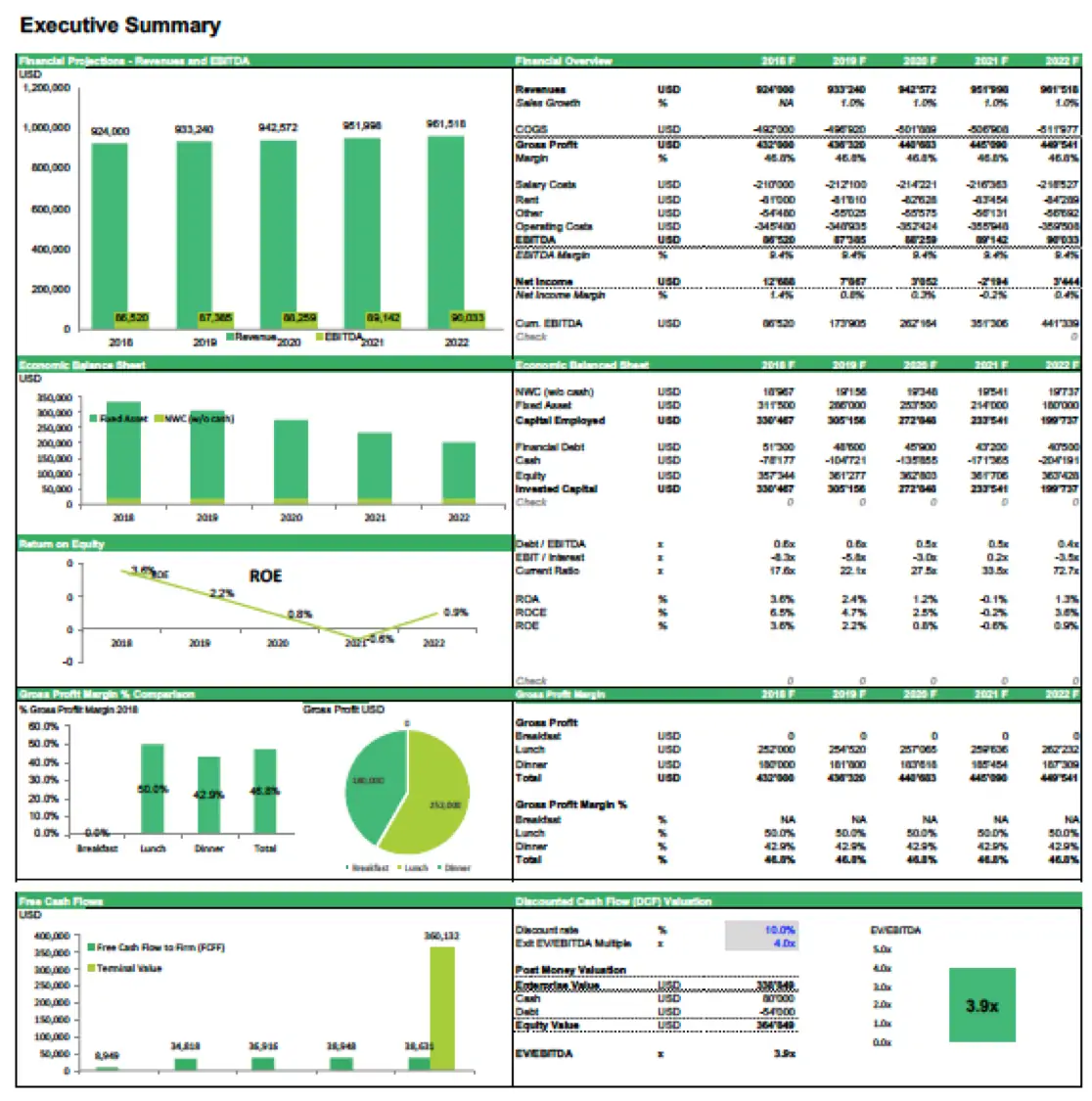

(1) Restaurant Valuation Model

This file contains a financial modelling example with the objective to value a restaurant via the Discounted Cash Flow (DCF) Valuation Method. This Excel Model forecasts the expected free cash flows of a restaurant and performs a Discounted Cash Flow Valuation to calculate their Net Present Value today. Download the PDF Example or the Excel model.

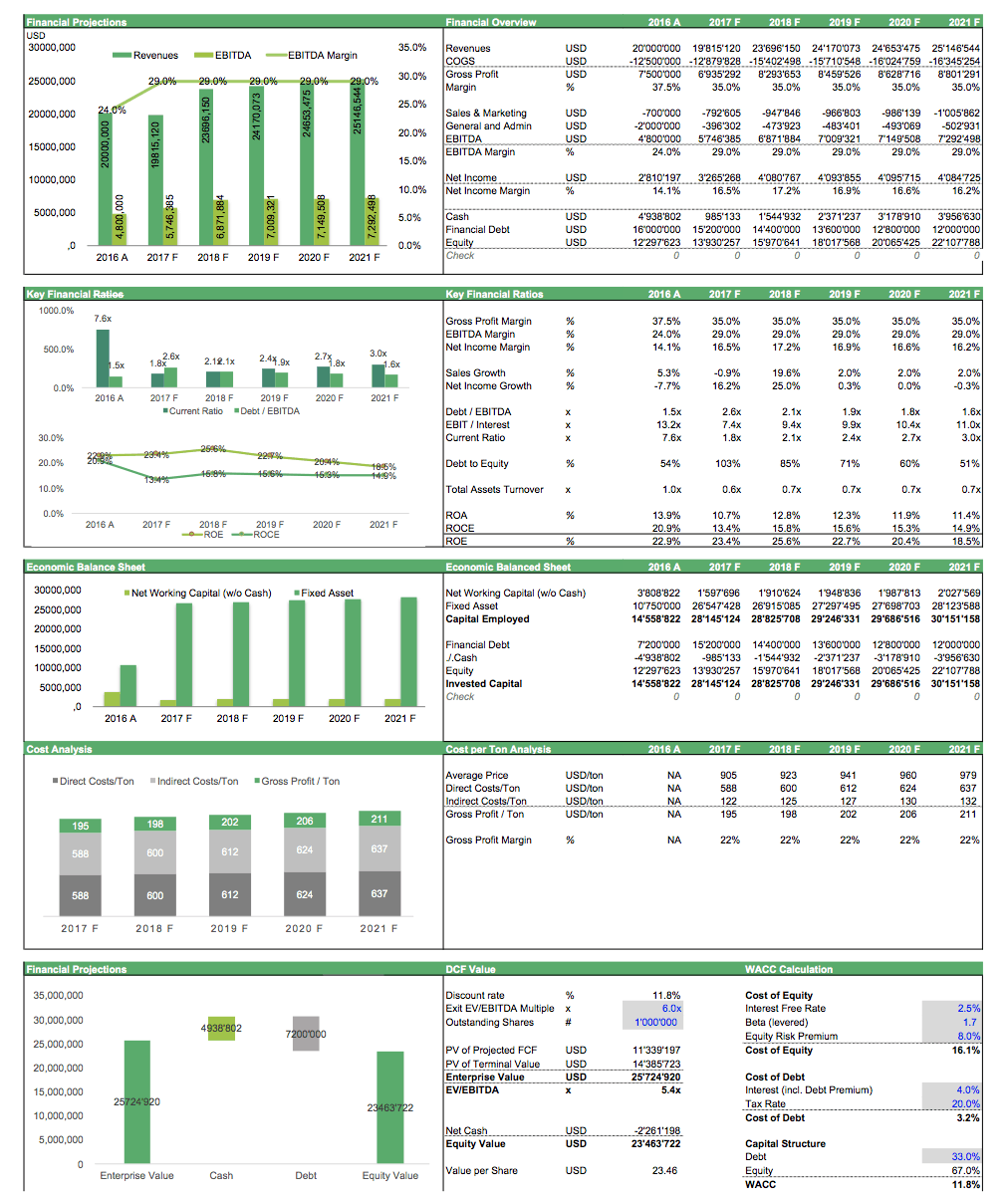

(2) Financial Modelling for a Manufacturing Company

This financial model forecasts the operations and builds the financial projections for a manufacturing company. See the PDF Financial Model Demo for more information.

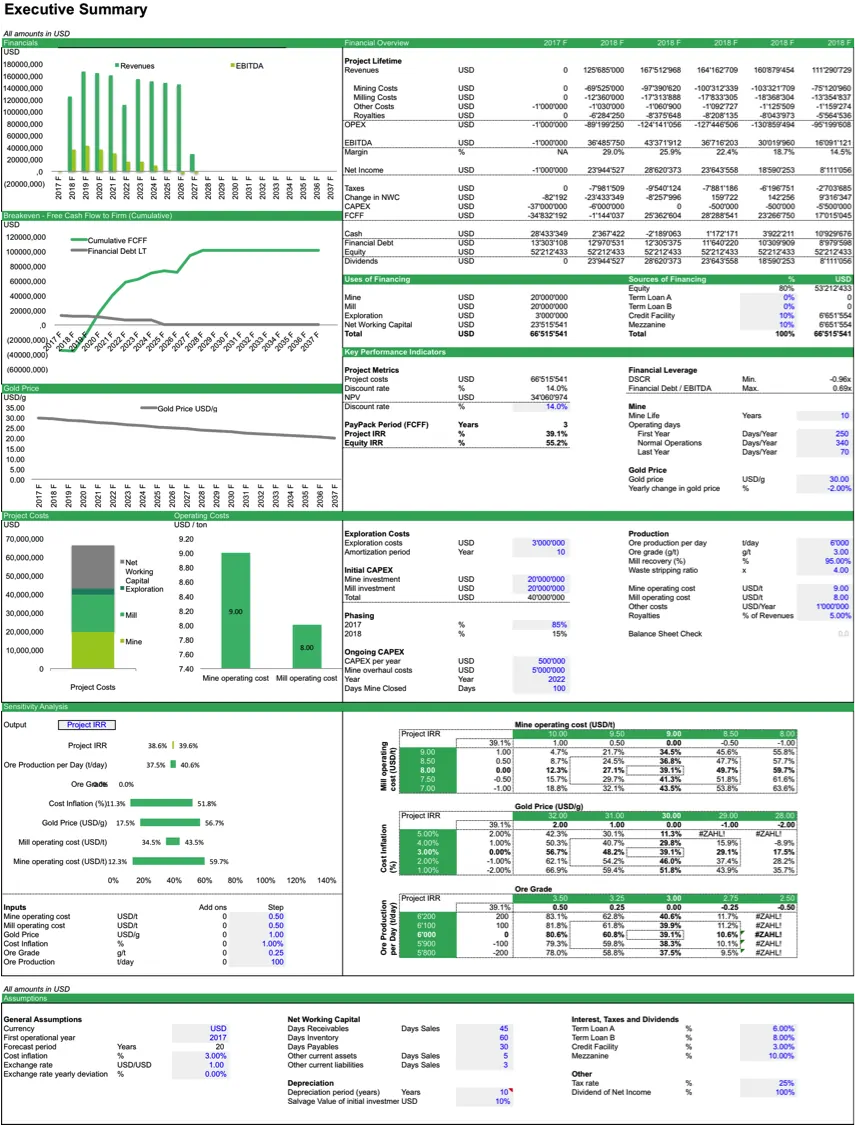

(3) Financial Model for a Gold Mine

This financial model focused on the IRRs when investing in a Gold Mine. You will have to estimate the yearly volumes of ore processed and its metal content. Based on the installed capacity, you can forecast the expected gold output, forecast gold price and forecast the expected costs during the mine’s life. The model results in Project and Equity IRRs. A FREE PDF Financial Modelling example is available for download.

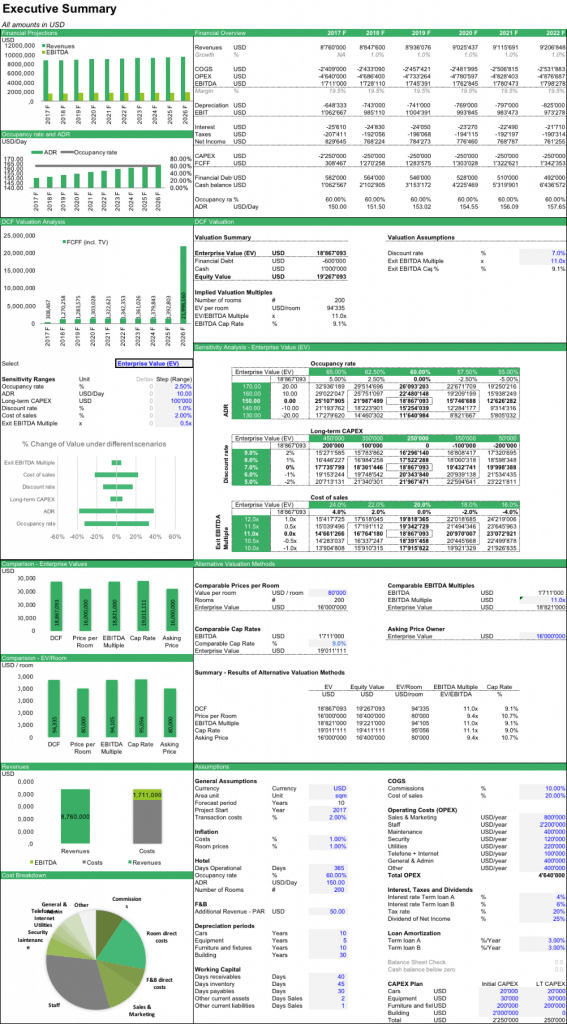

(4) Financial Modelling for a Hotel

A financial model for a hotel valuation uses the Discounted Cash Flow (DCF) Valuation method to calculate the Net Present Value (NPV) of the hotel’s free cash flows in the future. A FREE PDF Financial Modeling example shows you how.

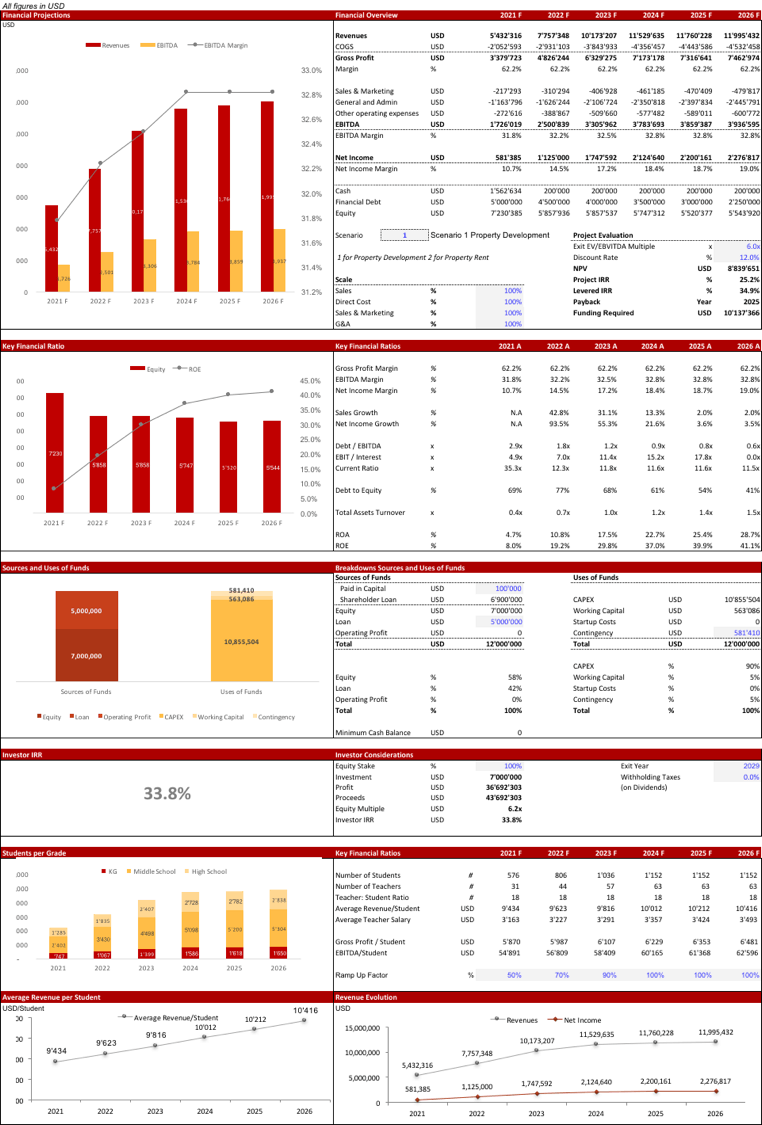

(5) Financial Model for a Private School Startup Project

A financial model for a private school startup will project expected number of students, classes and teachers over the next years. Based on the expected growth scenario, the models builds the expected cash flows. The PDF Financial Model Version will show you how.

Beverage Manufacturing Startup Financial Model

The Beverage Manufacturing Startup Financial Model Template assists founders of…

Manufacturing Company Financial Model

The Manufacturing Financial Model provides a framework to accurately forecast…

Financial Model for Mobile App | Mobile App Business Plan

The Mobile App Financial Plan Template in Excel allows you…