18 Different Types of Budgeting and 5 Major Classifications of Budgets

Table of Content

- Corporate Budget – 18 Types of Budgets for Corporate Use

- 1. Master budget

- 2. Operating Budget

- 3. Financial Budget

- 4. Static (fixed) Budget

- 5. Flexible (expense) Budget

- 6. Capital Expenditure Budget

- 7. Program Budget

- 8. Incremental Budget

- 9. Add-on Budget

- 10. Supplemental Budget

- 11. Bracket Budget

- 12. Stretch Budget

- 13. Strategic Budget

- 14. Activity-based Budget

- 15. Target Budget

- 16. Rolling (continuous) Budget

- 17. Probabilistic Budget

- 18. Zero base Budget

- Personal Budget – Concepts of Personal Budgeting

Budgeting is known as the process of preparing a budget that presents the financial income and expenses for a certain period. The budget will then serve as a tool to help estimate future cash flows as well as to help with managing the resources. Basically, it is the process of preparing, implementing, and then operating the budget. Yet, there are different types of budgets.

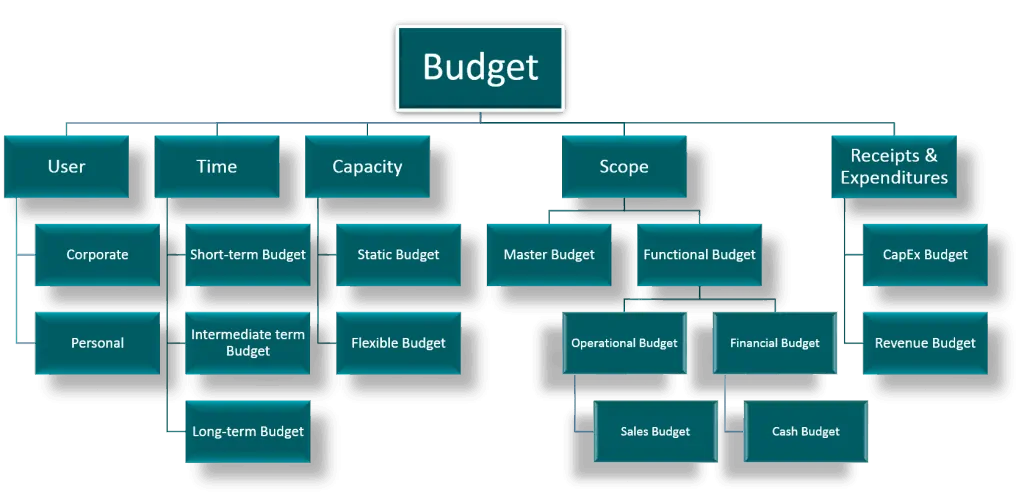

There are five major classifications of budgets, such as:

- Based on Users – A budget created according to the user or use namely the Corporate Budget (business budget) and a Personal Budget (individual budget).

- Based on Time – A budget created for a designated time period which is also called the Budgeting Period (short-term, intermediate-term, long-term).

- Based on Capacity – A budget created according to the capacity of resources namely the Static Budget and a Flexible Budget.

- Based on Scope – A budget created according to the scope or range that is covered by the budget plan such as, Functional Budget and the Master Budget.

- Based on Receipts and Expenditures – A budget that covers all the revenues and expenses such as the Capital Expenditures Budget and Revenue Budget.

Types of Budgeting According to Classifications

There are two main different types of budgeting according to user, one for corporate users (Corporate Budget) and the other is for personal financing (Personal Budget). Though in essence, both functions the same when it comes to tracking the financials and allocating resources, a corporate budget is much more comprehensive which requires different types of budgeting compiled and structured in a logical system.

Corporate Budget – 18 Types of Budgets for Corporate Use

It is undeniable that a budget is a critical factor when running any kind of business efficiently and effectively. Therefore, to ensure such a case, budgeting is very useful for evaluating the business as well as determining the best course of action among various alternatives through simulation. And that is why there are several types of budgets created according to the factors being considered.

The following are the 18 different types of budgets that are often conducted for business use.

1. Master budget

A master budget is the overall financial and operating plan for a period of time in the future. It is usually prepared every year or quarterly. Basically, it is a collection of sub-budgets tied together to summarize the planned activities of the business. Or in simpler terms, the formal statement of the management’s expectation regarding the sales, expenses, volume, and other financial transactions of the business for the coming period.

A master budget consists of several budgets grouped together to form a flow. As an example, below illustration shows a comprehensive master budget of a manufacturing company:

2. Operating Budget

The operating budget is created to reflect the results of operating decisions, which deals mostly with the costs for merchandise or services produced. It covers the income statement and is essential to see the business’ financial health.

The operating budget consists of several types of budgets such as:

Sales Budget – The starting point in preparing a master budget since the estimated sales volume affects nearly all other components appearing throughout the master budget. It should show that total sales in quantity and value e.g. break-even or projected sales. The sales budget also includes the computation of the expected cash collections from credit sales used for cash budgeting later on.

Production Budget – This is only determined right after the sales are budgeted. The production budget is a statement of the output by product and is commonly expressed in units. It considers the sales budget greatly as well as the plant capacity. Basically, the expected number of units is set forth in the production budget to meet the budgeted sales and inventory requirements.

This can be computed as follows: Expected Production Volume = Planned Sales + Desired Ending Inventory – Beginning Inventory.

Merchandise Purchase Budget – (for merchandising, retailing, or wholesaling firms) This type of budget is developed instead of a production budget which is mostly catered for a manufacturing plant. The merchandise purchase budget has the same format as a production budget except it shows the number of goods to be purchased from its suppliers during the period. In simpler terms, it shows the goods to be purchased rather than the goods to be produced.

This can be computed as follows: Required Purchases = Budgeted Cost of Goods Sold + Desired Ending Inventory – Beginning Merchandise Inventory.

Direct Materials Budget – Right after the production budget is computed, this type of budget is then constructed to show how much material will be needed for production and must be purchased to meet the production needs. It is often accompanied by a computation of expected cash payments for the materials.

This is best computed as follows: Purchase in Units = Usage + Desired Ending Material Inventory Units – Beginning Inventory Units.

Direct Labor Budget – The construction of a production budget is needed before this type of budget can be set forth. However, this can be computed alongside the direct materials budget as well as the factory overhead budget. To compute the direct labor budget, the expected production volume each period is multiplied by the number of direct labor hours required to produce a single unit. The direct labor hours to meet production requirements are then multiplied by the (standard) direct labor cost per hour to obtain budgeted total direct labor costs.

This is best computed as follows:

Total Hours = Units to be Produced (in units) x Direct Labor hours per unit

Total Direct Labor Cost = Total Hours x Direct Labor Cost per hour

Where: Both Direct Labor hours per unit and Direct Labor cost per hour are critical data needed to compute the Direct Labor Budget.

Factory Overhead Budget – This type of budget is very important for the direct materials and direct labor budget since it provides a schedule of all manufacturing costs. Basically, it shows all the planned manufacturing costs needed to produce the budgeting production level of a period other than the labor and materials costs. Therefore, the factory overhead budget shows how much it costs to run a manufacturing facility.

It can be calculated as follows:

Variable Overhead Budgeted = Budgeted Direct Labor Hours x Variable Overhead Rate

Total Budgeted Overhead = Variable Overhead Budgeted + Fixed Overhead Budgeted

Cash Disbursements for Factory Overhead = Total Budgeted Overhead – Depreciation

It is important to take note that depreciation does not mean that there will be a cash outlay, therefore, you must deduct it from the total factory overhead to finally compute the cash disbursement for factory overhead.

Ending Finished Goods Inventory Budget – This type of budget provides the data required for the construction of the budgeted financial statements. Basically, it is calculated to determine the cost of the finished goods inventory at the end of each budget period to provide the amount of the inventory asset that appears in the budgeted balance sheet. It is important to update on a regular basis especially for cases where a company needs to closely monitor its cash balances on an ongoing basis.

The ending finished goods inventory budget consists of the three main costs: direct materials, direct labor, and factory overhead cost. To help you get an idea about the Ending finished goods inventory cost calculation, see below:

Total Cost per Unit = Direct Materials Cost + Direct Labor Cost + Manufacturing Overhead Cost

Ending Finished Goods Inventory = Ending Finished Goods Units x Total Cost per Unit

Selling and Administrative Expense Budget – This type of budget shows a list of operating expenses involved in the selling of products and managing the business. If the factory overhead budget shows the schedule of all manufacturing costs, the selling & admin expense budget shows a schedule of all operating expenses. In case the number of expense items is large, the budget is divided into two sections: selling expenses and administrative expenses. Both sections can be fixed or variable (fixed or variable budgets will be explained later below) depending on the different types of factors, for example, Sales commission, Freight costs, Sales salaries, Depreciation, Rent, Supplies, and Utilities, etc.

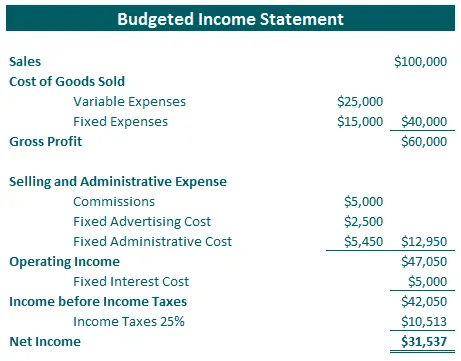

Budgeted Income Statement – In simpler terms, the budgeted income statement is a summary of all the various component projections of revenue and expenses for the budgeting period. Depending on the need of the user, the budget can be divided into quarters or even months for control purposes.

It is computed as follows:

Gross

Profit = Sales – Cost of Goods Sold (Variable and Fixed)

Income from Operations = Gross Profit – Selling and Administrative Expenses

Net Income = Income from Operations – Income Tax Expense

Which can be illustrated in a logical structure such as the example below:

3. Financial Budget

The financial budget is created to reflect the financial decisions of the business, which mostly examines the expected assets, liabilities, and stockholder’s equity of the business. It covers the budgeted balance sheet, the cash budget, and is also another essential tool to see the business’ financial health.

Cash Budget – The cash budget presents the expected cash inflow and outflow for a designated time period. It helps with keeping track of the cash balances allocated efficiently according to the needs of the business as well as avoiding idle cash and possible cash shortages.

It has 4 major sections:

- Receipts – the beginning cash balance, collections from customers, and other receipts

- Disbursements – all cash payments made by purpose

- Surplus or Deficit – shows the difference between cash receipts and cash payments

- Financing – detailed account of the borrowings and repayments expected during the period

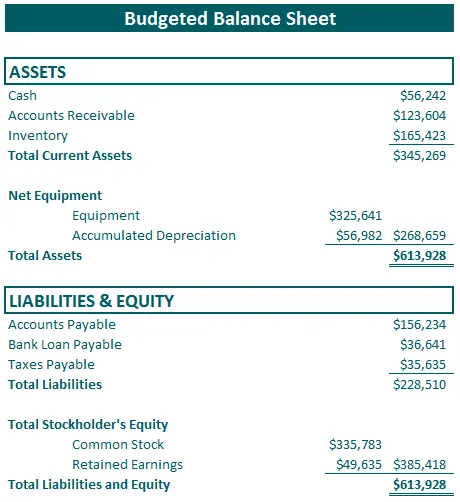

Budgeted Balance Sheet – Just like the budgeted income statement, instead of a summary of revenue and expense, it is a summary report covering the assets, liabilities, and equity-based on the previous budgets calculated for the accounting period. Meaning, the budgeted balance shows all of the accounts compiled from a number of supporting calculations to determine whether the cash flows estimated to be generated is enough to provide adequate financial resources for the business throughout the budgeting period. Constructing this budget is usually the last step in finalizing a master budget.

The reasons as to why the budgeted balance sheet is important are the following:

- To disclose unfavorable financial conditions that management wants to avoid

- To conduct a final check on the accuracy of all other budgets

- To help the management perform various ratio calculations

- To highlight future potential resources and obligations

See below illustration for example budgeted balance sheet calculation:

4. Static (fixed) Budget

A static budget or also known as the Fixed Budget shows budgeted figures at the expected capacity level. It is the allocated fixed allowance for a specific purpose. Meaning, it is not adjustable and remains unchanged over the life of the budget regardless of changes that occur during the budgeting period.

5. Flexible (expense) Budget

A flexible budget or also known as the Expense budget has a relational value to certain variables such as sales levels, production levels, or other external economic factors that affect the business. As such, creating a flexible budget is very popular since it allows for variability in the business and for unexpected changes. It is dynamic in nature rather than static, which is the complete opposite.

6. Capital Expenditure Budget

The Capital Expenditure Budget is a budget listing of all important long-term projects to be undertaken and capital to be acquired. Often classifies individual projects by objective such as:

- Expansion and enhancement of existing product lines

- Cost reduction and replacement

- Development of new products

- Health and safety expenditures

- Etc.

7. Program Budget

The program budget is a type of budget where you allocate funds to specific programs that cannot be used for control purposes due to the costs shown that cannot be ordinarily related to the responsibilities of specific individuals.

8. Incremental Budget

In the literal sense, the incremental budget is a type of budget that shows the increase in the budget in terms of dollars or percentages without considering the accumulated body of the budget is being tracked by this type of budget. Basically, it is prepared using a previous budget as a basis of the incremental amount added for the new budget which in turn, encourages the capability of a project to stick up to the budget.

9. Add-on Budget

The add-on budget examines the previous years’ budgets and adjusts it according to the current data such as inflation and employee raises. This type of budget is simply like how it is called, an add-on budget in case the need arises to satisfy new requirements.

10. Supplemental Budget

The supplemental budget is a type of budget where you plan out additional funding for an area not included in the regular budget plan. Basically, keeping a portion of the money to add-on for certain items that need funding.

11. Bracket Budget

A Bracket budget is known as the contingency plan where costs are projected higher or lower than the base amount. This type of budget provides the management to have a sense of earnings impact and a contingency expense plan if the base budget and the resulting sales forecast are not achieved. It is the most appropriate to have when there is a high downside risk such as a sharp drop in sales.

12. Stretch Budget

The stretch budget is a type of budget that is considered also as a contingency budget but on the optimistic side only. Basically, it is confined to sales and marketing projections that are higher than estimates. It is rarely applied to expenses. The targets for the stretch budget are usually held informally without making operating units accountable for them where it can be considered as official estimates for sales and marketing personnel. But as for the expenses, it is estimated according to standard budget only.

13. Strategic Budget

Though all budget plans are in essence “strategic”, this strategic budget is a type of budget that is integrated into the strategic planning and budgeting control specifically. It is very effective under the scenarios of uncertainty and instability. The strategic budget process is often long-range which spans more than one year of planning. Basically, it is an ideal budget plan to support the long-range vision for the position of an entity.

14. Activity-based Budget

The activity-based budget is a type of budget that is as simple as it looks like. It basically estimates the costs for individual activities. This type of budgeting is often used as a vehicle to prepare activity-based budgets that focus on the budgeted cost of activities required to produce and sell products and services.

15. Target Budget

The target budget is a type of budget that categorizes major expenditures and then matched accordingly to the goals of the company. It emphasizes on formulating methods of project funding to help move the company forward. Basically, it set the overall cost for a particular project to compare “top-down” budgeting for the project.

16. Rolling (continuous) Budget

A rolling budget is also known as the continuous or perpetual budget. This type of budget is basically, being revised on a regular basis. Typically, a budget plan is often updated to extend for another month or in accordance with the new data. This type of budget plan helps with keeping the managers focus at least a year ahead so that they won’t be narrowly focused on short-term results. Meaning, it directs the management’s attention toward the future and ensures that planning is ongoing, as opposed to an annual exercise.

17. Probabilistic Budget

Nothing is really certain in the future, as such, this type of budget provides several estimates for each several key components in the budget. Probabilities are then assigned to such estimates. It works kind of similar to conducting a Scenario Analysis where you can select a reasonable approach such as optimistic (best-case), pessimistic (worst-case), and most likely (base-case) estimate for each key figure in the budget. In simpler terms, the probabilistic budget provides an estimate of the degree of risks in which the business faces.

18. Zero base Budget

Zero base budget is a budget that utilizes a budgeting technique that requires the justification of the entire budget request in detail from a base of zero. Due to this, the need for an analysis of the output values of each activity of a particular expense is critical. This method can be extreme since it requires all activities to be scrutinized and then evaluated to be ranked in order of importance at various levels. However, the resulting end report is commendable since it provides structured data that enables the allocation of funds in an efficient and resourceful manner.

Some types of budgets are somewhat similar while others are the opposite, however, it is clear that each type of budget is beneficial for various purposes. It is also undeniable that it is necessary to be familiar with each type of budgets to better understand the whole picture and how these budgets interrelate with each other.

Differences between Traditional Budgeting and Zero Base Budgeting

Traditional Budgeting – technique commonly used by many for a long time which involves the addition and subtraction of a given percentage increase or decreases to the previous period’s budget and arriving at a new budget. The process focuses on inputs rather than the outputs related to the achievement of goals, hence, the need for evaluation for each activity from a cost or benefit perspective is not needed.

– Starts with an existing data / base

– Examines the cost and benefit for new activities

– Starts with dollars

– Not examining new ways of operating as an integral part of the process

– The resulting report is a non-alternative budget

Zero Base Budgeting – the technique used where all expenses must be justified for each new period. Basically, it involves the preparation of a budget from scratch with a fresh evaluation for each entry.

– Starts with zero base

– Examines the cost and benefits not only for new activities but for all

activities

– Starting with purposes and activities

– Examines the new processes explicitly

– The resulting report is well-structured which offers a choice of several

levels of service and cost

Zero base budget is known to be most applicable for planning service and support expenses, marketing, research, engineering, manufacturing support, capital budgets, etc. However, this type of budget is only suited for operations and programs with managements that have some discretion, meaning, it is not used for direct labor, direct material, and factory overhead.

Personal Budget – Concepts of Personal Budgeting

What is a personal budget?

A personal budget or can be taken as a household budget is a summary of expected income and expenses for a defined period of time. It is created with a goal in mind within a certain time period. It requires the data for the source and amount of income as well as the amounts allocated for expenses. Depending on the situation, a personal budget plan is usually built to be flexible to put leniency to some unexpected expenses. However, this is most often taken advantage of by others, using it as an excuse to deviate from the intended plan, which results in going off the budget completely.

Why it’s important to build a personal budget plan?

Just like how important it is to prepare a budget plan for your business, creating your own personal budget is also very beneficial. Keeping track of your cash flows from month to month can make a whole lot of difference in your money spending habits as well as potential financial freedom once you decided to retire.

It’s actually not that difficult to build your own personal financial plan, however, the task itself can be time-consuming as well as carries a negative vibe since the thought of budgeting is daunting on its own. How much more once you take action and create a proper budget plan for yourself, some even can’t follow through the plan. On the bright side, if you do pull-through with the whole process, it is always worth it especially at the later period of your life.

How to Allocate Money and for how much should you set aside?

There are many guidelines that one can refer to when it comes to how to allocate money in a budget. The truth is, there isn’t a definite solution for all to use but in some cases, some budgeting methods are effective to most people that resorted to personal budgeting such as the following:

- 60% Solution – a budgeting system formulated by the former MSN Money’s editor-in-chief, Richard Jenkins where 60 percent of the income is spent on fixed expenses then allocate the rest to retirement, long-term savings, irregular expenses, and fun money.

- Housing as 25% of spendable income – another budgeting solution where the allocation principle is central to the idea that the housing expenses (mortgage or rent) are limited to 25 percent of spendable income. This type of system is applicable for families moving to a new house.

6 Useful Tips to help you Avoid Pitfalls in Budgeting

Below, we listed six useful tips that we believe can help you avoid difficulties in your budgeting days.

- Have a goal in mind and stick to it.

- Know your future expenses and be as accurate as you can be.

- Though skimping is an obvious thing when budgeting, do not be too harsh when budgeting for entertainment and personal expenses.

- Always plan for the unexpected so ensure to set aside for emergencies.

- Keep track of your spending diligently and review it regularly.

- Adjust and update your budget plan if needed accordingly.

To help you manage your finances, please check out our list of Top 10 Ways to Budget when Broke article.

Feel free to download Personal Budgeting Worksheets in Excel with our selection below:

No Downloads found