Rental Business (New or Existing) Financial Projection 3 Statement Model

User-friendly 3 statement 5 year rolling financial projection Excel model for existing/startup rental business

PURPOSE OF MODEL

Highly versatile and user-friendly Excel model for the preparation of a 5-year rolling 3 statement (Income Statement, Balance Sheet, and Cashflow Statement) financial projection with a monthly timeline for a startup or existing rental business generating revenue by renting transport or other equipment (e.g. cars, bikes, scooters, etc) on a single or membership basis.

The model allows the user to model up to 5 rental categories and 8 variable costs categories for each rental category as well as marketing costs, staff costs, other operating costs, fixed assets, and borrowings.

The model follows good practice financial modeling principles and includes instructions, line item explanations, checks, and input validations, and incorporates a discounted cash flow valuation calculation using the projected cash flows.

KEY OUTPUTS

The key outputs include:

– Projected full financial statements (Income Statement, Balance Sheet, and Cashflow Statement) presented on a monthly basis across up to 5 years and summarised on an annual basis.

– Dashboard with:

o Summarised projected Income Statement and Balance Sheet;

o Compounded Annual Growth Rate (CAGR) for each summarised income statement and balance sheet line item;

o List of key ratios including average revenue growth, average profit margins, the average return on assets and equity, and average Debt to Equity ratio;

o Bar charts summarising income statement and balance sheet projections;

o Table summarising gross profit margin by rental asset category;

o Revenue by category and volume of rentals over time presented in a pie-chart and bar-chart format;

– Accounting break-even analysis;

– Discounted cash flow valuation using the projected cash flow output.

KEY INPUTS

Inputs are split into the income statement and balance sheet Inputs. Most inputs include user-friendly line item explanations and input validations to help users understand what the input is for and populate correctly.

Setup Inputs:

– Name of business;

– Currency;

– First projection year and month;

– Naming for rental asset categories, variable cost categories, staff costs, marketing costs, operating costs, fixed assets, and borrowings;

– Sales tax applicability for rental categories, variable costs, other expenses, and fixed assets.

Actuals Inputs:

– Opening balance sheet (for existing businesses);

– Income Statement actuals (for trend analysis);

Projection Inputs:

– Rental asset inputs including the number of assets, utilization rate per asset, percentage single vs membership utilization, additional amounts, and useful life;

– Membership rental revenue including customer additions, cancellation rates, and membership price per month;

– Single rentals revenue including rental basis (daily or hourly) and rental rate per day/hour;

– Variable costs per rental asset including expected increase per annum and average settlement period;

– Staff cost inputs including staff numbers, average salary per full-time position, average employer’s social security percentage of salary, average annual bonus and bonus payment months;

– Other costs inputs including marketing costs and other expenses;

– Sales and corporate tax inputs including rate and payment periods;

– Dividend inputs including amount (percentage of retained earnings) and frequency;

– Fixed assets including additional amounts and useful life;

– Borrowings including addition amounts and interest rate;

– Share capital additions;

– Discount rate inputs (for valuation calculation).

MODEL STRUCTURE

The model comprises of 9 tabs split into input (‘i_’), calculation (‘c_’), output (‘o_’) and system tabs. The tabs to be populated by the user are the input tabs (‘i_Setup’, ‘i_Actuals’ and ‘i_Assumptions’). The calculation tab uses the user-defined inputs to calculate and produce the project outputs which are presented in ‘o_Fin Stats’, ‘o_Charts’ and ‘o_DCF’.

System tabs include:

– A ‘Front Sheet’ containing a disclaimer, instructions, and contents;

– A checks dashboard containing a summary of checks by a tab.

KEY FEATURES

Other key features of this model include the following:

– The model follows good practice financial modeling guidelines and includes instructions, line item explanations, checks, and input validations;

– The model contains a flexible timeline that allows for a mix of actual and forecast periods across a 5-year period. This allows projections to be easily rolled forward as forecast periods become actual periods;

– Timeline is split on a monthly basis and summarised on an annual basis;

– The model allows the user to model up to 5 rental categories on a membership basis and single rental basis;

– The model is not password protected and can be modified as required following download;

– The model is reviewed using specialized model audit software to help reduce the risk of formula inconsistencies;

– The model allows for the following number of underlying categories for each line item (these can be easily expanded if required):

o Rental asset categories – 5 categories;

o Variable costs – 8 categories;

o Marketing costs – 5 categories;

o Staff costs – 8 categories;

o Other operating expenses – 15 categories;

o Other fixed assets – 5 categories;

o Borrowings – 3 facilities

– Apart from projecting revenue and costs the tool includes the possibility to model receivables and payables, fixed assets, borrowings, dividends, and corporate tax;

– Business name, currency, starting projection period are fully customizable;

– Revenue, cost, and fixed asset descriptions are fully customizable;

– The model included an integrated discounted cash flow valuation using the projected cash flow outputs;

– The model includes instructions, line item explanations, checks, and input validations to help ensure input fields are populated accurately;

– The model includes a checks dashboard that summarises all the checks included in the various tabs making it easier to identify any errors.

ABOUT PROJECTIFY

We are a small team of financial modeling professionals with experience working in big 4 business modeling teams and strong experience supporting businesses with their financial planning and decision support needs. Our aim is to provide robust and easy-to-use tools that follow good practice financial modeling guidelines and assist individuals and businesses with common financial planning and analysis processes.

We are keen to make sure our customers are satisfied with the tools/models they purchase and will be more than happy to assist with any questions or support required following or in advance of purchase.

We are also always keen to receive feedback so please do let us know what you think of our models by sending us a message or submitting a review.

This model template comes as a TRIAL or PREMIUM version in .pdf and .xlsx file type which can be opened using MS Excel and any PDF File Viewer.

Similar Products

Other customers were also interested in...

Online Car Rental – 3 Statement Financial Mo...

Online Car Rental Platform Business Plan Model is a perfect tool for a feasibility study on launchin... Read more

Car Rental Business Financial Model

This Car Rental Business Financial Model Template in Excel offers an ideal basis for developing a bu... Read more

Crane Truck Rental Company Financial Model

Step into the world of crane rental business success with our Crane Truck Rental Company Financial M... Read more

All-in-One Car Rental Business Start-Up Financial ...

This model is to provide users with an integrated and fully customized car rental business valuation... Read more

Crane Rental Company Financial Model

Dive into the financial planning of your Crane Rental Company with our comprehensive 10-year monthly... Read more

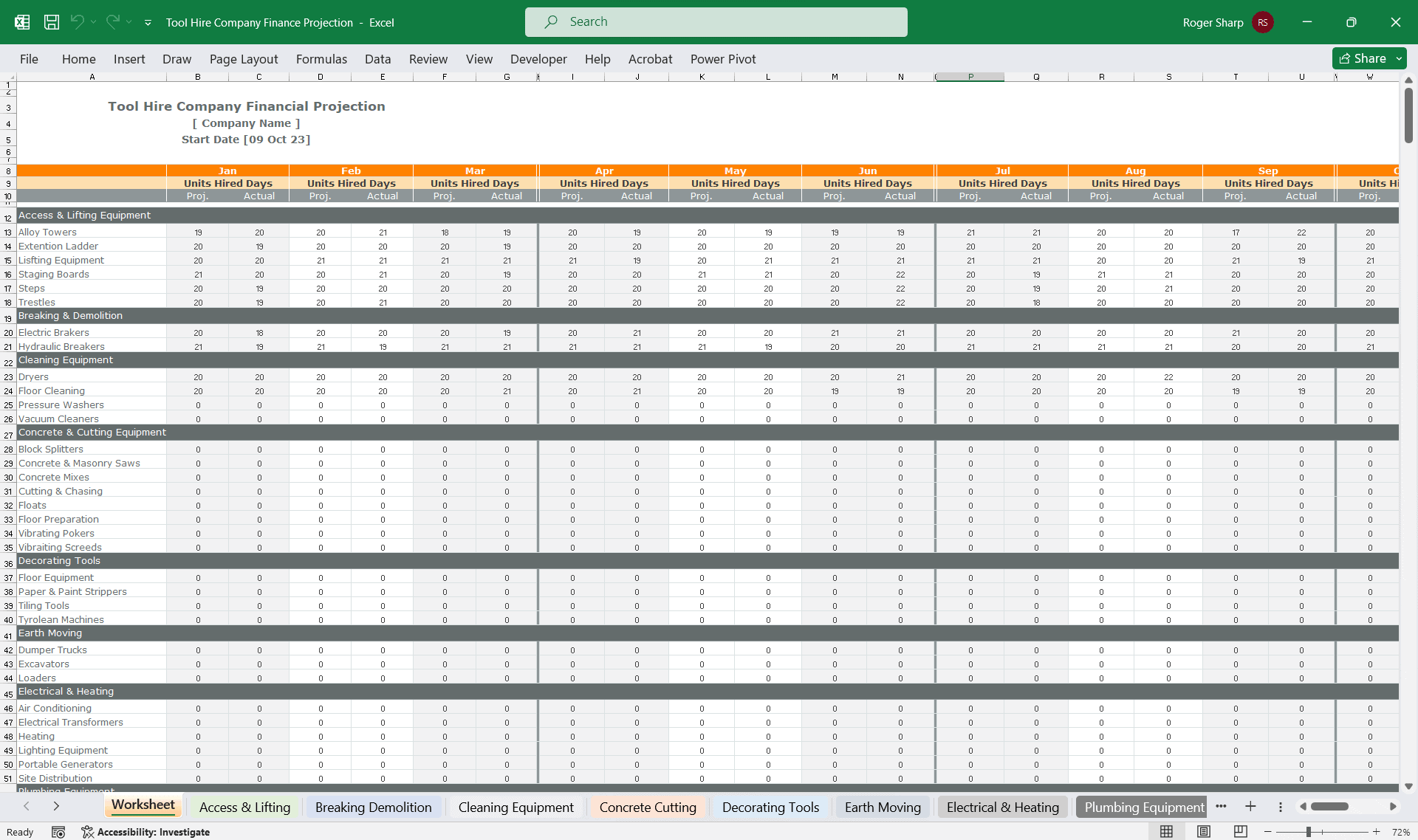

Tool Hire Company Finance Model

A very comprehensive editable Excel spreadsheet for tracking your tool hire financials throughout th... Read more

Car Rental Company Financial Model – Dynamic 10 ...

A Financial model presenting a business scenario of a Car Rental Company which offers Daily Car Rent... Read more

Bike Rental Company – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a startup or operating Bike Rental C... Read more

Car Rental Financial Model Excel Template

Order Car Rental Pro-forma Template. Simple-to-use yet very sophisticated planning tool. Get reliabl... Read more

Mopeds Rental Financial Model Excel Template

Impress bankers and investors with a proven, solid Mopeds Rental Pro Forma Projection. Five-year mop... Read more

You must log in to submit a review.