A Comprehensive Guide to Excelling in Basis Points Meaning

Understanding basis points meaning is critical for excelling in financial analysis. A basis point, or bps, is equal to one-hundredth of a percentage point.

It’s often used to describe changes in interest rates, bond yields, or credit spreads. Excelling in this area involves mastering the concept of basis points, knowing how to apply it to different financial metrics, and utilizing it effectively in decision-making.

This comprehensive guide will delve into the intricacies of basis points, providing you with the knowledge and skills necessary to excel in this fundamental aspect of financial analysis. Whether you’re a seasoned professional or just starting in the finance industry, this guide will equip you with the expertise needed to navigate the world of basis points with confidence and precision.

What Are Basis Points?

Basis points (bps) are a unit of measure used in finance to describe the percentage change in a financial instrument, such as interest rates or bond yields. They are commonly used to compare different rates or yields on a consistent basis.

How Basis Points Are Calculated

To calculate basis points, you take the difference between two interest rates or yields and multiply it by 100. For example, if the yield on a bond increases from 2.5% to 3%, the change is 0.5%, or 50 basis points (3% – 2.5% = 0.5% x 100 = 50 bps).

Another way to think about basis points is that they are equal to 0.01%, so 100 basis points is equal to 1%. This calculation allows for a standardized way to quantify changes in interest rates or yields across different financial instruments.

Why Are Basis Points Important?

Understanding basis points is crucial as they measure small percentage changes in interest rates or financial instruments. Excelling in this concept is key for making informed decisions in finance and investments, driving strategic growth and maximizing profitability. Mastering basis points meaning is essential in navigating the complex world of financial markets.

Basis Points play a crucial role in financial analysis and interest rate calculations, making them essential in the world of finance.

Role In Financial Analysis

In financial analysis, Basis Points provide a precise measure to compare and analyze different financial instruments.

- Help in evaluating investment returns

- Facilitate risk assessment and performance evaluation

Use In Interest Rate Calculations

Basis Points are widely utilized in calculating interest rates due to their accuracy and sensitivity.

- Enable precise measurement of interest rate changes

- Critical in determining loan rates and investment yields

Understanding Basis Points In Different Markets

Basis points are a crucial metric in various financial sectors, including bonds, loans, and investments. This comprehensive guide sheds light on the significance of basis points and offers valuable insights to excel in understanding their implications across different markets. Understanding the concept of basis points provides a competitive edge in financial decision-making and analysis.

Equity Markets

Equity markets play a crucial role in the world of finance, and understanding basis points in this context is essential for making informed investment decisions. Basis points, denoted as bps, are commonly used to measure small percentage changes in financial instruments, making them particularly relevant in equity markets. For example, a movement of 100 bps signifies a 1% change. By comprehending basis points in equity markets, investors can assess the potential returns and risks associated with their investments.

In equity markets, basis points are commonly used in various scenarios:

1. Benchmarking Performance: Investors often compare the performance of their portfolios or specific stocks against a benchmark index, such as the S&P 500. Basis points provide a precise metric to measure the deviation from the benchmark. For instance, if a portfolio outperforms the benchmark by 300 bps, it indicates a 3% higher return.

2. Transaction Costs: Understanding basis points is vital when considering transaction costs in equity markets. These costs, often charged as a percentage of the transaction value, can significantly impact the overall profitability of trades. By calculating the basis point cost of transactions, investors can assess their impact on returns.

3. Price Movement Evaluation: Analyzing price movements in equity markets using basis points helps investors gauge market volatility. A higher number of basis points over a specific time frame implies greater price fluctuations and potentially higher risks. This information assists in making decisions regarding trade entry and exit points.

Fixed Income Markets

In the fixed income market, where bonds and other debt instruments are traded, basis points are equally important. As the name suggests, fixed income instruments provide investors with a predetermined income stream (fixed interest payments) over a specified period. Understanding basis points in this context helps investors assess interest rate changes and evaluate the associated risk and return trade-offs.

Here’s how basis points apply to fixed income markets:

1. Yield Evaluations: Fixed income instruments have a yield, which represents the annual return on investment as a percentage of the bond’s price. Basis points help evaluate changes in yields with respect to prevailing interest rates. For example, a bond yield increasing by 50 bps indicates a 0.5% rise in its return.

2. Duration Management: Duration is a measure of a bond’s sensitivity to changes in interest rates. A bond with a longer duration will experience a greater price change for a given basis point shift. Understanding basis points facilitates effective duration management, helping investors navigate interest rate fluctuations.

3. Spread Analysis: Basis points are commonly used to analyze yield spreads between different fixed income instruments. By comparing the yield difference between two bonds in basis points, investors can identify potential opportunities or risks. For example, a corporate bond offering a 200 bps higher yield than a government bond suggests a higher risk premium.

Foreign Exchange Markets

Basis points also play a crucial role in foreign exchange (forex) markets, where currencies are traded. Understanding basis points in this context is instrumental in assessing the cost of currency transactions, evaluating exchange rate changes, and managing currency risk.

Consider the following scenarios in forex markets:

1. Exchange Rate Evaluation: Basis points help evaluate changes in exchange rates between currencies. For example, a currency pair’s exchange rate increasing by 150 bps implies the base currency has gained 1.5% relative to the quote currency.

2. Interest Rate Parity: Basis points aid in analyzing interest rate differentials between countries, which affect forex markets. A higher interest rate in one country compared to another may lead to a stronger currency. By monitoring basis points related to interest rate differentials, investors can make informed decisions in forex trading.

3. Transaction Costs: When engaging in forex trading, investors need to consider transaction costs, including spreads or commissions charged by brokers. Calculating these costs in basis points allows for efficient evaluation and comparison across different currency pairs and brokers.

In conclusion, understanding basis points is crucial across various markets, including equity, fixed income, and foreign exchange. By grasping the concept of basis points in different contexts, investors can navigate market dynamics, evaluate risks and returns, and make informed investment decisions.

Strategies For Excelling In Basis Points

Risk Management

Risk management is a critical component in excelling in basis points. Implementing robust risk management protocols allows traders to mitigate potential losses and protect investments. By diversifying portfolios, setting stop-loss orders, and staying informed about market trends, traders can effectively manage their exposure to risk and increase the likelihood of positive returns.

Optimizing Trading Spreads

Optimizing trading spreads is essential for maximizing profitability in basis point trading. By employing tactics to narrow spreads, such as utilizing limit orders and closely monitoring price movements, traders can reduce costs associated with trades and enhance overall performance. Additionally, leveraging advanced trading platforms and algorithms can aid in optimizing trading spreads to capitalize on small price differentials.

Common Pitfalls To Avoid With Basis Points

When it comes to maximizing your performance with basis points, it’s crucial to steer clear of common pitfalls that can hinder your success. By being aware of these potential stumbling blocks, you can take proactive steps to avoid them, safeguarding your financial strategy.

Neglecting Market Volatility

Market volatility is a critical factor that can directly impact basis points. Neglecting to consider the potential fluctuations in the market can lead to miscalculations and suboptimal decision-making. Whether it’s a sudden economic shift or geopolitical events, staying informed about market volatility is essential for accurately assessing the significance of basis points within the broader financial landscape. By maintaining vigilance over market conditions, you can ensure that basis points are interpreted within the appropriate context, empowering you to make well-informed choices.

Misjudging Basis Point Impact

It’s easy to misjudge the true impact of basis points, especially when dealing with complex financial transactions. Failing to grasp the full extent of basis point fluctuations can result in erroneous evaluations and potentially adverse outcomes. Whether you’re dealing with investment returns or interest rates, a comprehensive understanding of how basis points can affect these variables is crucial. Avoiding the common error of underestimating the significance of even a single basis point can help you make more precise financial decisions and capitalize on opportunities for growth.

Tools And Techniques For Analyzing Basis Points

Uncover the secrets of excelling in basis points analysis with this comprehensive guide. Learn the tools and techniques necessary for accurate and insightful analysis, paving the way for success in understanding and utilizing basis points effectively.

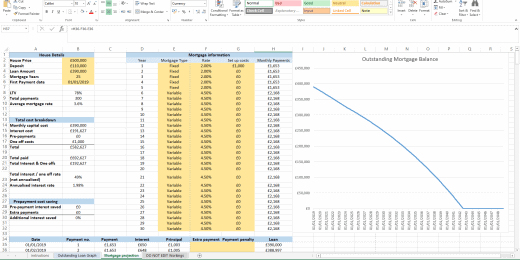

When it comes to understanding and analyzing basis points, it is crucial to have the right tools and techniques at your disposal. These tools and techniques not only simplify the process but also provide accurate and reliable data to make informed decisions. In this section, we will explore two essential tools – basis point calculators and basis point charts – that can help you excel in analyzing basis points.

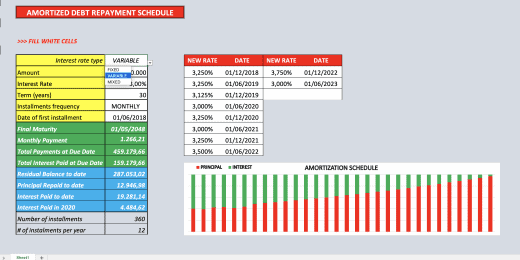

Basis Point Calculators

Basis point calculators are invaluable tools for quickly and accurately calculating basis points. These calculators save you time and effort by eliminating the need for manual calculations. With just a few inputs, you can effortlessly determine the basis points and gain valuable insights into your investment or financial data.

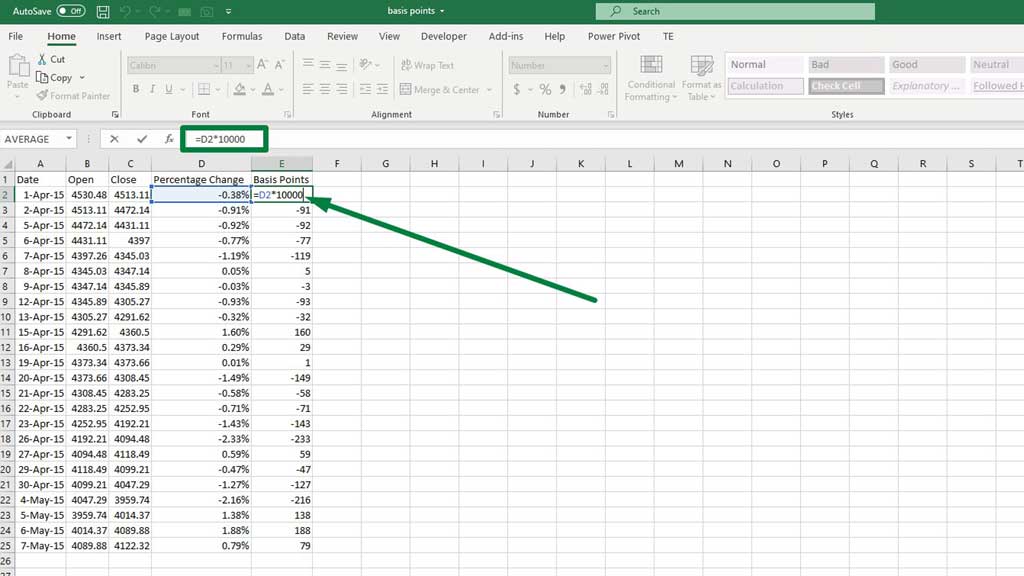

These calculators work by taking the difference between two numbers, such as yields or interest rates, and converting it into basis points. They provide a concise representation of the percentage change in financial indicators, allowing you to compare different scenarios or assess the impact of market fluctuations.

Basis point calculators are user-friendly, making them accessible to individuals with various levels of financial expertise. Whether you are a seasoned investor or a beginner in the world of finance, these calculators will streamline your analysis process.

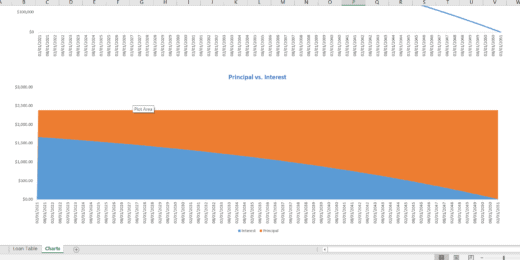

Basis Point Charts

Basis point charts provide a visual representation of basis point movements over time. These charts are essential for spotting trends and patterns, enabling you to make data-driven decisions. By plotting basis point data on a chart, you can easily identify fluctuations, outliers, and potential correlations.

With basis point charts, you can track the performance of various financial instruments, such as stocks, bonds, or currencies, and observe how basis points impact their value. These visuals simplify complex data sets, making it easier to communicate insights and share information with colleagues or clients.

Additionally, basis point charts are customizable, allowing you to choose the time period, frequency, and data points to include. This flexibility enables you to focus on the specific aspects that are most relevant to your analysis, saving you time and enhancing the clarity of your findings.

In conclusion, using basis point calculators and basis point charts is essential for analyzing basis points effectively. These tools provide accurate calculations and visual representations that simplify complex financial data. By utilizing these tools, you can gain a deeper understanding of basis points and make informed decisions in your investment strategies.

Real-world Examples Of Basis Point Analysis

Explore real-world examples of basis point analysis to master the intricacies of this crucial financial metric. Delve into a detailed guide on understanding basis points meaning to enhance your proficiency in financial analysis techniques. Gain valuable insights on how basis point analysis can elevate your financial decision-making prowess.

Case Study 1: Impact of Basis Points on Bond Yield

In this case study, we will examine how a variation in basis points can impact the yield of a bond. By analyzing a bond investment with a 100 basis point increase, we can see how this change affects the overall return.

Suppose an investor holds a bond with a 2% yield and the interest rates increase by 100 basis points. The new yield would then be 3%. This shows that even a small change in basis points can have a significant impact on the investment return.

Case Study 2: Evaluating Trading Strategies

In this case study, we will explore how basis points play a crucial role in evaluating trading strategies. By comparing the performance of different strategies based on basis point analysis, traders can identify the most effective approach.

For example, let’s consider two trading strategies with varying returns of 150 and 200 basis points respectively. By examining these results, traders can determine which strategy outperforms the other and make informed decisions based on this analysis.

Overall, these real-world examples highlight the importance of basis point analysis in understanding the financial implications of changes in interest rates and investment decisions.

Frequently Asked Questions

What Are Basis Points And How Are They Calculated?

Basis points, often denoted as “bps,” represent a unit of measure used in finance to describe the percentage change in a financial instrument. They are calculated as one-hundredth of a percentage point, providing a precise way to compare changes in interest rates or financial indices.

Why Are Basis Points Important In Financial Analysis?

Basis points play a critical role in financial analysis by allowing for precise comparison of interest rates, bond yields, and other financial metrics. They provide a standardized and easily understandable way to measure and communicate changes in financial values, aiding in informed decision-making and analysis.

How Can Businesses Leverage Basis Points To Optimize Financial Performance?

Businesses can utilize basis points to assess the impact of interest rate changes on their borrowing costs, evaluate investment returns, and develop pricing strategies. By understanding and effectively utilizing basis points, businesses can make informed financial decisions to enhance their overall performance and profitability.

Conclusion

To excel in basis points meaning, it is crucial to understand its significance and implementation. By utilizing these strategies, such as conducting thorough research, analyzing data, and evaluating market trends, one can confidently navigate the complexities of basis points. Additionally, staying updated with industry developments and continuously refining your knowledge will enable you to make informed decisions.

Remember, a strong foundation in basis points will empower you to achieve success in various financial endeavors. Start applying these insights today and watch your understanding and expertise flourish.